| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

Gold entered the final quarter of 2025 with a rare alignment between East and West. In Shanghai, vaults have swollen to unprecedented levels; in New York, COMEX stocks have quietly crossed the 40-million-ounce mark for the first time in five months. And in Zurich, UBS has raised its gold forecast to $4,200 per ounce across all timeframes, a call that few in the institutional space are ignoring.

Each of these milestones tells a different story about where global capital is moving. Together, they signal a new phase in the metal’s long-term cycle — one that rewards patience and punishes complacency.

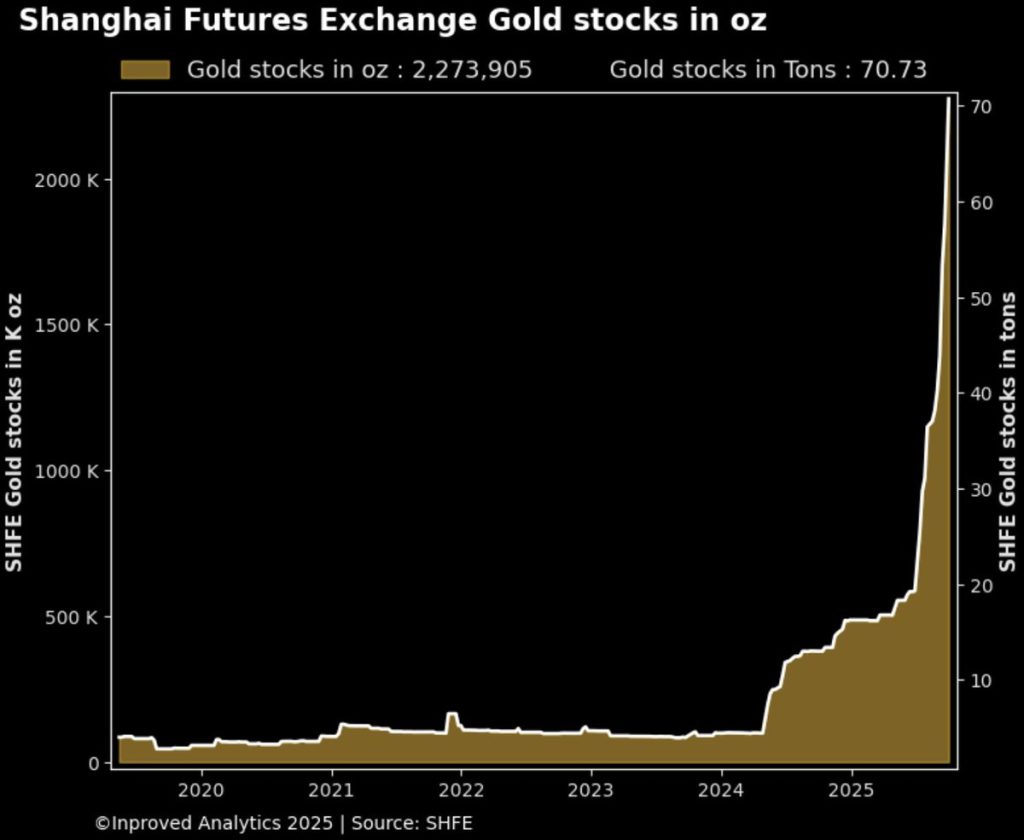

Shanghai’s gold vaults have been setting record after record. By the end of September, holdings reached 70.73 tonnes (2.3 million ounces), marking the largest accumulation since official tracking began. The week ending September 30 alone saw an inflow of 2.1 tonnes, part of a broader monthly surge of more than 8 tonnes.

The scale of this buying dwarfs seasonal norms. Over the past decade, the average monthly inflow into the SHFE vaults during the same period has been about 1.8 tonnes. China’s current rate is four times that, and it comes despite Shanghai gold trading at a discount (-1.22% to LBMA). In other words, investors are accumulating even when the local price is lower than the global benchmark — a sign of conviction, not speculation.

Hugo Pascal notes,

“Discounts are not disinterest; they’re opportunities. When premiums flip negative but inflows keep rising, it tells you gold is being stored for strategic reasons, not traded for tactical gains.”

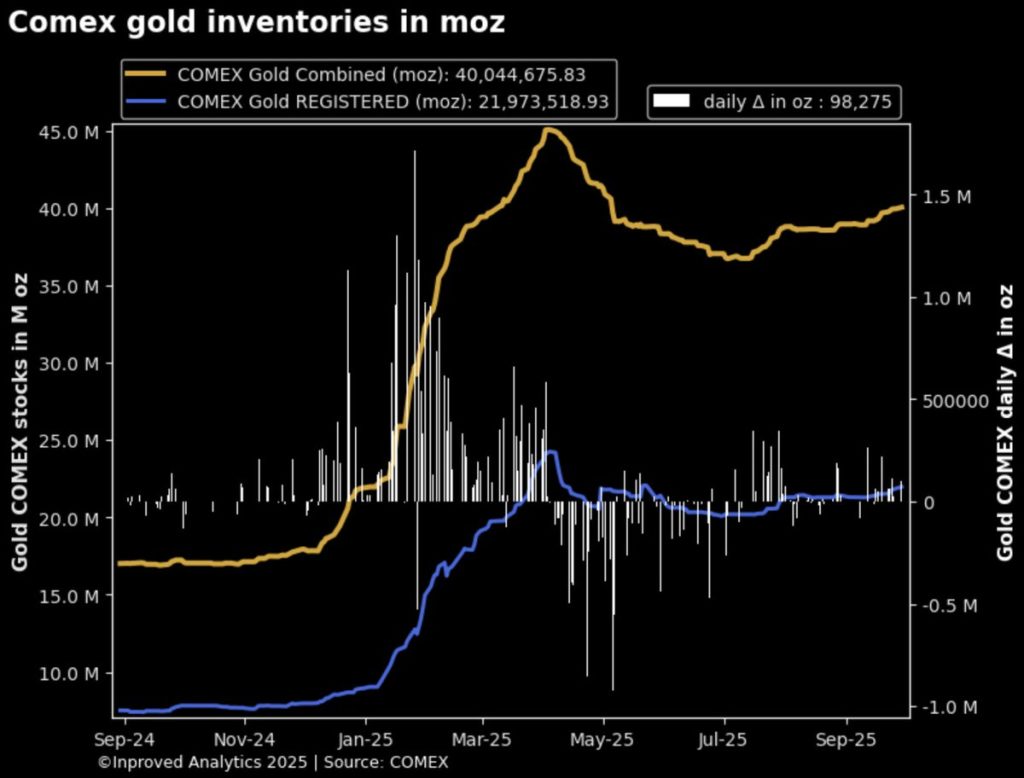

Across the Pacific, the COMEX warehouses are showing signs of quiet rebuilding. After months of drawdowns, inventories rose 5,000 ounces last Thursday to 40.1 million ounces — the highest level in five months. The move may look modest, but it reflects a broader re-accumulation trend: clearing members are opting to hold metal on balance sheet rather than rely on futures or synthetic exposure.

That trend is reinforced by the Exchange-for-Physical (EFP) spread for the December 2025 contract, which remains elevated at $25 per ounce above LBMA spot. Wide EFPs indicate strong physical delivery demand, typically from long-term holders such as refiners, sovereigns, or ETFs that are seeking allocated bars rather than cash settlement. The last time the EFP stayed this high for consecutive weeks — mid-2020 — COMEX vault stocks grew by 11 million ounces over the following quarter.

UBS’s revision adds an institutional layer to the story. In a note released this week, the bank lifted its gold price outlook to $4,200 per ounce across all timeframes, compared with its previous targets of $3,800 (end-2025) and $3,900 (mid-2026). The report also introduced a stress-case scenario of $4,500 per ounce, contingent on an accelerated Fed easing cycle and renewed dollar weakness.

UBS’s rationale centers on three structural shifts:

1. Central-bank diversification — official reserves have increased gold’s share from 13% to 17% in two years.

2. Falling real yields — 10-year U.S. Treasury yields have slipped to 4.25%, with inflation expectations stable near 3%, driving negative real returns.

3. Asian re-monetization of gold — China and India continue to treat bullion as a savings vehicle amid property and equity volatility.

Historically, such synchronized upgrades from major banks have foreshadowed extended bull cycles. When UBS and Goldman Sachs raised targets in 2019, spot gold rose 26% within six months. The last comparable institutional consensus emerged in 2007 — and gold doubled over the next two years.

Despite bullish fundamentals, speculative positioning remains restrained. Managed-money longs have trimmed exposure by 2.76%, while commercial shorts (swaps + producers) have risen 10.6% week-on-week to -302,400 contracts (-$112.6 billion) — the highest short exposure in seven months. This divergence between paper caution and physical accumulation mirrors the pattern seen in 2018–2019, when futures traders stayed skeptical just as Asian vaults began absorbing record tonnage. Gold rallied 40% in the following 18 months.

Pascal remarks, “The futures market often reflects the past. The vault data tells you the future.”

At first glance, China’s -0.9% to -1.3% discount to LBMA might suggest soft local appetite. Yet the second-largest weekly increase on record (+8.2 tonnes) into the Shanghai vault contradicts that narrative. Traders appear to be front-loading physical stock ahead of potential yuan depreciation and trade disruptions. In previous cycles — notably August 2015 and March 2020 — similar discounts flipped into +1–2% premiums within two months as domestic demand caught up.

The 21-day moving average of 9.2 tonnes traded per day for the AU9999 contract is the highest in four months, confirming that physical activity remains strong even as paper sentiment oscillates.

For long-term investors seeking clarity amid this divergence, Singapore continues to offer the cleanest exposure to gold. With 0% GST on bullion, no capital-gains tax, and full MAS-regulated custody, the city-state serves as the neutral ground between China’s capital-controlled market and the speculative flows of Western exchanges.

Overseas Chinese and Indian investors in particular benefit from tighter acquisition spreads — typically within 0.2% of LBMA — compared with 1–1.5% in Mumbai and 0.8% in Shanghai. That difference compounds over time: a $100,000 allocation bought and stored in Singapore instead of India can save more than $1,000 per year in transaction and storage drag.

Pascal calls Singapore “the Switzerland of the East,” adding, “When you combine price efficiency, neutrality, and regulatory transparency, Singapore becomes not just a storage choice — it’s a wealth-preservation strategy.”

For civil servants, PMETs, and other mature investors who prioritize stability over speculation, today’s setup resembles 2011’s mid-cycle re-accumulation phase — a period when gold paused before its next major ascent. Here’s how to position prudently:

1. Rebalance, Don’t Chase. Maintain gold exposure around 8–12% of total assets. Adding gradually on dips — particularly when Shanghai premiums are negative — allows accumulation at favorable entry points.

2. Hold What You Can Touch. With EFP spreads near $25, physical is commanding a premium for a reason. Allocated bullion stored in Singapore or another LBMA-certified facility provides insurance against liquidity crunches that paper contracts can’t match.

3. Hedge Currency, Not Conviction. If your liabilities are in SGD or INR, using gold-linked accounts or monthly purchase plans in local currency neutralizes short-term FX swings without diluting exposure.

4. Watch the Real Yield. Historically, every 1% drop in U.S. 10-year real yields has lifted gold 10–12% within six months. With current real yields slipping back below 1%, the probability of a Q4–Q1 rally is rising.

For public-sector professionals and long-term savers, these moves aren’t speculation — they’re balance-sheet management. As Pascal summarizes, “Gold is not an asset you trade; it’s an asset you inherit. You hold it so your savings outlive your salary.”

The current alignment — strong vault inflows, wide EFPs, institutional upgrades — has appeared only three times in the modern era:

Each case marked a transition from consolidation to expansion — the same inflection the data hints at today.

Gold’s current discount in China — roughly $30–$35 per ounce — has less to do with demand than with liquidity cycles. Domestic banks are still constrained by credit quotas, limiting short-term buying even as households accumulate quietly through savings programs. Once financing normalizes, these stored imports will translate into consumption, tightening the spread.

During the COVID era 2020 discounts, Shanghai traded 1.5% below LBMA for two months; six months later, premiums surged to +3%. The current setup mirrors that pattern almost exactly.

The UBS target of $4,200 doesn’t exist in isolation. Options markets are already aligning with it: December 2025 call walls cluster near $3,700, and 25-delta risk-reversal skews remain positive (+1.7), showing persistent demand for upside hedges. These are institutional footprints, not retail bets.

Pascal frames it plainly: “When the call wall and the analyst forecast converge, it’s not hype — it’s positioning.”

If that convergence holds, gold could reach $3,700 within months and $4,200 by mid-2026, in line with UBS’s baseline. The upper band of $4,500 — their ‘extreme case’ — would likely require deeper Fed cuts or a renewed dollar slide, both plausible within the current macro cycle.

The story of early Q4 2025 is one of accumulation — slow, deliberate, and globally synchronized. Shanghai adds tons; COMEX rebuilds; UBS upgrades. Discounts may cloud the near-term picture, but the flow of metal tells a clearer truth: long-term capital is moving into gold.

For conservative investors, that means stay the course. For institutions, it means front-load allocation before the price curve steepens. And for policymakers watching reserves erode in fiat terms, it’s a reminder that trust, once again, is migrating back to metal.

“Every cycle ends with rediscovery,” Pascal writes. “And every rediscovery begins with people who never stopped buying.”

Singapore offers some of the lowest LBMA-linked gold prices and zero capital-gains tax worldwide. Explore InProved.com to buy, store, or diversify your holdings under full transparency — the conservative investor’s way to stay ahead of uncertainty.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions