| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

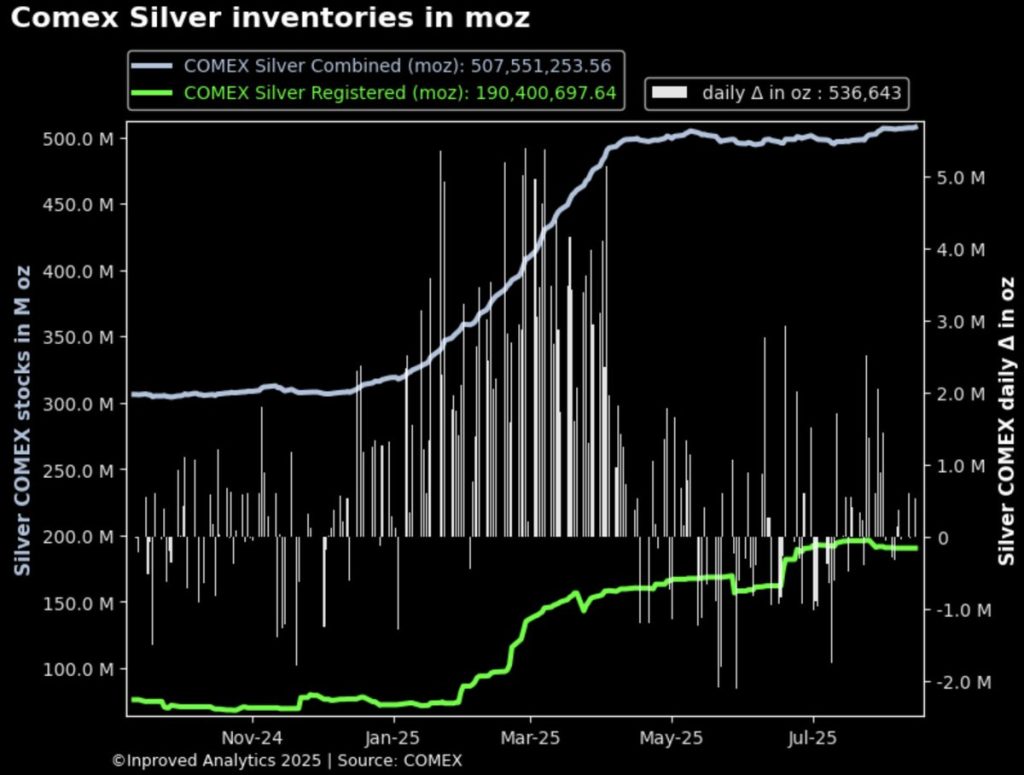

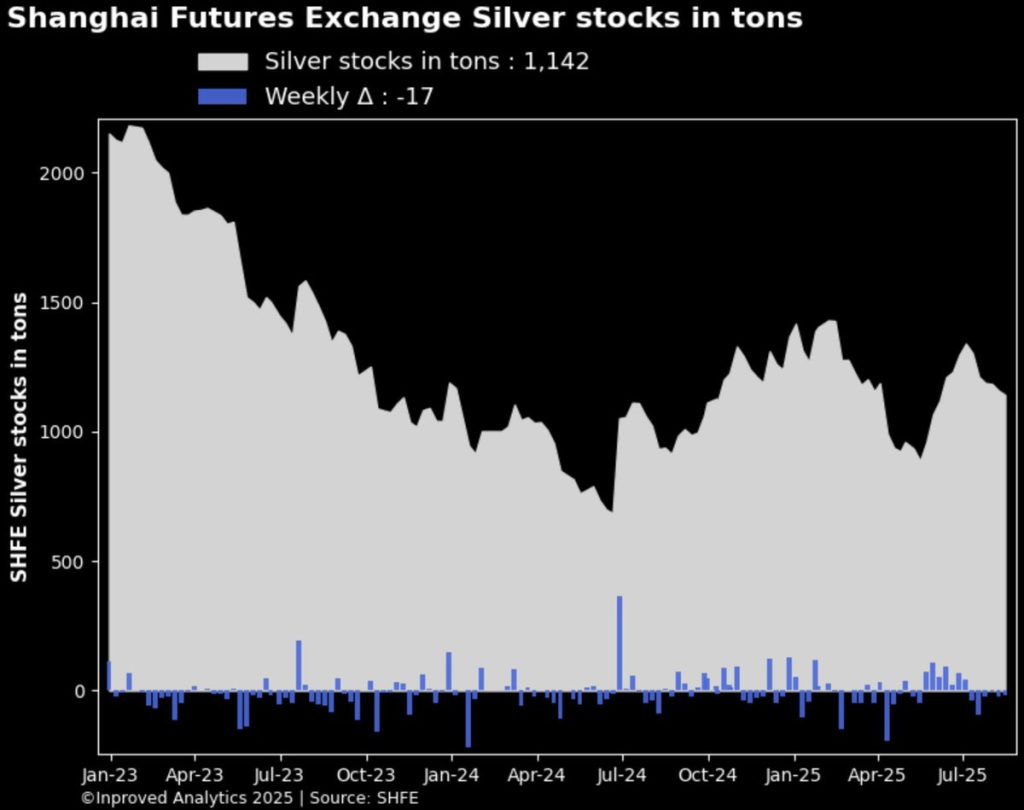

The story of silver has always been one of tension—between paper and physical, East and West, abundance and scarcity. The last week has made that tension unmistakable. At a time when COMEX vaults in New York reached a record 507.5 million ounces, Shanghai’s silver vaults bled another 17 tons, extending a string of consecutive weekly outflows. On the surface, silver looks plentiful in the United States but scarce in China, and the contrast is sharpening by the day.

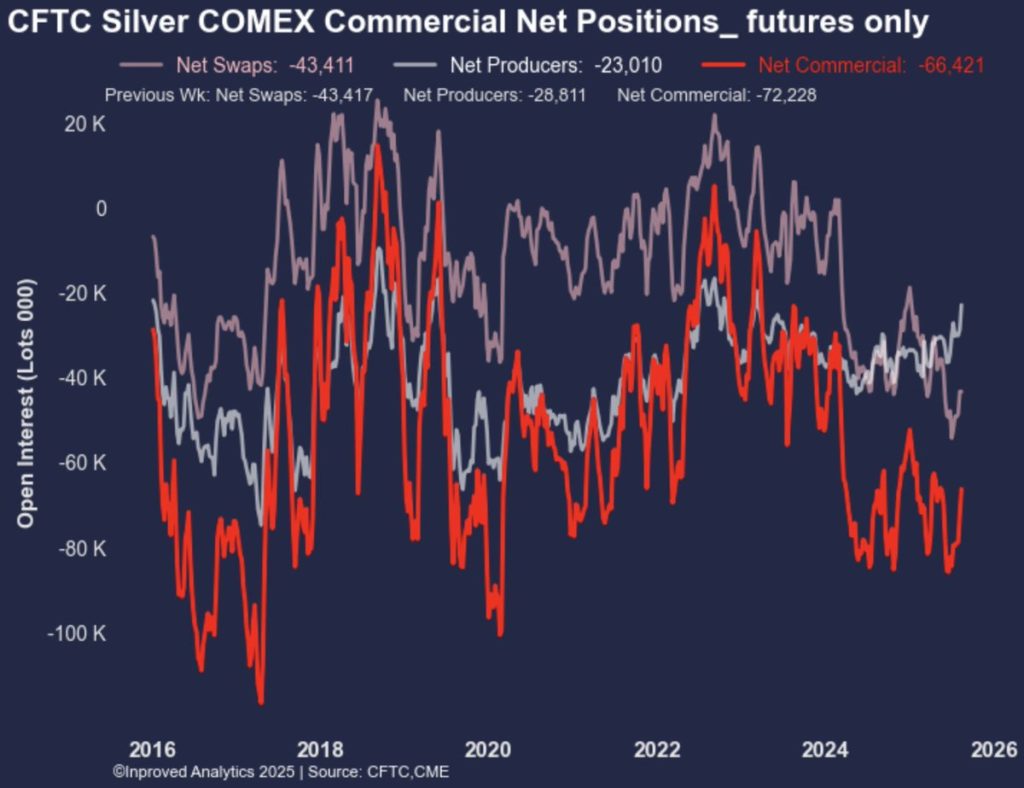

Add to this the fact that commercial traders—producers and swaps—are shifting their positioning in ways not seen for years, and the picture becomes even more layered. Producers, historically some of the most reliable short players in silver, are now holding the least bearish positions in two and a half years. Swap dealers remain short, but they have not added to their positions. And while this happens in the futures market, premiums on physical ounces in Asia are beginning to climb again, despite record inventories in New York.

It is a market that feels like it is preparing for something.

Producers, the miners who bring silver out of the ground, have traditionally shorted futures contracts to hedge against price declines. When silver rises, they lock in profits by selling futures, ensuring their operations remain profitable even if prices fall later. This makes sense—producers want certainty, not speculation.

But as of this week, producers are holding only -23,000 contracts short, or -115 million ounces, the lowest in two and a half years. Hugo Pascal has been quick to point out what this means:

“When producers hedge less, they are sending a message. It’s not that they’ve suddenly turned into speculators, but rather that they’re worried about leaving too much money on the table in a market that looks ready to break higher.”

The history of silver shows that producer hedging often retreats at key inflection points. Before the 2011 run to nearly $50/oz, producer shorts had been whittled down dramatically. In the 2020 COVID crisis, producers likewise hesitated to hedge into strength, fearing they would miss the upside. The pattern is repeating again.

On the other side of the ledger sit the swap dealers—large banks and financial institutions that take the other side of trades. They remain short -43.4K contracts (-217 million ounces), unchanged from the previous week. In many ways, their position reflects the backbone of the paper silver market: they balance speculative demand with hedging supply.

But swaps holding steady while producers retreat hints at fragility. If speculators pile in aggressively, swaps may be forced to cover—or at the very least widen spreads—to avoid exposure. That’s where volatility erupts.

One of the most talked-about dynamics in recent weeks has been vault flows. Headlines speak of silver “flying” into COMEX vaults and “flying” out of Shanghai’s. But what does this mean in practice?

Vaults are the warehouses where bullion is stored under strict regulatory frameworks. Silver entering a vault (“inflows”) usually comes from mine production, recycling, or international shipments. Silver leaving (“outflows”) often goes to meet industrial demand, jewelry, or investor withdrawals.

This week, COMEX vaults saw inflows of 16.7 tons on Thursday alone, 34.6 tons week-to-date, lifting total inventories to an all-time high of 507.5 million ounces. At the same time, Shanghai vaults lost 17 tons, falling to 1,142 tons.

For traders, this divergence matters. Rising COMEX inventories suggest the U.S. futures market is flush with deliverable metal—enough to backstop contracts and ETF allocations. Declining Shanghai inventories suggest China’s domestic market is drawing down its reserves, whether for industrial use, investment, or to arbitrage price differences with the West.

“Flows are the bloodstream of the precious metals market,” Hugo Pascal notes. “When one region is bleeding silver while another is soaking it up, you’re seeing global rebalancing in real time. And the market rarely lets such dislocations persist without consequence.”

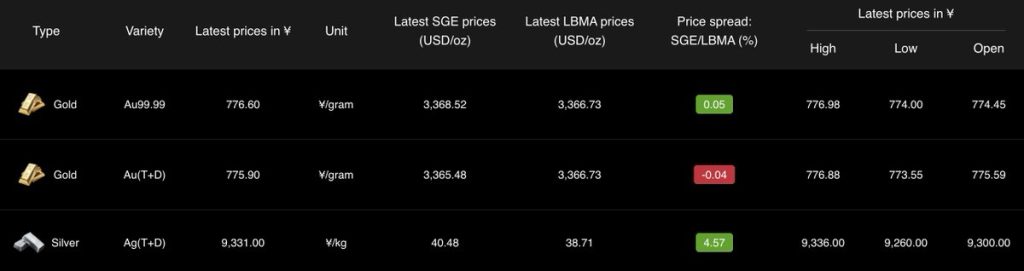

Premiums—what investors pay above international benchmark prices like the LBMA—are another key signal. This week, silver traded at $39.7/oz on August 15, or +4.65% above LBMA, while premiums earlier in the week closed at $1.95 per ounce, or +5.2% above LBMA.

These premiums tell us that, despite record COMEX inventories, buyers are still willing to pay more for physical ounces in Asia. That reflects scarcity at the local level. If premiums rise further, it could drive arbitrage flows—metal shipped from West to East to capture the spread.

History tells us that when premiums and vault flows both move in the same direction (outflows plus rising premiums), price rallies often follow.

To understand today’s setup, it’s worth revisiting two key episodes in silver’s modern history.

In 2011, silver rocketed to nearly $50/oz. The rally was fueled by investor speculation, ETF inflows, and a collapse in available supply in Asia. Producers had cut their hedges, swaps were caught flat-footed, and premiums surged. The rally ended in a crash, but the lesson was clear: once momentum builds in silver, it can overwhelm even the deepest paper markets.

In 2020, during the COVID crisis, silver experienced another sharp squeeze. Vaults in London and New York drained as investors scrambled for physical. Premiums soared, ETFs like SLV saw record inflows, and the disconnect between paper and physical grew so wide that delivery delays became common. That episode ended differently—central banks and fiscal stimulus helped stabilize markets—but it showed again how fragile silver’s balance can be.

Today’s market carries echoes of both. Producers are light on hedges, premiums are creeping higher, vaults in China are draining, and speculative appetite is warming up.

The ETF market remains a crucial barometer of silver demand. Products like SLV in the U.S. and PSLV in Canada provide a way for investors to gain exposure without handling bars. Inflows into these ETFs force custodians to secure physical ounces, tightening supply.

Recent weeks have seen modest inflows, particularly into PSLV. If momentum builds, ETFs could become the transmission mechanism that turns speculative demand into physical scarcity.

One of the starkest contrasts lies in the ratio of paper claims to physical inventory. On COMEX, open interest currently stands at hundreds of millions of ounces against registered inventories of just under 200 million ounces. That’s a leverage ratio of more than 2:1. In Shanghai, the ratio is even more extreme, with futures open interest versus vault inventories at around 12:1.

These ratios highlight the fragility of the system. As long as most futures contracts are cash-settled, the leverage works. But if even a small percentage of traders demand delivery, the pressure can overwhelm available stockpiles. This is what analysts mean when they warn of a “silver squeeze.”

Silver sitting near $40/oz is already a statement. But the ingredients for another leg higher are present:

The psychological level of $40 is now both a magnet and a wall. If silver clears it decisively, the next targets are $41.2, then $43, and perhaps beyond. Speculative pressure combined with structural tightness could even echo the 2011 rally.

As Hugo Pascal puts it: “The market right now feels like a coiled spring. Every week we’re seeing more stress—vault outflows, premiums rising, shorts unwinding. If silver breaks $40, there may be no going back in the short term.”

For long-term investors, silver’s story is not just about speculation. It is about the interplay of industrial demand, monetary policy, and physical scarcity. With the global push for solar panels, electric vehicles, and green infrastructure, silver’s role as an industrial metal has never been more vital. Add to that its centuries-old function as money, and you have a commodity that bridges two worlds.

And in times of geopolitical strain, the physical ounces matter most. Vault inflows and outflows may seem technical, but they are the heartbeat of a market where delivery is never guaranteed.

For all the complexity of futures contracts, vault flows, and hedging strategies, the conclusion is straightforward: holding physical silver is more important than ever. Whether through coins, bars, or vaulted solutions, investors who secure their ounces now will be best positioned for what comes next.

At InProved Metals, we are committed to helping investors bridge the gap between paper and physical. Download the InProved mobile app or visit InProved.com to access some of the lowest LBMA bullion prices in the world, with secure storage in Singapore’s tax-efficient, world-class vaults.

Silver may be flying into vaults in New York and out of vaults in Shanghai, but the best silver is the silver you already control.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions