| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

The mood in gold this October feels eerily familiar — a surface calm masking deep structural tension.

Across Asia, Shanghai gold discounts are tightening, closing Friday at -0.28% (roughly $-9/oz below LBMA), the narrowest gap since mid-August. Yet at the same time, implied volatility across gold futures and ETFs has erupted, signaling that beneath the smooth surface, volatility is brewing.

For conservative investors, the pattern is clear: a narrowing East-West spread, record physical demand in China, and rising options premiums often precede the same thing — a turn in the cycle.

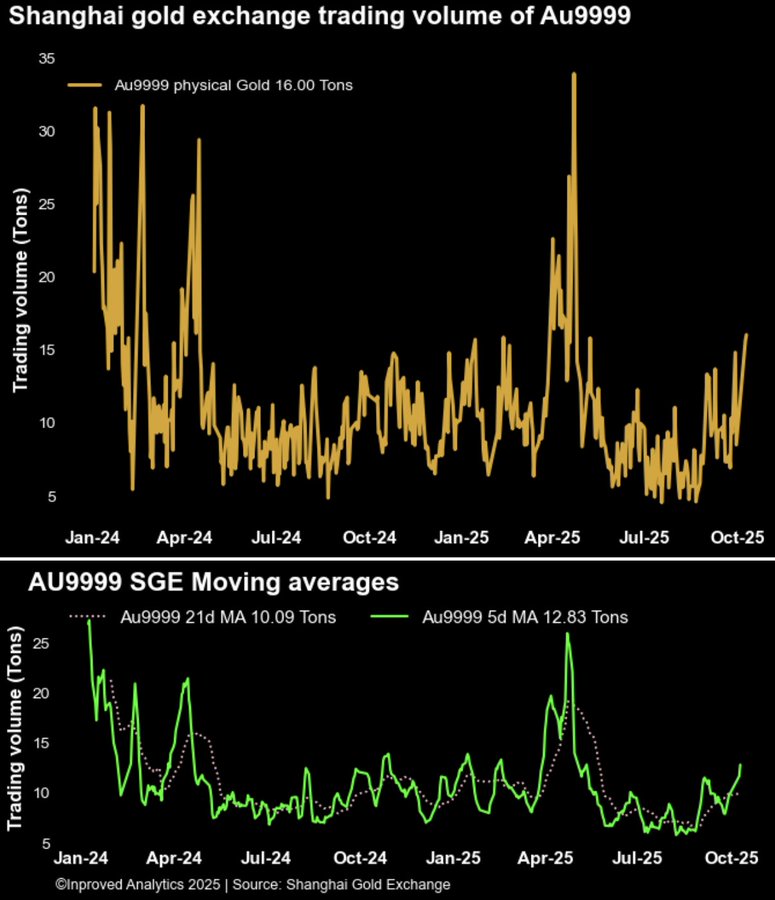

For ten consecutive sessions, trading on the Shanghai Gold Exchange (SGE) has stayed elevated. On Friday alone, 16 tons of the AU9999 contract — the physical benchmark for spot delivery — changed hands, pushing the weekly moving average to 12.8 tons, its highest since April.

Even during the Mid-Autumn Festival lull, when vault inflows temporarily paused at 70.73 tons, trading interest never cooled. That resilience contrasts sharply with 2024, when volumes fell below 6 tons per day amid tightening liquidity.

This renewed appetite points to a market where retail and institutional buyers are both stepping in, even as prices remain subdued and premiums slightly negative. As Hugo Pascal observed on X this week: “Discounts in gold don’t mean disinterest — they often mark digestion. When the street stops selling, vaults start filling again.”

Historically, he’s right. During 2018 and 2020, similar trading surges under discount conditions preceded multi-month rallies as local refiners, jewelry fabricators, and reserve managers absorbed available supply.

Gold’s Shanghai–LBMA discount narrowing from -1.2% to -0.28% is more than a rounding error; it’s a sentiment reversal. The last time this compression happened — early 2020 — Chinese traders quietly absorbed supply ahead of a 30% global rally.

The dynamic is simple but powerful. When discounts narrow despite steady prices, it means local sellers are pulling back. Inventories shift from “for sale” to “for storage.” That shift in psychology — from liquidity to possession — typically marks the exhaustion of selling pressure.

It’s also worth noting that the second methodology (the blue line) used to smooth out short-term volatility confirms this tightening trend, albeit less dramatically. The steady convergence between the two models suggests this is not noise, but a structural rebalancing in demand.

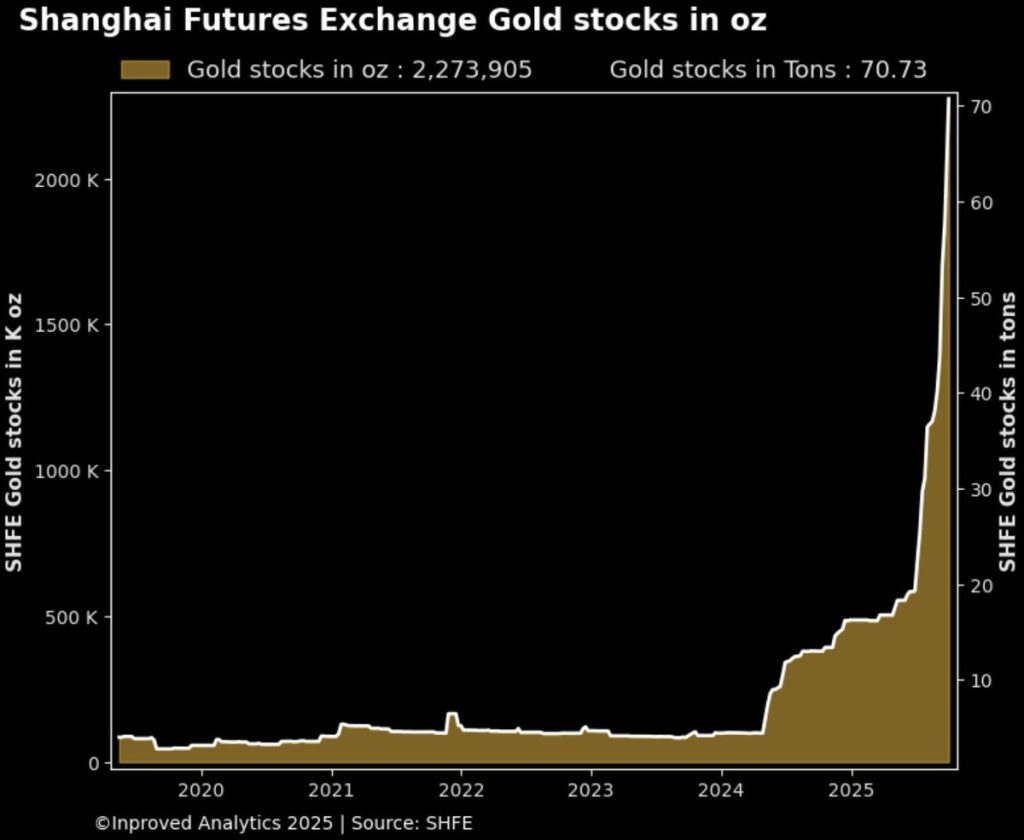

Interestingly, Shanghai vaults have seen no new inflows since the Mid-Autumn Festival, remaining stable at 70.73 tons. Under normal conditions, the absence of inflows might seem bearish. But in context — with daily volumes spiking and discounts shrinking — it reflects something subtler: the market has shifted from “building stock” to “testing availability.”

In previous cycles, when vault inflows paused but trading remained strong (as in early 2021), it often meant that buyers had already front-loaded their accumulation, and were now rotating between contract maturities rather than liquidating.

That’s what the data shows: steady vault levels, high trade turnover, tightening spreads. In the language of commodities, that’s equilibrium — the kind that often precedes a new upward leg.

Behind the calm in spot prices, the derivatives market is roaring.

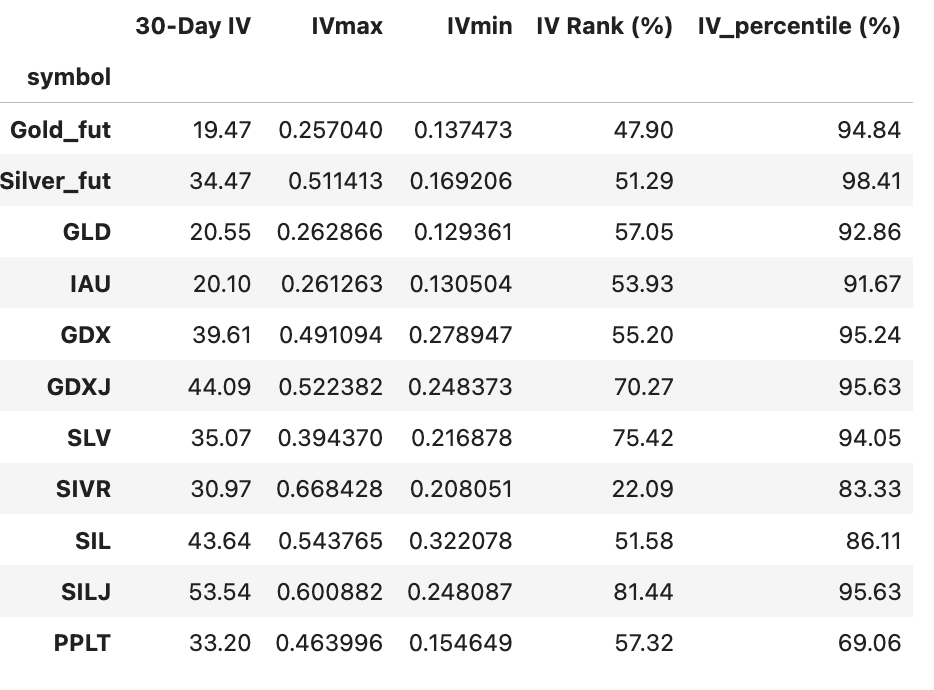

As of this week, gold futures implied volatility (30-day) sits near 19.5%, with an IV rank of 47.9% and a percentile of 94.8% — meaning volatility is higher than 94% of readings over the past year. For ETFs, the trend is similar: GLD at 20.55% IV, IAU at 20.10%, and the gold miners’ ETF GDX at 39.6%.

In normal times, such elevated IV levels suggest uncertainty. But in gold, they often precede inflection points. High volatility with flat prices implies traders are paying up for protection — not against collapse, but against missing an upside move.

As Pascal noted in his weekend commentary: “When options are expensive, it’s not fear — it’s positioning. The market’s buying time before reality catches up with supply.”

And supply, especially physical supply, remains tight. With COMEX inventories hovering around 40 million ounces and EFP spreads still wide at $25 per ounce, the message is consistent: the world wants gold it can touch, not contracts that promise it later.

For risk-averse investors — professionals, retirees, or civil servants looking for stability — it’s easy to dismiss volatility as “trader’s noise.” But in gold, these dislocations often mark the hand-off between short-term and strategic buyers.

A few key lessons stand out:

1. Discounts Shrink Before Rallies. Every major gold rally since 2016 began with shrinking Asian discounts. When local premiums compress from deep negative territory toward parity, it means sellers have exhausted their liquidity. The next bid usually comes from central banks and long-term allocators.

2. Volume Leads Price. The five-month high in trading volume — from 10-ton daily averages to 15–16 tons recently — is a classic accumulation pattern. Historically, Chinese physical volume leads price by 3–5 weeks.

3. Volatility Is Opportunity, Not Risk. With IV in the 90th percentile, conservative investors can use structured exposure — gradual accumulation, hedged purchases, or long-dated calls — to enter at controlled costs. Low IV is comfort; high IV is often conviction.

The current setup echoes early 2019, when gold hovered near $1,300, volatility climbed toward 20%, and Asian discounts narrowed from -1.1% to -0.3%. Within six months, gold broke above $1,500 — a 15% gain.

The trigger then was a U.S. rate pause. Today, markets expect the another Fed cut within 90 days, and UBS has raised its gold target to $4,200 by end-2025. Combine that with persistent Chinese buying, and the parallels are striking.

What differs now is scale. Shanghai’s vault holdings at 70+ tons are nearly triple their pre-2020 average, reflecting a fundamental shift in ownership from speculative to strategic. The gold market is not waiting for Western ETF inflows — it’s being driven by steady, physical accumulation in the East.

For disciplined investors focused on long-term security rather than trading profits, the current phase offers a textbook playbook:

The numbers tell a consistent story:

1. Shanghai vaults steady at 70.73 tons

2. Trading volumes surging to 16 tons/day

3. Discounts narrowing to -0.28%

4. Implied volatility near 95th percentile

Each by itself might seem minor. Together, they describe a market resetting — from fatigue to readiness.

For Hugo Pascal, it’s déjà vu: “Gold’s calm isn’t weakness; it’s breath control. The market’s inhaling before it exhales higher.”

For conservative investors, that breath is the moment to prepare — to allocate while the world mistakes consolidation for complacency. The next rally will belong, as always, to those who acted while the signal was still quiet.

Singapore remains one of the world’s most trusted jurisdictions for physical gold ownership — tax-free, transparent, and fully LBMA-aligned. Visit InProved.com to access institutional bullion pricing and vault storage options before the next wave of demand resets the floor.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions