| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

As we approach the end of May 2025, the global gold market presents a complex picture, marked by contrasting dynamics between East and West. While China’s physical gold demand shows signs of moderation, Western markets grapple with technical resistance levels. This divergence underscores the multifaceted nature of gold trading and investment in today’s interconnected world.

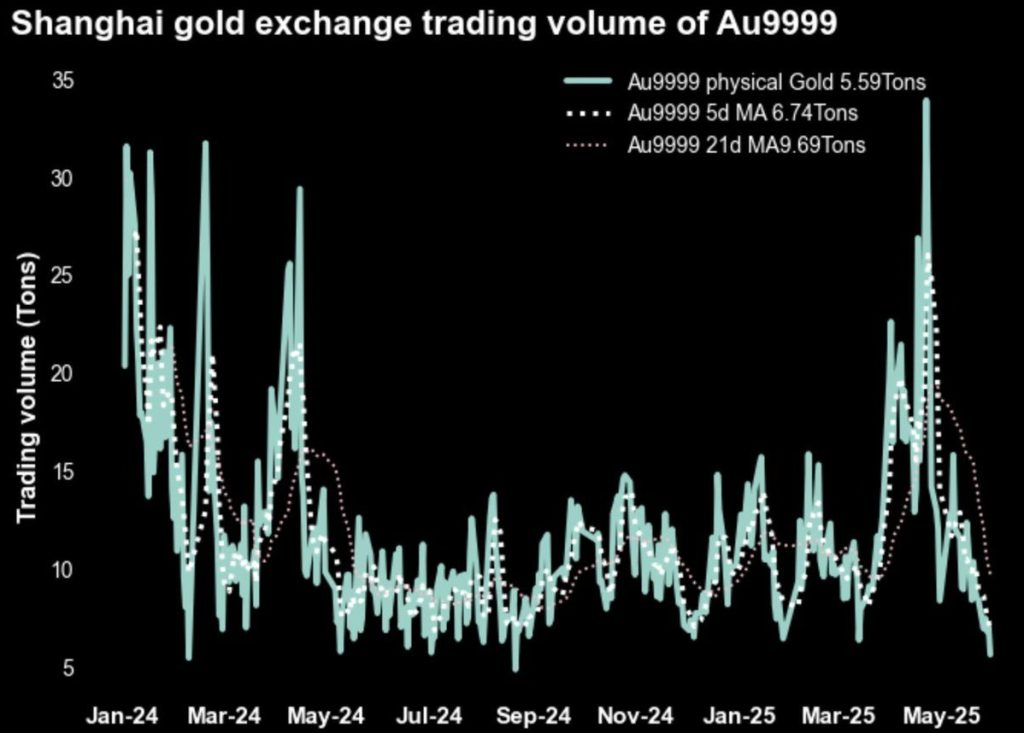

The Shanghai Gold Exchange (SGE), a key indicator of China’s physical gold demand, has reported a significant decline in trading volumes. The Au9999 contract, representing the physical gold proxy, registered its lowest trading volume in eight months, with only 5.6 tonnes changing hands. This marks a 20.5% decrease compared to the previous week.

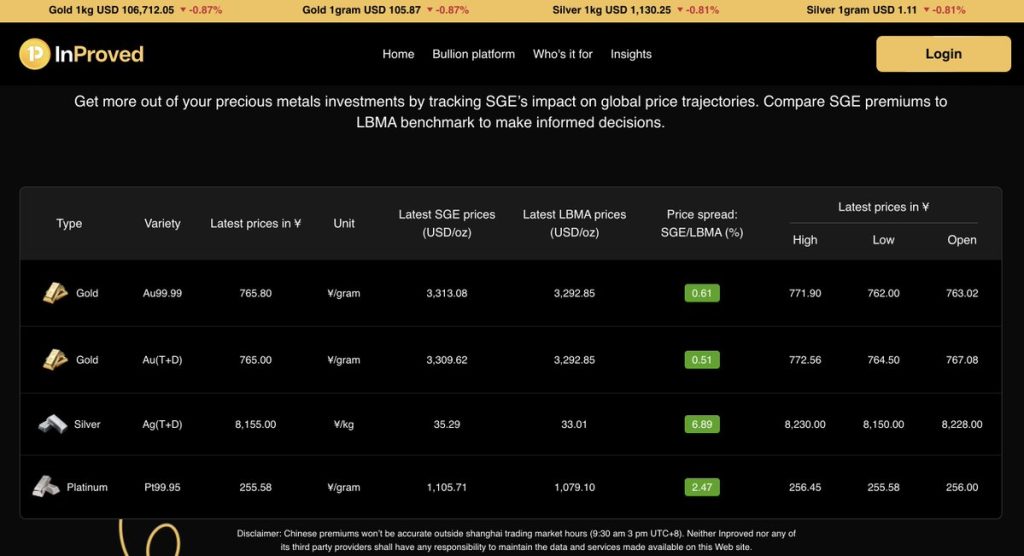

Despite this slowdown, gold in China continues to trade at a premium. As of May 30, gold was priced at ¥769 per gram, translating to $3,315 per ounce, which is 0.8% above the London Bullion Market Association (LBMA) benchmark. Investors can now monitor these premiums in real-time, albeit with a slight delay during Shanghai trading hours, via InProved’s tracking tool.

On the COMEX, gold futures for August 2025 are encountering significant resistance. The 68.2% retracement levels are identified between $3,352 and $3,436, with a notable put wall at $3,000. Additionally, the 25-delta risk reversal skew stands at +0.8, indicating a modest bullish sentiment but also highlighting the challenges in breaking through the current resistance levels.

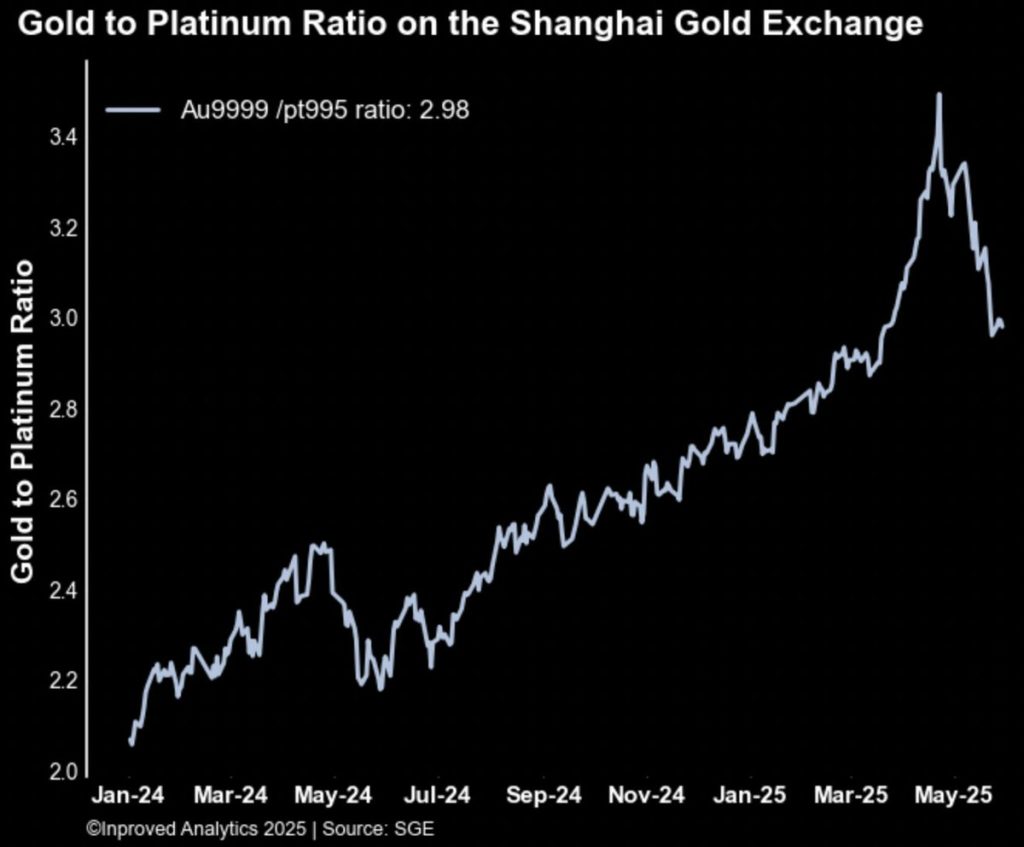

In related markets, the gold-to-platinum ratio on the SGE has declined to 2.98:1, its lowest in two months. This means that one ounce of gold can now purchase 2.98 ounces of platinum, suggesting a relative undervaluation of platinum compared to gold.

For investors seeking cost-effective avenues to invest in precious metals, InProved offers a compelling proposition. By leveraging direct supplier relationships and proprietary pricing algorithms, InProved consistently provides lower premiums compared to traditional Singaporean suppliers. For instance, first-time savers can enjoy unbeatable premiums on their first 1kg gold, silver, or platinum bar, ensuring maximum savings and investment returns.

The current landscape presents a nuanced picture: while China’s physical gold demand shows signs of cooling, Western markets grapple with technical resistance levels. Investors should remain vigilant, monitoring both physical demand indicators and technical market signals to navigate the complexities of the gold market effectively.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions