| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

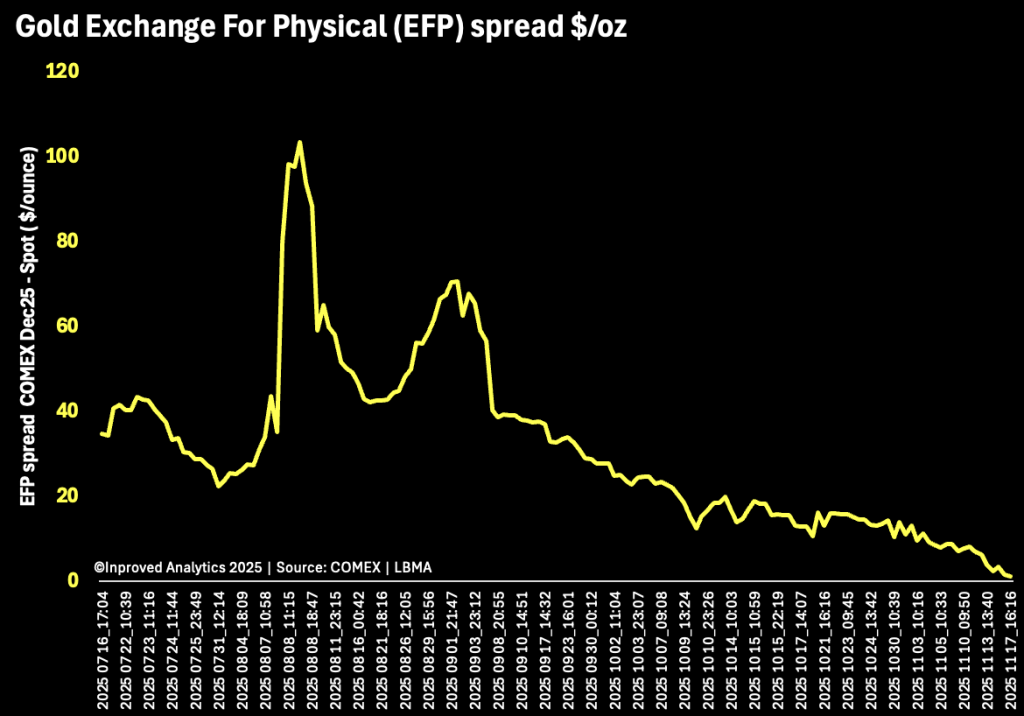

There are weeks when gold writes the headline and weeks when the market’s plumbing does. This is the latter. The screen looks calm—November’s dip has been textbook seasonal—but underneath, the mechanics are unusually loud: professional expectations have compressed, the front of the curve is hugging flat carry into expiry, and options pricing is screaming “fat tails” even as spot barely budges. Put differently, the market is quietly paying for time while refusing to give you an obvious price signal.

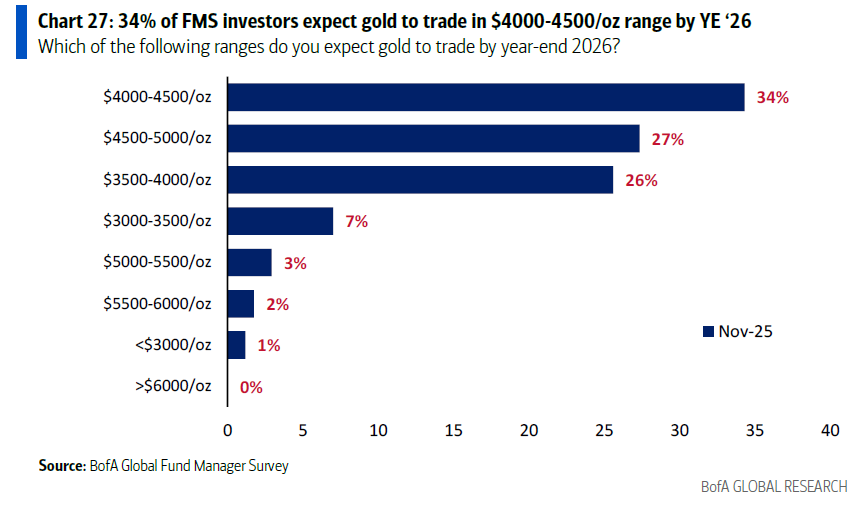

As of November 19, only five percent of fund managers think gold trades above $5,000 by the end of 2026, and none see $6,000. That’s not just cautious; it’s a ceiling. When consensus crowds into a low upper bound at the same moment policy is easing and central-bank demand remains firm, the asymmetry becomes obvious. The path to disappointment is narrow; the path to upside surprise is wide. If gold merely does “better than five percent expect,” benchmarked portfolios will be forced to chase higher—late, not early.

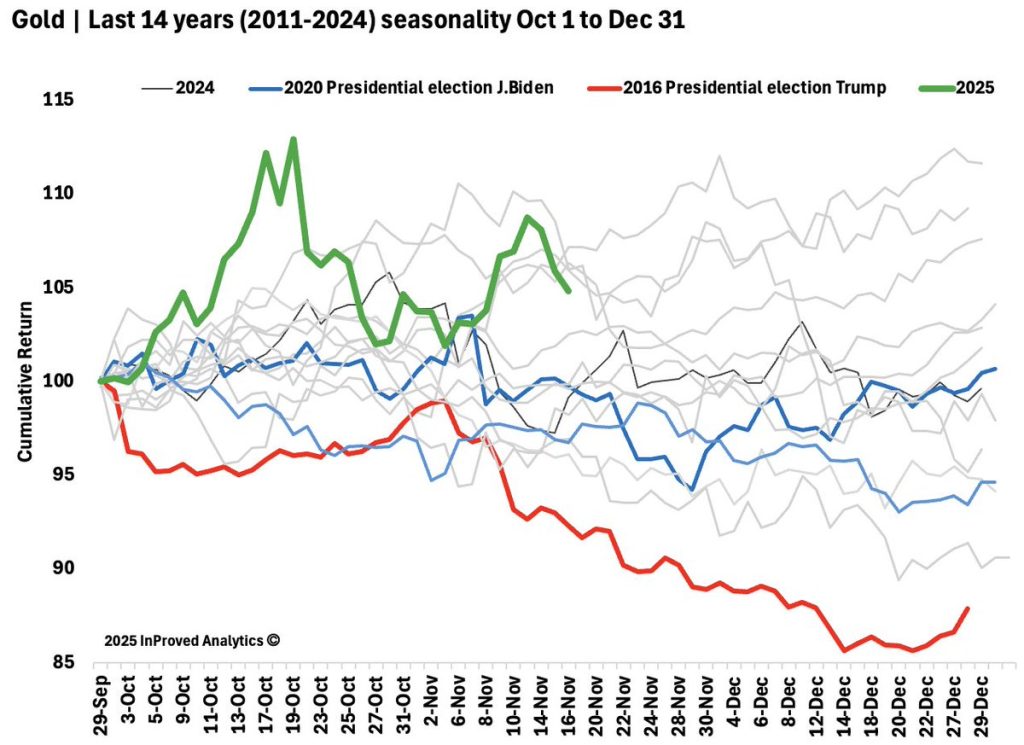

Seasonally, a mild November pullback is normal before the year-end “sweet spot” kicks in. This month has behaved to form. The relevance isn’t that price sagged; it’s that the dip coincided with tightening market mechanics, not loosening ones. Spot softness without structural give is exactly the kind of reset that long investors tend to exploit—because it compresses expectations without fixing the underlying squeeze points.

Into expiration, the Dec ’25 COMEX contract has been flirting with backwardation, quoted about $1.08 per ounce over $XAUUSD—near-flat carry that can tip on delivery pressure. In a comfortable contango, time is worth something tangible: financing, storage, and convenience yield. When that compensation collapses to nearly zero, the market is telling you that immediacy is almost as valuable as time. Whether the line actually flips negative intraday is secondary; the message is that the premium for “now” is within a hair of eclipsing the value of “later.”

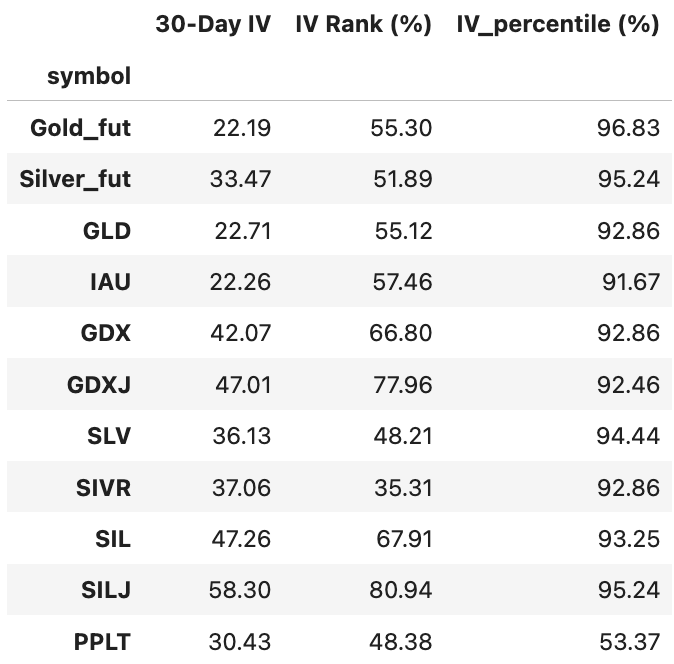

By November 17, gold and silver options implied volatility were both above the 90th percentile of the past year—meaning vol was higher than on nine out of ten trading days—while platinum’s IV percentile cooled to ~53%. That split is the tell. The market is paying up for convexity in the monetary metals, not across the whole complex. Elevated IV with a mostly steady spot is classic “coiled spring” behavior: participants are buying time because the distribution of outcomes widened, even if the headline price hasn’t yet chosen a direction.

Line these facts up—compressed professional expectations, a routine November dip, a front month hugging flat carry, and a hot vol surface—and they don’t describe fatigue. They describe re-accumulation in disguise. Historically, when the market pays for time while consensus caps upside, the repricing (if and when it comes) tends to be abrupt, not incremental. The curve moves first; the narrative catches up later.

When term structure compresses into expiry and implied vol is rich, good dealers don’t try to be clever—they get logistical. With Dec ’25 nearly flat to spot, the penalty for staying close to cash is minimal; with IV high, intraday liquidity is surprisingly orderly because counterparties are hedged. That’s the moment to rebuild core lines while premiums are tame and to stage product in jurisdictions where settlement is frictionless for cross-border clients—Singapore and London remain the obvious hubs. The point is to own availability before seasonality and any curve flip force your hand. In a market that’s flirting with backwardation, the spread belongs to whoever can say “deliverable now” and mean it.

For civil servants, PMETs, and other conservative allocators, the signals argue for disciplined, scheduled buying, not market-timing heroics. November’s softness is normal; the front of the curve is tight enough to be one headline from backwardation; volatility is elevated specifically in the monetary metals; and consensus tops out at $5,000 into 2026. The simplest way to harness that setup is to ladder small, regular purchases—weekly or monthly—expressed as fully allocated holdings in a tax-efficient, LBMA-linked jurisdiction like Singapore. If seasonality and a curve flip deliver a year-end pop, you already own the ounces; if the lull stretches, your average improves without asking you to guess the day.

Options can be justified tactically, but price discipline matters when IV sits above the 90th percentile. For conservative profiles, the higher-probability edge is to own metal and let time and policy do the work, rather than renting convexity at premium prices.

The near-term jostle will be driven by expiry mechanics on Dec ’25, the usual December-January physical flows, and whether elevated IV relaxes once roll risk clears. Any one piece can nudge spot a percent or two. The more important question is structural: does the curve widen back into comfortable contango after expiry, or does it keep threatening to flip as seasonal demand arrives? If it’s the latter, the market will have told you—twice—that the premium for “now” is sticky. That’s when under-allocated institutions, the same ones capping forecasts at $5,000, tend to climb the ladder quickly.

When 95% of managers don’t see gold above $5,000 by end-2026, the professional ladder above $4,500 is thin. Thin ladders move fast when capital is forced to climb. You don’t need a grand thesis to prepare for that. You need the mechanics on your side: a curve that’s almost flat, volatility that’s already bought, and storage that’s already solved. In that matrix, certainty beats cleverness. Dealers who hold inventory win the scramble for immediacy; conservative investors who hold ounces avoid paying urgency premia later.

Gold doesn’t need drama to do its job. It needs time, policy, and a market that gradually pays more for certainty than for hope. Right now, the time is favorable, the policy backdrop is loosening, and the curve is whispering that “now” and “later” are almost the same price—until they aren’t. Position accordingly, before the survey that capped upside becomes the catalyst that unlocks it.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions