| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

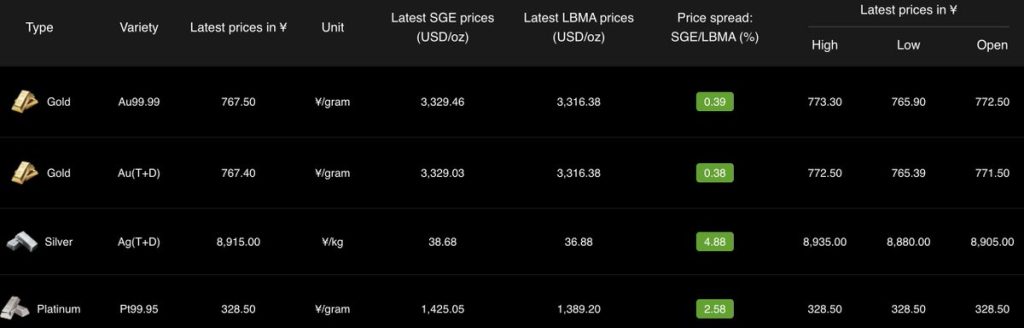

As of July 7, gold is trading at $3,329/oz, representing a 0.4% premium to the LBMA benchmark. This consistent spread, while modest, reveals a firm bid for physical metal globally. Although the premium hasn’t rocketed, its persistence reflects steady demand, especially among Asian buyers. While premiums alone don’t dictate the next move, they contribute to a broader narrative underpinning bullish sentiment.

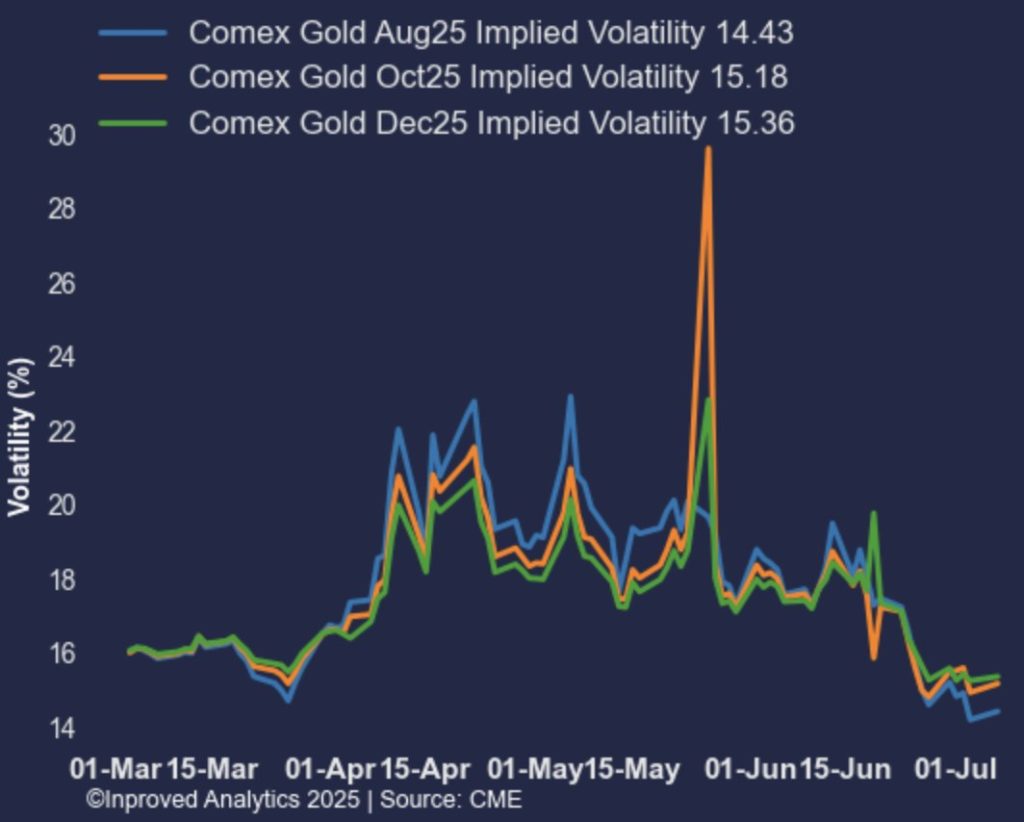

Gold’s at-the-money implied volatility has fallen to a three-month low. In the eyes of savvy market watchers like Hugo Pascal, this isn’t a sign of weakness—rather, it’s a signal. “Low IV just ahead of gold’s seasonal strength window sets the stage for asymmetric upside,” he notes. With this backdrop, buying calls becomes an attractive strategy: capped downside with theoretically unlimited gains if gold reignites upward momentum.

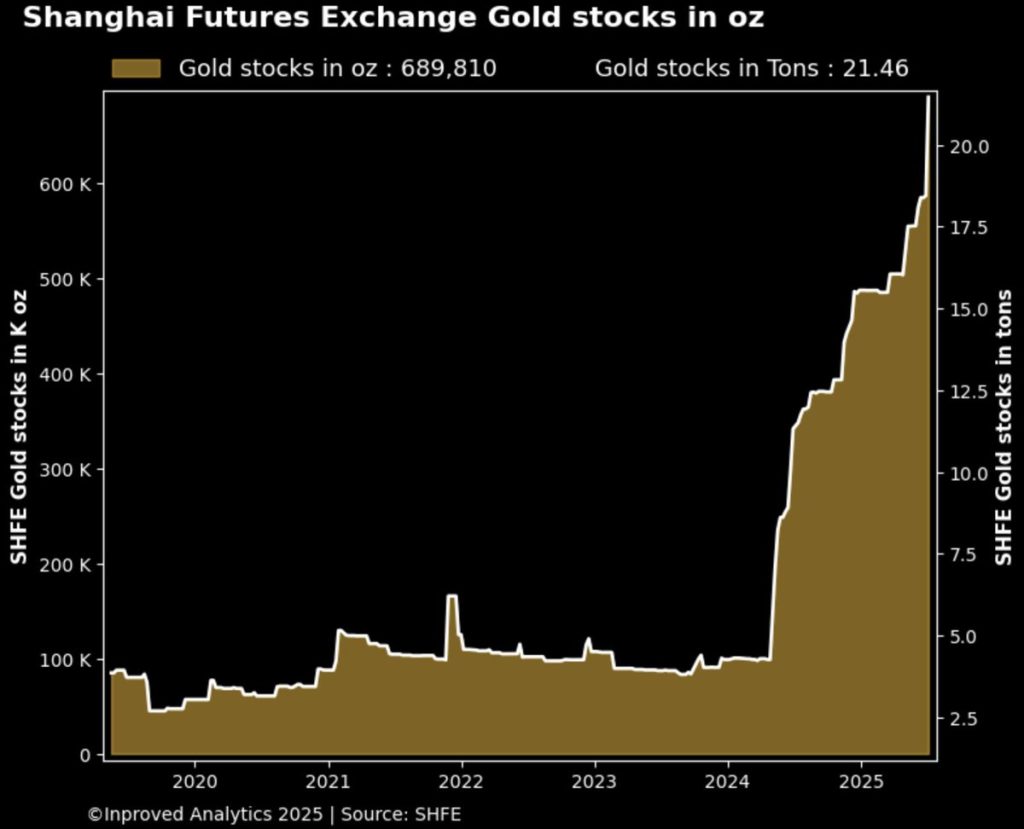

Across the world, Shanghai’s gold vaults recorded a steep 17.7% week-on-week increase, adding 21.5 tonnes (or about 3.2 tonnes/103,000 ounces). In a market where physical metal moves with measured precision, this inflow is significant. According to Pascal, “When vaults in Shanghai surge at this pace, it’s not periodic demand—it’s structural accumulation.” This suggests institutional and retail buyers are quietly positioning ahead of what they expect to be a meaningful price move later in the year.

Interestingly, while vault inflows are at their strongest in months, trading volume in Shanghai’s physical proxy contract (AU9999) has been weak—just 5 tonnes traded on July 3, the lowest since August 2024. Premiums remain at +0.4%, but the low turnover indicates that market participants are holding onto bullion rather than circulating it. Pascal interprets this as “a shift from transactional to contemplative positioning—vaults are going full; hands are now sticky.”

These layered signals—premium strength, vault inflows, low implied volatility, and muted volumes—coalesce around a powerful thesis: a steady accumulation phase before seasonal strength arrives. Summer often sparks inflows into bullion as investors diversify and protect wealth. With volatility subdued, premiums firm, and Asian vaults filling, gold appears primed for a breakout but may need a catalyst—geopolitical news, rate decisions, or macro surprises.

For those looking to act on these trends:

If you’re in Singapore—or anywhere aiming to anchor their assets in gold with precision—InProved offers the tools and rates to execute thoughtfully. Our mobile app provides live LBMA bullion pricing, regional premium tracking, and global vault access, complemented by expert strategies informed by data like this—brought to you by leaders like Hugo Pascal.

Download the InProved app today to tap into institutional pricing, real-time vault insights, and call-option guidance before gold’s seasonal window opens.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions