| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

It’s not often that platinum steals the show in the precious metals complex. Yet this past week, platinum didn’t just knock—it barged through the door.

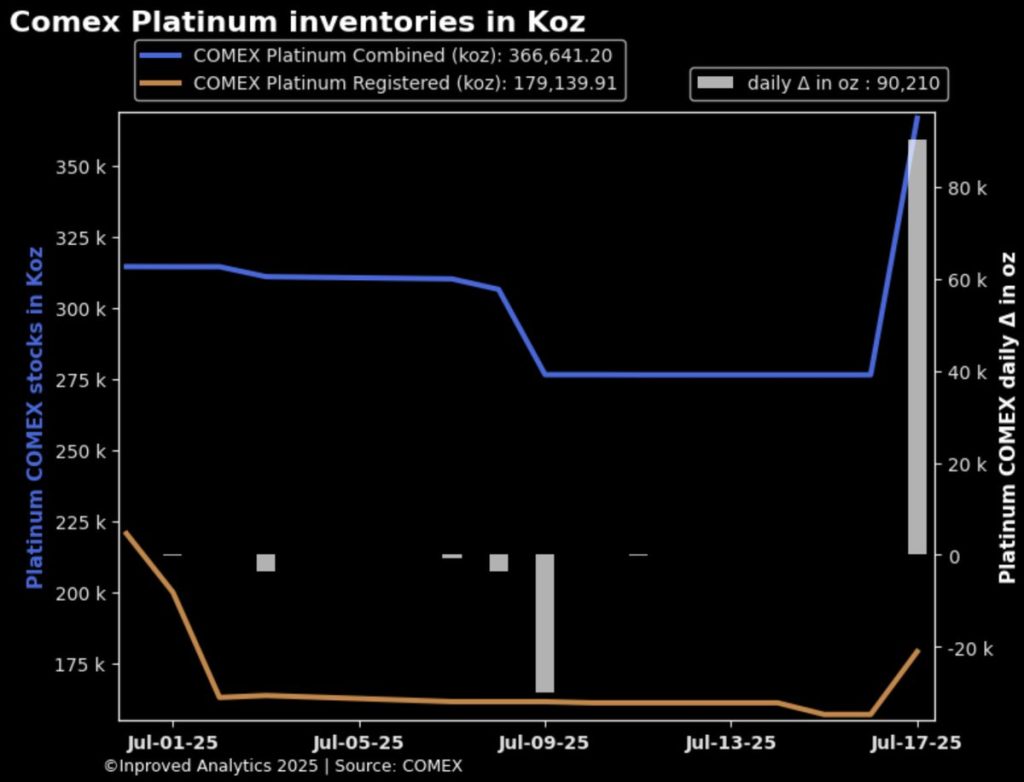

On Thursday, COMEX platinum vaults recorded a dramatic inflow, the kind of move that signals institutional reshuffling and strategic recalibration. A 32.7% jump in total holdings (+90,000 ounces) pushed inventory levels back toward equilibrium. But as always with platinum, the devil—and the signal—is in the details.

The vault action was split sharply between the two main categories. The eligible category, which houses platinum not yet earmarked for delivery, saw a massive 57% increase (+68.1K ounces). Meanwhile, the registered category, already designated for settlement, rose by 14% (+22K ounces) to 179,100 ounces. This is not passive reshuffling—this is positioning.

“These kinds of shifts are not about spare ounces,” says Hugo Pascal. “They’re about preparing metal for either delivery or strategic redeployment. You don’t add 90,000 ounces in a day without a clear thesis.”

The week’s activity brings COMEX platinum vaults up to 366,641 ounces (11.4 tons)—a powerful swing considering that month-to-date holdings were down as much as 12% just days prior. The registered category had been down nearly 30%, a sign of delivery pressure or withdrawal—until now.

This sudden reversal in vault flows comes against the backdrop of a robust open interest level for platinum. The COMEX currently shows 91,742 contracts outstanding, representing about 4.6 million ounces or 143 tons—an amount that dwarfs actual deliverable metal on the exchange.

Let that sink in: for every ounce of platinum sitting in COMEX registered vaults, there are over 25 ounces tied up in futures contracts. The mismatch is acute and unusual.

“Platinum has always walked the fine line between liquidity and scarcity,” Pascal notes. “But when OI surges while registered inventories dip, it sets the stage for squeezes or repricings.”

While gold and silver premiums have shown resilience or even tightening, platinum saw something very different: its premium flipped negative, trading at -0.7% relative to the LBMA benchmark. On the surface, it looks like weak demand. But the reality is more nuanced.

A negative premium often means that there’s sufficient liquidity—or even excess metal—available locally, reducing the need to pay above global benchmarks. But paired with vault dynamics, this may instead reflect a deliberate effort to reprice access ahead of strategic accumulation.

According to Hugo Pascal: “When vaults refill and premiums drop, it usually precedes structured positioning. Someone is preparing to load the cannon.”

It’s easy to overlook platinum in a world obsessed with $40 silver or $3,400 gold. Yet platinum has quietly gained ground this quarter. Its ratio to gold—long a measure of how undervalued it might be—has narrowed. On the Shanghai Gold Exchange, the gold-to-platinum ratio hit a one-year low of 2.29:1, meaning an ounce of gold now buys fewer ounces of platinum than at any time since 2023.

That’s no small matter. When this ratio narrows, it often reflects capital rotation from gold to platinum, particularly when investors are seeking undervalued hedges in the face of rising geopolitical or trade risk.

Platinum, often overlooked as merely industrial, may now be asserting its duality—part precious, part critical.

Three factors stand out:

1. US-China Trade Friction: While gold has not reacted strongly to the tariff uncertainties this week, platinum might be absorbing some of the hedging flow. With its primary industrial use in auto catalysts and hydrogen applications, platinum remains tightly linked to East Asian manufacturing sentiment.

2. Vault Positioning Ahead of Q3: The surge in eligible metal suggests institutions are preparing to shift into platinum during Q3—perhaps hedging against either dollar strength or inflation creep.

3. Relative Value Play: At a time when gold hovers near all-time highs and silver breaks into the $40 zone, platinum remains comparatively cheap, especially when viewed against historical spreads.

Shanghai, typically a more telling barometer for platinum demand due to its industrial proximity, is showing signs of quiet accumulation. Trading volumes on the SGE have been picking up through the week, suggesting increasing interest—if not yet outright buying pressure.

While gold trading volumes dipped to an 11-month low, platinum’s steadiness here hints at quiet substitution or diversification strategies among large Chinese accounts.

If the inflows into COMEX vaults persist, platinum may stay range-bound as supply pressures ease. But if we see vault levels stabilize and open interest continue to climb, we could be looking at a vault-based repricing event in Q3.

The narrowing gold-platinum ratio, combined with negative premiums and fresh inventory build, suggests a coiled market—one that could spring if industrial headlines shift or if speculative flows rotate out of overcrowded silver trades.

If you’re an investor watching platinum from the sidelines, here’s what to consider:

1. Look at relative ratios, not just price. The platinum/gold and platinum/silver ratios remain near cyclical lows.

2. Follow vault flows: Inventory surges or reductions are often the only true transparency in platinum.

3. Use InProved’s tracking tools: The premium dashboard at InProved.com lets you see real-time shifts in platinum premiums—often before headlines react.

4. Diversify exposure across physical and options: Especially now that vault replenishments may delay upward moves—but create deeper long-run value.

Platinum is not making noise because it’s loud—it’s making noise because it’s getting ready. The COMEX inflows this week weren’t an accident. The narrowing ratio wasn’t an anomaly. And the shrinking premium isn’t a signal of weakness—it’s a whisper of opportunity.

“When premiums drop and inventories rise, you’re looking at a battlefield being set,” says Hugo Pascal. “Platinum is staging its quiet return.”

Now’s the time to watch, plan, and potentially position.

If you want to secure your position in platinum, gold, or silver—at some of the lowest LBMA prices in the world—sign up now at InProved.com or download the InProved app to begin stacking and tracking real value.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions