| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

For much of modern financial history, gold has lived on the periphery of mainstream investment strategy — respected as a relic, but often dismissed as dead weight in an equity- and bond-driven world. Yet, every so often, the metal reclaims the spotlight with such force that even the most entrenched institutions are compelled to take notice. This week may prove to be such a moment.

Goldman Sachs, the archetypal Wall Street house, has issued what it called its “strongest recommendation” for gold, setting a 2025 year-end target of $3,700 per ounce and projecting $4,000 by mid-2026, with upside in extreme cases that could push the price above $4,500.

On its own, such a call is eye-catching. But what makes it consequential is the timing: it arrives as Chinese vaults fill to record levels, as Western funds like the Sprott Physical Gold Trust (PHYS) see discounts narrow, and as the Federal Reserve faces the growing likelihood of deeper rate cuts. Together, these factors weave a narrative of gold not as a niche hedge, but as a core allocation in a fractured global financial system.

Goldman’s forecast is bold, but not without precedent. The bank has a long history of calling for big moves in gold. In 2008–2011, during the aftermath of the financial crisis, Goldman issued a string of bullish notes, some of which were criticized for fueling speculative frenzy. By September 2011, gold touched $1,921 per ounce, marking an all-time high at the time.

In 2019–2020, the bank once again raised its targets, citing central bank easing, pandemic-driven uncertainty, and geopolitical shocks. By August 2020, gold had surged to $2,075, vindicating its call.

Yet, what separates this latest recommendation is both its language and the scale of the target. To set $3,700 as a base case for 2025, and $4,000 for 2026, is to acknowledge that gold is no longer simply a tactical hedge against volatility. It is, in Goldman’s words, an essential element of diversification.

As Hugo Pascal of InProved put it, “The moment traditional asset managers treat gold not as a trade, but as a strategic allocation, is the moment the market changes character.” Goldman’s call suggests that moment is here.

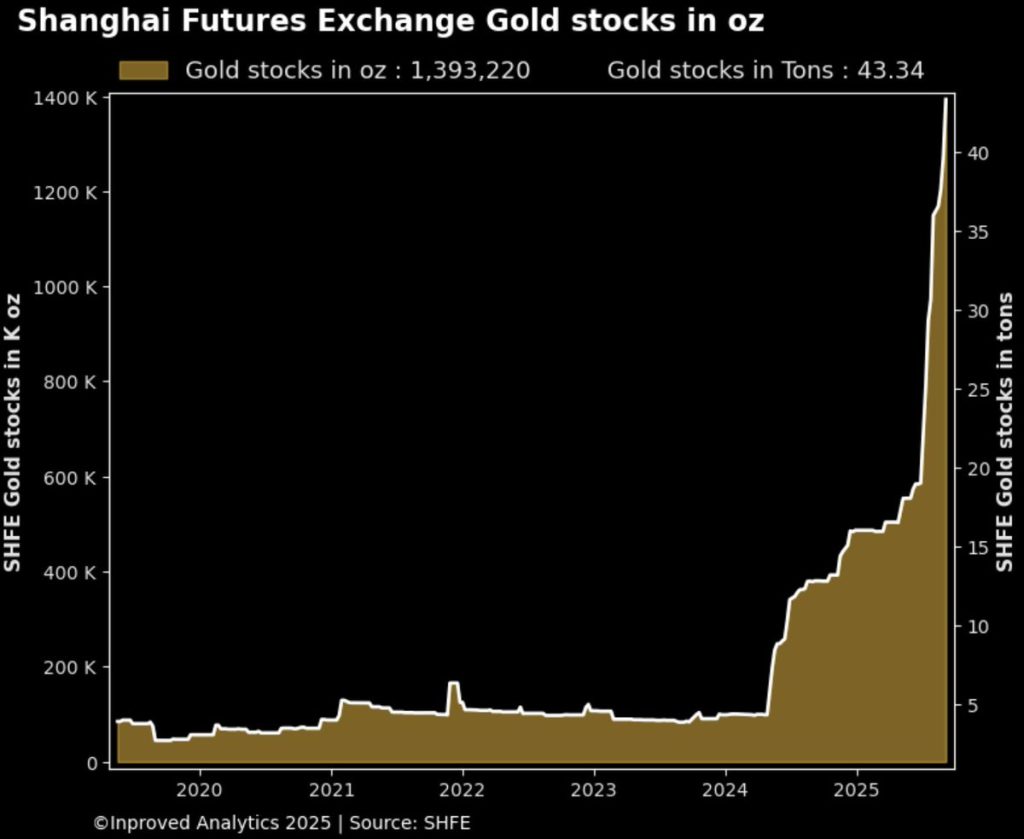

While Goldman frames the Western narrative, the East tells its own story. In China, the Shanghai Futures Exchange (SHFE) reported record vault holdings this week: 43.35 tons (1.4 million ounces), up 3.71 tons from the prior week. The steady drumbeat of inflows has now lasted more than 10 weeks, with inventories consistently pushing higher.

At the same time, the October 2025 SHFE gold contract closed 1.31% higher at ¥814.88/g ($3,550.45/oz), while open interest surged 13.3% week-to-date to 442,000 contracts — a one-month high. The message is clear: Chinese traders and institutions are adding aggressively, even at prices that would have seemed unimaginable just a few years ago.

This divergence between East and West has played out before. In 2013, when Western ETFs like SPDR Gold Shares ($GLD) saw massive outflows, Chinese demand surged, with premiums in Shanghai reaching $30–$40 above LBMA spot. That year, China imported over 1,000 tons of gold, absorbing what Western investors discarded.

Today, however, both regions are moving in the same direction — Wall Street recommending gold, Shanghai stockpiling it — a rare alignment that amplifies the bullish case.

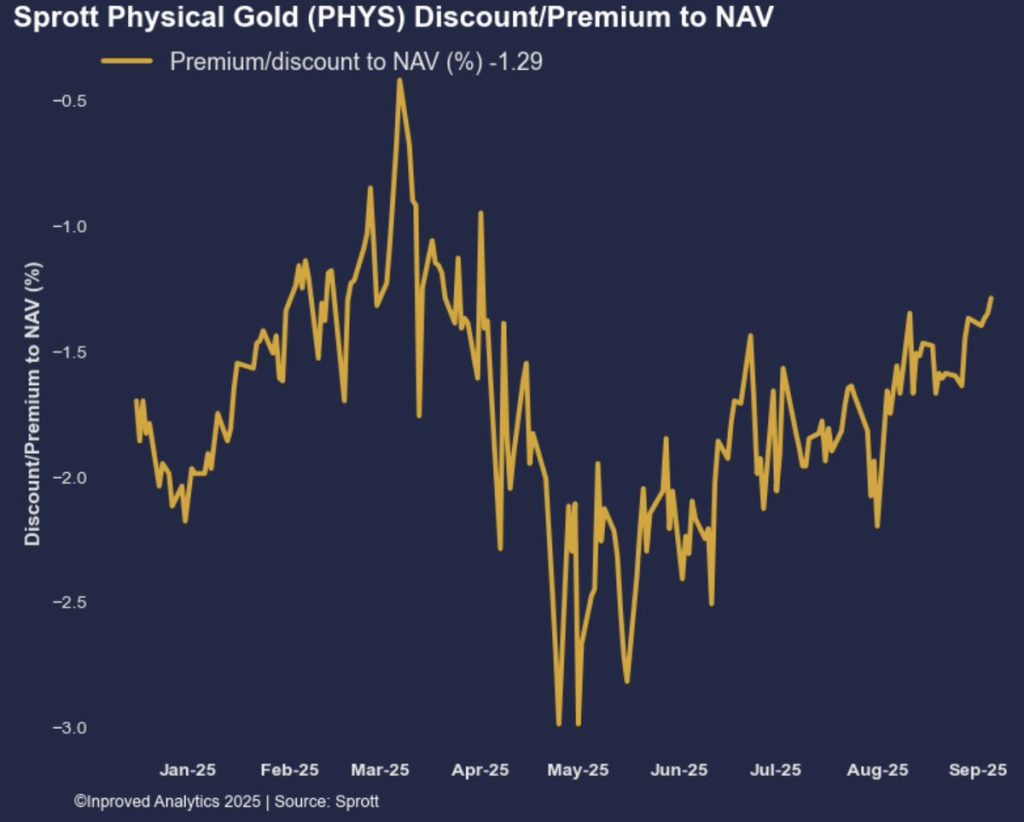

The Sprott Physical Gold Trust (PHYS) offers a window into Western investor sentiment. Unlike paper ETFs, PHYS is fully backed by allocated bullion, and its trading price often diverges slightly from the value of its holdings (NAV). When sentiment is weak, it trades at a discount. When demand is strong, that discount shrinks or even flips to a premium.

This week, the discount narrowed to -1.29%, a sign of rising demand for physical exposure. Historically, such narrowing gaps have preceded periods of price strength. In 2019, for example, PHYS discounts shrank in the months leading up to gold’s breakout above $1,500. In 2020, as gold rallied toward $2,000, PHYS briefly traded at a premium.

Pascal observed, “When the discount shrinks, it tells you investors aren’t satisfied with synthetic exposure. They want the real thing.” That dynamic is now in play, alongside China’s relentless vault inflows.

The last two decades offer useful parallels. In the 2000s, gold climbed from under $300 to over $1,900 in a decade-long bull market, fueled by dollar weakness, rising oil prices, and the 2008 financial crisis.

In the 2010s, gold peaked early in the decade, fell sharply as the U.S. economy recovered, but staged a comeback in 2019–2020 amid trade wars and COVID.

Both cycles were characterized by a tug-of-war between Western financial flows and Eastern physical demand. When they converged — as in 2019–2020 — gold entered a supercharged rally. The setup today looks similar: Wall Street banks are openly bullish, while Shanghai vaults are bursting with inflows.

Options markets provide another lens. On COMEX, the December 2025 contract shows a 68.2% retracement band between $3,567 and $3,646, with a call wall at $3,700. The 25-delta risk reversal skew sits at 1.7, signaling strong demand for calls relative to puts.

Historically, when skew rises above 1.5, it indicates asymmetric demand for upside exposure. In March 2020, skew surged as traders rushed to buy calls amid pandemic fears; gold rallied over 20% in the following months. In early 2022, during the Ukraine war, skew spiked again, foreshadowing gold’s climb back above $2,000.

The present skew suggests traders are positioning for higher prices, aligning with Goldman’s forecast and Shanghai’s activity.

The broader macro environment adds urgency. U.S. non-farm payrolls are weakening, and if the trend continues, the Fed may have no choice but to cut rates more aggressively than its current guidance. A 25bp cut may be the baseline, but markets are already whispering about larger moves.

Historically, sustained rate-cutting cycles have been rocket fuel for gold. From 2001–2003, as the Fed slashed rates after the dot-com bust, gold broke out of a two-decade bear market. From 2008–2011, amid the Fed’s emergency cuts and quantitative easing, gold rallied over 150%.

If the Fed embarks on another easing cycle in 2025, especially in an environment of sticky deficits and geopolitical risks, it could catalyze the kind of move Goldman envisions.

One recurring theme in Pascal’s commentary is the fragility of the systems that connect paper contracts to physical bullion. COMEX open interest currently stands at over 45 million ounces, while registered inventories hover closer to 21 million ounces — a leverage ratio above 2:1. In Shanghai, the ratio is even higher.

So long as trust holds, this leverage is manageable. But in times of stress, when more participants demand delivery, the system creaks. That was evident in March 2020, when EFP spreads widened sharply as logistical bottlenecks prevented bars from moving between Switzerland, London, and New York.

If today’s rising inflows in Shanghai coincide with renewed Western appetite for physical exposure, pressure on these systems could resurface, pushing prices higher in the process.

Amid all this, one geography stands out as a quiet but strategic beneficiary: Singapore. The city-state has emerged over the past decade as a premier hub for bullion storage and procurement, particularly for investors from China and India.

Unlike India, where gold imports are subject to high duties, or China, where capital controls complicate overseas purchases, Singapore offers a tax-efficient, transparent environment. Premiums on LBMA bullion in Singapore are often among the lowest in the world, and storage facilities are world-class, attracting both retail and institutional flows.

For overseas Chinese and Indian investors, Singapore provides a bridge: access to global bullion without the frictions of domestic regulation. As premiums widen in Shanghai or Mumbai, the relative advantage of buying and storing in Singapore becomes even more compelling.

This week’s developments — Goldman’s bullish forecast, Shanghai’s record vault inflows, narrowing discounts in Western trusts, and derivatives skewing toward calls — are not isolated data points. They are pieces of a larger puzzle pointing to a structural re-rating of gold.

In 2008 and 2020, similar alignments of macro stress, institutional recognition, and physical demand sparked rallies that defined the decade. Today, with Goldman explicitly targeting $3,700–$4,000, and with Shanghai vaults overflowing, the stage is set for another chapter.

As Hugo Pascal remarked, “When East and West converge on gold at the same time, you’re no longer trading sentiment. You’re trading inevitability.”

If history rhymes, as it often does in the gold market, that inevitability may soon carry the metal to levels that once seemed unthinkable.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions