| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

As the gold market heads deeper into May, two powerful currents continue to pull in opposite directions. On one side, bullish sentiment in China is intensifying — manifesting in elevated futures activity, call-heavy options flow, and rising premiums. On the other hand, U.S. gold inventories are quietly thinning, and technical resistance on COMEX is beginning to cap price movement near $3,250/oz. The net result? A market brimming with tension, but underpinned by structural support.

According to Hugo Pascal, Chief Investment Officer at InProved, “We’re seeing one of the most geopolitically and structurally divergent gold markets of the past decade. Bullish conviction remains high in Asia, but physical constraints in the West and technical ceilings in New York are keeping the next breakout on pause — for now.”

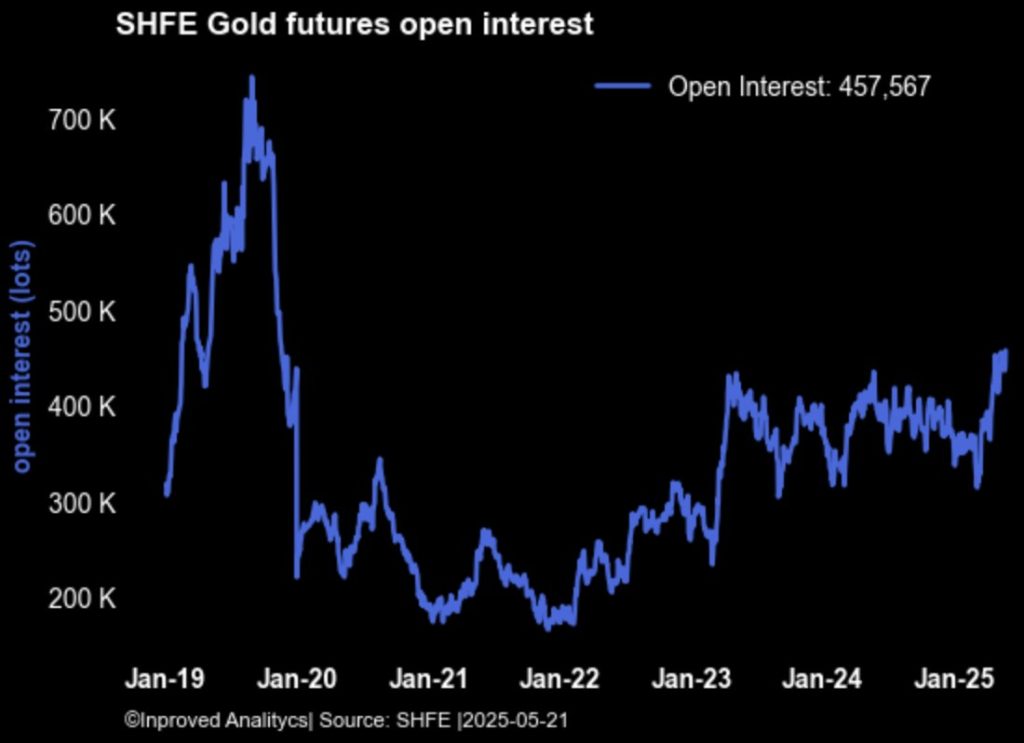

Chinese traders continue to lead the charge. Gold open interest on the Shanghai Futures Exchange (SHFE) has climbed to a 5½-year high, reaching 457,600 contracts, with a 4.7% increase week-to-date (+20 tonnes equivalent).

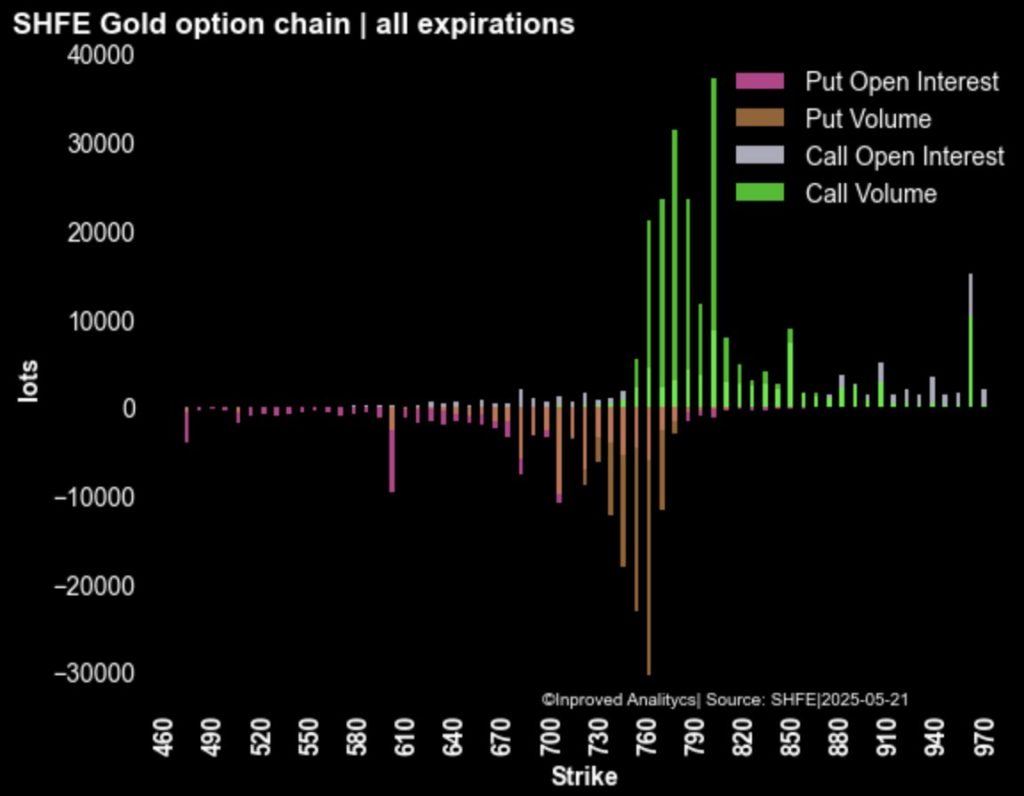

The options market tells the same story. The most actively traded strike on May 21 was ¥800/gram — equivalent to a bullish $3,452/oz on COMEX — pointing to expectations of further upside even after gold’s 21% YTD rally. The put/call volume ratio sits at 0.71, signaling that calls are clearly in favor, as investors position for higher prices, rather than protection against a reversal.

Pascal highlights the significance of this trend: “Options are forward-looking. When the most popular call strike is $3,450, you’re not seeing hedging — you’re seeing conviction. This isn’t defensive.”

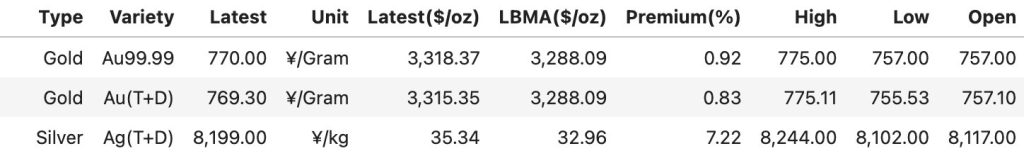

At the physical level, gold premiums in China remain elevated — and appear to be rising again. On May 21, gold traded at ¥769/gram, or $3,315/oz, which is +0.8% over the LBMA benchmark. The previous day, it closed at ¥754/gram ($3,250/oz) — a +0.7% premium.

Interestingly, these premiums are persisting despite record-level imports. According to customs data, China’s gold imports surged to an 11-month high in April, showing that demand has remained resilient even in the face of all-time high prices.

“This is the most telling part,” says Pascal. “You have record prices, record imports, and still, Chinese buyers are paying premiums. That speaks to depth of demand and long-term capital allocation.”

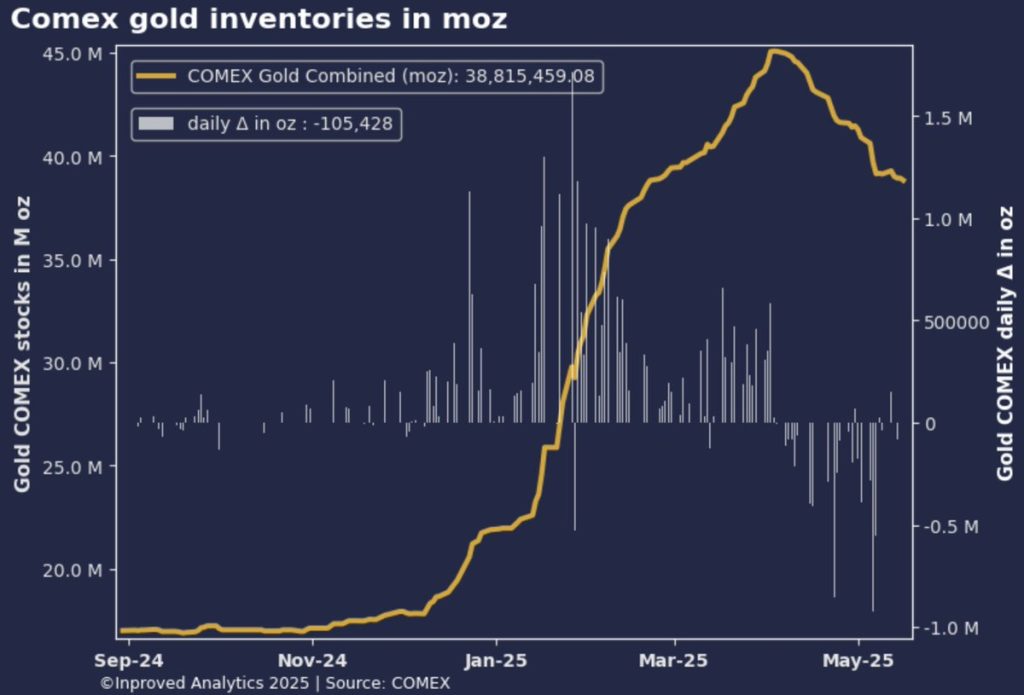

While Asian exchanges buzz with speculative activity, the physical story in the West tells of quiet depletion. On May 20, COMEX gold vaults hit a three-month low at 38.8 million ounces, marking a drop of 6.2 million ounces (195 tonnes) since the April 3rd peak.

This retreat reflects ongoing delivery requests, private vault transfers, and increased bullion withdrawal into OTC channels. Though not dramatic in a single-day context, the cumulative drawdown of 6+ million ounces in six weeks is enough to raise concerns about tightening float — particularly as central bank demand remains strong.

Pascal emphasizes that COMEX isn’t just a speculative engine — it’s also where serious bullion is stored and moved. “When metal leaves COMEX and doesn’t come back, it’s not a trade. It’s a signal.”

With price action tightening, COMEX gold (June ’25) has now become highly sensitive to near-term technical levels:

“The skew is still positive, which is constructive,” notes Pascal, “but until we see the call wall break with volume, gold will trade heavy in this range.”

From a macro lens, the gold market may appear sideways, but the underlying activity — in vaults, options, and futures — tells a far more active story.

1. China is betting higher, in both speculation and physical accumulation.

2. The U.S. is bleeding inventory, albeit slowly and quietly.

And technical positioning on COMEX suggests a coil — not a collapse.

As Hugo Pascal concludes: “The next move in gold isn’t about headlines — it’s about pressure. And that pressure is building, not easing.”

For now, gold continues to hold firm in a high-altitude range, awaiting either a fundamental macro push — or simply a breach in resistance. Either way, the traders positioning for upside aren’t blinking. And neither, it seems, is the metal.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions