| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

For years, silver has been treated as gold’s more volatile cousin — a metal that spikes during manias and fades when calm returns. But this month, as both Shanghai and COMEX vaults hemorrhage physical ounces, the narrative is changing fast.

The numbers are staggering.

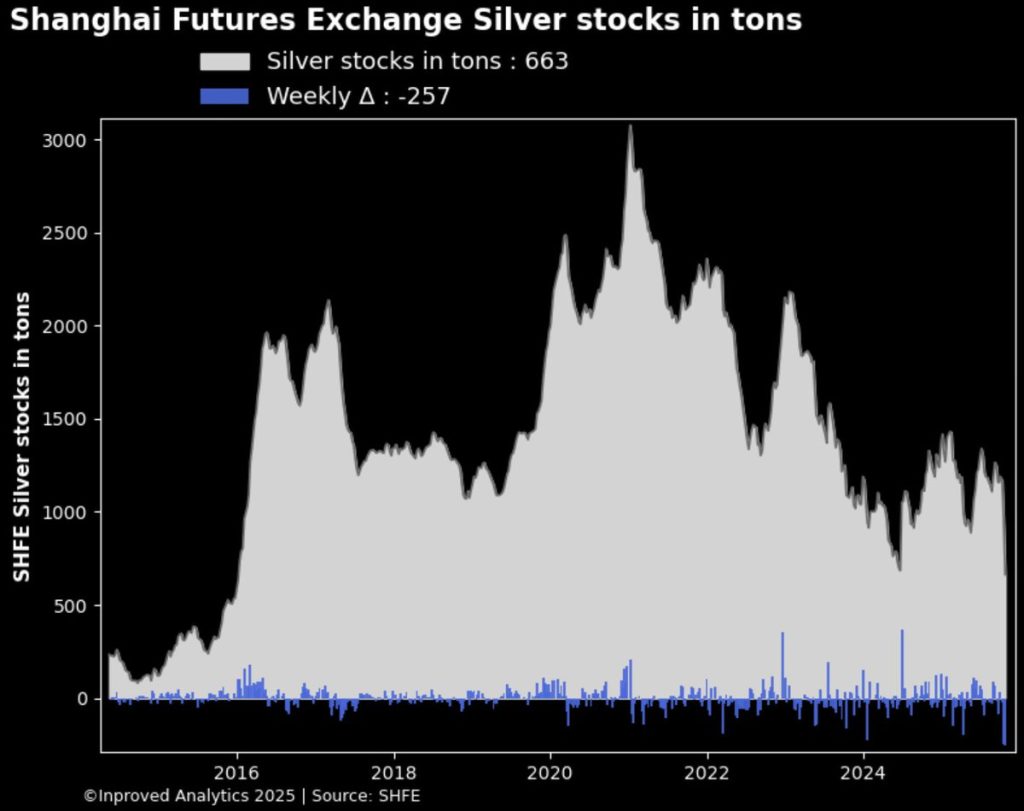

In China, the Shanghai silver vaults have just logged their largest weekly outflow ever — down 257 tons week-to-date, dragging inventories to 663 tons (21.3 million ounces), the lowest level in 21 months. That means 43% of all stored silver has vanished in just two weeks.

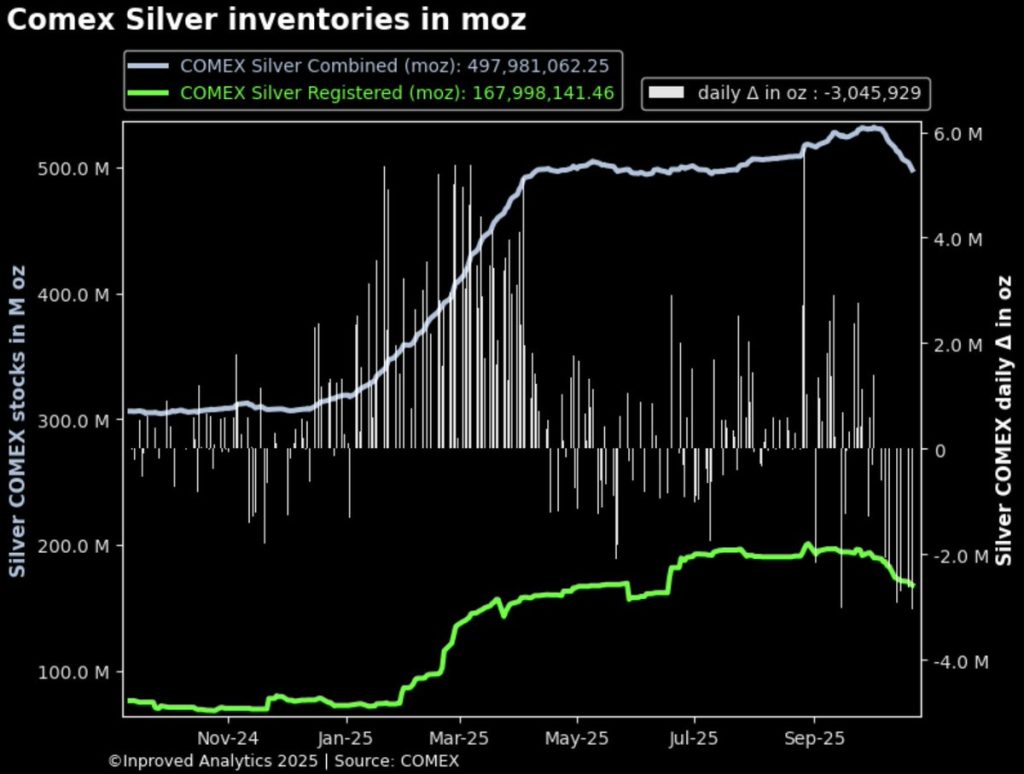

Meanwhile, across the Pacific, the COMEX vaults have now recorded 14 consecutive days of outflows totaling 33.9 million ounces (1,028 tons) — an unbroken bleed that few expected to last this long.

At the same time, premiums in China have flipped positive again, trading 1.5% to 1.8% above the LBMA benchmark, even as prices whipsaw. In other words, the physical market is paying up while the paper market plays catch-up — the opposite of what happens in a bear phase.

Something big is happening beneath the surface of silver.

To understand the magnitude of what’s unfolding in Shanghai, consider this: at the start of October, the city’s silver holdings stood comfortably above 1,100 tons. Two weeks later, that number is down nearly 500 tons across ten trading sessions — a rate of withdrawal unmatched since the market liberalization period of 2015.

The immediate cause? A tightening of local liquidity combined with aggressive arbitrage into India and the UK, where premiums have risen due to retail demand and refining constraints. As local traders offload silver domestically at premium, others are diverting inventory to higher-paying regions abroad.

Hugo Pascal captured the scale succinctly in his market wrap: “Shanghai isn’t just exporting metal — it’s exporting confidence. Each ton leaving those vaults tells you where physical tightness is moving next.”

The most telling figure is not just the outflow but the speed: 228 tons in the past five sessions, 57.7 tons in a single day. Even during 2021’s post-lockdown reflation, daily withdrawals never exceeded 30 tons.

If Shanghai’s drawdown is the story in the East, COMEX’s is the mirror image in the West.

The U.S. vaults have now seen 14 straight days of outflows — more than 33.9 million ounces gone. Wednesday alone saw another 3 million ounces (95 tons) shipped out.

That marks the longest continuous drawdown streak in nearly a decade and highlights an extraordinary arbitrage loop: physical metal leaving the U.S. as global buyers secure supply while futures-based positions remain bloated.

Despite this exodus, COMEX inventories are still historically elevated after a record 2024 build-up. But the trend reversal — sustained, accelerating, and unidirectional — matters more than the headline figure. As Pascal noted: “It’s not the amount of silver leaving that shocks the market. It’s the fact that it keeps leaving — every day — even as prices correct. That tells you physical demand is real.”

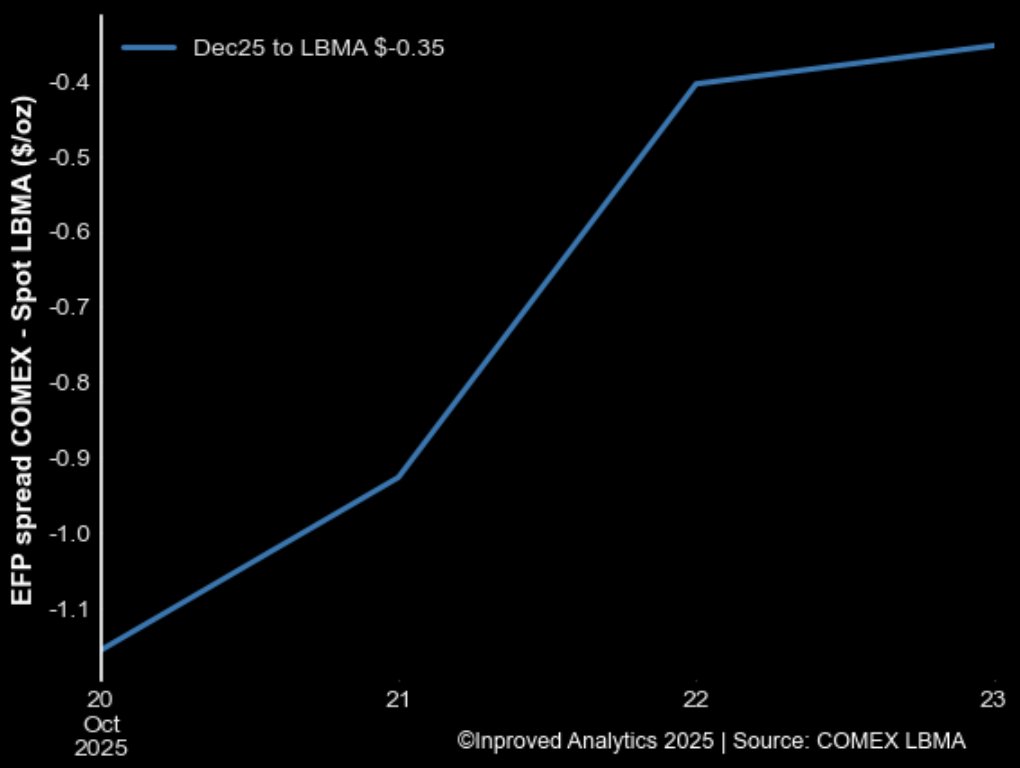

The forward curve confirms what vaults are shouting.

Silver’s backwardation — where near-term prices exceed longer-term futures — has narrowed to –$0.35 per ounce. A week ago, that discount was almost double. Normally, such narrowing signals easing pressure on immediate supply. But not this time.

Because both Shanghai and COMEX inventories are falling simultaneously, the curve’s flattening likely reflects forced convergence rather than comfort — a technical repricing as traders roll expiring contracts in a market with shrinking deliverable metal.

In other words, this isn’t backwardation disappearing. It’s stress being repriced further down the curve.

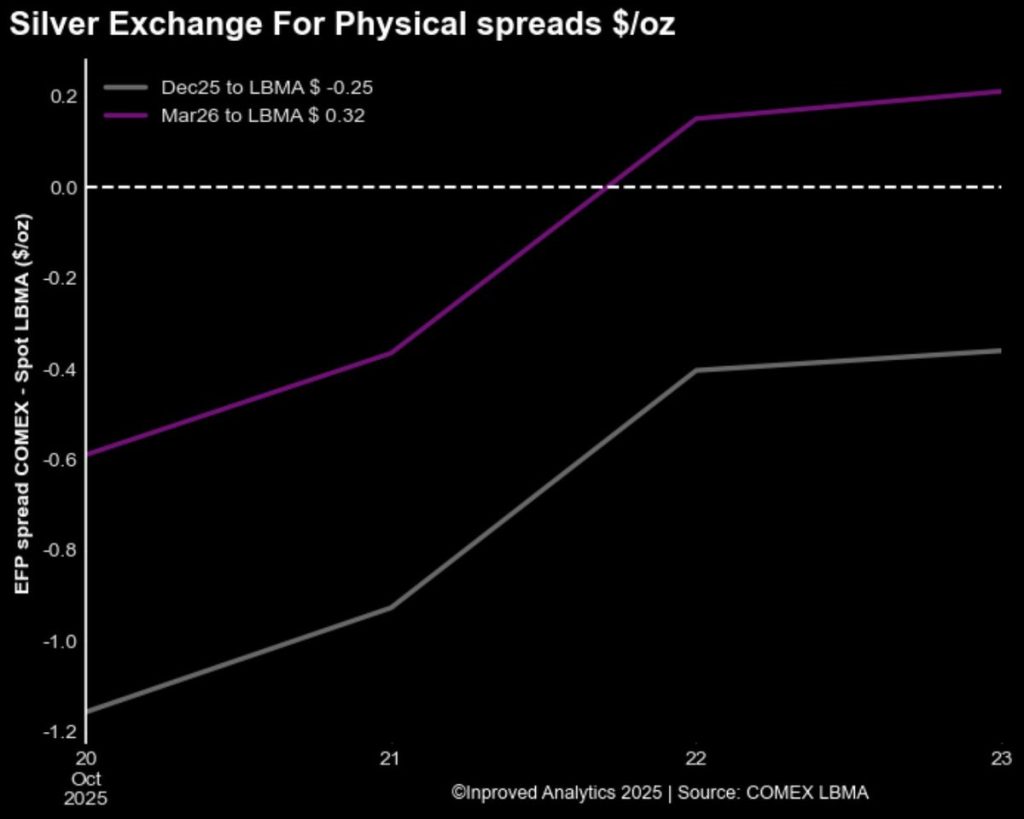

Silver’s Exchange-for-Physical (EFP) spreads now tell a story of fragmentation, not equilibrium.

What does that mean? It’s the physical market asserting itself — spot silver in London and Asia commanding tighter supply premiums, while futures further out still reflect the assumption that metal will “return” to the system.

But what if it doesn’t?

In the past, such EFP inversions preceded structural deficits. The same shape appeared in late 2007, right before silver ran from $13 to $20, and again in mid-2020, just ahead of the squeeze to $30. The pattern doesn’t repeat perfectly — but it rhymes loudly.

Perhaps the most revealing shift this week: Chinese silver premiums have turned positive again, rising to +1.5%–1.8% above LBMA.

That’s a swift reversal from last week’s discounts — and it mirrors what happened earlier this year when premiums jumped to 5% amid a rush of industrial restocking. Once again, we’re seeing physical buyers step in at lower nominal prices, bidding up immediate delivery even as international futures trade sideways.

This is why vault data matters. Prices can fall, but when buyers still pay a premium over global benchmarks, it signals confidence in ownership, not speculation.

Behind these flows lie two quiet beneficiaries: India and the UK.

India’s silver import volumes remain near record highs, with refiners absorbing the slack created by Shanghai’s exports. The local premium in Mumbai’s wholesale market remains around 6–7%, enough to attract fresh inflows from Asia’s tightest hub.

The UK, meanwhile, benefits through its role in the London Bullion Market Association (LBMA) network, where ETFs and custodians have been restocking after months of drawdowns.

In essence, silver is migrating westward again, just as it did in 2020 — flowing from Asia’s storage to Western ETFs and industrial users. But this time, the physical drain looks deeper and faster.

Traders call it “the quiet squeeze.” Prices are volatile, but supply is genuinely thinning. Each ton that leaves a vault doesn’t just reduce inventory — it raises the marginal cost of trust.

As Pascal wrote earlier this week: “When traders start paying premiums for delivery in a falling market, that’s the market admitting there’s less silver to go around than it thought.”

That’s the core of every squeeze — not a single buyer cornering supply, but many small holders refusing to sell, forcing futures markets to reconcile with physical scarcity.

With Shanghai’s vaults now at a 21-month low, COMEX draining daily, and premiums back in positive territory, the stage is quietly resetting.

For conservative investors — especially those who have relied on gold as their anchor — silver’s current dislocation offers a powerful reminder: physical discipline beats speculative timing.

1. Physical scarcity is real.

The largest ever Shanghai outflow (–257 tons) and the longest COMEX streak in a decade are not random noise. They mark structural tightness returning to a metal that underpins industrial and monetary hedging alike.

2. Premium flips are signals, not surprises.

The return to +1.8% premiums in China during falling prices shows that demand didn’t vanish — it paused, then resumed more aggressively.

3. Singapore remains an optimal bridge.

With zero capital gains tax, full LBMA linkage, and transparent custody systems, Singapore offers a neutral entry point for both Asian and global investors seeking to secure silver allocation without geographic friction.

For PMETs, civil servants, and long-horizon investors, this isn’t a time to chase volatility. It’s a time to recognize what vault data reveals: a systemic drawdown in available silver that paper markets are still underpricing.

This is not just another weekly data point. It’s the anatomy of a supply shift. Silver is leaving warehouses in both East and West. Vaults are bleeding, premiums are rising, and forward curves are warping.

The market may call it volatility. But history — from 2008 to 2020 — calls it the prelude to repricing.

As Hugo Pascal summed up in his Friday note: “You can suppress price for a while, but you can’t suppress tonnage. When the vaults empty, the market rewrites its own rules.”

The emptying has begun. And once again, the real story of silver is being written not on screens — but in the vaults.

Access LBMA-linked bullion pricing, physical storage in Singapore, and real-time market analytics through InProved.com — where the world’s tightest metal spreads meet the strongest custody infrastructure for serious investors.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions