| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

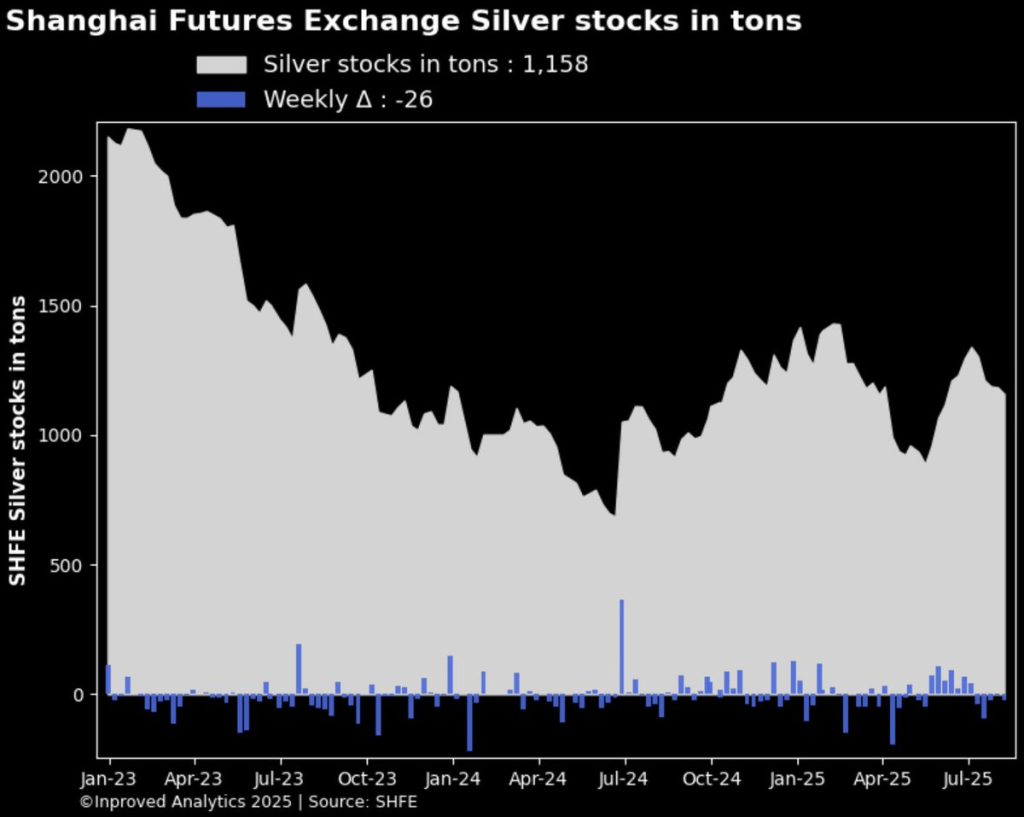

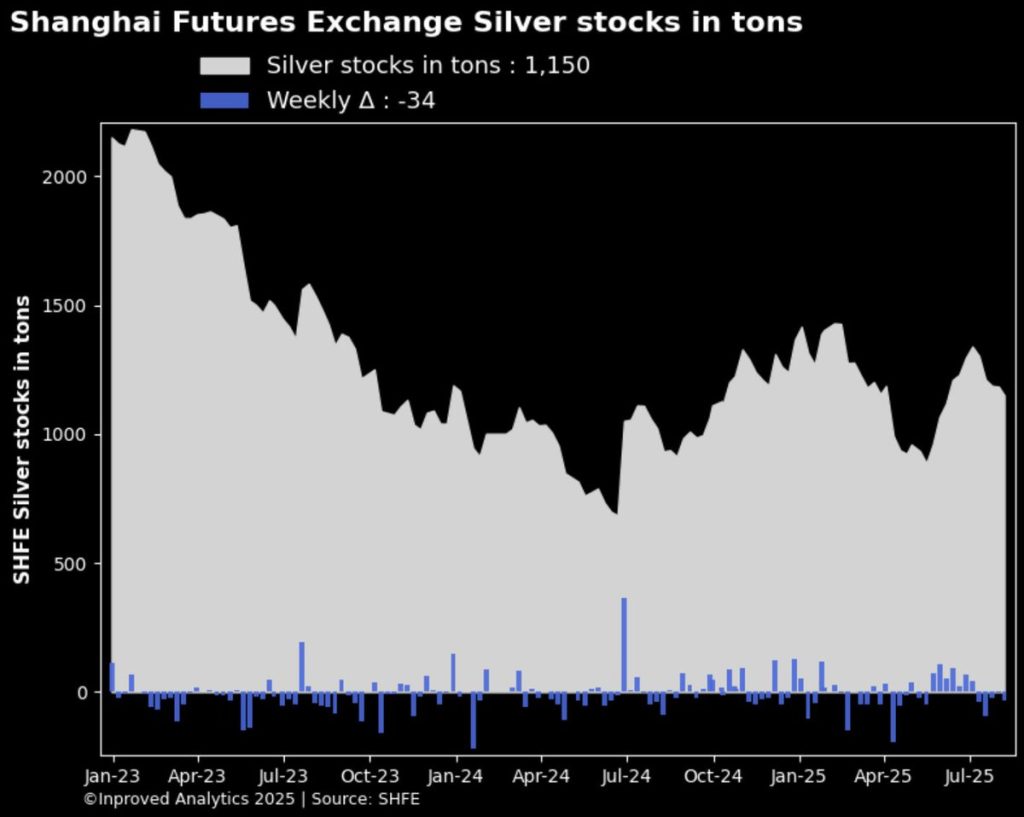

Silver has been telling two very different stories on opposite sides of the world. In Shanghai, the metal is bleeding out of vaults at a pace that’s starting to raise eyebrows among even the most seasoned traders. For the fifth consecutive week, Shanghai silver holdings have shrunk, dropping another 26 tons week-on-week to 1,158 tons. Midweek updates paint an even starker picture—down 34 tons week-to-date to 1,150 tons, marking a two-month low.

It’s not a quiet drift; it’s a decisive outflow that mirrors a broader shift in Chinese market dynamics. Physical silver is being drawn out, whether for industrial use, investment allocation elsewhere, or opportunistic selling into higher prices. The Shanghai Futures Exchange still shows resilience—on August 6, silver (Oct25) closed 1.2% higher at ¥9,182/kg, or $39.72/oz COMEX equivalent—but vault behavior suggests that not all participants are willing to keep their ounces parked in the city’s custodial facilities.

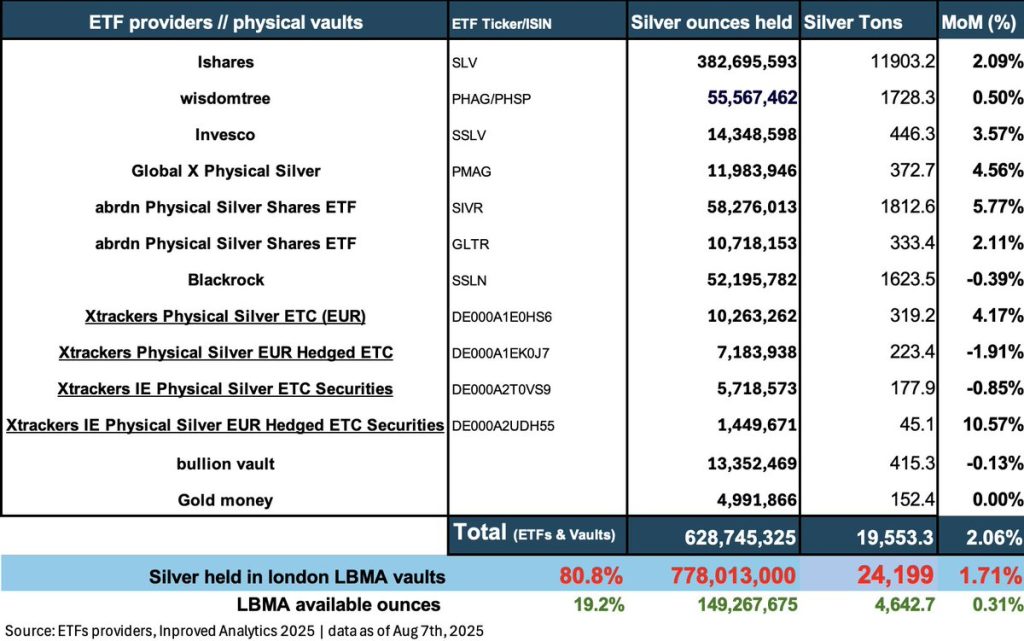

While Shanghai bleeds metal, London is quietly topping up. Our free float estimate for silver in London remains pinned near a record low of 149.3 million ounces, inching up only 0.31% month-on-month. That number matters—it reflects the silver in London not tied up in ETF custody, leasing arrangements, or long-term storage contracts.

ETFs themselves continue to absorb metal. Silver ETFs held in London rose 2.1% MoM, equivalent to 394 tons of new inflows. That’s a significant footprint, and when paired with the modest free float, it paints a picture of a market where deliverable metal in the open pool is tight.

Gold is seeing the same quiet accumulation pattern in London. Vaults now hold 8,865 tonnes of gold, up 1.02% MoM, while silver vault totals climbed 1.7% MoM to 24,199 tonnes.

The contrast couldn’t be sharper. In Shanghai, vault stocks are being drawn down for the fifth week in a row, while in London, ETF-driven inflows are tightening the pool of readily available ounces.

“Whenever you have this kind of East-West divergence, you need to ask yourself who’s playing the longer game,” I said this morning. “If London is locking up metal while Shanghai is releasing it, there’s usually a point where the flows meet—and that’s often where price reacts.”

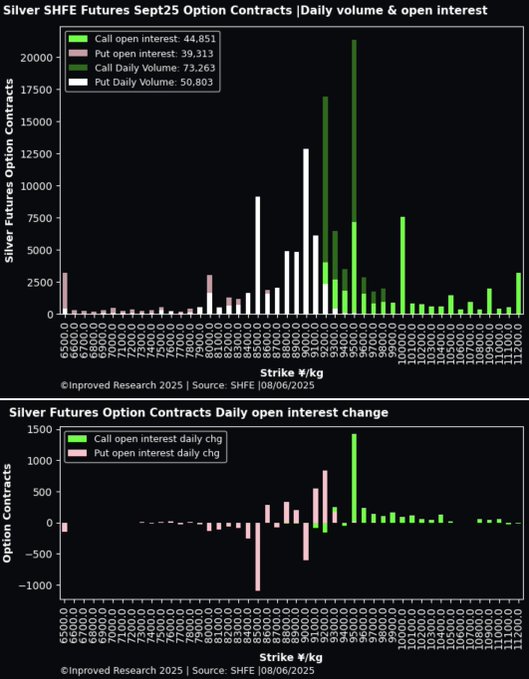

The SHFE snapshot shows an options market leaning bullish. The put-to-call volume ratio sits at 0.69, and the P/C open interest ratio is 0.58—both suggestive of traders positioning for further upside rather than hedging downside risk.

There are a few plausible readings here. The Shanghai outflows could be a sign of industrial drawdowns, especially if certain sectors are ramping up production ahead of anticipated supply disruptions. It could also reflect speculative selling from investors taking profit into recent strength, particularly with silver trading well above its long-term average.

In London, the tight free float and steady ETF inflows suggest that Western investors are using the current price band to build positions without rushing the market higher. That’s classic accumulation behavior—measured, deliberate, and often a precursor to sustained price moves when combined with a tightening supply picture.

With silver closing near $39.72/oz COMEX equivalent, the $40 psychological mark is once again within striking distance. The bullish options skew on the SHFE indicates traders aren’t shying away from higher strike prices, and if we see any macro shock—or simply a coordinated squeeze in the physical market—silver could push through that ceiling with momentum.

Markets like this reward those who look past the daily price noise and study the flows. Shanghai’s exodus of metal is not inherently bearish—it could be the prelude to scarcity. London’s quiet vault build is not flashy, but it’s strategic. And when both these patterns converge, it’s rarely a coincidence.

If you want to secure your own position in physical silver—or gold—before the next price leg begins, now is the time to act. Download the InProved mobile app or visit InProved.com to access some of the lowest LBMA bullion prices in the world, fully stored in Singapore’s tax-efficient, highly secure vaults. In a world where metal is either leaving fast or being locked away tight, your safest ounces are the ones you already own.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions