| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

The gold market thrives on paradoxes. It is the most ancient of safe-haven assets, yet one of the most actively traded on modern derivatives exchanges. It is hoarded for decades in central bank vaults, yet also churns through delivery contracts every month in Shanghai, London, and New York. That dual character makes it sensitive not just to price, but to the plumbing of how gold actually moves — and this past week, the plumbing began to rattle.

Hugo Pascal, CIO of InProved, drew attention to two developments that, taken together, suggest the world’s most enduring store of value is once again navigating a period of stress: record inflows into Shanghai vaults and a sharp widening of the exchange-for-physical (EFP) spread on December contracts.

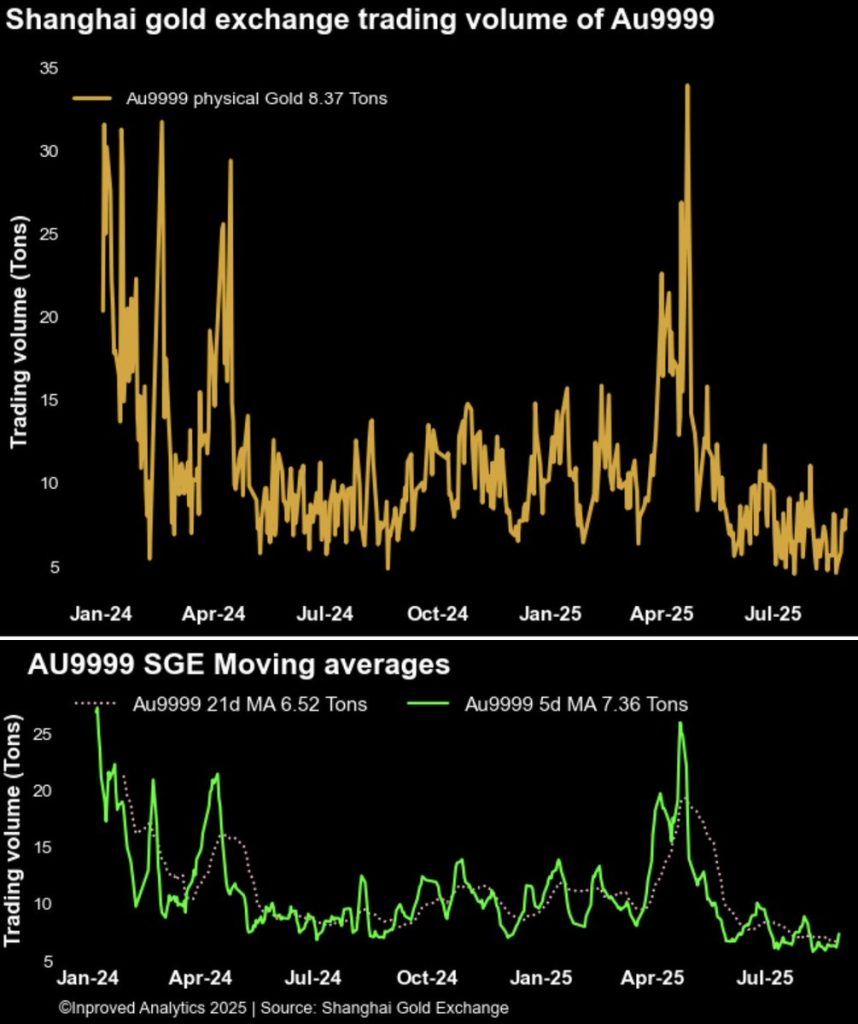

In China, trading in the physical proxy contract AU9999 is gaining momentum. Volumes have risen sharply, with 8.4 tons changing hands in a single day and the five-day moving average climbing to 7.36 tons. This is not a trickle of interest — it is a steady surge, underscoring how Chinese buyers are stepping in even at today’s elevated prices.

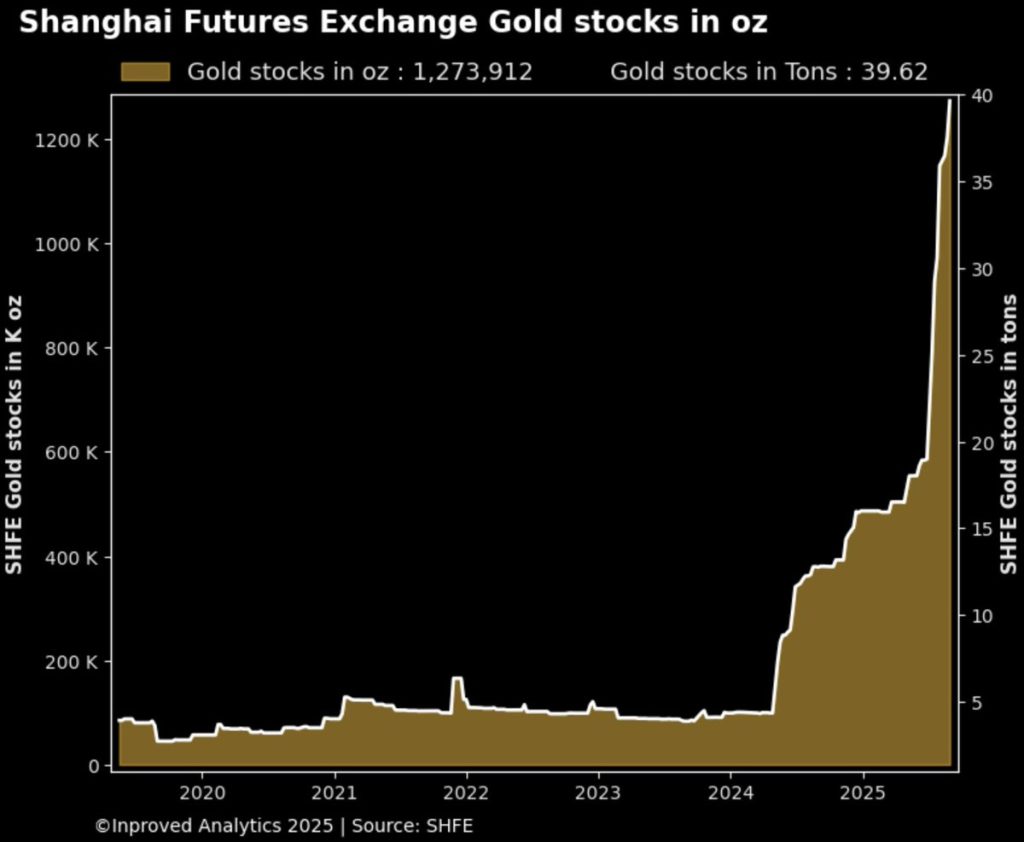

That appetite is reflected in the vaults themselves. SHFE gold inventories climbed another 2.17 tons this week, reaching a record 39.62 tons (1.27 million ounces). This marks the tenth consecutive week of inflows, a remarkable streak that speaks to both confidence in bullion and the financial system’s determination to anchor exposure in physical metal rather than paper claims.

Yet while vaults bulge in Shanghai, spreads are widening elsewhere — a contradiction that seasoned traders know should not be ignored.

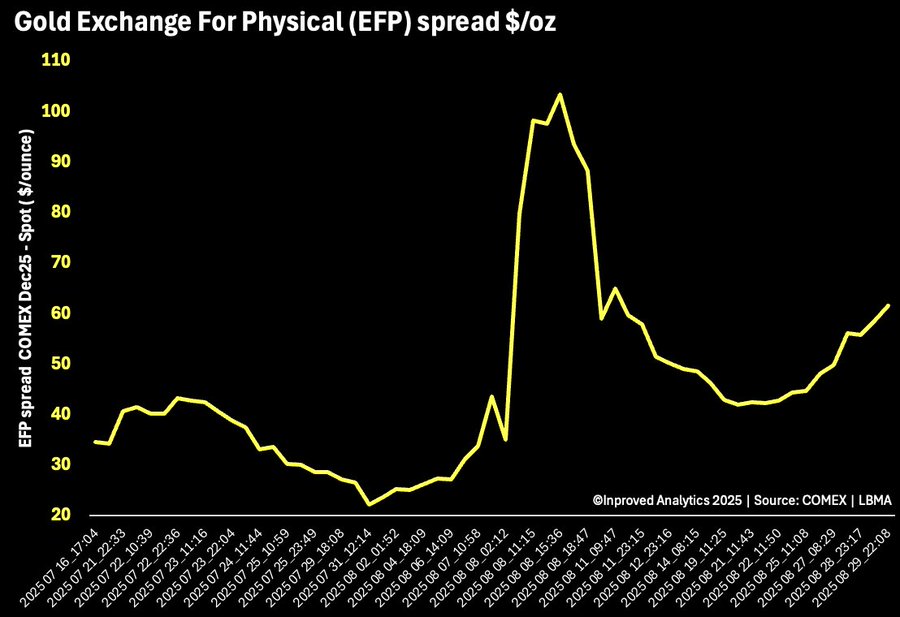

On the same day that Shanghai celebrated record inflows, the December 2025 gold EFP spread ballooned to $61.50 per ounce above LBMA spot. Even earlier in the week, the spread was already trading near $58.40, well above normal levels.

For context, the EFP — exchange-for-physical — is a bridge between the paper futures market and physical bullion. In normal times, that bridge is stable, and spreads are tight. When spreads widen, it signals growing mistrust that paper can be smoothly converted into metal. In short, traders are paying up to ensure they are not left holding contracts that can’t be delivered against.

Pascal notes that this kind of divergence — record inflows into vaults in one geography and simultaneous strain in futures-to-physical conversion in another — often reflects deeper imbalances. “When spreads blow out while vaults are full, it’s not about ounces in storage. It’s about confidence in who controls them, and who can deliver at scale when called upon,” he explained.

Gold has seen EFP spreads widen before, and the episodes have often coincided with major stress. During the COVID liquidity crisis in March 2020, gold EFP spreads surged as flights carrying kilo bars from Switzerland to New York were grounded. Futures traded at steep premiums because physical delivery became logistically impossible. Prices whipsawed violently until supply chains normalized.

Even earlier, in 2008, EFPs briefly widened as banks hoarded collateral and refused to make markets, preferring to keep gold locked down rather than risk lending it out. Within months, gold had launched into a decade-long bull run.

Today’s spreads, at more than $60 per ounce above LBMA, are not yet at crisis levels, but they are significant. They suggest that the liquidity pipeline between paper and metal is again under strain — at the very moment when Chinese demand is accelerating.

The surge in Shanghai activity is more than just a regional story. China has steadily positioned itself as a physical hub for gold pricing, with the Shanghai Gold Exchange increasingly acting as a counterweight to the LBMA and COMEX. When vaults in Shanghai fill while Western spreads widen, it is a sign that the locus of demand is shifting eastward.

This is consistent with broader macro trends. In 2023 and 2024, the People’s Bank of China was one of the most aggressive central bank gold buyers, adding to reserves for 18 consecutive months before briefly pausing. Household buying has remained strong, even in the face of slowing economic growth, as citizens see gold as a hedge against yuan volatility and geopolitical uncertainty.

In that sense, the inflows into Shanghai vaults are not just a technical detail — they are a vote of confidence by the world’s largest consumer base for gold.

The combination of swelling Chinese vaults and widening Western spreads suggests a market bifurcating between regions. On the one hand, China is stockpiling, anchoring trust in physical bars. On the other, Western traders are paying premiums in EFPs, signaling nervousness about timely delivery.

If history is any guide, such bifurcations can set the stage for volatility. When the East holds the bulk of physical stock while Western markets rely heavily on paper, price gaps can emerge. Premiums in China can widen further, drawing more metal eastward, while futures in New York and London struggle to keep pace.

Already, speculative positioning is heating up. Call options on Shanghai’s gold futures contracts have seen growing interest, especially at higher strike prices that imply traders are betting on another leg up. If those bets collide with physical tightness in Western markets, the outcome could be explosive.

On paper, the gold market looks well-supplied. Vaults in Shanghai are swelling, with inventories at record highs. But beneath the surface, the widening of EFP spreads suggests something more fragile. Confidence in the ability of paper contracts to translate into real metal is wavering.

As Hugo Pascal puts it, “Markets don’t break when vaults are empty — they break when traders stop trusting the pipes that connect paper to physical.”

That may be the truest warning of this week’s data. Record inflows and record spreads are not contradictions; they are two sides of the same coin. They tell us that gold, despite its age-old status as the ultimate safe haven, remains a market defined not just by ounces in the ground, but by trust in the systems that deliver them.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions