| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

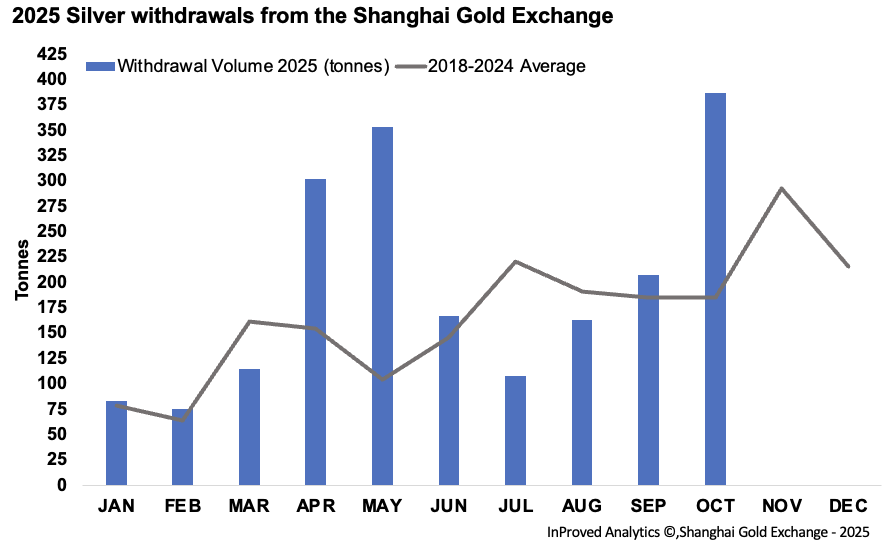

The numbers out of Shanghai are shouting even if price action looks composed. The proxy for physical silver demand is “going through the roof”: the Shanghai Gold Exchange (SGE) logged 387 tons of silver withdrawn in October, an 87% jump month-on-month. At the same time, the city’s dedicated silver vaults drained another 42 tons this week, leaving inventories near a 10-year low at 623 tons (≈20 million oz). Pair that with implied volatility cooling across precious-metals ETFs and you get a market that looks tranquil on the surface while the physical layer tightens beneath it.

Withdrawals are the metal leaving exchange custody to meet fabrication, investment, or export demand. 387 tons in a single month isn’t about speculative churn; it’s end-users pulling bars for real-world needs. That’s why the simultaneous collapse in Shanghai’s silver vault balance (623 tons) is so important: the pipeline is being tapped faster than it’s being refilled.

Contrast this with gold. Shanghai gold vault balances have been making new highs while silver vaults slide. Why the divergence? Three practical reasons:

1. Industrial draw vs. investment restock. Silver’s dual role means electronics, solar, and auto supply chains keep pulling metal even when investors hesitate. Gold’s recent inflows reflect investment and reserve accumulation; silver’s outflows reflect industrial throughput plus investment.

2. Curve incentives. With silver’s near contract still in backwardation (more below), it pays to deliver/hold metal now rather than later. Gold’s curve has been steadier, encouraging accumulation in vault rather than drawdown.

3. Collateral preferences. When risk tempers, institutions re-stock gold as balance-sheet ballast. Silver—more volatile and more “working” metal—keeps flowing to factories and fabricators.

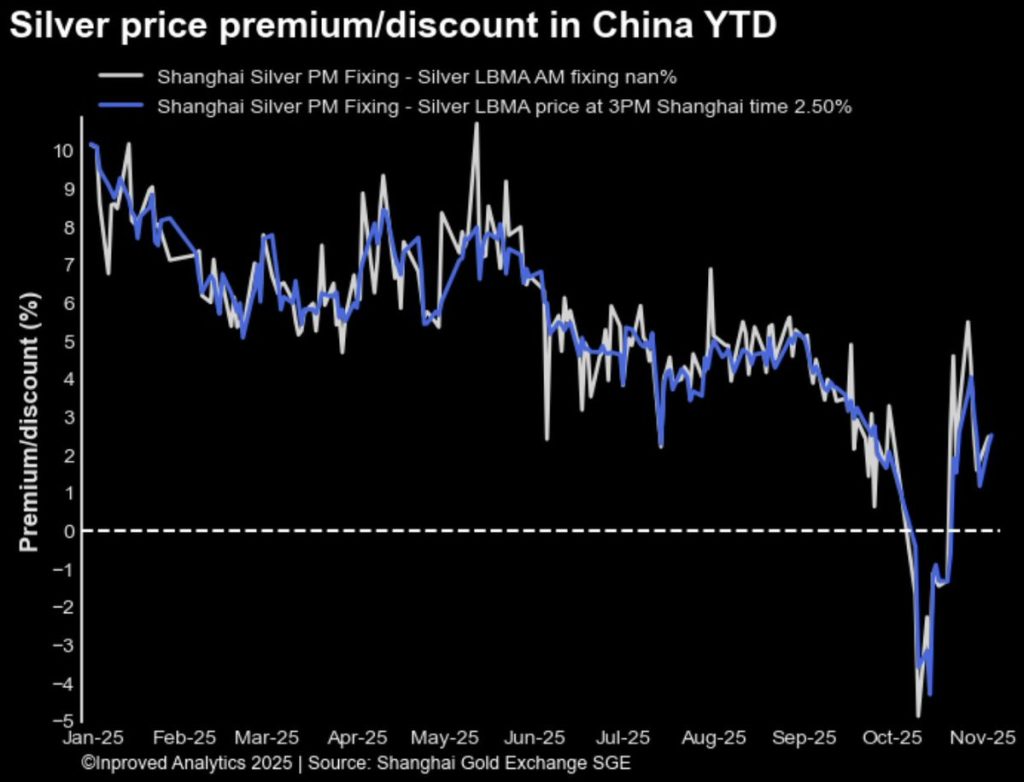

Despite the drain, China’s silver still commands a premium of about +2.5% (≈$1.20/oz) over LBMA. Premiums rising while local inventories fall is textbook tightness: immediate-delivery ounces are worth more than benchmark paper. It’s also a signal that the domestic market is paying up to secure flow—consistent with those heavy SGE withdrawals.

The EFP picture (exchange-for-physical differentials) shows the same split:

Translation: the market is tighter now than it expects to be in a few quarters. Near-dated backwardation rewards holders of deliverable metal; the modest contango further out implies confidence that supply can be re-routed or rebuilt with time. But as long as Shanghai inventories sit at decade lows and premiums stay positive, the near end of the curve will keep hinting at scarcity.

We also saw implied volatility cool off across precious-metals ETFs. Lower IV doesn’t negate tightness; it just tells you panic hedging is receding while the physical imbalance persists. For professionals, that means optionality is cheaper to own; for physical buyers, it means the market is de-levering without loosening.

If you’re a wholesale or retail dealer, this is a replacement-risk moment:

For professionals and managers looking to diversify without drama, the signal is clear:

Silver’s demand proxy is “through the roof”—387 tons withdrawn in October—while Shanghai vaults sink to a 10-year low of 623 tons and China keeps paying a premium for metal at the door. Near-dated backwardation (Dec ’25 –$0.38/oz) says immediate ounces are valuable; longer-dated modest premia say the market hopes supply catches up. Until inventories actually rebuild, the weight of evidence sits with the physical tightness—quiet, persistent, and visible in every ton leaving custody.

For dealers, it’s time to secure pipeline metal and lean on “deliverable now.”

For conservative investors, it’s time to accumulate deliberately, not react emotionally.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions