| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

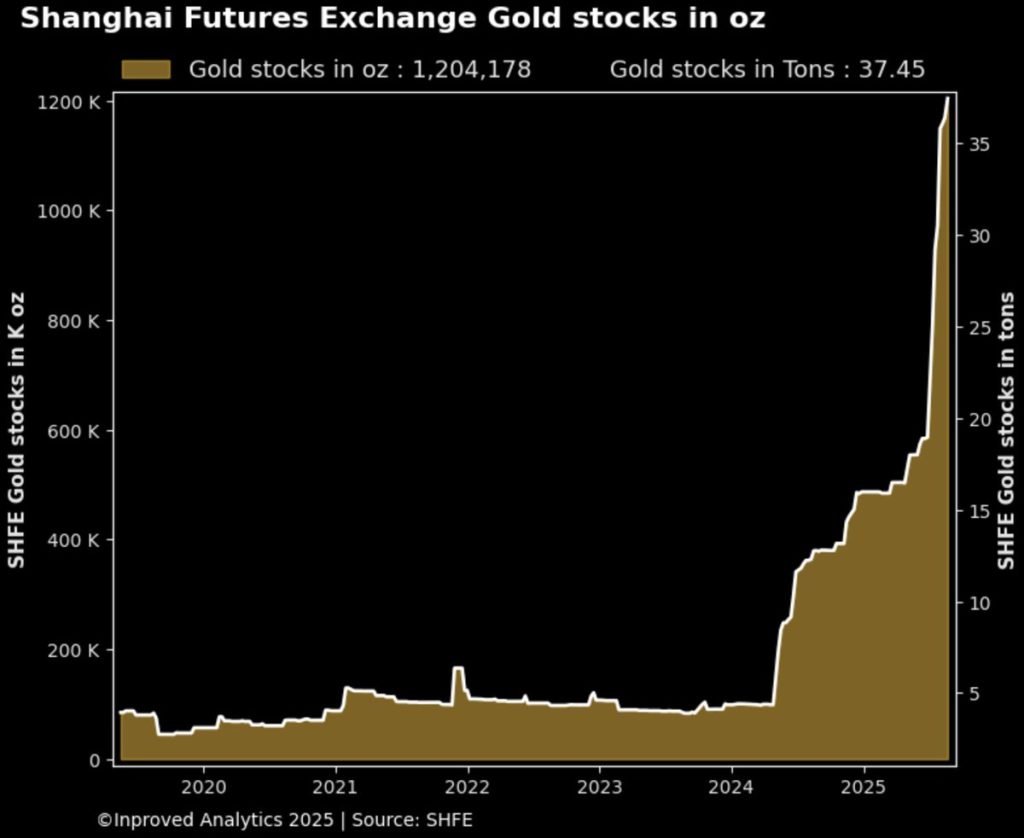

The Shanghai gold vaults have once again made headlines. This past week, inflows surged by more than a metric ton, pushing inventories to a new record of 37.45 tons — equivalent to roughly 1.2 million ounces. On the surface, the number looks like another milestone in a market that has been setting records all year. But for traders, bullion banks, and global investors, the rise is not just about tonnage. It is about timing. It is about what has happened in the past when vaults in China swelled at this pace — and what those moments have meant for the trajectory of gold prices globally.

Gold, as any seasoned observer knows, has a rhythm to it. It moves in long cycles tied to macroeconomic dislocations, inflationary scares, monetary easing, and geopolitical crises. And at several points in the last two decades, Shanghai’s vault activity has been a leading indicator of sentiment that later spread into the wider market. The inflows we are seeing today sit within that lineage, raising the question: if history is a guide, what does this mean for where gold could go next?

To understand the significance of the latest inflows, it is worth stepping back to recall why Shanghai matters in the first place.

The Shanghai Gold Exchange (SGE), founded in 2002, was built to provide Chinese investors, institutions, and the central bank with direct access to bullion markets. Unlike Western exchanges, where trading is dominated by futures and derivatives, Shanghai’s contracts have always had a more direct physical settlement component. That means the vaults attached to the SGE are not abstract warehouses of paper claims; they are the end-point for real bars being moved into Chinese hands.

Every time inventories rise significantly, it is generally because local buyers — ranging from jewelers to state-owned banks — are increasing their allocation. And historically, these increases have often coincided with two circumstances: either gold is being seen as undervalued relative to global conditions, or global uncertainty is driving Chinese investors to secure more physical metal at home.

We don’t have to look far to find precedents.

Seen in this context, the current inflows are not an isolated event. They fit into a pattern: when Shanghai vaults rise, it usually signals an undercurrent of demand strong enough to alter global market balances.

So what exactly do the latest numbers mean?

This week’s inflows — an addition of 1.11 tons — may not sound enormous compared to the thousands of tons traded globally each year. But context matters. Year-to-date, Shanghai vault holdings have risen by more than 22 tons, an increase of over 130%. That is not a trivial number. For a market that began the year under 20 tons, doubling inventories in less than eight months is a statement.

Equally important is how this dovetails with broader patterns. At the same time vaults are swelling, trading volumes for the SGE’s AU9999 physical proxy contract remain subdued, hovering 45% below the five-year average. That means that, despite lower turnover in daily trading, investors are still moving metal into storage. In other words, this is not just short-term speculation — it looks like longer-term allocation.

Premiums, too, are worth watching. Gold in Shanghai is currently trading around 0.1% above London benchmarks, or roughly $3–4 per ounce. That premium may seem modest, but in previous cycles, even small positive premiums have been enough to pull bullion eastward, tightening supply in the West.

One of the more striking backdrops to today’s inflows is the divergence between physical demand in Asia and derivatives-driven positioning in the West.

On COMEX, open interest remains heavy, with more than 450,000 contracts outstanding — equivalent to 45 million ounces of gold. Yet registered inventories stand at just over 21 million ounces, meaning that there are more than twice as many paper claims as there is physical metal available for delivery.

This mismatch is not new, but it becomes more glaring when physical vaults in Shanghai are filling up at record pace. Traders like Hugo Pascal, who has been closely tracking this divergence, note that “when physical is bid in the East while derivatives dominate in the West, the market tends to eventually converge toward the physical side. Paper can stretch sentiment, but in the end, ounces matter.”

That tension — between paper leverage in New York and physical allocation in Shanghai — has been one of the defining dynamics of the gold market since the 2000s. And right now, it is tilting toward the physical side.

If Shanghai vault inflows tell us about Chinese appetite, Singapore tells us where global investors can best position themselves to benefit.

For years, Singapore has carved out a niche as the most tax-efficient, transparent, and liquid hub for bullion in Asia. Unlike India, where import duties on gold regularly exceed 10%, or China, where cross-border flows are tightly controlled, Singapore offers a relatively frictionless environment.

Historical premium data shows this clearly. While gold in India frequently trades at discounts or premiums of $20–40 per ounce relative to London due to import restrictions and local festival-driven demand, Singapore premiums have generally remained close to parity, rarely straying more than a few dollars. For Chinese or Indian investors living overseas, buying and storing gold in Singapore has therefore offered a way to access global liquidity without the distortions of their home markets.

Capital gains treatment also matters. In India, physical gold holdings are subject to capital gains tax upon sale, often at punitive rates. In Singapore, there is no capital gains tax on bullion. That difference alone has drawn wealth managers, family offices, and increasingly retail investors to use Singapore as their primary storage hub.

As Shanghai vaults surge, the question is not only how gold prices respond, but also where investors should position themselves. And in that conversation, Singapore stands out as the pragmatic choice.

The historical record suggests three key possibilities.

Hugo Pascal, whose daily commentary on precious metals flows has become a key reference point for traders, summed it up recently:

“What we’re watching in Shanghai is not noise. When vaults are absorbing metal like this, it reflects a longer-term decision to hold physical rather than play the paper game. And that tells us something about confidence — or the lack of it — in the broader system.”

Others agree. A senior strategist at a Hong Kong bullion bank, speaking anonymously, noted that “the build-up in Shanghai vaults has a habit of catching the West off-guard. By the time COMEX realizes what’s happening, the metal is already locked away, and the premiums start to widen.”

Shanghai’s record vault inflows are not an isolated statistic. They are part of a longer story, one in which the East has increasingly dictated the rhythm of physical gold demand while the West continues to trade paper. The last time vaults in China swelled this rapidly, gold was either establishing a floor or preparing for a breakout.

Whether history repeats exactly remains to be seen. But what is clear is that the flows themselves are meaningful. They tell us about where confidence lies, how investors are positioning for the future, and where the balance between physical and derivatives may ultimately resolve.

For global investors — whether in London, New York, or Singapore — ignoring that signal would be a mistake.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions