| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

Silver rarely moves in straight lines, and last week was no exception. What we witnessed was a curious mix of contradictions — a flood of inflows into COMEX vaults, record inflows into Shanghai vaults, yet simultaneously a widening of the exchange-for-physical (EFP) spread and a surge in speculative call option activity. Taken together, these developments suggest a market under strain, one where the plumbing is rattling and traders are starting to price in bigger risks ahead.

As Hugo Pascal, CIO of InProved, has been closely tracking, COMEX inventories soared to an all-time high of 517.2 million ounces after a staggering 177 tons were added on Wednesday alone, bringing the weekly total to 261 tons. In ordinary times, such an increase in registered supply would be enough to calm nerves. Instead, it coincided with widening cracks elsewhere in the system — namely the EFP spread and speculative pressure in Shanghai.

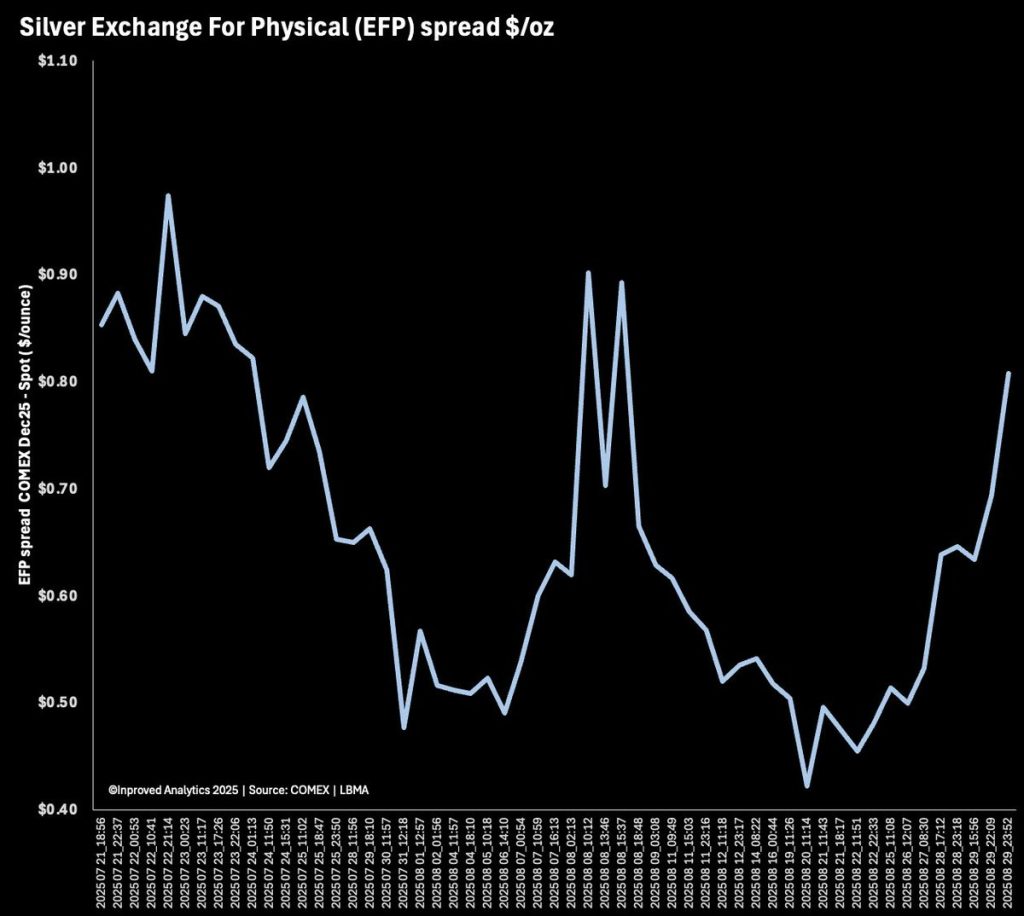

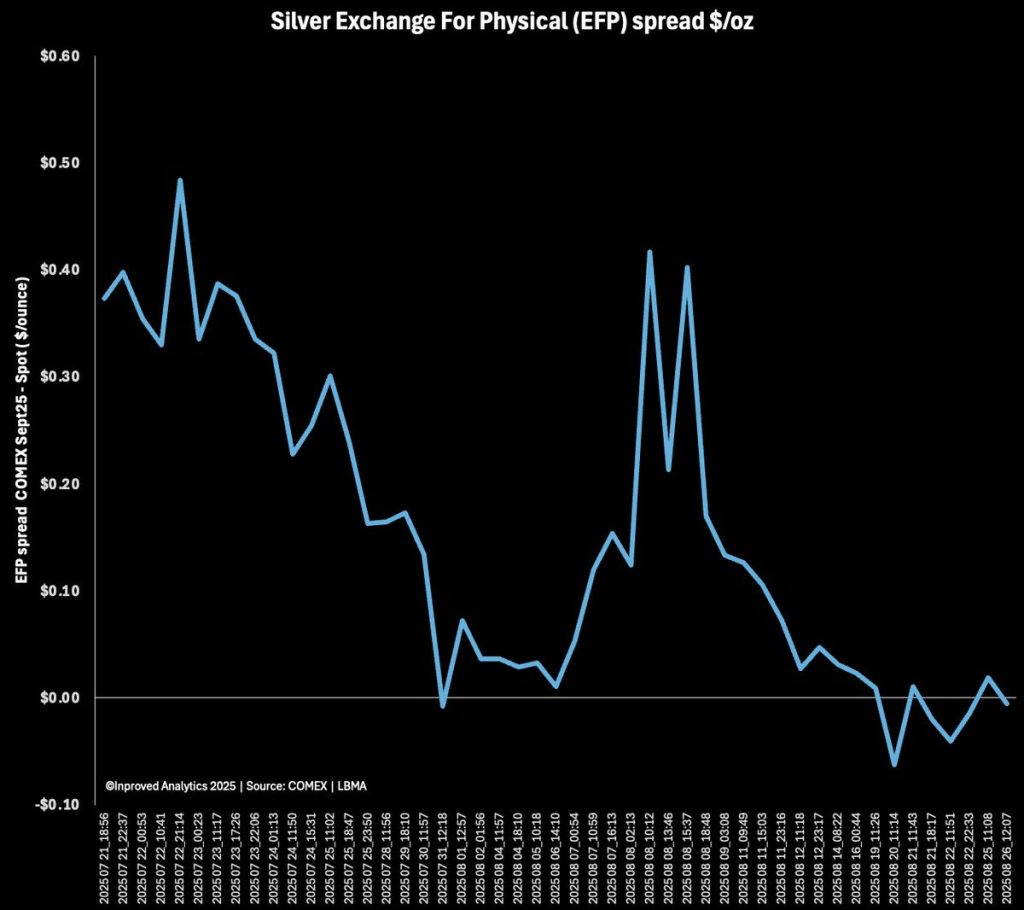

Perhaps the most important number of the week was the December 2025 silver EFP spread, which widened to $0.81 above LBMA spot, up from $0.70 just hours earlier. By week’s end, it was still holding around $0.64–0.70, well above normal.

For those less familiar, the EFP — or “exchange for physical” — is a key mechanism that allows traders to shift exposure between futures contracts and physical metal. In normal conditions, the spread hovers close to zero, reflecting confidence that futures can be rolled into physical delivery without friction. When it widens, it means confidence is eroding. Traders are willing to pay a premium to secure physical exposure instead of being left with paper.

History shows these moments can be telling. In March 2020, when global supply chains seized up, gold and silver EFPs blew out, with some spreads hitting multi-dollar premiums. Prices surged soon after. That’s why Pascal’s observation of a fast widening this week matters: it’s not just noise, but potentially a sign that the futures market is struggling to keep up with demand for real bars.

At the same time, the Shanghai Futures Exchange (SHFE) vaults registered their largest weekly inflows in two months, rising by 87 tons to 1,196 tons. Just a week earlier, inflows were 56–69 tons, already the highest in 10 weeks. The reversal from weeks of steady outflows to strong inflows is notable. It suggests two things: first, that Chinese traders are positioning for heavy physical demand into Q4; second, that imported silver is finally catching up with premiums.

Yet paradoxically, premiums in China remained firm at 5.6% above LBMA. In theory, rising inventories should depress premiums. That they remain elevated implies the new inflows are being quickly absorbed, leaving the market tight despite the surge.

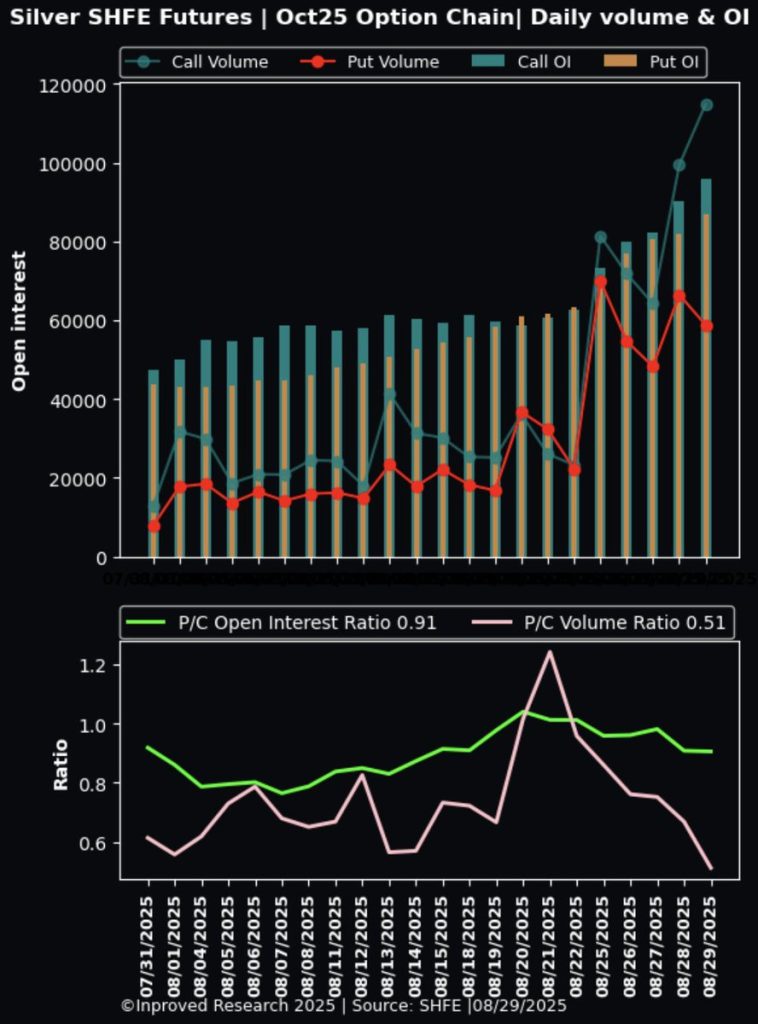

Another layer of complexity is building in Shanghai’s options market. Traders have been aggressively targeting higher strikes, with open interest steadily climbing at ¥10,000/kg — equivalent to $43.60/oz on COMEX. That’s a full $2.50 above current spot. The put/call volume ratio for October 2025 has stayed between 0.51 and 0.67, underscoring that calls are dominating.

This kind of behavior is reminiscent of late 2020, when speculative calls piled in ahead of the solar boom, driving implied volatility higher. Back then, silver jumped nearly 50% in six months. While it’s too early to call a repeat, the positioning suggests traders see asymmetric upside risks, even if vault stocks look flush.

Meanwhile, the September 2025 COMEX silver contract slipped into backwardation ahead of delivery. In plain English, that means near-term contracts are trading at a premium to longer-dated ones — a classic signal of tightness in immediate supply. Backwardation doesn’t happen often in silver, and when it does, it usually reflects a scramble to secure near-term metal.

Combined with the widening EFP, it paints a picture of a market that is superficially well-stocked, but where traders distrust the depth of available supply once delivery season begins.

So how can silver vaults be overflowing in New York, rising in Shanghai, and yet the market still signal stress? The answer lies in the distinction between available stock and deliverable stock. Just because metal is sitting in a warehouse doesn’t mean it’s free to be delivered against futures or sold into the open market. Some of it is tied up in ETFs, some in leasing agreements, and some earmarked for industrial users.

Hugo Pascal frames it succinctly: “You can have record inventories and still a shortage of liquidity. Silver is a collateral asset, and when collateral is spoken for, spreads widen even if the headline numbers look comfortable.”

That’s why the focus should be less on absolute tonnage and more on the behavior of spreads, premiums, and options skew. Each of those is flashing yellow right now.

Looking forward, the silver market faces a set of crosscurrents. On one hand, record COMEX inventories should act as a buffer against panic. On the other, persistent premiums in China, speculative calls, and widening EFPs suggest that buffer may be less solid than it looks.

The last time silver straddled this kind of contradiction — abundant stocks but rising market stress — was in late 2010. Within six months, the metal had surged from $25 to nearly $50 before collapsing back. Few markets swing between abundance and scarcity as violently as silver.

With Liberation Day-related demand spikes, ongoing U.S.–China trade tensions, and the industrial pull from solar and electronics, the conditions are in place for volatility to continue. Whether this builds into a full-fledged “squeeze” depends on whether premiums widen further and whether shorts can weather the speculative storm building in Shanghai.

Silver today looks abundant on paper. Vaults are full, inventories are setting records, and yet the subtle signals — EFP spreads, backwardation, call option fever — tell another story. They tell of a market where confidence in deliverability is slipping, where traders are willing to pay up for security, and where speculative bets are starting to crowd the upside.

History suggests these periods rarely resolve quietly. And as Pascal has observed in past cycles, “Silver doesn’t whisper for long — it shouts.”

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions