| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

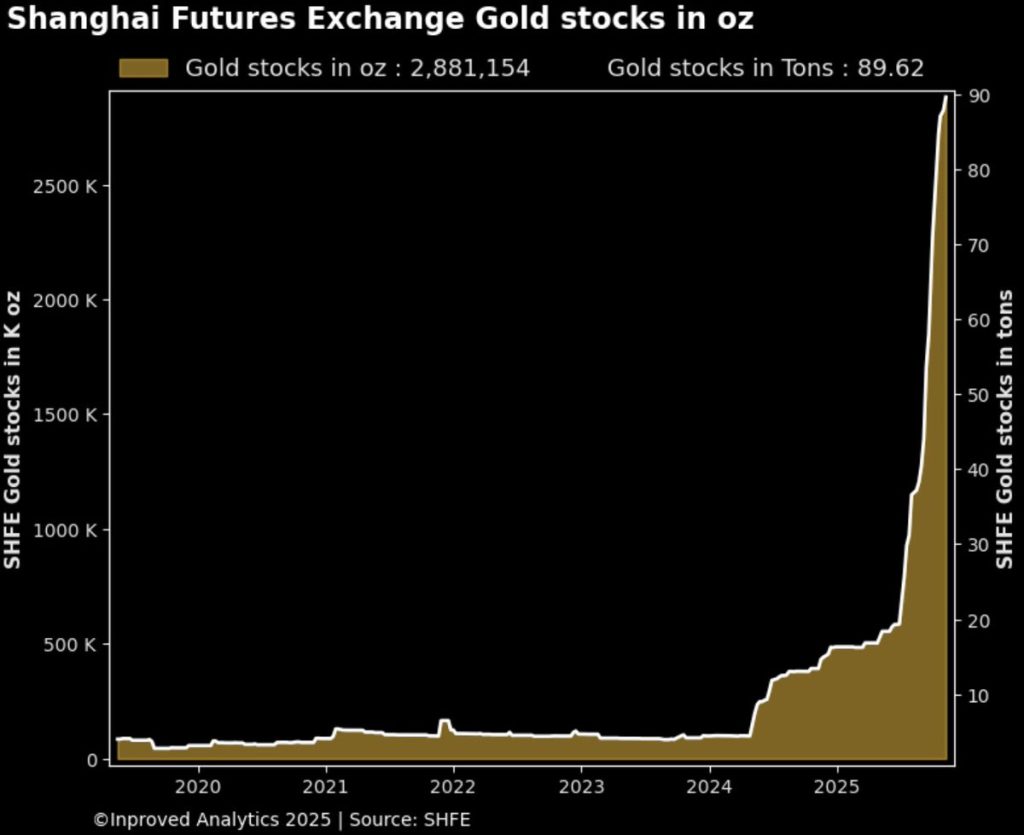

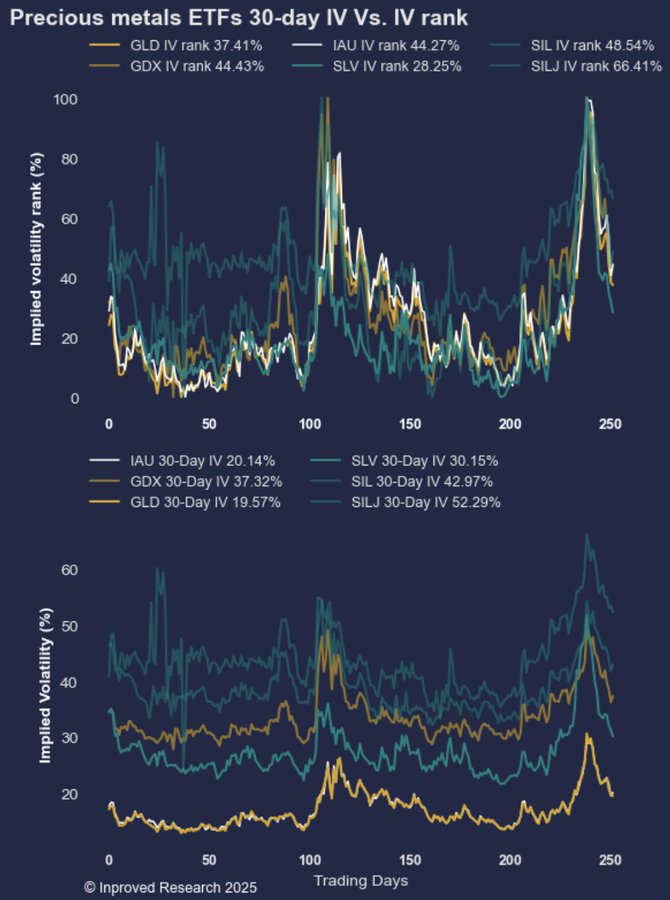

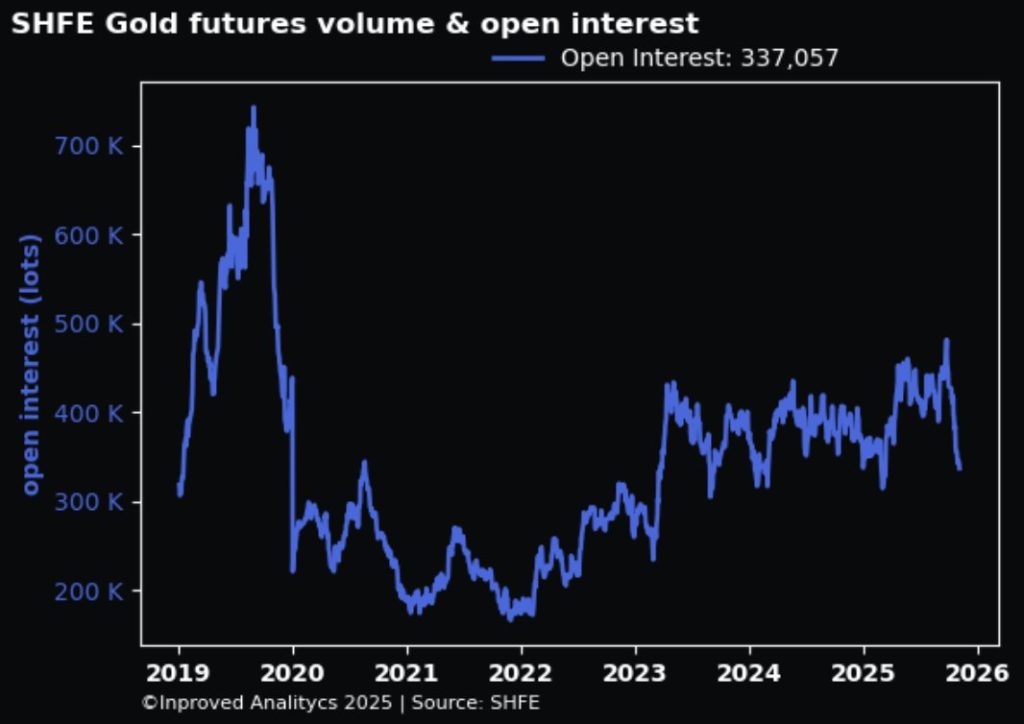

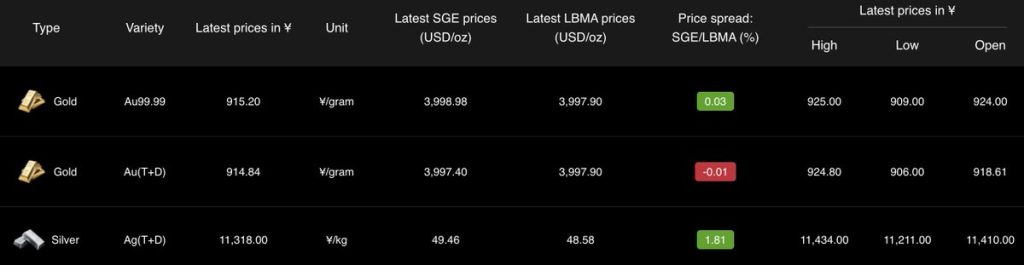

Gold didn’t roar this week; it whispered—loud enough for anyone watching the plumbing to hear it. While the headline price closed flat to LBMA at $3,997.4/oz (Nov 3), the market’s internals told a far more interesting story: Shanghai’s gold vaults hit a new all-time high at 89.6 tons, adding +1.8 tons on the week, even as implied volatility across precious-metals ETFs cooled and open interest on the Shanghai Futures Exchange fell to an eight-month low at 337,000 contracts.

Taken together, those four facts sketch a market that’s quietly de-risking on paper while continuing to accumulate the real thing. That is the kind of divergence that often anchors the next leg higher—not because price is sprinting, but because ownership is migrating from leverage to custody.

A fresh all-time high of 89.6 tons in Shanghai vaults isn’t a footnote; it’s a policy-grade tell. Weekly inflows of +1.8 tons amid a flat international price say local buyers weren’t waiting for a dip—they were re-stocking into stability. When physical inventory grows while price rests, it usually signals patient demand from institutions, wholesalers, and fabricators who need metal regardless of the latest headline.

For months, the pattern has been consistent: the East buys with intention when the screen goes quiet. This week extended that pattern, reinforcing the idea that physical balances—not narratives—are steering the ship.

By Nov 5, precious-metals implied volatility cooled across major ETFs. Lower IV doesn’t mean gold has lost its bid; it means the market is paying less for insurance. When you pair softer vol with higher vault balances and unchanged international pricing, the mosaic points to calmer positioning, tighter hands, and reduced forced selling. In other words: the market is breathing, not wheezing.

On Nov 4, gold open interest on the Shanghai Futures Exchange fell to an eight-month low (337k contracts). That’s not apathy—it’s deleveraging. Fewer outstanding futures against rising local stocks is a clean shift from speculative exposure to delivered metal. De-risking on the derivatives layer while vaults set records is exactly how markets lay down a sturdier floor.

Traders may step back, but the metal keeps stepping in.

With spot flat to LBMA at $3,997.4/oz (Nov 3), gold closed the week by doing what long-term holders want most: nothing dramatic. Stability while the underlying ownership base improves is the kind of “non-event” that matters later. The screen shows stasis; the ledger shows accumulation.

Pricing & inventory: A flat LBMA print with record Shanghai stocks and lower IV is ideal for replenishing wholesale books. Replacement risk is lower when option premia are subdued and spreads aren’t whipping around. Treat this window as a chance to scale into standard kilobars and 100g lines while physical is available and retail flows are steady but not frantic.

Product mix: With SHFE OI down to 337k, expect less hedging flow and more outright physical requests from trade clients (fabricators/jewellers). Keep core SKUs in size; be selective on numismatics until retail momentum re-accelerates.

Margins & turns: Calmer vols typically compress intra-day ranges but improve fill quality and inventory turns. That favors dealers who run tighter pricing and rely on velocity. Consider tiered quotes for larger tickets tied to on-hand allocated bars; the narrative of “delivered now, no fuss” resonates when markets are de-risking.

Regional routing: With China’s vaults expanding, Singapore remains the natural offshore hub to stage inventory for ASEAN corporate and HNWI demand—efficient LBMA linkage, strong logistics, and clean documentation for cross-border clients. Dealers can market that certainty while competitors focus only on price.

Signal over noise: Three signals lined up—record Shanghai vaults, lower ETF implied vol, reduced futures OI. Together they describe quieter risk with stronger ownership. For conservative investors, that argues for disciplined, incremental allocation rather than market timing.

Why now works: Buying when price is flat and custody is rising has historically produced better holding-period outcomes than chasing breakouts. You’re not paying for adrenaline; you’re paying for optionality—the ability to benefit if macro catalysts (policy easing, fiscal slippage, geopolitical surprises) re-ignite gold’s trend.

How to express it:

This week’s quartet—ATH Shanghai vaults, +1.8t weekly inflow, cooling IV, lower SHFE OI, with price flat to LBMA—isn’t accidental. It’s the profile of a market that’s handing the baton from traders to owners. Deleveraging doesn’t kill a bull case in gold; it cleans it.

As we move deeper into Q4 with trade diplomacy in the headlines and a newly easier Fed backdrop, a flat week doesn’t diminish gold’s role—it clarifies it. The metal is doing what it’s supposed to do between cycles: sit still while the strong hands take more of it off the table.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions