| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

As global financial markets navigate the volatile waters of mid-2025, gold remains outwardly composed, trading just above the $3,340 mark with a modest +0.2% premium to the LBMA benchmark. Yet, beneath this calm surface, profound structural shifts are underway—subtle tremors that speak volumes about positioning, sentiment, and the road ahead.

Hugo Pascal, CIO of InProved Metals, captures it succinctly: “When gold is quiet, you should listen even harder. Because in precious metals, silence is rarely stillness.”

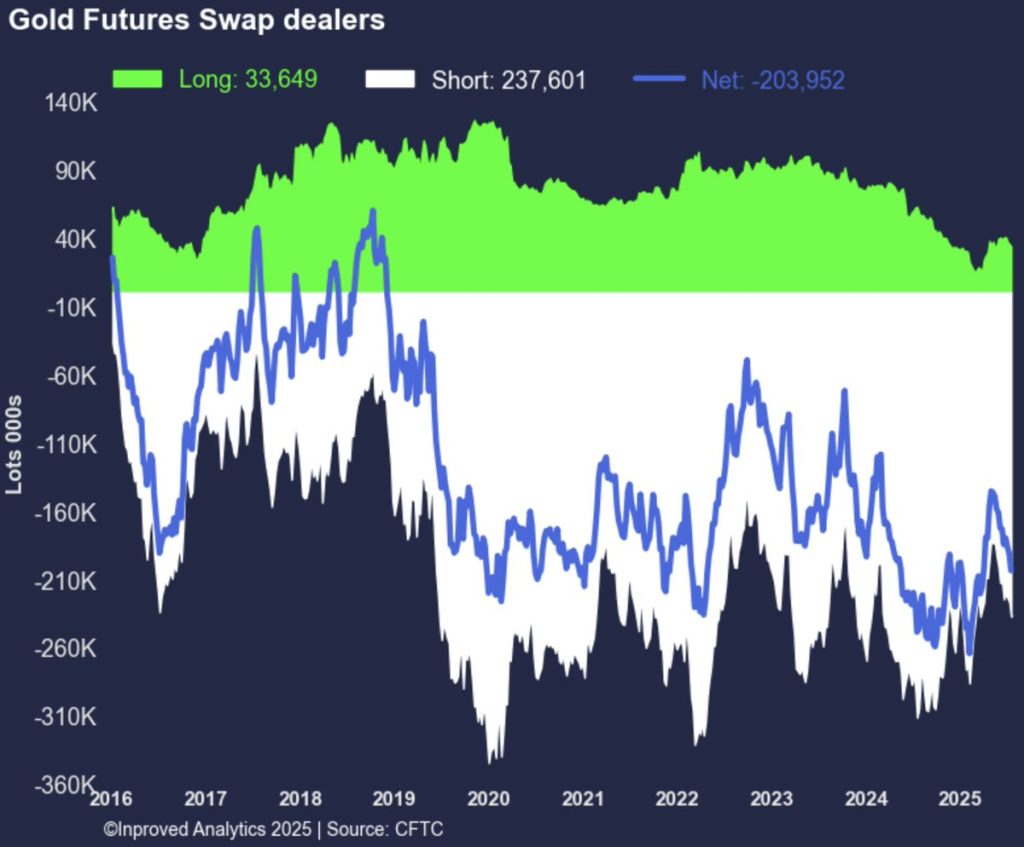

One of the most telling developments this week comes from the swaps category—those institutional intermediaries tasked with absorbing the risks that commercial hedgers and speculators generate. According to the latest COT report, swap dealers increased their net short positions in gold for the third consecutive week, reaching a three-month high of -204,000 contracts. That’s over 20 million ounces of gold, a notional value of roughly $67.8 billion, sitting short in the market.

This isn’t just a minor adjustment in risk management—it’s a statement. Swap dealers don’t take directional positions lightly. When they accumulate this kind of exposure, it implies that they’re supplying gold to a crowd of eager buyers—and that the pressure for physical settlement, options coverage, or speculative demand is rising on the other side of the ledger.

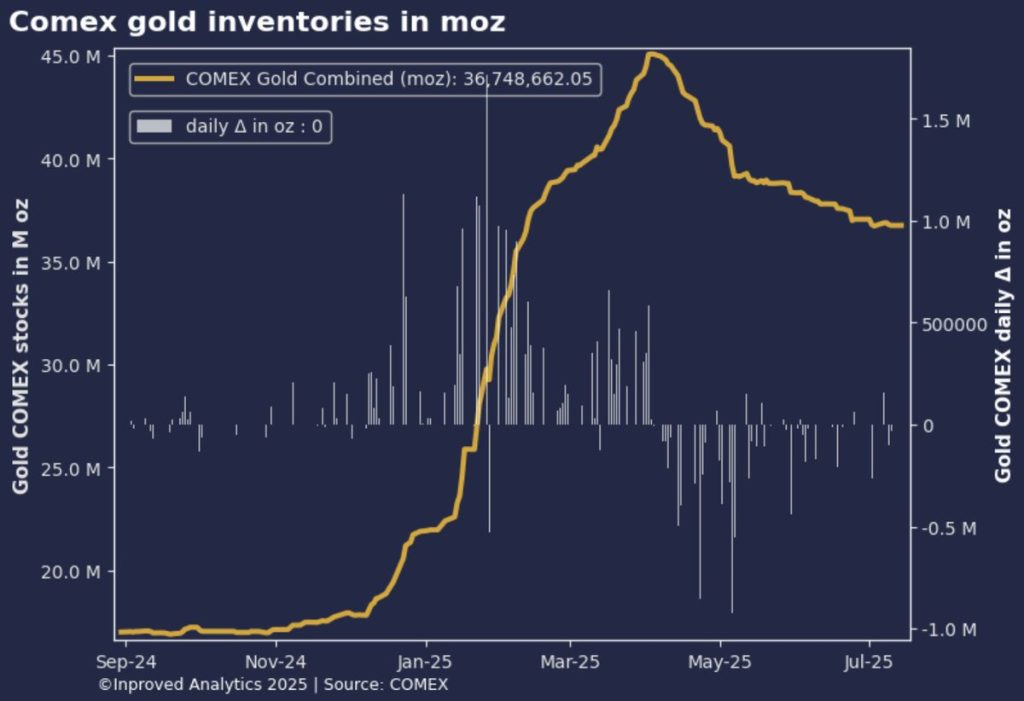

Overlay this with vault dynamics, and the picture becomes even more intriguing. Comex gold vaults are now holding near a 5-month low at 36.7 million ounces. That’s a significant drawdown from the April highs. The persistent decline in registered ounces (gold allocated for delivery) suggests either increased demand for physical withdrawals or a reluctance from participants to register metal that might be required for delivery later.

*“The irony of gold,” Hugo Pascal notes, “is that the less it moves, the more its infrastructure shifts. Watch the vaults, not just the price.”

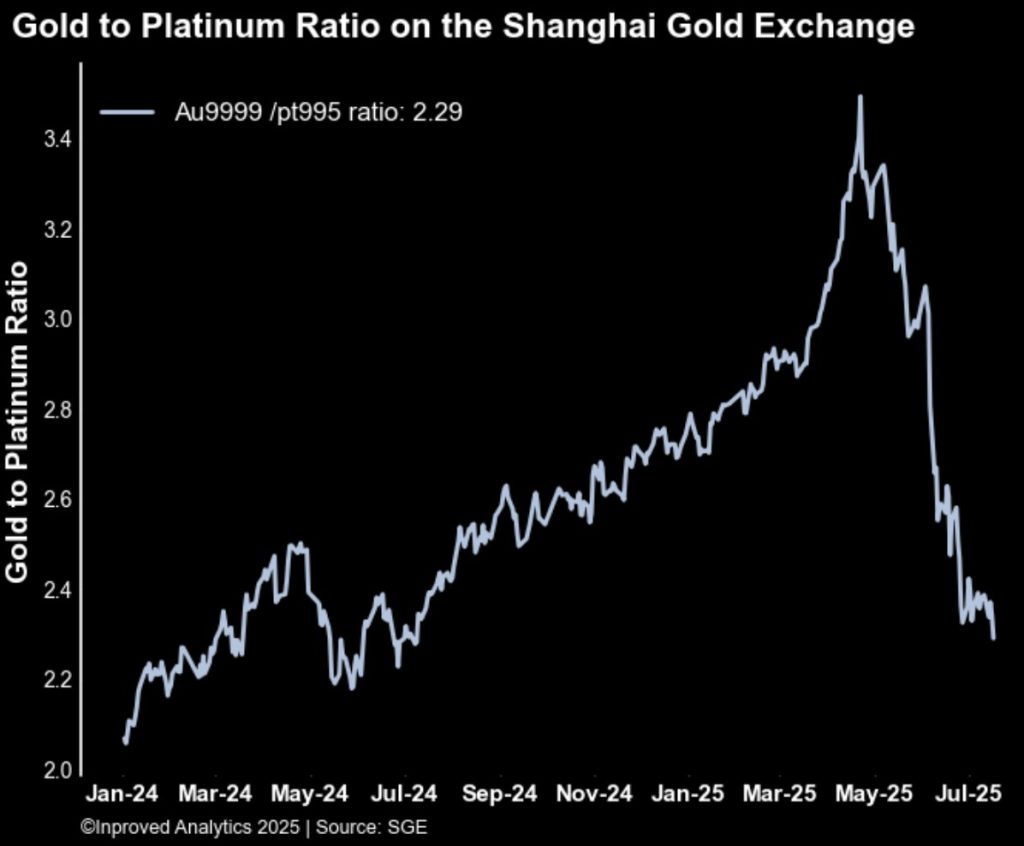

One of the most symbolic signals of late has been the continuing collapse of the gold-to-platinum ratio on the Shanghai Gold Exchange, now at 2.29:1, the lowest in a year. In simple terms, it means you can now purchase 2.29 ounces of platinum for every ounce of gold in China—down from over 2.5 just months ago.

This is not merely a footnote in a trading log. It’s a behavioral tell. Chinese investors, ever sensitive to relative value and macro-hedging efficiency, are gradually rotating toward platinum—encouraged by its industrial application, its scarcity, and perhaps its bargain against an arguably overextended gold chart.

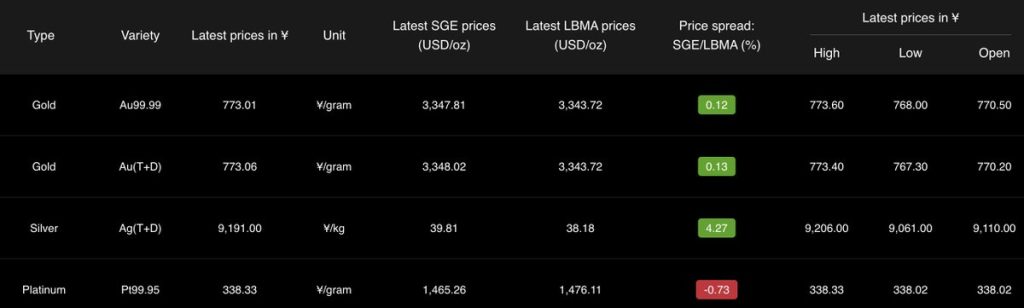

Gold in Shanghai continues to trade at a modest premium of +0.2% to LBMA spot, a level it’s held consistently over the past three trading days. This consistency, while not dramatic, is important. It tells us that domestic demand remains steady, not euphoric. But more importantly, it tells us that physical inflows and logistical constraints aren’t overwhelming—yet.

The Shanghai-LBMA premium can be tracked live via InProved’s dashboard—offering real-time insight during Asian market hours. And for traders watching macro geopolitics, it’s one of the sharpest indicators of East-West divergence in bullion sentiment.

“A widening premium often reflects rising urgency in the East,” Hugo adds. “It means someone is paying extra to ensure delivery. That’s a heartbeat, not a headline.”

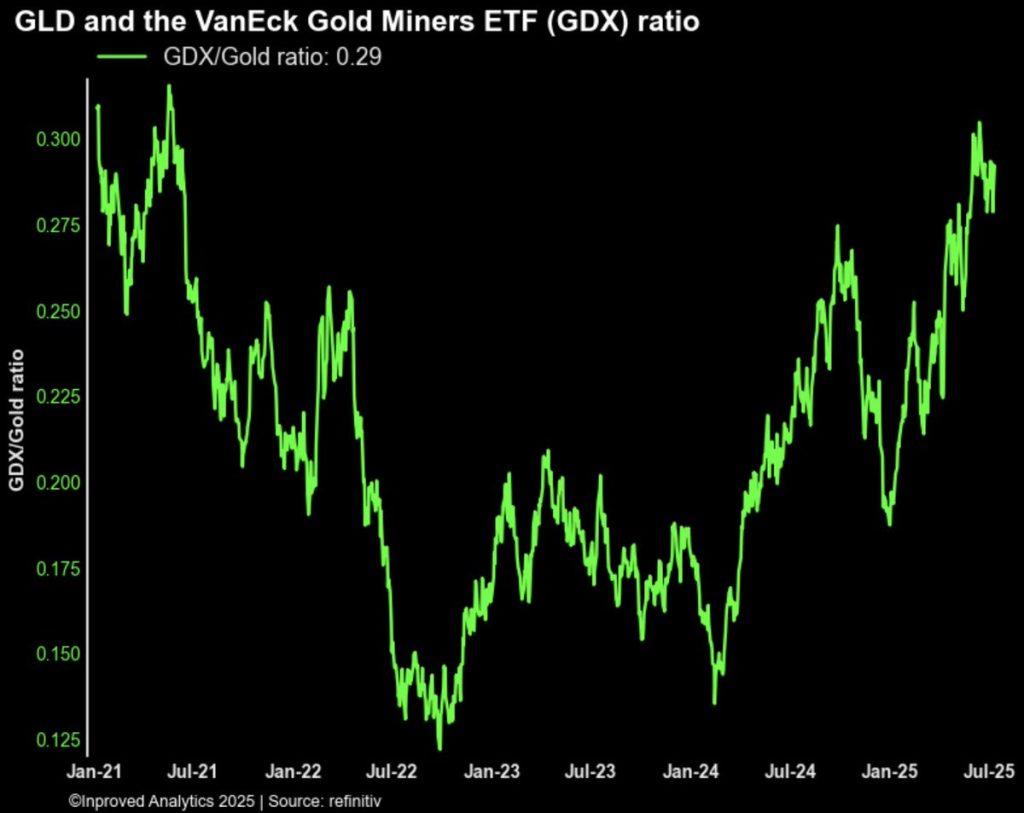

Meanwhile, in the paper gold space, the VanEck Gold Miners ETF (GDX) and GLD (Gold ETF) ratio remains pinned near a 4-year high at 0.29. This is one of those lesser-watched metrics that tends to predict shifts in capital preference. When miners outperform gold bullion, it typically signals risk-on behavior from investors betting not just on price stability, but margin expansion and operational leverage.

In other words, investors don’t just want gold—they want exposure to the companies mining it. That’s optimism, and it’s worth noting given the cautious tone in macro commentary elsewhere.

The current setup paints a picture of quiet bullishness—but with serious complexity. On one hand, gold’s price action remains range-bound, refusing to break down even amid rising swap shorts. On the other, vault drawdowns, premium persistence, and cross-metal rotations all suggest underlying strength.

Could this be the calm before another rally?

The increase in swap short positioning might mean that some leveraged players are overexposed to the long side and could be vulnerable if macro data, particularly US inflation or job numbers, turn hawkish. Meanwhile, China’s lukewarm appetite for AU9999 contracts—the primary physical proxy for gold on the SGE—hints at local fatigue, or at least a waiting game for better entry points.

And yet, it would be a mistake to assume gold is weakening. As Hugo reminds us: “Gold doesn’t need to move to matter. It’s the structure around it—options skew, vaults, premiums—that tells you how it will move next.”

From our vantage point at InProved, gold is in a coiled state. Option skews remain mildly bid for calls, suggesting protective upside is still being purchased. Physical infrastructure is tightening, not loosening. And geopolitical uncertainty—from the Middle East to renewed trade tensions—remains a constant undertow.

Our strategy? Maintain core allocations, accumulate on weakness, and consider building long-dated call positions while implied volatility remains modest. For more advanced clients, ratios like gold-to-platinum offer rotational trades with significant upside.

And remember—price isn’t the only cost. Premiums, accessibility, and storage jurisdiction all matter.

Which is why we’ve built InProved.com—a platform that gives you real-time access to Chinese and global bullion premiums, ultra-competitive pricing benchmarked to LBMA, and world-class vaulting in Singapore, one of the world’s most trusted financial safe havens.

As the summer of 2025 unfolds, don’t be lulled into inaction by a quiet gold chart. Watch the swaps. Follow the premiums. And read the behavior of the vaults, the miners, and the options flow.

Because when gold is quiet, smart money is preparing.

🟡 Track real-time Chinese premiums at: https://inproved.com/lbma-vs-sge

🟡 Secure bullion at LBMA benchmarks with InProved: https://inproved.com

🟡 Download the InProved app to vault, monitor, and protect your assets—today.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions