| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

There was a time—not so long ago—when platinum was the crown jewel of the precious metals complex. More valuable than gold, scarcer than silver, and indispensable to the auto industry, platinum enjoyed a period of dominance in the early 2000s when catalytic converter demand was king and green energy ambitions still slept.

Then came the disruption. Palladium surged on the back of gasoline vehicle production. Gold reclaimed its safe-haven throne during multiple economic shocks. And silver, ever the volatile sibling, found a speculative frenzy in the age of Reddit traders and ETF rotations. Platinum was left behind—temporarily.

But the tide, as we’re seeing now, is turning once again.

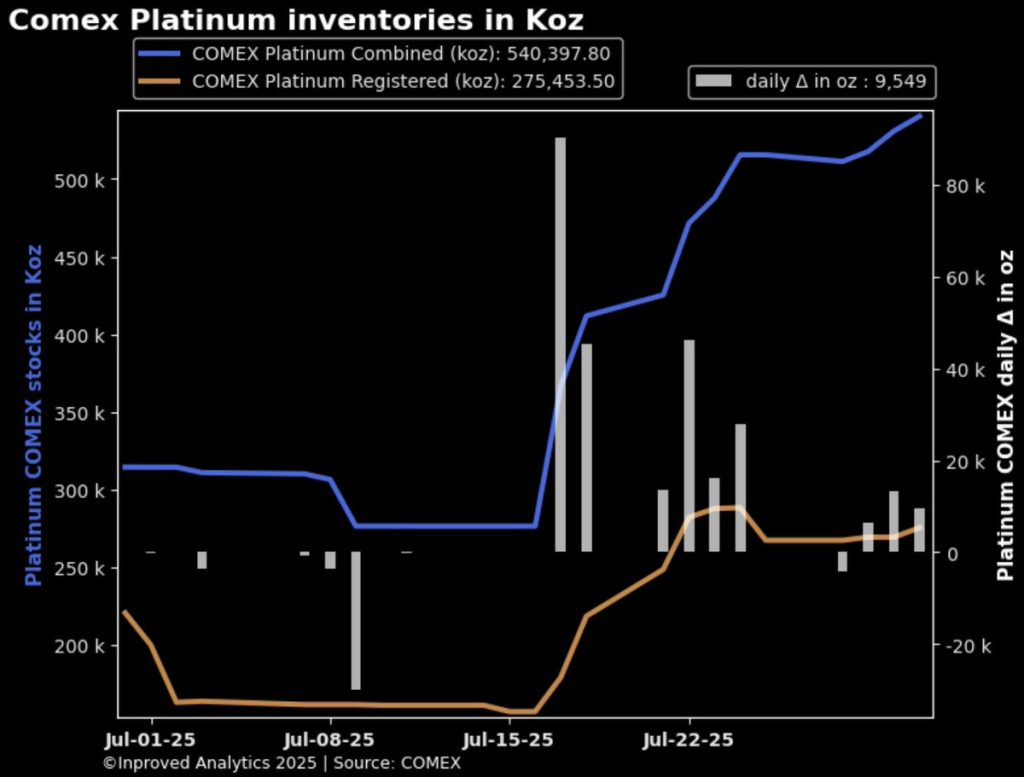

The numbers don’t lie. As of this week, COMEX platinum stocks are hovering near their March highs at 540,000 ounces (17 tons), boosted by a 25,000-ounce inflow Week-To-Date. This isn’t simply a warehouse move—it’s reflective of growing institutional appetite and the rebalancing underway in metals portfolios.

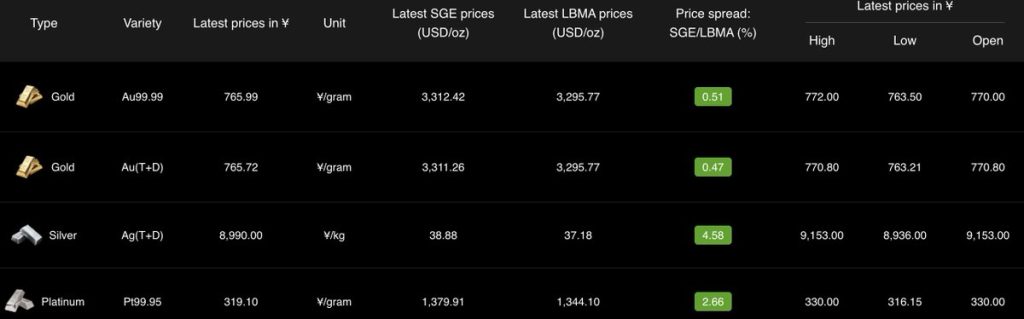

Platinum is currently trading at $1,435.10/oz, up 2.75% from the previous week and about 3% above the LBMA benchmark, signaling renewed physical demand and widening premiums in global trade routes.

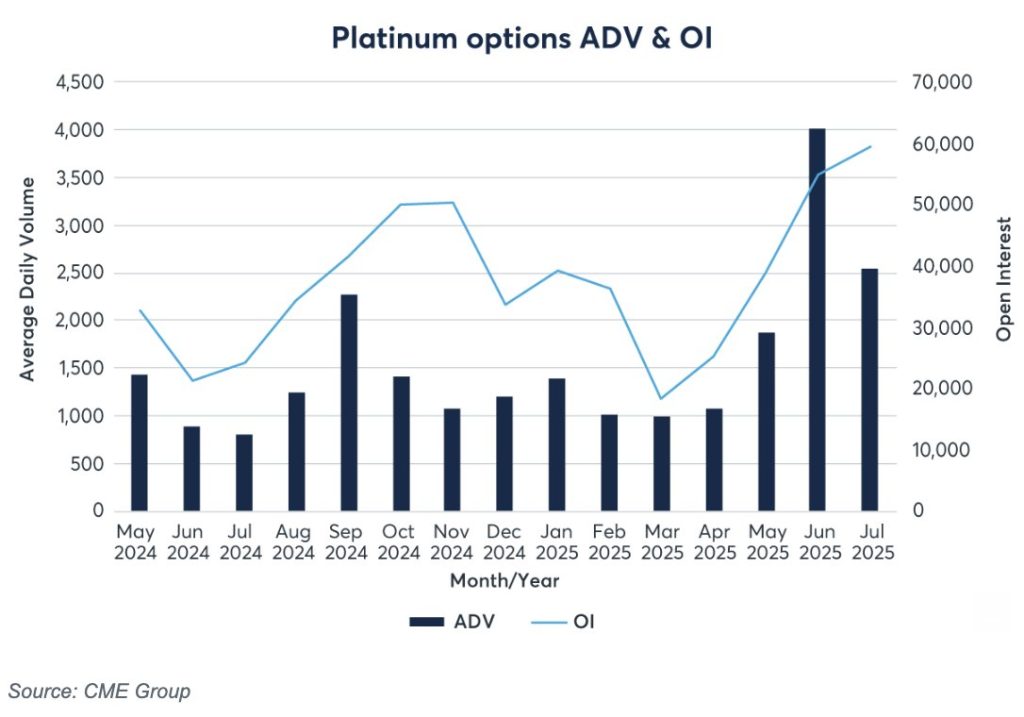

It’s not just price action that tells the story. Volume does too. In July, platinum futures and options hit new highs, with open interest (OI) surging past 60,000 contracts and average daily volume (ADV) exceeding 44,000—double the historical baseline.

Hugo Pascal of InProved comments: “The data speaks to a reinvigorated interest in platinum—not just from hedge funds, but from manufacturers, allocators, and even sovereign entities. Futures are humming, but so is the physical side of the trade. That alignment doesn’t happen often, and when it does, it’s a signal of a fundamental shift.”

Unlike gold and silver, platinum derivatives have long operated in a smaller, more discreet corner of the financial system. The COMEX platinum futures contract, trading under the ticker PL, represents 50 troy ounces of platinum per contract and is settled physically. This is a critical distinction. Unlike cash-settled financial contracts, physical delivery enforces accountability—and invites arbitrage when vault stocks are tight.

Options on platinum futures are also gaining steam. These instruments allow traders to express directional views—calls to bet on price rises, puts for declines—with defined risk. Over 99% year-to-date growth in platinum options activity signals increasing sophistication among market participants.

Why does this matter? Because in precious metals, derivative volumes tend to precede physical delivery pressures. As more players hedge, speculate, and roll contracts, the backend logistics of sourcing real, deliverable platinum intensifies. This is when premiums spike and physical investors gain a strategic edge.

For those seeking to hold platinum outside the futures sphere, the physical market offers several reliable formats:

But beyond form factor, where you store matters just as much as what you buy.

When choosing a jurisdiction for precious metals storage, factors like acquisition cost, taxation, liquidity, and political neutrality all come into play. Few locations tick all boxes like Singapore.

1. Acquisition Premiums

In China, retail premiums on platinum can range from 5–10% due to import duties, VAT, and limited local refining.

India, although liberalizing, still imposes 18% GST on platinum purchases—making it one of the most expensive jurisdictions globally to acquire the metal.

In contrast, Singapore has zero GST on investment-grade platinum, and premium spreads through dealers like InProved can be as low as 1.5–2%, rivaling wholesale pricing in Zurich and London.

2. Capital Gains Tax

China and India apply capital gains taxes on bullion sales.

Singapore does not tax capital gains on precious metals, making it an ideal long-term holding jurisdiction.

3. Vaulting and Accessibility

Singapore’s reputation for regulatory clarity, low crime, and pro-business policy makes it a natural destination for wealth preservation.

InProved’s secure vaulting partnerships across the city allow for real-time ownership verification, 24/7 account access, and seamless liquidity back into fiat or crypto.

Pascal notes, “For investors serious about platinum, Singapore offers a trifecta: low acquisition costs, tax efficiency, and elite vault security. It’s where East meets West in precious metals—without the friction.”

With COMEX inventories rebuilding, options OI surging, and premiums holding firm, the path to $1,500/oz platinum looks increasingly achievable. The macro backdrop supports it: supply chains remain vulnerable, green hydrogen initiatives continue to expand, and geopolitical volatility is breathing new life into safe-haven allocations.

Furthermore, if platinum continues to reassert itself in the auto and energy transition space—particularly in fuel cell applications and as a catalytic converter substitute—the fundamental floor could rise sharply.

“We’re watching the re-industrialization of platinum,” Pascal says. “As nations try to onshore supply chains and decarbonize, platinum’s dual nature—as an industrial and monetary metal—becomes a serious asset. The market is only beginning to price that in.”

While gold captures headlines and silver tempts with volatility, platinum is staging a calculated return. The smart money is moving. The derivatives markets are expanding. And the vaults—especially in Singapore—are filling with forward-looking capital.

If you’re still underexposed to platinum, it may be time to rebalance. Because when platinum regains its throne, it won’t knock first.

At InProved, we offer investors direct access to LBMA-approved platinum products—bars, coins, and even tokenized formats—stored in Singapore’s most secure vaults. With some of the lowest premiums globally, real-time transparency, and a mobile-first platform, you can own platinum the smart way.

📲 Download our mobile app or visit www.InProved.com to explore our full platinum offering and secure your wealth in one of the most promising precious metals of this cycle.

Because the queen of metals is no longer asleep—and the court is watching.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions