| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

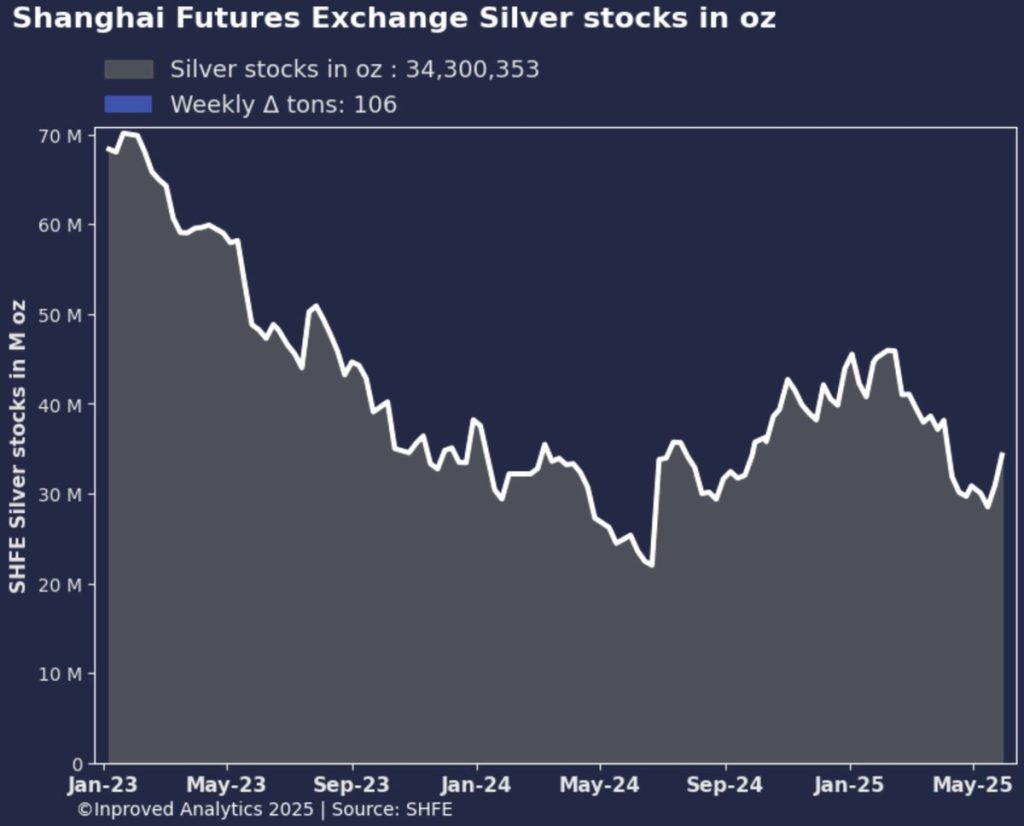

As May 2025 drew to a close, the silver market sent a resounding signal through Shanghai: physical accumulation is ramping up with renewed intensity. For the second consecutive week, vaults in Shanghai saw significant inflows, a move that has caught the attention of traders and analysts alike.

According to Hugo Pascal, a leading voice in precious metals strategy and Chief Investment Officer at InProved, the Shanghai silver vaults added a staggering 106 tons week-to-date, lifting inventories to 1,067 tons, or 34.3 million ounces—the most substantial weekly inflow in five months. “This is no ordinary refilling,” said Pascal. “We are witnessing a structural rebalancing in the East’s silver appetite, with implications stretching beyond short-term demand.”

Only a few weeks ago, Shanghai’s silver vaults were hovering near multi-month lows, reflecting sluggish import flows and muted speculative enthusiasm. But sentiment has changed swiftly. The recent additions follow another strong weekly build: 75 tons were added the previous week, bringing vault levels to 1,036 tons, and 46 tons the week before that. This three-week trend represents a dramatic turnaround and hints at a deeper shift in domestic positioning.

Several factors underpin this silver accumulation:

“The 25 delta risk reversal skew currently sits at 2.3, signaling that calls are being bid more aggressively than puts,” Pascal commented. “That’s a clear indicator of bullish sentiment among options traders.”

While Shanghai vaults are actively accumulating, COMEX inventories in New York have remained relatively stable. As of May 30, COMEX vaults hovered around 500 million ounces, up only 608,000 ounces (19 tons) from the previous day. This divergence suggests that while the Western market remains technically neutral, the East is preparing for something more significant—whether industrial or financial in nature.

Despite the buildup in physical demand, silver remains range-bound in the futures markets. Pascal notes that silver has continued to oscillate within a six-week trading range of $31.85 to $33.50, struggling to break convincingly above or below.

“Although we’re seeing consistent support at $31 and persistent resistance at $35,” said Pascal, “the underlying momentum is shifting in favor of the bulls. If premiums remain firm and vault inflows continue, we could be nearing an inflection point.”

The silver narrative is quietly evolving. With Shanghai vaults seeing their largest inflows in half a year and premiums climbing toward 7% over LBMA benchmarks, a structural shift in global silver demand may be underway. Bullion investors—particularly those in the West—should take note.

Whether this buildup leads to a breakout or merely reflects hedging ahead of macro volatility remains to be seen. But as Hugo Pascal puts it, “When the East starts stocking up quietly, the rest of the world would do well to listen.”

📌 If you’d like to track Shanghai vs LBMA premiums in real time, visit inproved.com/lbma-vs-sge. For in-depth strategies and real-time data, explore InProved’s advanced tools, analytics, and physical bullion marketplace.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions