| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

There’s a quiet intensity coursing through the global gold markets right now. No fireworks, no dramatic headlines—yet beneath the surface, the signals are growing louder. The physical flows are shifting. The derivatives are stirring. Vaults are filling in Shanghai, while Comex breathes life back into its gold inventory. And new players, like Vietnam, are angling to regulate and rejuvenate their bullion markets as Asia braces for another wave of gold appetite.

All of this is happening as gold trades just below its all-time highs, giving speculators and investors alike a curious dilemma: do you buy now, or wait for the next big catalyst?

The latest data offers clues, and it’s telling a story of reaccumulation, recalibration, and strategic positioning. This isn’t about panic buying—it’s about careful choreography in a high-stakes game of value preservation.

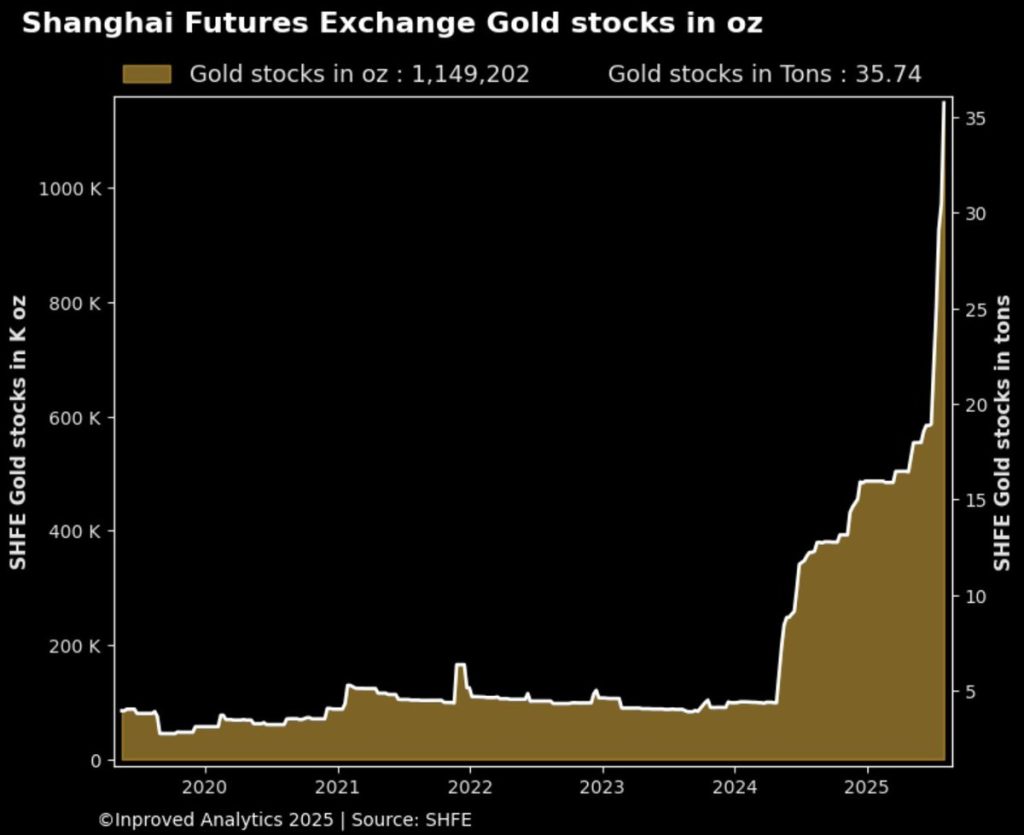

Few data points are as striking this week as the Shanghai Gold Exchange vault inflows, which surged 18.15% week-on-week to 35.74 metric tons, a total increase of 176,000 ounces. Year-to-date, these vaults have grown an astonishing +136%, adding over 20 tons of gold. This is a resounding endorsement of physical accumulation—and not from retail speculators. These kinds of numbers typically signal institutional or wholesale market behavior.

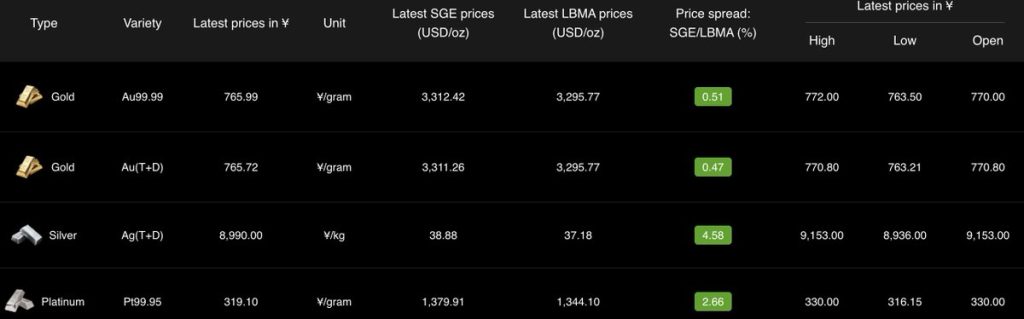

And yet, Chinese gold prices are swinging between premium and discount, almost as if searching for a catalyst. As of the most recent snapshot, Shanghai gold closed at a premium of $8.70 per ounce, or 0.26% above the LBMA benchmark, reflecting a modest but notable tilt toward demand.

“The physical gold flows into Shanghai vaults are increasingly decoupling from the speculative noise,” says Hugo Pascal, CIO at InProved Metals. “When you see these kinds of inflows, it’s not about day-trading the metal. It’s about quiet confidence. Someone out there is getting ready.”

On the futures front, Shanghai gold (October 2025 contract) closed slightly higher at ¥770.72 per gram, or roughly $3,325/oz equivalent on the Comex benchmark. But it’s the options market that’s drawing attention.

The most active strike is now ¥856 (October 2025)—the equivalent of $3,700 per ounce—signaling bullish sentiment among Chinese traders. With a put/call volume ratio at 0.5 and open interest ratio at 0.62, the bias is clear: upside bets are dominating.

This isn’t limited to Asia. On the Comex side, the registered gold category has rebounded to a two-month high, now sitting at 38.7 million ounces, a sharp reversal from the previous drawdowns in Q2. After weeks of negative sentiment, gold is flowing back into U.S. vaults—just as speculation builds on Chinese desks.

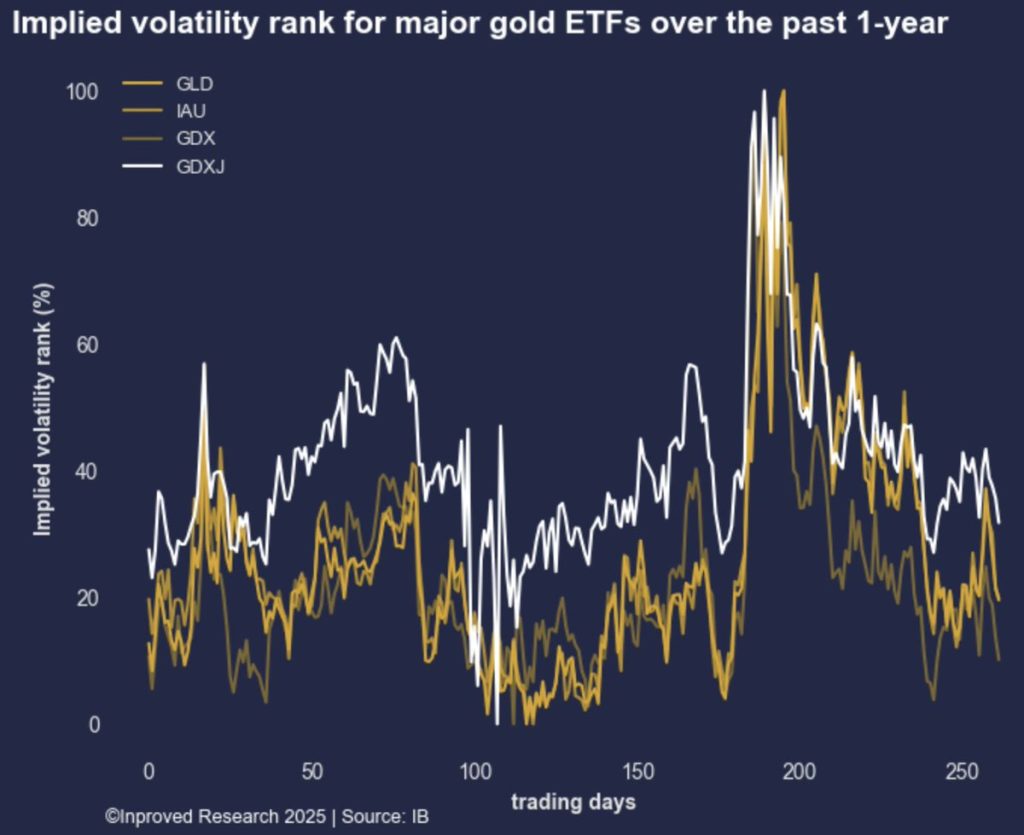

Another signal pointing toward latent bullishness: implied volatility (IV) for major gold ETFs such as GLD, IAU, and GDX remains notably low, all with IV Rank below 30%. In options trading parlance, this means that calls are cheap, and option buyers have an asymmetric edge.

Hugo Pascal notes, “The market is offering unusually inexpensive insurance on a move higher. For those with conviction, building long call spreads now could pay handsomely if we see gold test or break April’s highs again.”

This comes as trading activity picks up sharply on the SGE’s physical gold proxy contract, AU9999, which recently registered its most active trading session in five weeks, with 11 tons exchanged. That’s particularly striking given that gold is still 7% below its April peak—suggesting fresh accumulation is underway even without the FOMO of a breakout.

One of the lesser-covered developments this week is news of Vietnam’s upcoming gold market regulation revamp. While details remain sparse, local headlines and official murmurs suggest that the Vietnamese central bank is preparing to liberalize or restructure bullion trade, potentially opening the door to more competitive pricing and improved access.

If Vietnam, a nation with a deeply ingrained culture of gold accumulation, manages to modernize its bullion infrastructure, it could unleash a new wave of regional demand—and tighten the already narrow margins in Asia.

Hugo Pascal points out: “Vietnam sits at the crossroads of retail and institutional gold flows in Southeast Asia. Any move to regulate or expand access could re-anchor gold premiums in the region and pull more metal eastward.”

The gold market right now is like a storm cloud waiting to break. It’s holding moisture, it’s building pressure—but it hasn’t yet unleashed its fury. The fundamentals are clear: strong vault inflows, rising derivative activity, subdued volatility, and quiet demand from central banks and long-term allocators.

Yet, gold remains in limbo.

It’s trading just over $3,337 per ounce, a comfortable level that keeps both bulls and bears on edge. The Comex equivalent trades at a 0.43% premium to LBMA, and Shanghai premiums are now trending higher again, settling around 0.5% on the latest data. These are small figures—but in precious metals, small premiums tell big stories.

The catalyst could come from anywhere. Renewed geopolitical friction. A surprise rate cut. A burst of inflation. Or perhaps, simply, the return of retail fear or sovereign accumulation.

Whatever the trigger, the positioning is already underway.

This is not a time to chase gold—it’s a time to prepare for it. The signs are everywhere: vaults are filling in China, premiums are stabilizing, options are cheap, and volatility is dormant. This is the season for strategic accumulation.

At InProved, we help investors build smart, flexible, and tax-efficient gold positions through our Singapore-based mobile platform. With some of the lowest LBMA premiums in the world, live tracking of SGE-LBMA spreads, and direct access to vaulted gold holdings, we empower clients to stay ahead of the curve.

Download the InProved mobile app today or visit www.InProved.com to begin your journey in gold allocation with real-time transparency, unmatched pricing, and global liquidity.

Because by the time the headlines arrive, the gold will already be spoken for.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions