| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

Silver has always lived in the shadow of gold. It is gold’s cheaper cousin, the “poor man’s precious metal,” a commodity at once monetary and industrial, loved by retail buyers and tolerated by central banks. But in recent years, silver has quietly been making a name for itself, and the latest data out of India and China is a reminder that this market is evolving in ways that could reshape its trajectory for years to come.

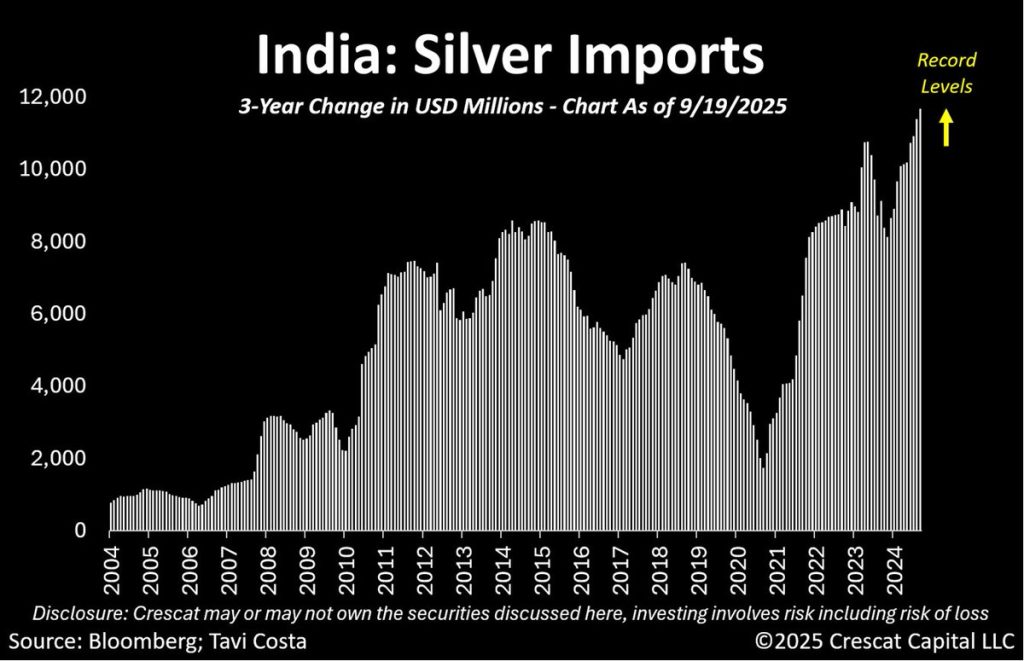

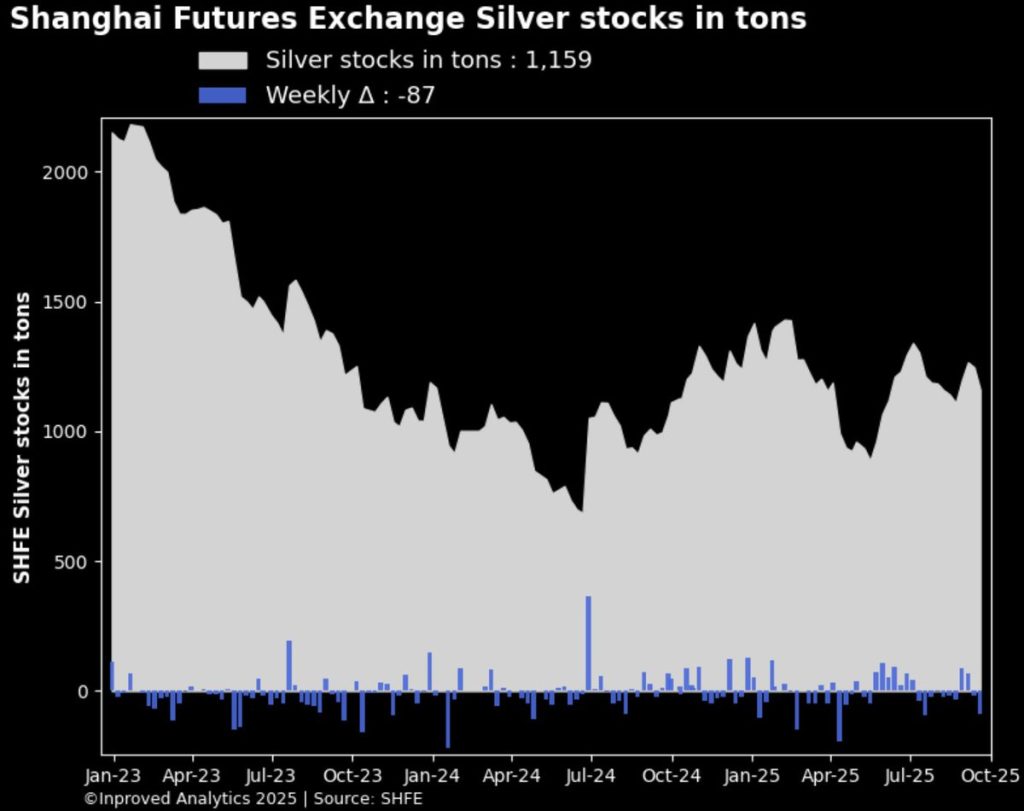

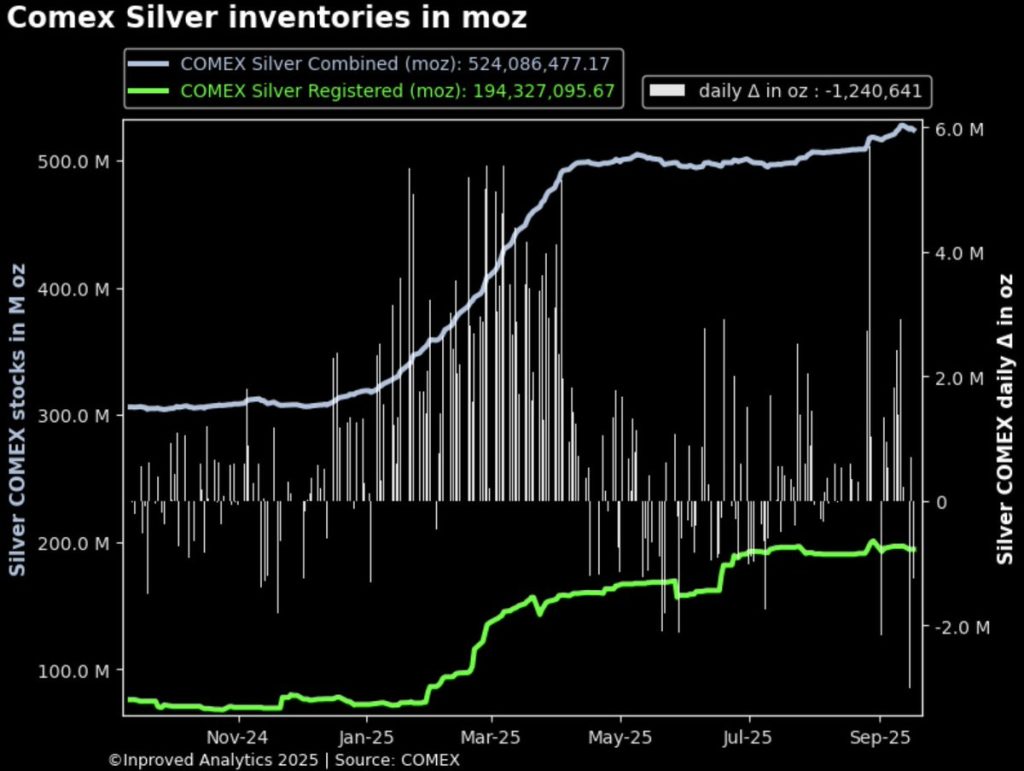

On September 18, we saw a flurry of telling signals: India’s silver imports soared to record highs over the last three years, while Shanghai’s silver vaults experienced another week of heavy outflows, hitting a four-week low at 1,159 tons after 87 tons were withdrawn in just seven days. At the same time, premiums in China remained positive — silver was trading +3% to LBMA at $43.4/oz, suggesting demand was resilient despite the vault drains. Meanwhile, COMEX vaults, in stark contrast, continued hovering near all-time highs even as they posted a 3.5 million ounce outflow week-to-date.

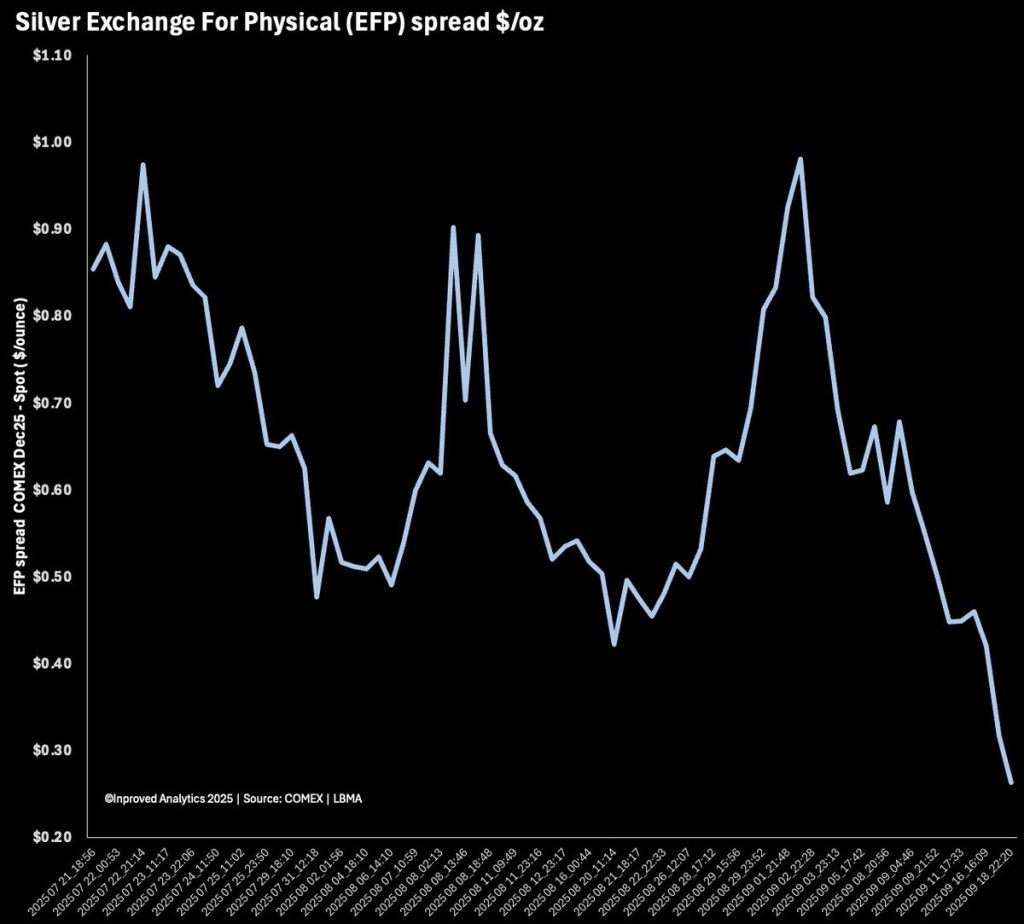

Against this backdrop, the silver Dec25 EFP (exchange for physical) spread receded to $0.26/oz or +0.63% above LBMA, hinting at tighter physical availability despite strong paper market liquidity. And yet, SHFE silver futures closed slightly lower at ¥9,835/kg ($43.04/oz COMEX equivalent), underlining the push-and-pull between speculative positioning and physical realities.

The question now is whether these trends are temporary quirks in a volatile market or the beginnings of something larger — perhaps even the foundations of a new “silver squeeze.”

Let’s start with India. The country has always had a deep cultural affinity with silver, which finds its way into jewelry, utensils, religious artifacts, and increasingly investment bars and coins. What makes today’s situation remarkable is the scale of inflows. Over the past three years, India has imported record volumes of silver — levels not seen in decades.

This surge has several drivers. First, rising affluence among India’s middle class has broadened the consumer base for silver jewelry and investment products. Second, gold’s rally to above $3,300/oz has priced many retail buyers out of the yellow metal, shifting attention to silver as the more affordable alternative. Third, silver’s dual role as both a precious and industrial metal has boosted its appeal, particularly as India continues to invest in solar energy, which relies heavily on silver for photovoltaic cells.

But the most important signal from India’s import boom is this: it underscores the possibility that central banks, having embraced gold as a reserve diversification tool, may eventually turn to silver. As one analyst in Mumbai put it this week, “It took central banks two decades to return to the gold market. It may take less than half that time for them to discover silver.”

If India is pulling silver in, China appears to be draining it out. For the second consecutive week, Shanghai silver vaults reported outflows, with 87 tons removed, dragging holdings to a four-week low at 1,159 tons. Earlier in the same week, the vaults were already down 43 tons WTD to 1,204 tons, showing how quickly silver is leaving storage.

Why does this matter? Because Shanghai has become the world’s most important hub for physical precious metals trading. The vaults there are a bellwether of real demand and supply dynamics. When vault stocks fall, it typically reflects one of two things: either stronger domestic consumption or arbitrage opportunities pulling metal elsewhere.

The fact that Shanghai silver is trading at premiums to LBMA (+$1.4/oz or +3.3%) suggests that the outflows are demand-driven, not a sign of weakening appetite. In other words, silver is leaving the vaults because buyers want it in hand. As Hugo Pascal noted in a recent post, “Silver flying out of Shanghai vaults is never a story of weakness. It’s always a story of physical buyers calling the market’s bluff.”

This kind of vault drain has historical precedent. In early 2021, during the first “silver squeeze” episode inspired by retail traders on Reddit’s WallStreetBets, Shanghai also saw heavy vault withdrawals.

Prices spiked briefly above $30/oz, and while the rally didn’t last, it highlighted the thin line between a balanced and imbalanced silver market. The lesson then — as now — is that silver supply chains are tighter than many assume.

While Shanghai vaults are shrinking, COMEX vaults in New York remain swollen. Despite a 3.5 million ounce (108 ton) outflow week-to-date, total COMEX silver inventories are still hovering near record highs, surpassing 517 million ounces earlier this month. This divergence between East and West is striking.

It raises two questions:

1. Is silver piling up in COMEX vaults because the market sees less physical demand in the U.S.?

2. Or is it that COMEX stocks are increasingly “paper barrels,” more about hedging and positioning than actual physical liquidity?

Here’s where EFP spreads become important. The Dec25 silver EFP receded to $0.26/oz above LBMA, down from wider spreads seen earlier in August. Narrower spreads suggest tighter arbitrage opportunities and potentially less willingness of vault holders to release physical metal at current prices. It’s a subtle but telling shift: while COMEX inventories look large on paper, not all of it may be readily available for delivery.

This is not unlike what we saw in 2011, when COMEX vault stocks were high on paper but deliverable inventories were constrained. That episode culminated in silver’s spectacular rally to nearly $50/oz — a level that has haunted traders and inspired every subsequent “silver squeeze” narrative.

Premiums are the heartbeat of the physical market. On September 18, Shanghai silver premiums were steady at +$1.4/oz or 3.3% above LBMA. Compare this with gold, where premiums in China have turned into deep discounts. The divergence is telling: while gold’s demand signal is muddied by central bank buying and investor positioning, silver’s demand is flashing bright green.

EFP spreads, meanwhile, are narrowing. A $0.26/oz spread may not sound like much, but in a market where arbitrage is razor-thin, this receding premium is meaningful. It reflects that while there is still demand for physical, the pressure is shifting from extreme tightness to something more manageable — at least for now.

As one veteran trader put it, “Premiums are the market’s way of telling you whether futures prices are real. When premiums rise and vaults drain, you know the paper market is lagging behind physical reality.”

So, are we heading for another silver squeeze? The ingredients are certainly there:

The last time we saw a similar cocktail was in early 2011, when investment demand collided with tight supply and propelled silver to $49/oz. More recently, in 2021, the retail-led silver squeeze attempt showed how even coordinated small-scale buying can rattle the system.

Today, however, the stakes are higher. Silver is not just a monetary hedge; it’s an industrial necessity. With the green energy transition accelerating, demand from solar, electric vehicles, and electronics adds a floor to consumption that did not exist in 2011. As Hugo Pascal remarked, “Every ounce that leaves Shanghai vaults is not just an investment — it’s a component in someone’s solar panel or circuit board.”

This dual demand function makes silver uniquely vulnerable to squeezes: it is both a store of value and an input for technology. That means when financial demand collides with industrial necessity, the market can tighten dramatically.

The silver market today feels like it’s at a crossroads. On one side, India is importing record amounts, reflecting retail enthusiasm and industrial need. On the other, Shanghai vaults are draining, showing that physical buyers are calling for delivery. Meanwhile, COMEX remains flush with metal on paper but faces narrowing spreads and questions about deliverability.

Add to that a macro backdrop of weaker U.S. employment numbers (Non-Farm Payrolls came in at 22k vs. expectations of 75k), increasing the likelihood of more rate cuts. That environment is generally bullish for precious metals. It also raises the odds that silver — often overshadowed by gold — may outperform in the next leg higher.

The story is not about whether silver is at $43 today. It’s about whether the pieces are aligning for a structural re-rating of the market. If India keeps importing, Shanghai keeps draining, and COMEX keeps swelling with “paper” rather than deliverable ounces, then another silver squeeze may not be a question of if but when.

As Hugo Pascal put it succinctly this week, “The vaults are speaking louder than the charts. Ignore them at your peril.”

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions