| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

Amid escalating geopolitical tension, gold remains front and center in global investor strategies. As U.S.–Iran relations deteriorate anew, bullion is emerging not just as a hedge, but as a potential catalyst for a fresh ascent in price. At the same time, shifting dynamics in Asian trading hubs are providing insiders – like Hugo Pascal – clues to where this rally may be heading.

When geopolitical crises loom, safe-haven demand often triggers gold’s most dramatic moves. Right now, U.S. pressure on Iran is intensifying, with military posturing and economic sanctions reigning in markets. Historically, similar episodes have led to swift gold spikes—whether during Middle East conflicts or periods of oil volatility. As Hugo Pascal notes, “Geopolitical flare-ups act like accelerants for gold demand. It’s the unwritten force multiplier to any policy or macro theme.”

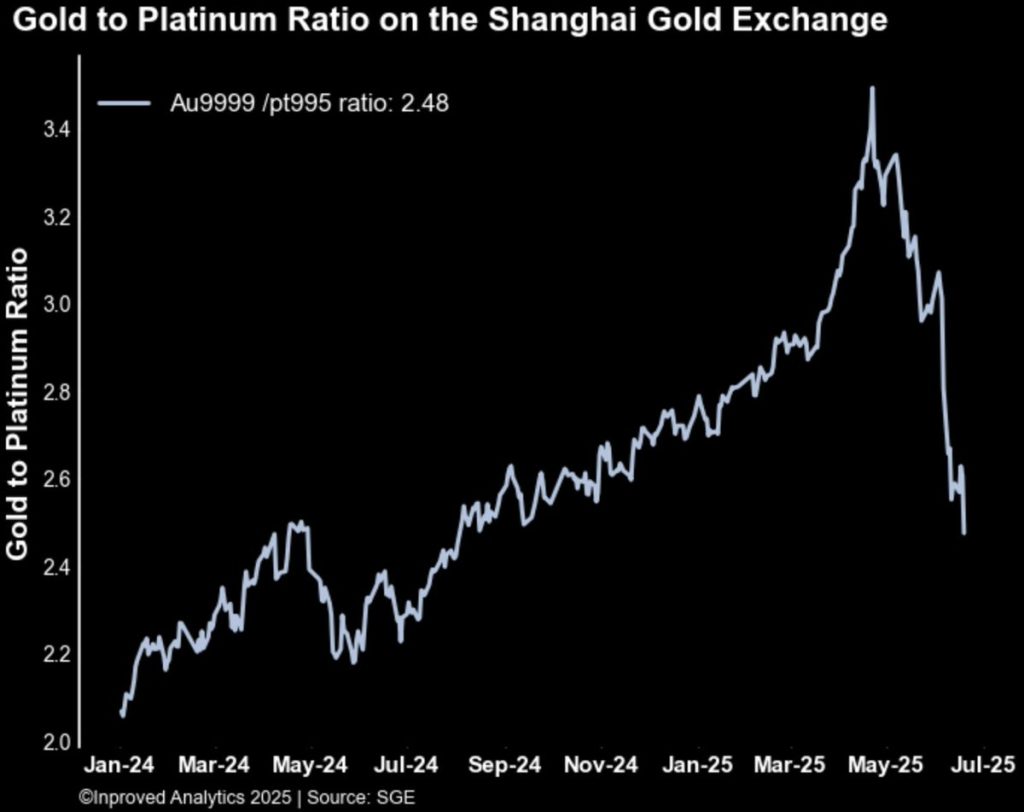

As global attention pivots to uncertainty, regional gold markets are pricing it in. In Shanghai, the gold-to-platinum ratio has dropped to 2.48:1—a 10-month low, signaling that gold is being bid more aggressively relative to platinum. At this ratio, each ounce of gold buys only 2.48 ounces of platinum, pointing to shifting investment flows.

Meanwhile, gold premiums on the Shanghai Gold Exchange (SGE) are climbing, recently trading at $3,366/oz, or +0.25% above LBMA. That may seem modest, but in physical bullion markets, premium creep is the first signal of demand pushing up the price floor.

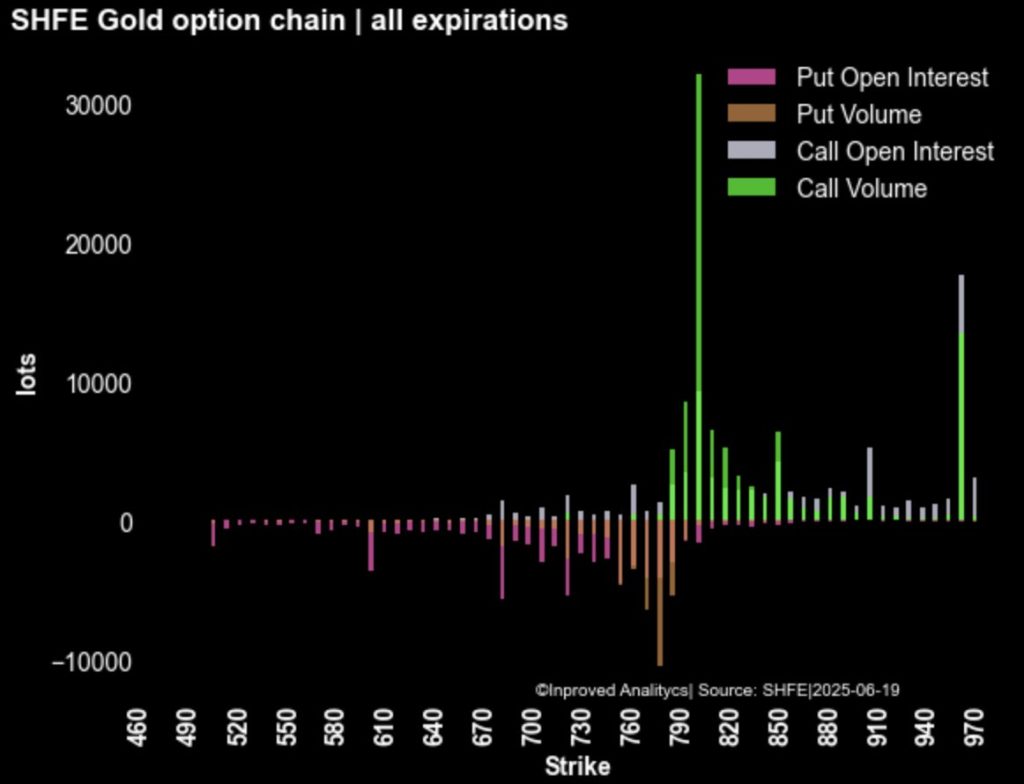

Over on the Shanghai Futures Exchange (SHFE), call option appetite continues to grow. Traders are targeting ¥800/gram calls, tying to a COMEX equivalent of $3,460/oz. With a put/call volume ratio of only 0.45, bullish bets far outweigh protective puts. Hugo Pascal interprets this as more than just hedging—it’s “directional conviction baked into option prices.”

Asian buyers are clearly preparing for higher gold levels if U.S.–Iran tensions spiral further. That’s a signal investors elsewhere should heed.

In the U.S., instruments like PAXG (Tokenized Paxos Gold) are mirroring these moves. With spot gold gaining steam, PAXG is climbing as investors opt for direct bullion exposure in regulated digital form. Its movement confirms the momentum is broad—trading on both physical and tokenized platforms.

Given the combined factors:

gold looks primed for a re-test of the $3,400–$3,500 range in the near term.

If conflict escalates, a tactical puncture above $3,500 becomes increasingly feasible. Conversely, a de-escalation could cause a retreat to the $3,300–$3,350 corridor—where the growing premium support remains compelling.

Hugo Pascal puts it this way: “We’re seeing all structural levers engaged. Geopolitics, Asian flows, option dynamics—they aren’t signaling a pause. They’re lining up for a run.”

For investors based in Singapore (or anywhere else), now is a time of opportunity and caution:

If you’re in Singapore—or anywhere in Asia—and want to ensure your wealth is anchored in quality bullion at globally competitive pricing, look no further. At InProved, our mobile app offers real-time access to strategic tools, institutional-level LBMA pricing, and direct custody in local vaults.

Download the InProved app today and begin securing your assets with gold, silver, and platinum that reflect true market value—built for resilience in uncertain times.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions