| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

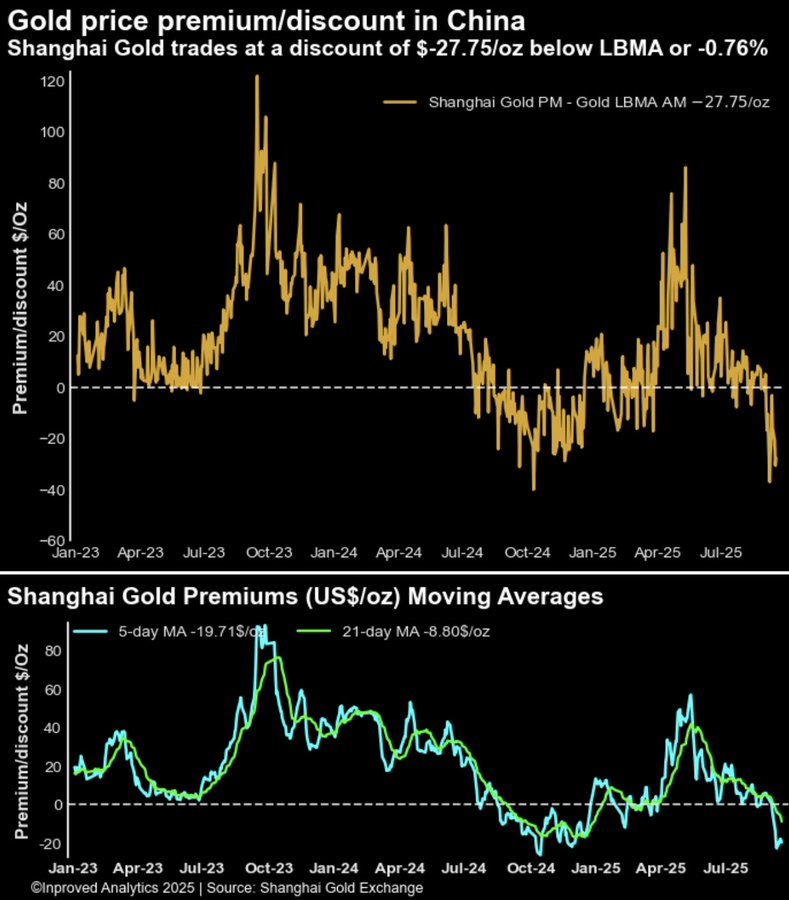

By now, the story of gold’s resilience is familiar to investors: geopolitical uncertainty, inflationary pressure, and central bank demand have kept the metal in the spotlight. But this September, the narrative is shifting. Instead of premiums — those small add-ons that investors in Asia have historically paid above London benchmarks to secure physical bullion — we are staring at discounts, some of the steepest seen since the COVID outbreak in China.

On September 18, estimated Shanghai premiums fell to -1.3% below the LBMA benchmark, with gold trading around $3,608/oz, a discount of nearly $28 per ounce. It’s a striking reversal, particularly as vault data show physical inflows into Shanghai hitting all-time highs. Gold stocks at the Shanghai Gold Exchange vaults surged to 57.43 tons (1.85 million ounces), with a weekly inflow of 4.5 tons — some of the heaviest weekly additions on record. As Hugo Pascal noted in his latest commentary, “Shanghai’s vaults are swelling even as premiums remain negative — a paradox that tells us something about both supply and sentiment.”

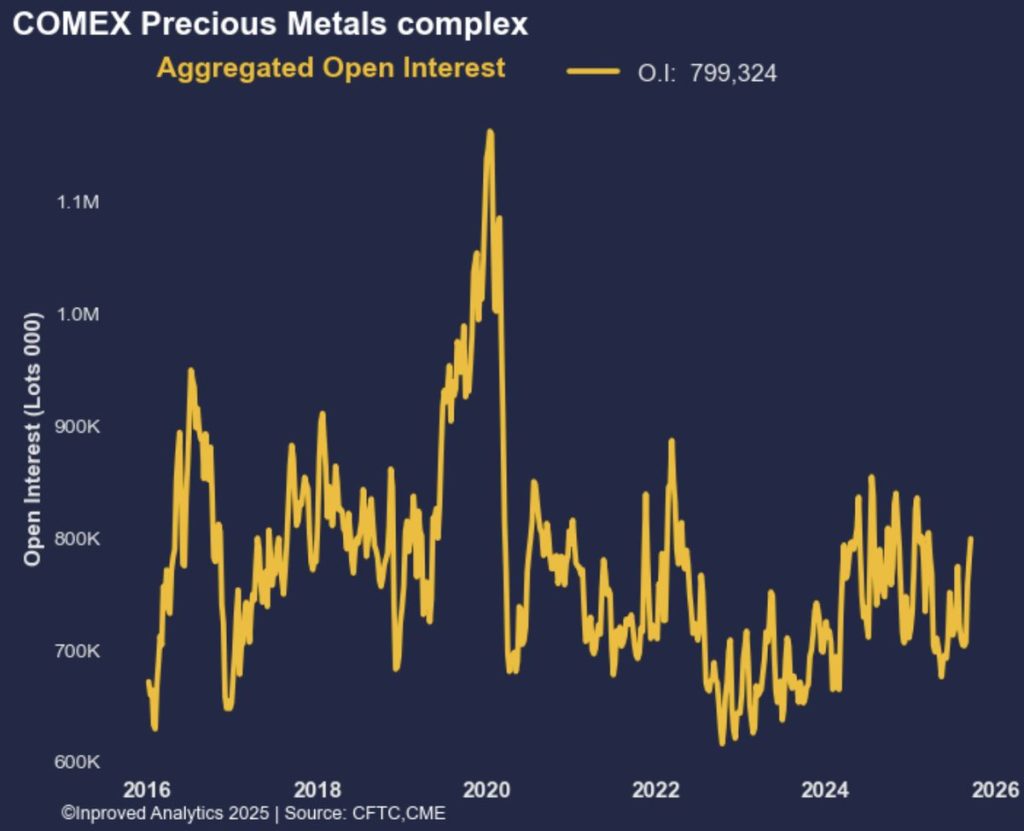

Meanwhile, futures positioning is painting a very different picture. The broader precious metals open interest complex surged to a six-month high at 800,000 contracts, signaling renewed engagement across the board. But the balance of positioning is worth noting.

Commercials — a category that includes swaps and producers — increased their short exposure in gold to -302,400 contracts, the highest level in seven months, a position equivalent to about $112.6 billion. In plain terms: the very institutions who often hedge production or act as counterparties to speculators are betting heavily against gold in the near term.

Speculators, on the other hand, have quietly trimmed their net longs. Net long positions in gold dropped by 4,500 contracts (-2.76%), suggesting money managers are less confident chasing the recent highs. The divergence between swelling commercial shorts and reduced speculative longs is worth watching. Historically, such moments have preceded periods of heightened volatility.

Yet, if one looks east, the picture is completely different. The physical AU9999 contract traded on the Shanghai Gold Exchange remains robust, with the 21-day moving average of volumes reaching a four-month high at 9.2 tons per day. Even on days where premiums are negative, trading activity is holding up. This indicates that Chinese investors and institutions are not abandoning gold; instead, they are transacting more actively, possibly taking advantage of cheaper prices relative to international benchmarks.

The irony here is hard to miss. Gold is flowing into Shanghai vaults at a staggering pace, yet local pricing shows a discount to LBMA. In the past, such periods of divergence between paper market pessimism (in the form of heavy commercial shorts) and physical accumulation (in vault inflows) have often marked inflection points.

To place today in context, it’s worth remembering that Shanghai gold discounts are not new. The COVID outbreak in early 2020 produced discounts of similar magnitude, largely because the Chinese economy was under pressure while international investors were piling into gold as a global hedge. Within months, however, premiums returned as economic reopening and pent-up demand reignited physical buying.

Another useful parallel is 2013, during the so-called “Taper Tantrum.” As US Treasury yields spiked and gold sold off in futures markets, Shanghai prices temporarily traded at a discount. But vault inflows surged, as local investors saw the opportunity to buy physical at cheaper prices. That episode set the stage for a base-building phase, even if prices remained rangebound for years.

Today, the circumstances are different — we are not in the aftermath of a Federal Reserve tightening shock but on the cusp of a potential easing cycle, with weaker US Non-Farm Employment reports increasing expectations of rate cuts. As one veteran bullion trader put it this week, “Discounts in China during a period of monetary loosening globally are unusual. This could be the tell that physical is being accumulated aggressively even while futures markets remain skeptical.”

So, where does this leave us? We have:

The push-and-pull between these forces is likely to define gold’s path in the final quarter of 2025. If past patterns hold, discounts in China rarely last. Physical demand tends to reassert itself, pulling prices back toward parity or premium. At the same time, the aggressive shorting by commercials could backfire if macro conditions (softer US data, geopolitical risks, central bank buying) support higher prices.

In many ways, the current gold market reflects a battle of narratives. Futures traders, armed with macro signals and balance sheets, are betting on weakness. Physical markets, particularly in Asia, are quietly hoarding more metal than ever before. The outcome will hinge on whether global growth weakens enough to justify rate cuts and whether safe-haven demand flares again amid geopolitical stress.

As Hugo Pascal observed, “Every ton added to Shanghai vaults is a reminder that the East is not playing the same game as the West. Discounts are temporary; accumulation is permanent.”

For investors watching from the sidelines, the message is clear: short-term noise aside, gold remains deeply embedded in the architecture of global finance. And whenever futures and physical diverge this sharply, history suggests opportunity may not be far behind.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions