| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

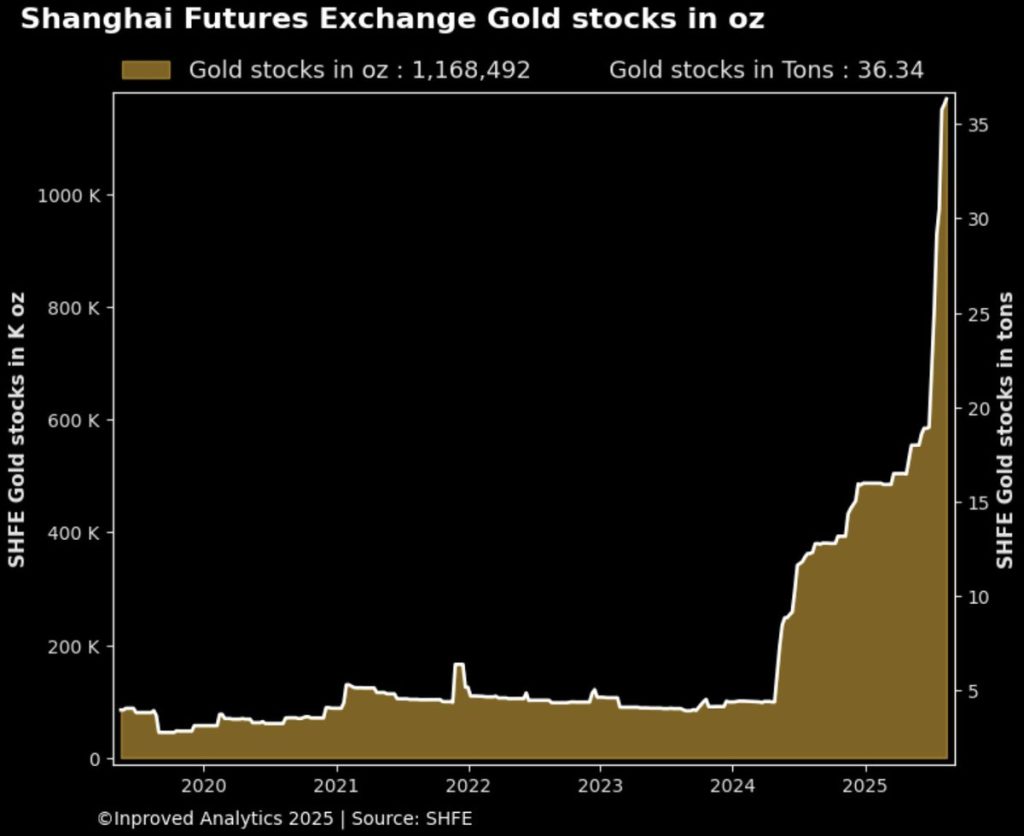

The story of gold is never static. It shifts with global politics, monetary cycles, and investor psychology, always walking the line between its role as a financial hedge and as a physical anchor of wealth. In recent weeks, the gold market has once again been showing signs of subtle but important change: futures positioning is rising, physical inventories in Shanghai are climbing to new highs, and premiums are edging back into positive territory.

But beneath these daily ticks and shifts lies a deeper story—one that highlights the interplay between paper and physical gold, and why Singapore is increasingly becoming the place where serious investors in Asia, especially from China and India, come to secure their wealth.

Data out of China provides the first clue to what is happening beneath the surface. The trading volume for the physical gold proxy contract on the Shanghai Gold Exchange (AU9999) in August has slumped to 6.2 tons, 45.6% below its five-year average. This suggests that retail and institutional buyers in China are momentarily cautious, pulling back from active physical trading despite gold hovering near record highs.

And yet, paradoxically, Shanghai’s gold vaults rose by 300 kilograms last week, hitting a fresh record high at 36.34 tons. This indicates that while speculative volumes may be subdued, accumulation is continuing quietly. Investors may not be aggressively trading in and out, but they are still tucking away ounces for the long haul.

Premiums tell the same story. Gold in Shanghai is flirting with positive territory, trading at $3,342/oz or 0.1% above LBMA. After weeks of slipping into discounts, the return of even a marginal premium suggests that the physical market is regaining strength, albeit in stealth mode.

Overlaying this physical dynamic is the world of derivatives. Futures, options, and swaps continue to dwarf physical trading volumes, shaping short-term price action. For gold, the growing use of call options and the steady climb in open interest are setting the stage for volatility in Q3 and Q4.

The impact of derivatives on the physical market cannot be overstated. When futures prices surge, premiums often widen as arbitrageurs move metal across borders to exploit spreads. When options skew turns bullish, refiners and dealers often find themselves facing greater delivery demands. In this sense, the “paper” market doesn’t just mirror physical flows—it actively reshapes them.

Hugo Pascal, CIO at InProved Metals, has repeatedly highlighted this dynamic:

“Every futures contract ultimately traces back to a physical ounce. Traders forget that. When derivatives expand too quickly, they put pressure on inventories. It may not be immediate, but it always comes due.”

This is why today’s mix—weak trading in Shanghai, record vault holdings, and a cautious return of premiums—should not be dismissed as noise. It may be the prelude to stronger physical demand as derivative-driven volatility spills into the real market.

As this tug-of-war between paper and physical plays out, the question for investors is not only when to buy gold but where to buy it. Increasingly, the answer is Singapore.

Singapore has emerged as one of the world’s most efficient and secure bullion hubs for several reasons:

For Chinese nationals with overseas accounts or residency, Singapore offers a bridge around domestic restrictions. They can hold bullion in an internationally recognized jurisdiction while avoiding the capital controls that complicate direct buying at home. For Indians abroad, the benefits are equally compelling: lower premiums, zero import duties, and no capital gains tax. As Hugo Pascal has noted,

“Singapore is where East meets West in bullion. Chinese and Indian investors may pay high premiums at home, but in Singapore they can access gold almost at global spot prices. And they can do so within one of the safest jurisdictions in the world.”

Gold’s resurgence is not about daily ticks in price; it is about the deeper rebalancing between paper contracts and physical ounces. As speculative volumes dip in Shanghai but vault holdings rise, as premiums edge back into positive territory, and as futures markets gear up for another wave of volatility, the conditions are aligning for gold to reassert itself into Q4.

For investors, the challenge is not whether to hold gold—it is where to hold it. And in that race, Singapore’s advantages stand out more clearly than ever.

Gold remains the ultimate test of time, bridging ancient trust and modern finance. But in today’s fragmented global market, where contracts stretch far beyond available ounces and premiums vary widely between borders, securing your wealth in the right jurisdiction matters as much as securing it at the right price.

At InProved Metals, we provide investors with access to some of the lowest LBMA-aligned bullion prices in the world, backed by secure vaulting in Singapore. Download our mobile app today and take the first step in securing your wealth in gold, silver, and platinum—tax-free, safely, and efficiently.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions