| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

Silver has always been a restless metal. Unlike gold, which sits in vaults and central bank reserves for decades at a time, silver is constantly in motion — poured into solar panels, soldered into electronics, minted into coins, and hoarded by investors whenever uncertainty spikes. That dual life, part industrial commodity and part monetary refuge, makes silver uniquely sensitive to small imbalances in supply and demand. When inventories shrink, it doesn’t take much to ignite volatility.

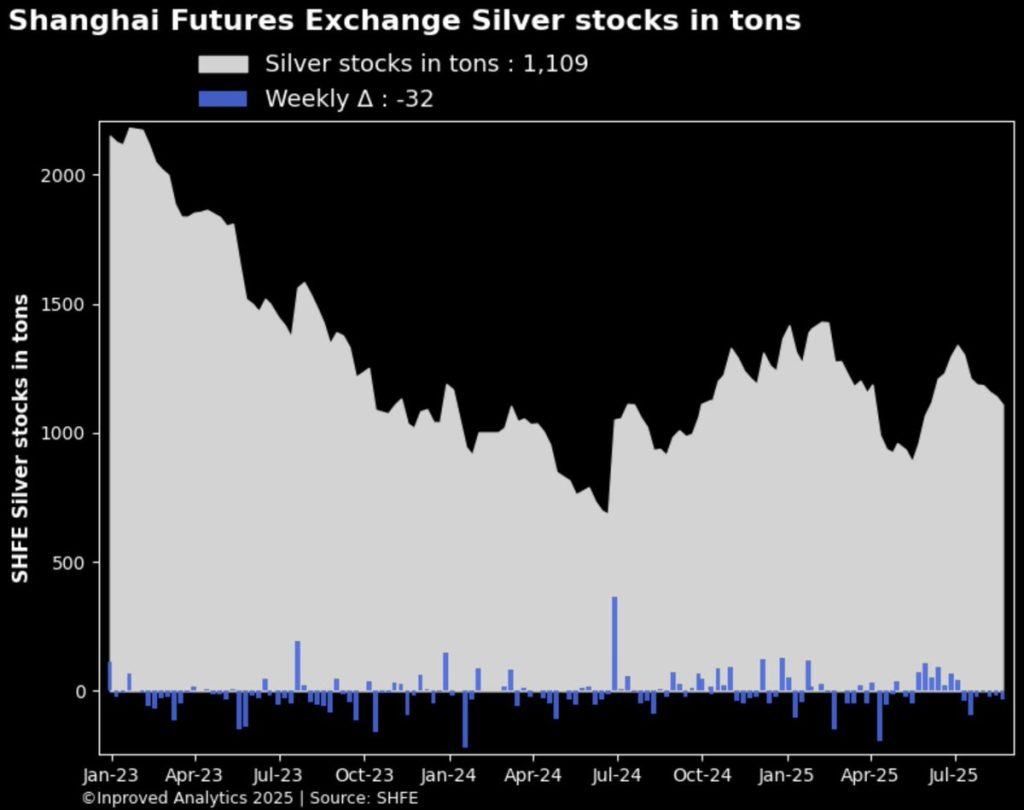

This week, one of the clearest signals of strain emerged from Shanghai. According to exchange data highlighted by Hugo Pascal, CIO of InProved, silver inventories in Shanghai’s vaults fell to a 10-week low of 1,109 tons, or 35.6 million ounces. That marks the seventh consecutive week of outflows, a steady bleed that has drained hundreds of tons since June. In any normal market, this might be dismissed as seasonal variation. But silver is not a normal market. History shows that prolonged vault outflows often precede violent price action, sometimes even setting the stage for what traders call a silver squeeze.

Silver’s past is littered with episodes where physical scarcity collided with speculative positioning to trigger price explosions.

The most famous, of course, was the Hunt Brothers squeeze of 1979–80. Nelson and William Hunt, heirs to a Texas oil fortune, tried to corner the silver market by buying up both futures contracts and physical bullion. At the peak of their effort, they controlled an estimated one-third of the world’s deliverable supply. Prices rocketed from around $6 per ounce in early 1979 to nearly $50 by January 1980. Vaults in New York and London were drained, and the COMEX exchange had to change its rules mid-game to halt the spiral. The bubble eventually collapsed, leaving a trail of lawsuits and bankruptcies, but the memory lingers. The mechanics — thin inventories, crowded shorts, and sudden panic — are the same forces that can still destabilize the silver market today.

A generation later, another squeeze unfolded during the post-financial crisis rally of 2008–2011. Silver, which had collapsed below $9 per ounce in the panic of late 2008, began to climb steadily as investors sought inflation hedges and safe havens from currency debasement. By 2011, amid massive ETF inflows and record coin demand, silver again surged close to $50. This was not the work of a single actor like the Hunts, but of millions of investors and institutions collectively drawing down inventories. Vaults were thin, premiums widened in Asia, and those caught short were forced to scramble.

Even in more recent memory, the 2020 pandemic recovery showed how quickly physical tightness can feed into price. As China’s solar sector roared back to life and Western investors poured money into ETFs, Shanghai vaults saw heavy drawdowns. In just five months, silver doubled from $15 to over $30 per ounce. Online forums tried to brand it a “silver squeeze,” but in truth it was the same old story: too little metal chasing too much demand.

That is why today’s seven-week streak of outflows in Shanghai should not be dismissed as a footnote. The pattern — steady depletion of vaults, modest but persistent premiums above LBMA, and speculative call option buying in Asia — rhymes strongly with the early chapters of past squeezes.

Why focus so much on Shanghai? Because unlike COMEX in New York, where futures are largely cash-settled, the Shanghai Gold Exchange and Shanghai Futures Exchange are physical delivery markets. Contracts that expire must be settled with real bars and ingots. This makes Shanghai vault data a rare window into actual physical flows, rather than the paper speculation that dominates Western venues.

When Shanghai vaults rise, it usually reflects inflows of imported bullion or recycled supply. When they fall, it means physical silver is leaving the warehouses to meet real-world demand. That demand can be industrial — China is the world’s largest producer of solar panels, each of which consumes a thin layer of silver paste. Or it can be monetary, as households and institutions buy bars and coins as a hedge against inflation or currency weakness. Either way, outflows sustained over seven weeks suggest that the balance between incoming supply and outgoing demand has tipped decisively.

As Hugo Pascal has observed, “Every ounce leaving Shanghai vaults reduces the cushion. At some point, traders will realize that what looked like liquidity was just an illusion, and they’ll be forced to chase.”

Nowhere is that illusion more dangerous than in the gap between paper contracts and physical metal. On COMEX, open interest in silver futures often represents hundreds of millions of ounces. Yet the registered inventory — the portion actually available for delivery — typically covers only a fraction of those claims.

This mismatch is not new. In 2020, COMEX futures represented more than 800 million ounces of theoretical silver, while registered stocks were under 100 million. The system works as long as most contracts are rolled over or settled in cash. But if too many holders stand for delivery, or if Asian demand drains physical stocks, the disparity becomes untenable. That is when squeezes occur: shorts scramble to cover, prices gap higher, and physical premiums explode.

Shanghai’s recent outflows bring this risk closer. With seven straight weeks of drawdowns, inventories now sit at just over 35 million ounces. That is barely a rounding error compared to global paper claims. The danger is not that Shanghai runs out tomorrow, but that the optics of shrinking inventories collide with speculative positioning in the West. Markets that live on confidence can be destabilized quickly when confidence in supply disappears.

One of the most reliable telltales of physical stress is the premium between Shanghai and London. When Chinese buyers are willing to pay more than the LBMA benchmark, it means domestic demand is outpacing imports.

During the 2020 squeeze, Shanghai premiums widened to more than 10% over LBMA. Even in the 2011 rally, Asian premiums stayed elevated for months, confirming that physical buyers were leading the move. By contrast, when premiums are negative — as they were for much of 2023 — it signals slack demand and surplus supply.

Today, premiums are modest, around 4–5% above LBMA. That may not sound dramatic, but in context it matters. Premiums flipped positive just as vault outflows began, and they have stayed positive through seven weeks of depletion. History suggests this is how squeezes begin: premiums rise, inventories fall, and before long futures traders are forced to adjust.

Another reason silver is vulnerable to sudden scarcity is its split personality. Roughly half of all silver demand is industrial — in solar cells, electronics, and other applications. The rest is investment and jewelry. This means silver can rally on two fronts at once: as a safe-haven asset like gold, and as an industrial metal riding the green energy transition.

Right now, both fronts are active. China’s solar buildout continues at record pace, and geopolitical tensions — from U.S.–Iran friction to ongoing tariff disputes — have stoked safe-haven buying. In such an environment, even modest supply disruptions can cascade into large price moves. Vault outflows are not just numbers; they are physical evidence of this twin demand.

So, is this the beginning of a silver squeeze? The answer depends on whether today’s patterns extend. A true squeeze requires three ingredients:

1. Physical scarcity, shown by sustained vault drawdowns and widening premiums.

2. Speculative shorts, who must eventually cover at higher prices.

3. Investor inflows, into ETFs or direct bullion, that accelerate the imbalance.

All three are visible in embryonic form. Shanghai vaults are falling, premiums are positive, and COMEX data shows swap dealers maintaining net short positions. Meanwhile, Sprott’s PSLV trust added nearly 3 million ounces this week, reflecting rising appetite for physical exposure.

History shows that once these forces align, silver can move with breathtaking speed. From August 2010 to April 2011, the metal doubled in less than a year. From March to August 2020, it doubled in five months. Each time, vault stocks were falling and shorts underestimated the move.

If Shanghai vaults drop below 1,000 tons in the coming weeks, it could be the psychological trigger that convinces markets we are heading into scarcity. In that case, a run toward $45 or even $50 would not be unthinkable.

For long-term holders, the lesson is simple: silver’s volatility is a feature, not a bug. It is precisely because the market is small and supply chains are thin that it can deliver outsized gains in periods of stress. The current drawdowns in Shanghai may or may not culminate in a squeeze, but they are an unmistakable signal that demand is outstripping supply.

Investors who watched the gold market in 2022 or the copper market in early 2025 know how quickly narratives can flip. One week inventories look comfortable; the next, headlines scream of shortages. Silver is particularly prone to such flips because its industrial base keeps consuming metal regardless of price. Unlike gold, silver cannot simply be “not bought” by solar panel manufacturers.

That structural demand means drawdowns like the current one in Shanghai matter. They are not just about investor sentiment; they reflect real-world consumption colliding with finite supply.

The Shanghai vaults now hold 1,109 tons of silver, the lowest in ten weeks, after seven straight weeks of decline. That is a fact, not an opinion. But facts like this whisper to those who listen. They whisper that demand is running hot, that inventories are finite, and that history has seen this movie before.

Whether this ends in a dramatic squeeze or simply a tighter, more expensive silver market remains to be seen. What is certain is that the conditions for volatility are building. For those who remember 1980, 2011, or 2020, the script looks eerily familiar. And as Hugo Pascal often notes, “In silver, it’s never quiet for long.”

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions