| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

In late June 2025, it’s not just the metals that are shifting—it’s the global balance of speculative interest, physical demand, and regional market dynamics that are doing the heavy lifting. As safe-haven assets reset in response to softer Treasury yields and forex market swings, a striking new pivot is emerging in the precious metals complex—led not by gold, but by platinum. And as always, Hugo Pascal’s keen observations at InProved help illuminate the turning tides.

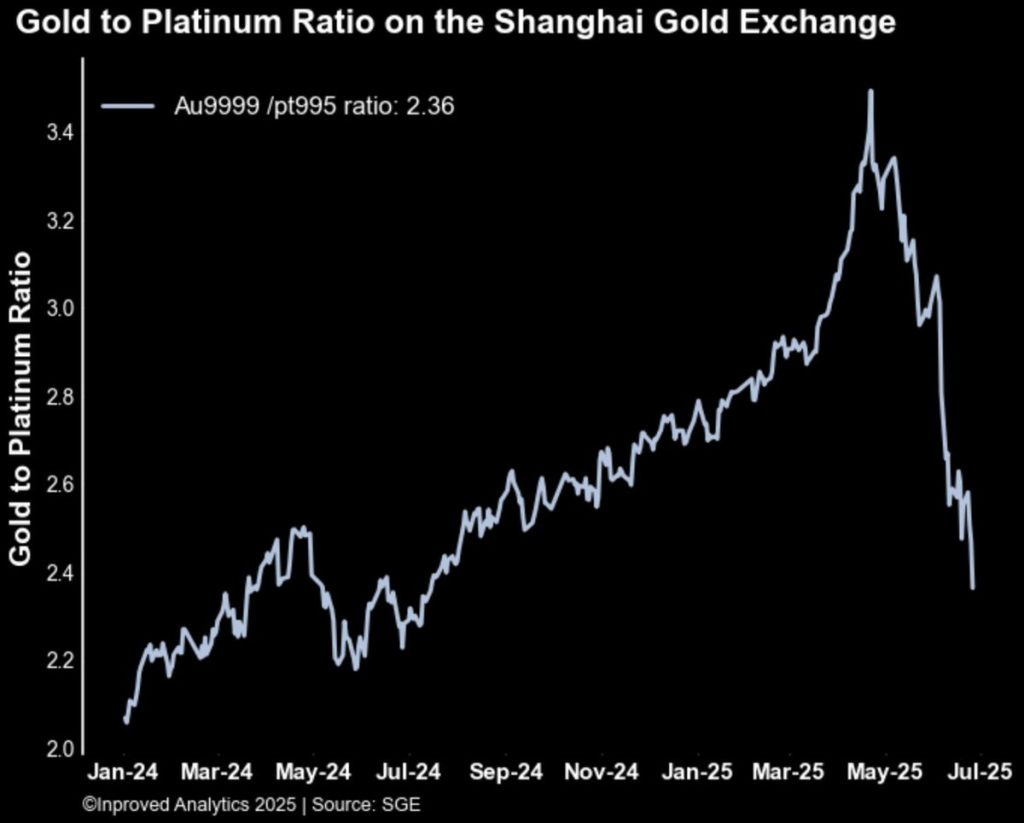

On the Shanghai Gold Exchange, the gold-to-platinum ratio fell sharply to 2.36:1, marking the smallest gap in a year. Those who follow bullion flows will recognise the significance: an investor could now pick up 2.36 ounces of platinum for every ounce of gold, a discount not seen since supply shocks and policy shifts rattled metals markets in 2024. Hugo Pascal notes that such a level tends to “draw forward demand into platinum as markets rebalance against more expensive gold.”

While LBMA trading volumes in London still dwarf those in Shanghai—maintaining its position as the world’s trading powerhouse—the real money is flowing east. Premium signals show just how home-grown behaviour is reshaping value:

Platinum’s discount signals two things: regional over-supply in Asia and the need for catch-up, especially when gold is already trading higher across markets.

Fuel has also been injected into precious metals with broader financial shifts. The U.S. 10-year Treasury yield recently pulled back to 4.27%, reducing the opportunity cost of holding non-yield-bearing gold, silver, and platinum. At the same time, the EUR/USD pair tumbled to about 1.169, increasing interest among dollar-based investors hunting alternative assets. Hugo Pascal emphasizes, “When real rates soften, and FX uncertainty rises, precious metals become the go-to shelter.”

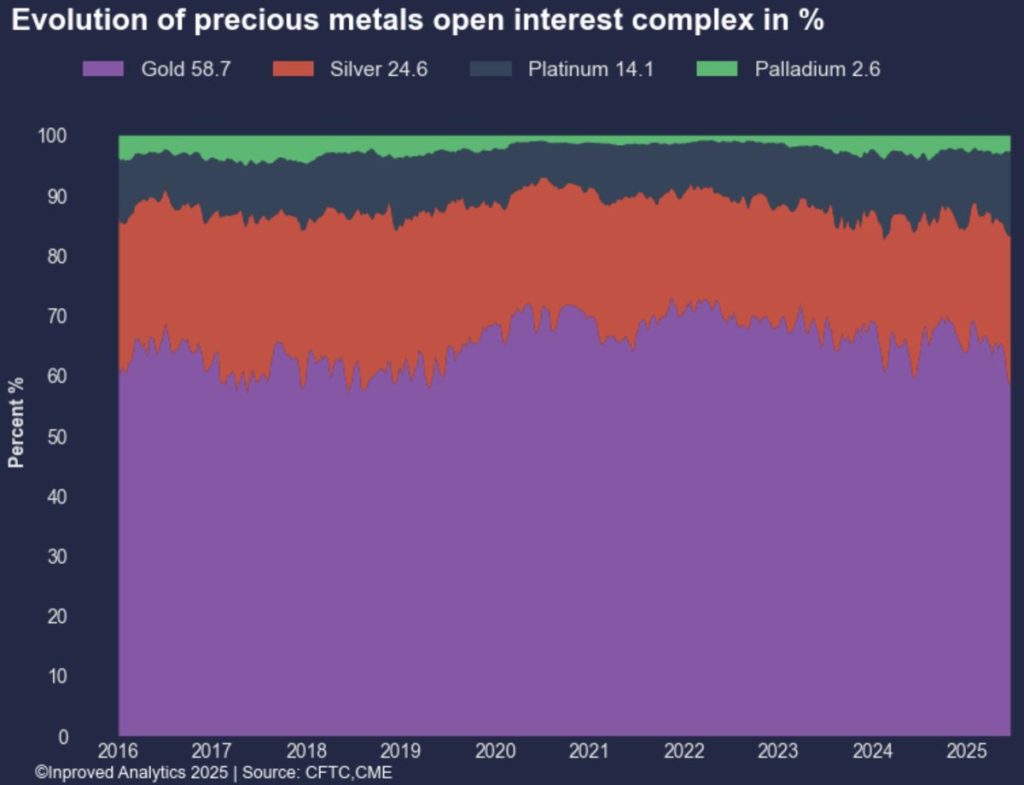

The seismic shift isn’t just physical—it shows up in futures data too. On the Comex, gold’s portion of total precious metals open interest has tumbled to 58.7%, a six-year low, while platinum’s share jumped to a decadal high of over 14%. These aren’t minor rotation dynamics; they are structural reallocations occurring under the radar.

Pascal comments, “Funds are clearly rotating toward metals that offer more asymmetry—platinum being the one that’s historically undervalued against both gold and silver.”

It’s not about choosing one metal over another; it’s about positioning for asymmetry and strategy. Here’s what market dynamics suggest:

Hugo Pascal sums it up: “The narrative is evolving—from gold-only shelter plays to a broader metal mix that includes platinum as a star propeller. Those who recognise early are gaining the proposition advantage.”

If you’re in Singapore or across Asia, or simply want a better approach to precious metals, InProved equips you with:

This moment calls for agility, insight, and access. Download the InProved app today to position your portfolio not just in gold, but in the full suite of metals that will define the next chapter of 2025.

Thinking of repositioning toward platinum or seeking a basket strategy across metals? Let’s explore a tailored solution—or keep watch together as markets pivot.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions