| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

The silver market has always been a paradox: vast in industrial utility, modest in monetary role compared to gold, and yet capable of producing the most spectacular price squeezes when supply and demand collide. This week, the paradox grew sharper.

The London Bullion Market Association (LBMA) reported a 1.85% increase in silver inventories, or 447 tons, bringing headline holdings higher. At first glance, that might appear reassuring — more silver in the system, more cushion for the market. But dig deeper, and the story turns. The free float — the portion of silver actually available to trade — is shrinking, as ETF inflows absorbed 492 tons on a month-over-month basis, more than offsetting the reported increase.

In other words: there is “more” silver in the vaults, but less available to meet the market’s real demand. It is precisely this kind of divergence that has, in the past, set the stage for dramatic rallies.

Friday’s Non-Farm Employment Change came in far weaker than expected, printing 22,000 versus a forecast of 75,000. For precious metals traders, it was an instant catalyst. Silver prices jumped 1.1%, hitting $41.1/oz, extending a rally that has already made 2025 one of the most volatile years in recent memory for the metal.

The reaction is textbook: weaker jobs data implies greater pressure on the Federal Reserve to cut rates, weakening the dollar and lowering opportunity costs for non-yielding assets like gold and silver. But silver is not just another monetary hedge. Its dual role as both an industrial metal and a safe haven gives it leverage to these surprises. Lower rates and potential stimulus boost industrial demand prospects, while simultaneously fueling safe-haven buying.

This twin-engine effect has been seen before. In 2009–2011, when the Fed launched its QE programs, silver rallied nearly 400% in less than two years, from $9 to just under $50 an ounce.

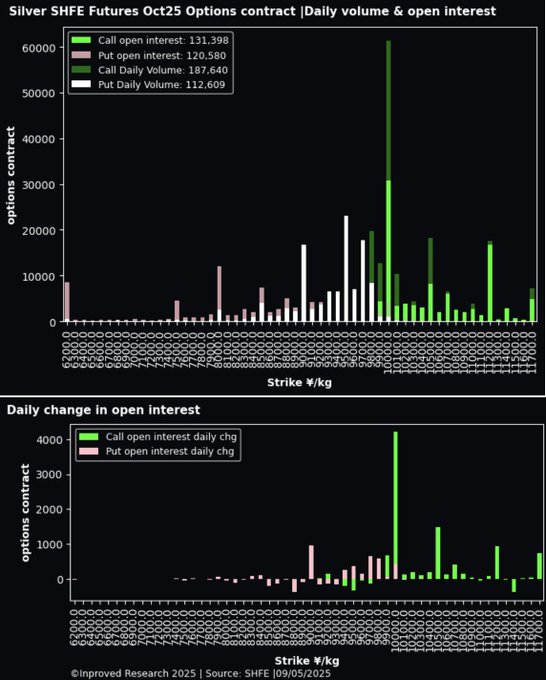

On the other side of the world, the Shanghai Futures Exchange (SHFE) is providing its own momentum. The October 2025 contract closed 0.34% lower at ¥9,812/kg ($42.75/oz COMEX equivalent) this week, but the underlying detail matters more than the headline close. Traders are increasingly eyeing ¥11,200/kg ($48.8/oz) as the next major target, with open interest rising steadily.

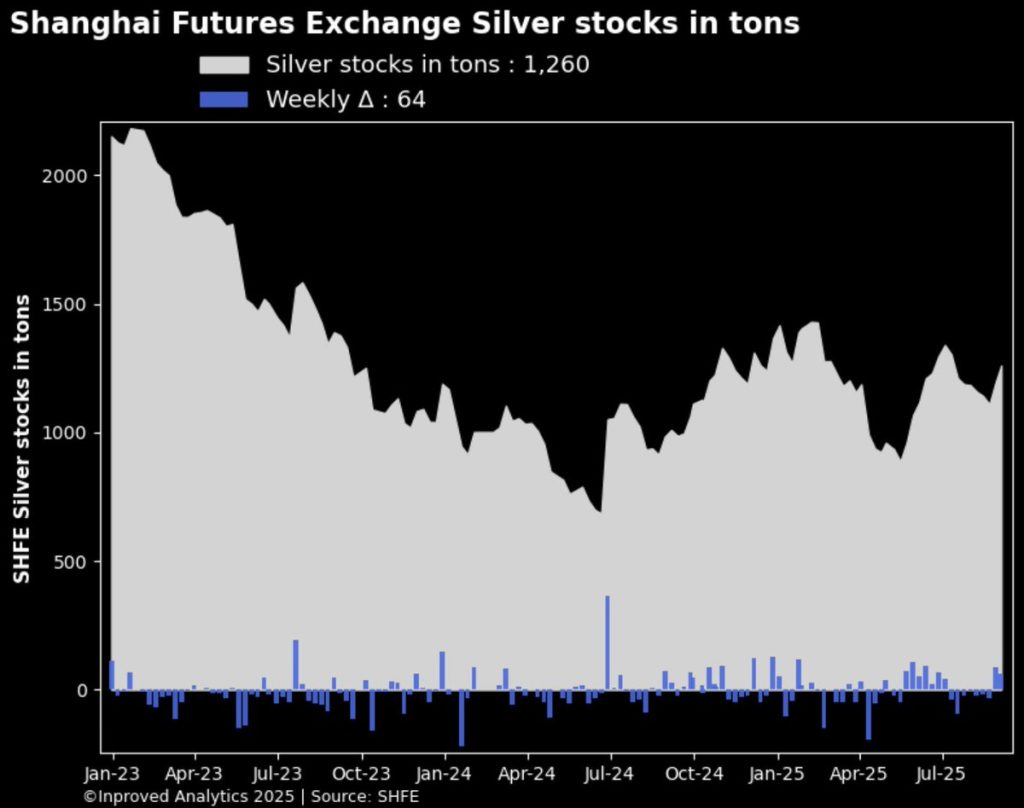

At the same time, Shanghai vaults are being replenished. For the second consecutive week, silver inflows hit 64 tons, lifting inventories to 1,260 tons — a seven-week high. That comes after months of persistent outflows earlier this year.

This turn matters because Shanghai has emerged as the price discovery hub for physical silver. In 2020, when Western ETFs and Reddit’s “Silver Squeeze” chatter briefly disrupted flows, it was the SHFE and the Shanghai Gold Exchange (SGE) that anchored global prices. If Chinese traders are rolling to higher strikes and vaults are refilling, it suggests not weakness, but renewed appetite to push the market higher.

The idea of silver heading toward $48 is not speculative fantasy — it is a price point etched in the market’s history. The last time silver touched such levels was January 1980, during the infamous Hunt Brothers squeeze, when leveraged futures buying collided with constrained physical supply. The price briefly spiked above $50 before collapsing, but the episode left a legacy: silver can move with breathtaking speed when liquidity tightens.

In 2011, silver once again charged to $49.80, propelled by QE-driven liquidity, surging ETF demand, and fears of currency debasement. At the time, silver ETFs like iShares Silver Trust ($SLV) experienced record inflows, draining London vaults and forcing refiners to scramble to meet delivery.

Today’s dynamics bear resemblance. ETFs are again pulling significant volumes, vault “free float” is diminishing, and traders are targeting $48. While the context is different — now it is geopolitical tension, trade war tariffs, and industrial decarbonization demand driving the narrative — the outcome could rhyme.

One underappreciated detail is the Exchange for Physical (EFP) spread, which measures the premium or discount between futures and spot. This week, silver’s December 2025 EFP narrowed to $0.80/oz above LBMA, while gold’s EFP held near a one-month high at $67.7/oz.

When silver EFPs widen, it often signals stress — futures holders demanding delivery at a higher cost. When they recede, it can mean the physical market is catching up, either through increased inflows or calmer logistics. The fact that silver’s EFP is moderating while gold’s holds firm is telling: silver’s vault replenishment in Shanghai may be smoothing near-term delivery pressures, but the underlying structural shortage remains.

Silver’s options market offers further clues. The put/call ratios on SHFE contracts are skewing toward calls, with the October contract registering 0.51 by volume and 0.62 by open interest. This bias toward upside is consistent with speculative positioning seen in past bull markets.

In 2010, for example, call-dominated positioning preceded the surge from $20 to nearly $50. In early 2021, a Reddit-driven spike in call activity fueled a short-lived rally to $30. Now, traders are not only buying calls but also rolling to higher strikes like ¥11,200/kg ($48.8/oz) — signaling conviction that the current rally is not yet finished.

Beyond trading flows and vault data, the industrial story remains silver’s long-term engine. 2025 is shaping up as a record year for solar panel installation, with China, the U.S., and Europe all expanding capacity to meet decarbonization goals. Silver is critical in photovoltaic cells, with demand projected to exceed 180 million ounces this year.

Add in growing usage in EVs, electronics, and green hydrogen applications, and the floor under silver prices looks firmer than in past cycles. Unlike 1980 or even 2011, today’s demand is not merely speculative; it is structural.

So, is this the setup for a genuine silver squeeze? The ingredients are certainly aligning:

As Hugo Pascal of InProved remarked this week, “When ETFs are absorbing more than vaults are adding, you’re looking at a silent squeeze.”

That silence could soon break.

Silver has always been volatile, prone to overreaction, and often overshadowed by gold. But in moments of stress — the Hunt Brothers in 1980, the QE rally in 2011, the Reddit mania in 2021 — it has proven its ability to leapfrog expectations.

With LBMA free float tightening, Shanghai vaults regaining momentum, and Goldman Sachs’ broader call for commodities to diversify portfolios, silver now sits at a critical juncture. If history is any guide, the market may not need a Reddit forum or billionaire speculators to push it higher. It may only need a continuation of what we are already seeing: steady ETF inflows, persistent Chinese buying, and a macro backdrop of weaker growth and looser Fed policy.

The $48 target traders are eyeing on the SHFE is more than a number. It is a reminder of silver’s tendency to surprise — violently, decisively, and in ways that rewrite the narrative.

And if that comes to pass, 2025 may be remembered not just as the year gold broke new highs, but as the year silver stole the show.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions