| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

A tentative breakthrough in U.S.-China trade relations may have offered markets a moment of calm, but for the gold market, the deeper signals remain unchanged: China’s appetite for precious metals is still ravenous, vault inventories in the West are draining, and speculative flows across Asia continue to signal that the structural bid for gold is anything but over.

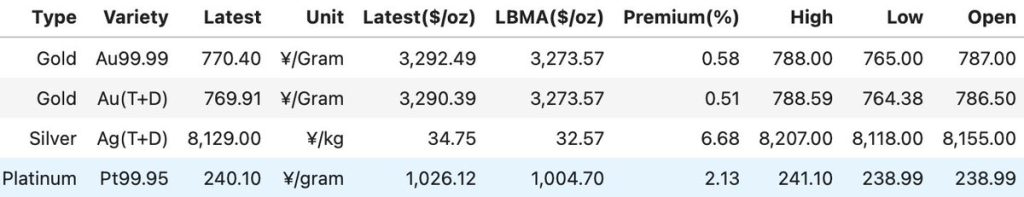

After days of tense discussions, news broke today that a deal has been reached between Washington and Beijing, addressing key trade and regulatory bottlenecks — though officials were quick to clarify that “further talks are still needed.” Markets reacted with cautious relief. In commodities, that translated into a modest retreat in premiums, with spot gold in China now quoted at ¥770/gram, or $3,290/oz, still +0.5% above the LBMA benchmark, but down from recent highs.

But as Hugo Pascal, CIO at InProved, points out, “The real gold story right now isn’t about front-page diplomacy. It’s about what’s still happening under the hood — in vaults, on trading desks, and inside option books.”

In the days leading up to today’s announcement, premiums in China had surged. On May 9, gold traded at ¥777/gram ($3,335/oz), +1.46% over LBMA. A day earlier, on May 8, that number climbed even further to ¥804/gram ($3,456/oz), as speculators bid into rising tensions and sought safety in physical metal.

Pascal notes that while premiums have cooled slightly post-announcement, the fact that they remain consistently above 0.5% is telling. “This isn’t a collapse in demand,” he says. “It’s just a recalibration of geopolitical hedging. The gold flows remain very real.”

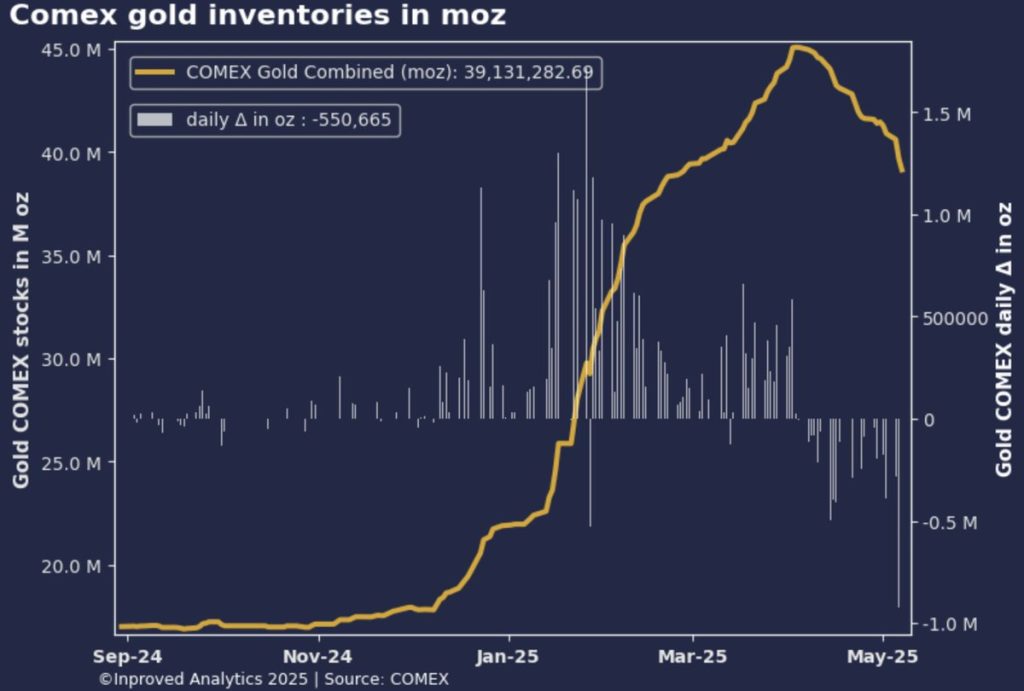

Meanwhile, in the West, the gold supply picture continues to tighten. The latest data shows that COMEX gold inventories have dropped to a 10-week low, now holding just 39.1 million ounces. This decline reflects ongoing deliveries into physical settlement, as well as withdrawals into private storage — likely by institutions reallocating metal into more secure or offshore jurisdictions.

Pascal believes this decline is structurally significant. “We’re seeing more gold fly out of COMEX vaults than go in. That’s not just about delivery — that’s about trust, about geopolitical neutrality, and about counterparty risk. It mirrors the 2020 playbook, and we know how that ended for prices.”

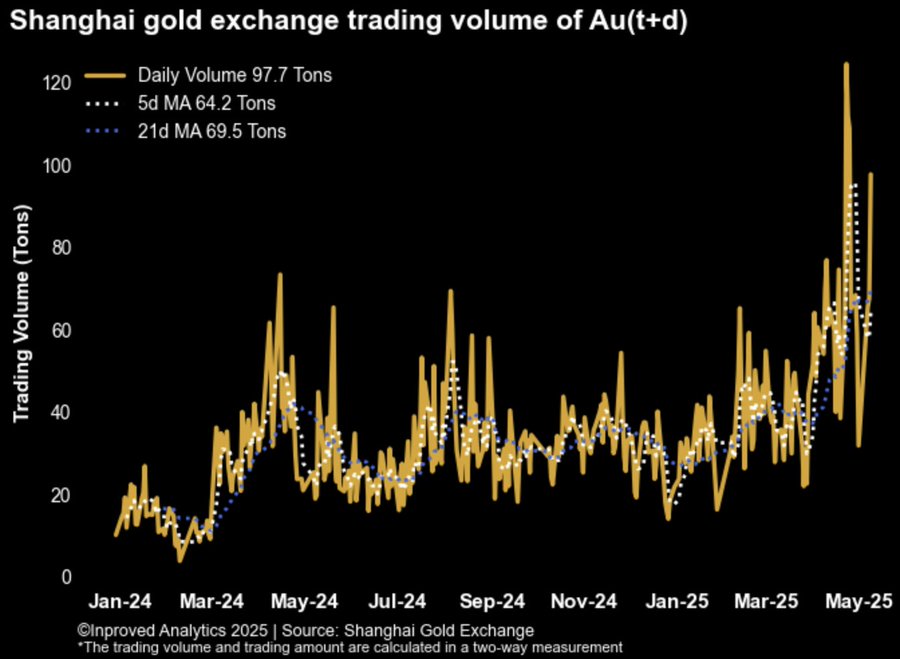

Even as premiums moderate, activity in Chinese futures and spot markets continues to blaze.

On May 8, the physical proxy contract AU9999 on the Shanghai Gold Exchange (SGE) recorded 15.8 tons traded, while the Au(T+D) rolling contract saw a massive 98 tons exchanged.

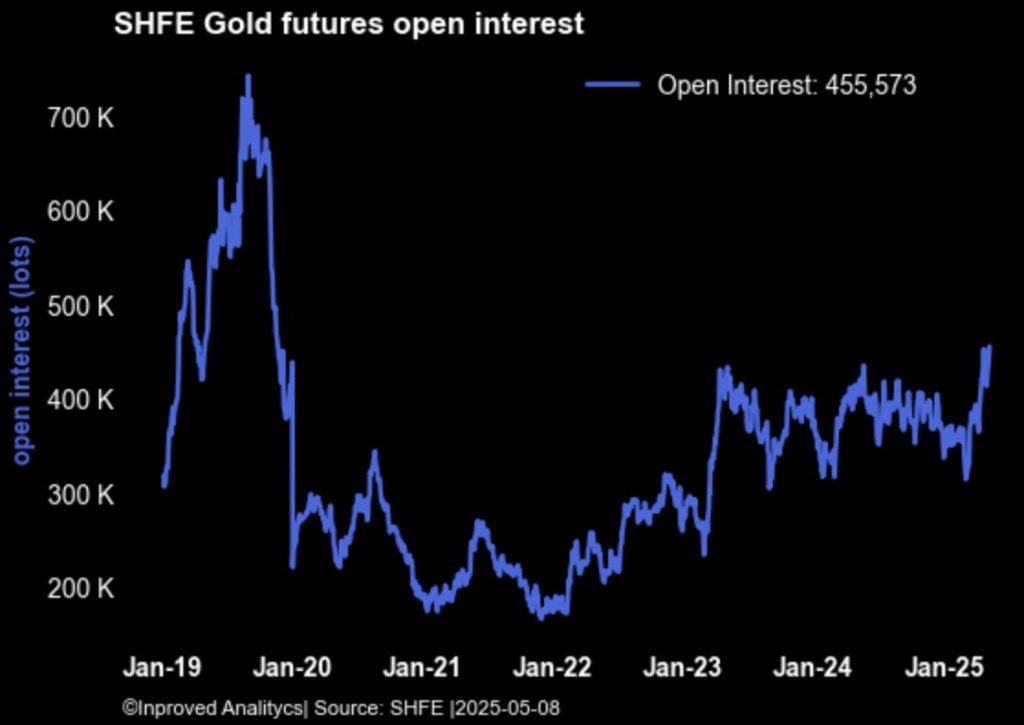

This follows a steady climb in open interest (OI) on the Shanghai Futures Exchange (SHFE). As of May 9, OI hit a 5½-year high at 455,600 contracts, increasing 10.15% week-to-date — equivalent to +42 tons of notional gold.

The options market is sending similar signals. On May 7, the most actively traded call strike was set at ¥960/gram, equivalent to $4,132/oz on COMEX — a level that remains more than 20% above current spot. Open interest for this strike has ballooned by 30.7% week-on-week to 12,500 contracts, reflecting deep speculative conviction. The put/call volume ratio sits at 0.65, showing that calls still significantly outpace puts, a classic indicator of bullish bias.

“People aren’t hedging against gold falling — they’re paying up to capture upside in the $4,000s,” Pascal explains. “That’s not the behavior of a nervous market. That’s how smart money positions ahead of structural repricing.”

Despite the current retreat in spot gold to $3,290/oz, sentiment remains fundamentally bullish. Earlier in the week, prices had reached $3,410/oz, alongside silver at $32.83/oz and platinum at $1,017/oz — all trading with significant premiums over their respective LBMA benchmarks.

Silver continues to trade at $35.10/oz, +6.15% above LBMA, suggesting that tightness in industrial and monetary silver persists, even as macro headlines drive temporary swings in the gold complex.

The answer is nuanced.

Yes, today’s agreement has cooled short-term political tensions — but it hasn’t resolved the underlying drivers of gold’s recent strength:

In Pascal’s words, “A temporary diplomatic handshake doesn’t erase trillions in debt, global yield curve inversion, or the fact that most central banks are still buying gold. This market isn’t priced on today’s headlines — it’s pricing in tomorrow’s risks.”

With COMEX vaults shrinking, China’s open interest spiking, and options markets targeting $4,000 gold, the strategic bid remains very much alive — even if spot prices fluctuate in response to shifting headlines.

Premiums may ebb and flow, but the core message of this market hasn’t changed: investors still want gold — and they’re willing to pay up for it.

As Hugo Pascal puts it:

“This isn’t the end of the gold rally. This is the market catching its breath — while the smart money runs ahead.”

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions