| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

For decades, gold has been a market shaped not only by price but by place. In London, it has long been a matter of institutional custody, with central banks and ETFs deciding how much of the global float should sit beneath the Bank of England’s streets. In New York, gold has been tied to futures, liquidity, and margin. But in Shanghai, the picture has always been different. There, gold represents a retail-heavy market, a barometer of household confidence, and increasingly, a strategic state-level lever. This past week, Shanghai gave the world another reminder of its growing role in the global bullion order.

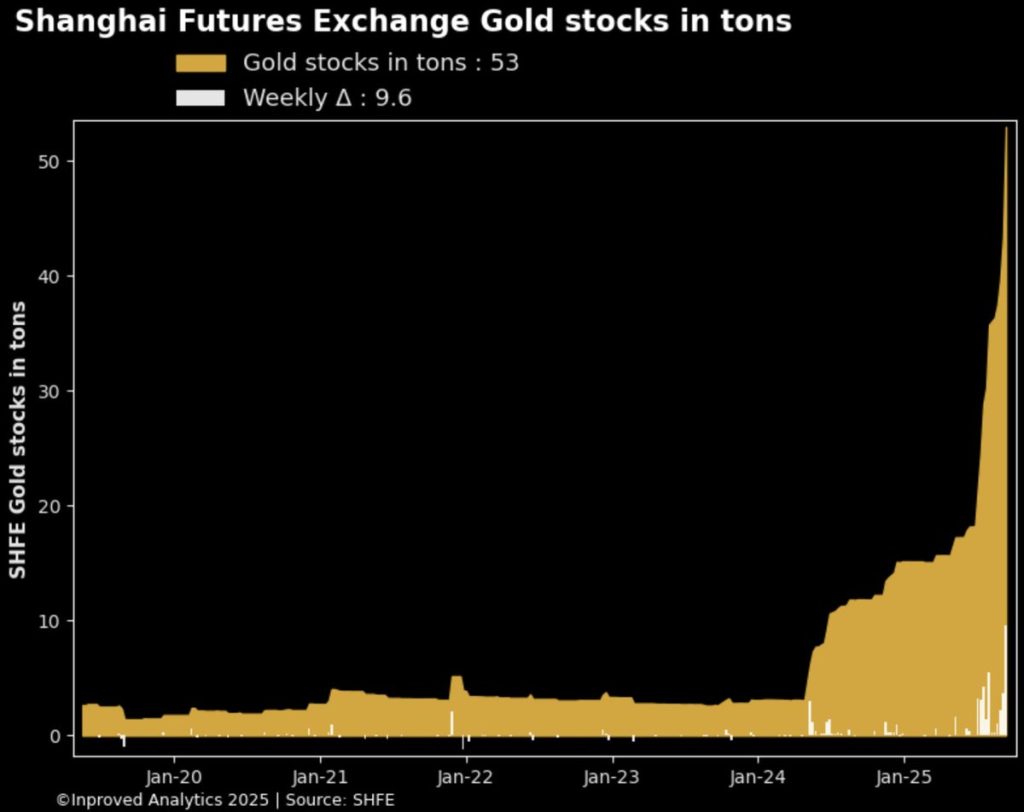

🚨Gold vaults in Shanghai hit an all-time high, marking the largest weekly inflow of 9.6 tons. In total, holdings surged past the symbolic 50-ton threshold for the first time in history. Week-to-date inflows of 6.8 tons set another record, reinforcing a narrative that has been building for months: gold is not just trickling into China, it is flooding in.

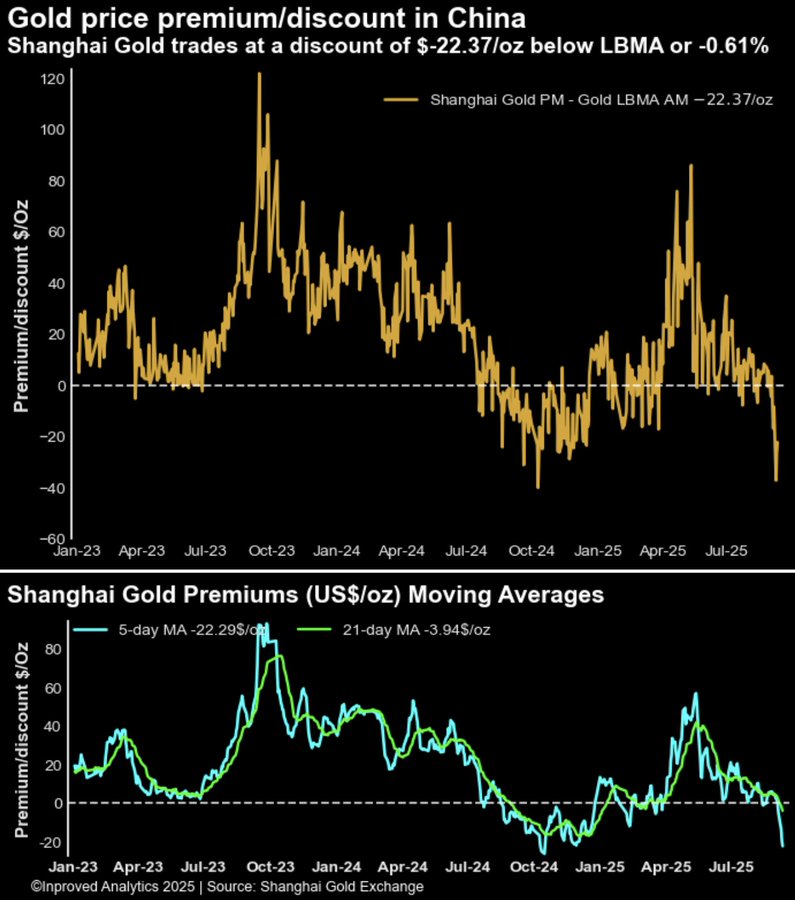

This surge in inventories has been accompanied by rising activity on the Shanghai Gold Exchange (SGE). The physical proxy contract, Au9999, registered trading volumes 7% higher than September last year, despite gold premiums in China closing at a discount. On September 10, those discounts widened to -$26.4 per ounce below LBMA benchmarks, equivalent to -0.7%.

On the surface, this looks contradictory. Why would vaults be setting records while local premiums are negative? Why would inflows surge even as Chinese buyers pay less than the global benchmark?

Hugo Pascal, a frequent commentator on these flows, framed it this way:

“The build-up in Shanghai’s vaults is not about immediate consumer demand. It’s about positioning. When you see inflows at this magnitude during a period of discounts, you should think less about the household buyer and more about state and institutional accumulation. This is metal being put aside for tomorrow, not for today.”

Indeed, history offers precedents. In 2013, when Chinese demand first overtook India’s to become the largest in the world, SGE premiums flipped negative briefly as the People’s Bank of China and state-connected institutions absorbed metal at scale. At the time, retail appetite was soft because of slowing growth, but imports surged nonetheless.

The same story played out in 2018–2019, when Shanghai vaults swelled in the run-up to the U.S.-China trade war escalation. Premiums went negative, yet the PBoC reported 16 straight months of gold reserve additions.

Today, we may be watching a similar accumulation — official or semi-official buying, masked by headline discounts that suggest weak consumer appetite but fail to capture the larger flows.

The fact that Au9999 volumes are running above last year’s levels tells us something else: while the premium picture signals weak jewelry demand, futures and trading activity suggest speculators and institutions remain engaged. The discount does not mean disengagement; it means market structure.

This divergence between vault inflows and retail demand has been one of the defining features of China’s bullion market. Unlike in India, where seasonal festivals and weddings dominate demand cycles, China’s flows are increasingly tied to macro strategy. Gold is both a financial hedge and a political instrument, a way to insulate from dollar volatility and sanction risks.

At 46 tons, or 1.48 million ounces, Shanghai’s vault footprint may look small compared to London’s thousands of tons, but the pace of accumulation is what matters. Inflows of 2.61 tons added week-to-date — and 9.6 tons in a single week — are records that indicate velocity. At this pace, Shanghai could emerge as the most dynamic physical hub in the world, not in absolute size but in marginal flow.

The 50-ton threshold is symbolically significant. For years, Shanghai vaults fluctuated in the 20–30 ton range, enough to service retail demand but never a true stockpile. Crossing 50 tons suggests a new phase: one where Chinese authorities are ensuring that sufficient physical gold sits inside the country’s borders at all times. This could be insurance against external shocks, a buffer for industrial demand, or simply a statement of independence from LBMA pricing.

What happens in Shanghai rarely stays in Shanghai. Persistent inflows into SHFE vaults shift the balance of physical metal away from London, the historical custodian of bullion. This matters for benchmarks, liquidity, and ultimately, for how gold is priced.

If Shanghai continues to stockpile even during periods of discount, arbitrage opportunities could arise. Traders may be incentivized to ship more bars east, draining London’s “free float.” As London vault reports show modest increases in gold holdings this summer, the question becomes whether those inflows can keep pace if Chinese accumulation continues.

New York’s COMEX adds another dimension. Its vaults currently hold nearly 39 million ounces, but much of it is “eligible” rather than “registered” metal. If Shanghai keeps absorbing, and COMEX faces heavy delivery pressure, we could see another bifurcation: paper liquidity in the West versus physical hoarding in the East.

History reminds us that these vault dynamics often precede price moves.

If the current build-up follows the same pattern, the implication is clear: Shanghai is quietly laying the groundwork for gold’s next leg higher. Discounts may obscure the signal, but history suggests vault inflows matter more than short-term premiums.

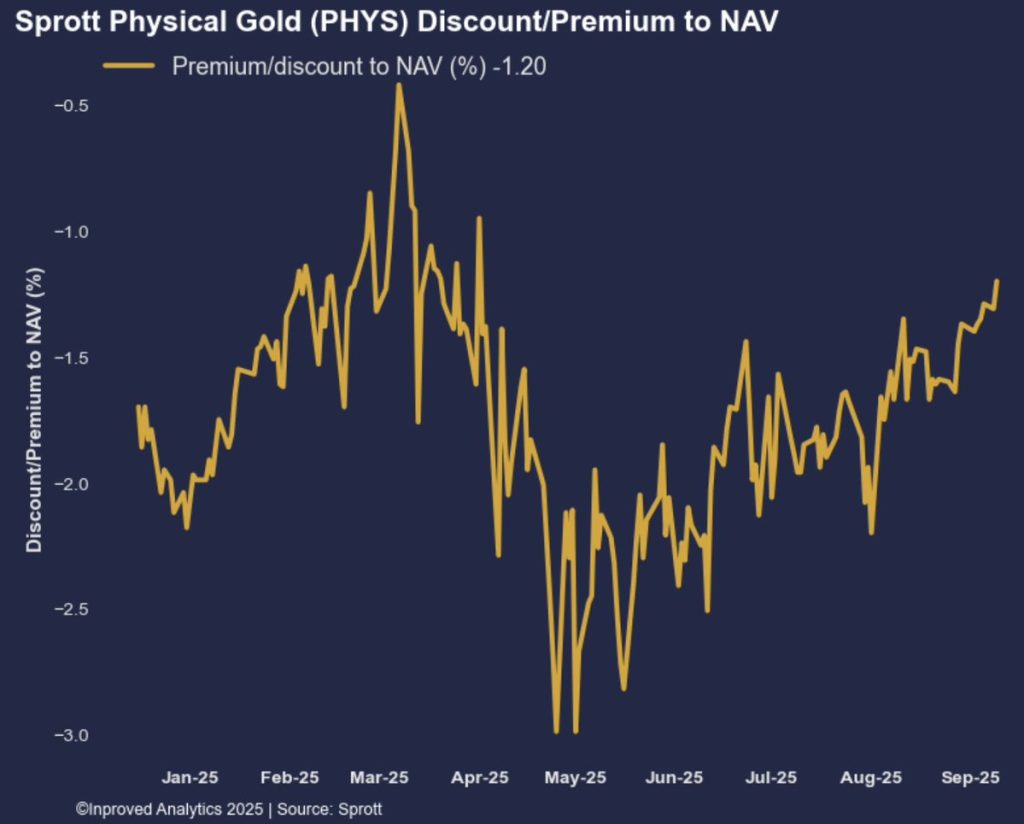

This quiet build-up in Shanghai is mirrored by sentiment shifts in Western vehicles for physical gold. The Sprott Physical Gold Trust ($PHYS), a favored proxy for investors who demand direct metal backing rather than paper claims, has seen its discount to net asset value shrink to just -1.2%. In practical terms, this means investors are increasingly willing to pay a near-par price for shares that represent vaulted bullion. Hugo Pascal noted this as an important confirmation of the broader trend:

“When the PHYS discount narrows, it tells you retail and institutional sentiment is aligning with what we see in the vault data. It’s a sign that physical gold is being sought, not avoided.”

Taken together, the record inflows in Shanghai and the narrowing discount in North America suggest that the appetite for physical gold is not confined to one geography. It is a global phenomenon, pointing toward a market in which physical scarcity and improving sentiment reinforce one another — the kind of backdrop that historically precedes strong upward legs in the gold price.

The market now faces a paradox. On the one hand, Shanghai premiums remain negative, signaling weak consumer demand. On the other, vault inflows are setting records, a classic accumulation signal. Which of these matters more?

Hugo Pascal offers a succinct answer:

“Premiums are the noise. Vault flows are the signal.”

If he is right, the surge past 50 tons could be the story we look back on in a year or two as the moment China positioned itself for gold above $4,000/oz.

As Shanghai’s vaults swell, global bullion markets are watching carefully. In the short term, discounts may keep prices capped in Asia. But in the longer run, physical accumulation in the East has always been a precursor to higher global benchmarks.

The world’s attention this week is focused on central banks and macro data in the West. But the real story may be unfolding quietly in Shanghai vaults, where bars of gold continue to stack higher, week after week, ton after ton.

If history is any guide, such build-ups rarely end quietly. They tend to reset the balance of power in the global gold market. And this time, with Shanghai past the 50-ton mark, that balance may be shifting decisively eastward.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions