| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

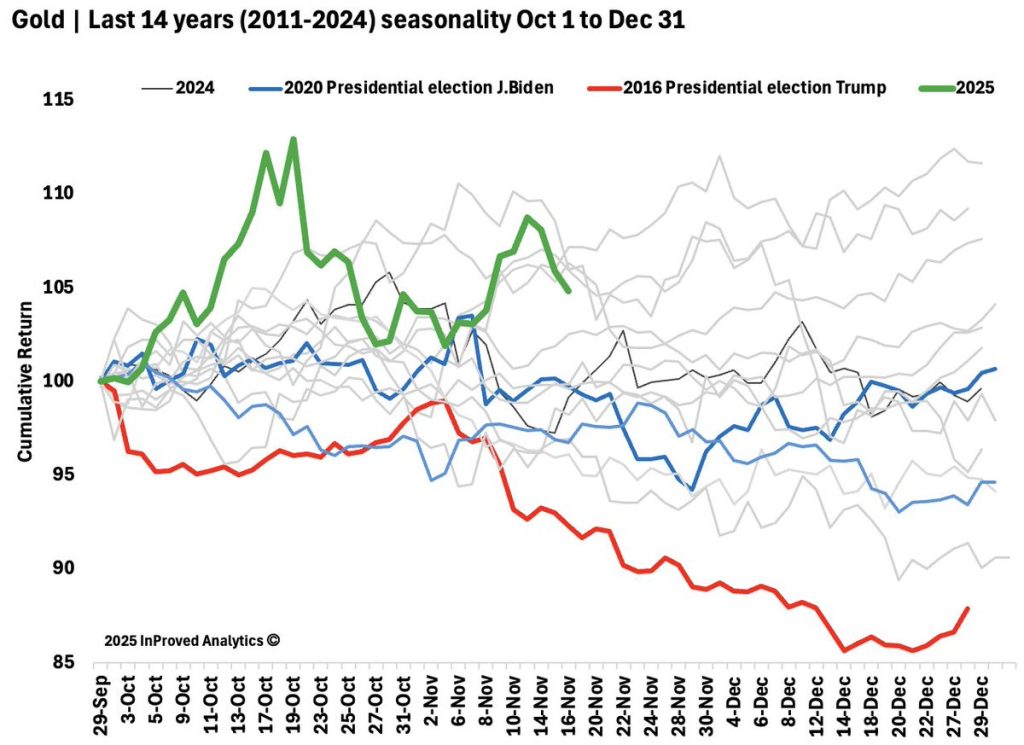

Gold is doing that very “gold” thing again—going quiet just as the underlying tells get louder. A modest November pullback is historically normal before the market’s year-end “sweet spot,” and this week’s tape fits the profile: spot around $4,086/oz, trading about 0.1% below LBMA, while positioning and option pricing hint that bigger forces are coiling underneath.

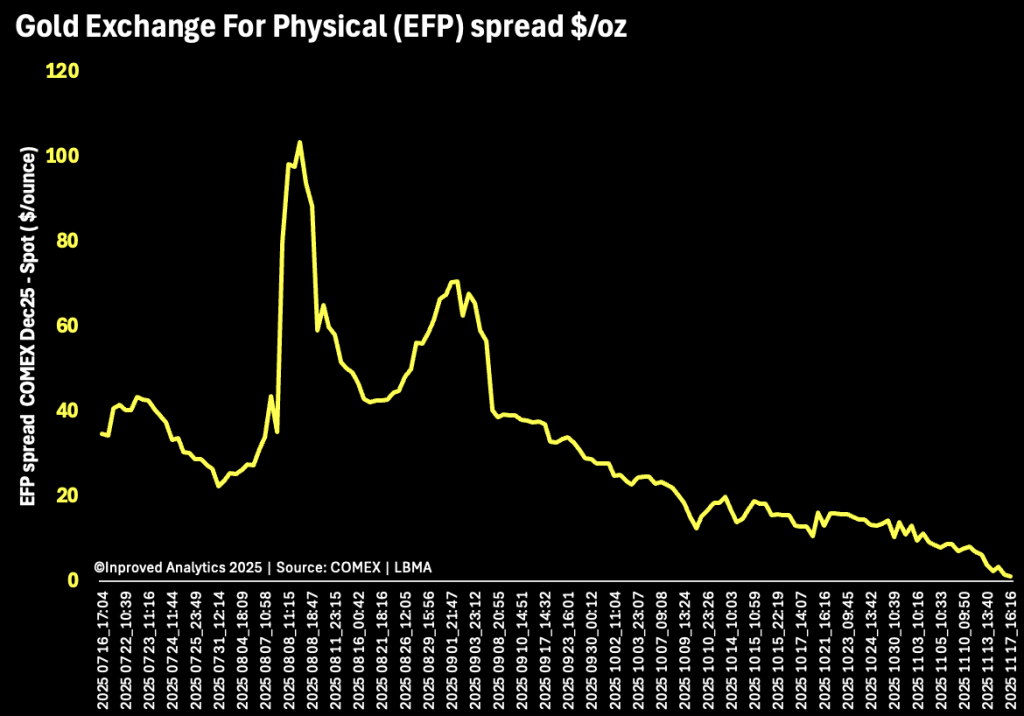

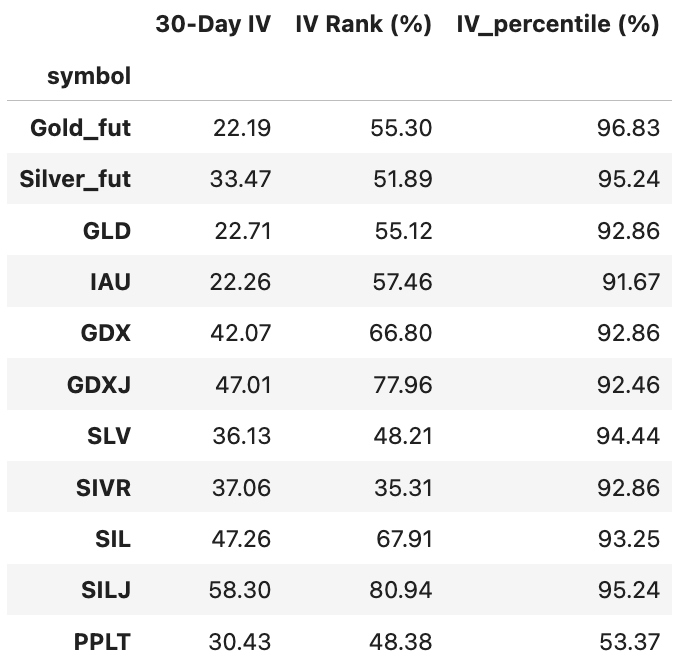

Two signals stand out. First, implied volatility for gold and silver options sits above the 90th percentile, meaning vol is higher than on 90% of trading days over the past year. Second, the Dec’25 gold contract is flirting with backwardation into expiry, currently about $1.08/oz over spot—a razor-thin edge that can flip intraday as delivery pressure and roll activity peak. Meanwhile, platinum’s temperature has cooled, with an IV percentile near 53%, reminding us that not all precious metals are sharing the same stress.

Put plainly: price looks calm; the plumbing does not.

A soft patch in November often precedes year-end firmness as jewelry demand, balance-sheet hedging, and reserve managers’ housekeeping collide with thinner liquidity. That’s why a slight correction here shouldn’t be read as fatigue. The 0.1% discount to LBMA tells you the East-West spread is close to flat—no distress, no toppy premium—while options markets price the possibility of outsized moves. Elevated IV without a large spot swing is a hallmark of transition: participants are paying for time because conviction about direction is building but not yet decided.

When a nearby contract “flirts with backwardation,” it’s the market telling you that immediacy is at a premium—that delivered ounces today are, at the margin, more coveted than promises later. Into expiration, that knife-edge can wobble: at the moment, Dec’25 trades ~+$1.08/oz over spot, a tiny positive differential that can vanish quickly if shorts scramble for cover or longs opt for delivery. The headline isn’t the exact dollar—it’s that we’re hovering near the inflection where time value collapses and the battle for physical settles the argument. If that flips negative, even briefly, it’s the footprint of tight near-dated conditions rather than speculative hype.

With gold and silver IV in the 90th percentile, option premia are rich. That rarely happens in a vacuum. Markets are bracing for catalysts—policy, macro, or flow-driven—while spot refuses to break. Platinum’s mid-pack 53% IV percentile is a useful control sample: it says the stress is concentrated in monetary metals, not across the whole complex. For practitioners, this split argues for selectivity: don’t pay for optionality indiscriminately; decide whether you need convexity (options) or carry (spot/allocated exposure).

Treat November’s softness as inventory time, not story time. With spot roughly $4,086/oz and the East-West basis near flat, restocking core lines (kilobars, 100g bars, standard coins) into year-end is operationally easier and pricing-cleaner than doing it during a December squeeze. Elevated IV also tends to stabilize day-to-day bid/ask behavior—you may see narrower execution windows intraday even as options stay expensive.

On the curve: a nearby contract hovering near backwardation into expiry is a practical warning that last-minute sourcing can become a queue. If you promise “immediate delivery,” have it; if you hedge, keep rolls planned days, not hours, ahead. Messaging to clients should be simple and numerical: “seasonal pullback, spreads tight, availability good now—lock in before year-end flows.”

This is the textbook window for disciplined adds. A small pullback into November with the market paying up for protection (high IV) and the curve flirting with tightness is exactly when long-horizon investors tend to get their best holding-period outcomes. Let volatility work for you:

The key is to separate signal (high IV, curve near an inflection, basis nearly flat) from story (“gold is tired”). The signals say positioning risk is high, not that value is low.

None of that screams “sell.” It reads like a market resetting risk while preserving demand.

A quiet November is often the prelude, not the epilogue. With gold barely below LBMA, options richly priced, and the nearby contract edging toward backwardation into expiry, the market is telling you to prepare, not to predict. Dealers should use the calm to secure inventory and execution certainty. Conservative investors should add deliberately, letting time and seasonality do the heavy lifting.

When the “sweet spot” arrives, it rarely sends a calendar invite. It shows up on vault ledgers, delivery logs, and the options surface first. This week, all three are already whispering.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions