| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

In a month dominated by geopolitical negotiations and strategic hedging, silver is once again at the center of the East–West divergence. While vaults in Shanghai are draining at an alarming pace, Western inventories — from COMEX to London — are quietly being replenished. The latest data from May underscores what market insiders like Hugo Pascal, Chief Investment Officer at InProved, have been saying for months: this is a tale of two silver markets — and both are preparing for something bigger.

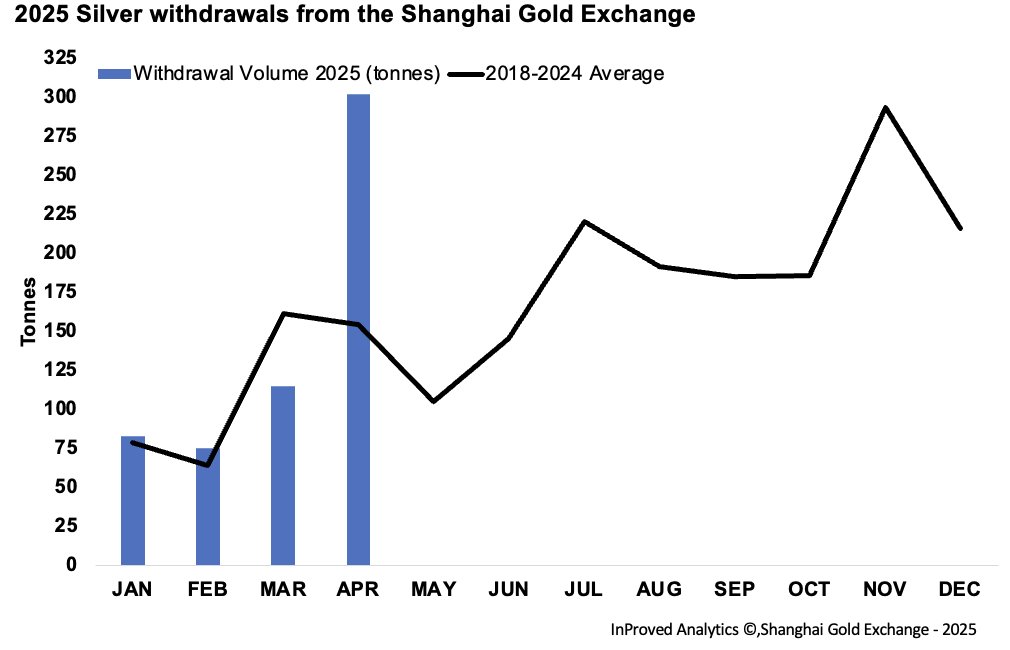

The clearest signal of demand strength continues to emerge from China. According to SGE data, silver withdrawals reached 302 tonnes in April, representing a 163% surge from the previous month. These are not cosmetic inventory shifts — they represent substantial physical outflows from officially recorded vaults, likely into private custody, industrial use, or export-restricted holdings.

“These kinds of monthly spikes don’t happen without purpose,” Pascal explains. “A 163% jump in withdrawals tells you there’s either a massive uptick in demand or a growing fear that supply will tighten in coming months. Or both.”

The trend has continued into May. By May 7, Shanghai vaults were down another 19 tonnes, bringing total holdings to just 941 tonnes, or 30.2 million ounces. Year-to-date, the outflows have now reached 475 tonnes, solidifying this as one of the most aggressive withdrawal streaks since the 2020 supply chain crunch.

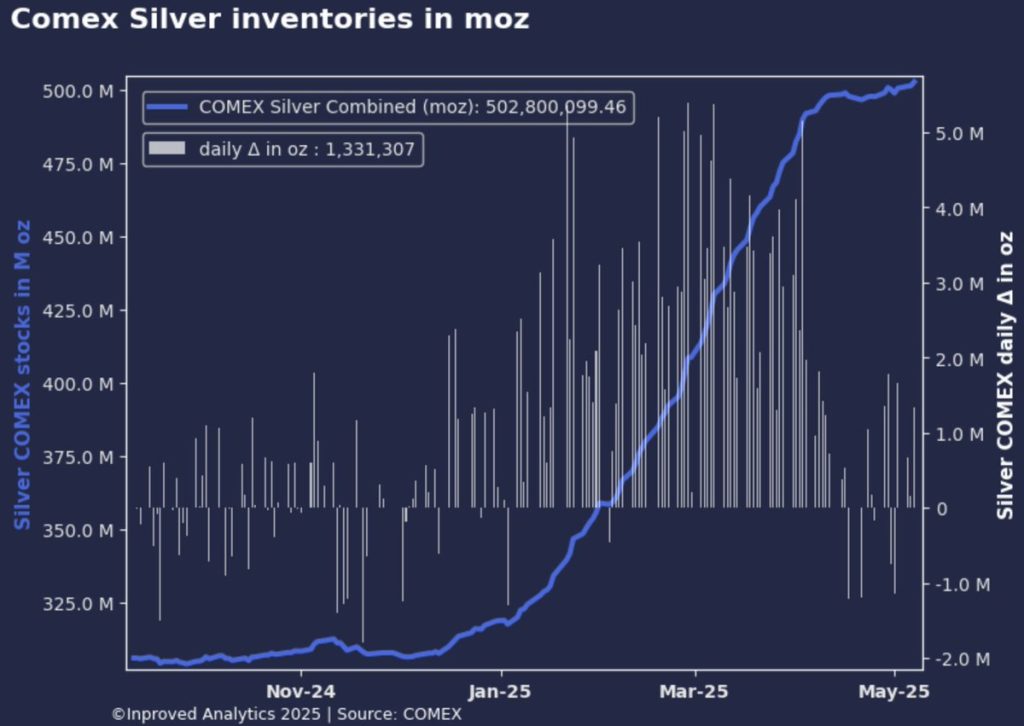

While Shanghai vaults drain, the story in the West is more about quiet stockpiling. On May 9, COMEX vaults received 1.3 million ounces (40.4 tonnes) of silver, pushing total inventories to 502.8 million ounces — a meaningful psychological and strategic threshold. Meanwhile, the London Bullion Market Association (LBMA) reported the following shifts in April:

As a result, available silver rose by 9.3%, now standing at 5,054 tonnes.

Pascal views this not as complacency, but as strategic positioning. “When Western vaults fill up as Eastern vaults drain, it’s not a contradiction. It’s a recognition of global tightness. COMEX and LBMA are preparing for elevated delivery risk — or for arbitrage flows if Asian demand spikes again.”

Despite the divergence in flows, prices are aligning on one key point — they’re going up.

On May 8, silver traded at $35.33/oz, representing a 7.6% premium above LBMA, as Asian speculators drove futures and physical spot prices higher during the morning session.

By May 9, silver remained firm at $34.80/oz, still holding a +7.8% premium, showing that even a modest cooling in geopolitical tensions has not dented physical appetite.

Alongside silver, gold also gained, trading as high as $3,410/oz in the Asian session, while platinum held above $1,000/oz — further confirmation that the entire precious metals complex remains well-supported, especially in Asia.

Behind all this movement lies the backdrop of renewed diplomatic sparring between Washington and Beijing. While headlines this week have focused on a tentative thaw and efforts to reach common ground in trade and technology, tensions remain unresolved on multiple fronts — from Taiwan, to semiconductors, to currency interventions.

And markets know it.

“Every trader watching silver right now understands that peace is paper-thin,” Pascal notes. “China is hoarding metal not just because it wants it, but because it may soon need it — to secure manufacturing chains, defend against sanctions, or hedge against currency devaluation.”

Silver is particularly exposed due to its dual role as an industrial metal and a monetary asset. China dominates global manufacturing in solar panels, EV components, and electronics — all of which rely heavily on silver. But in times of geopolitical risk, silver also functions as a secondary monetary reserve, especially in cultures that prize physical ownership over financial derivatives.

So what should investors, dealers, and institutions take away from this moment?

1. The East is still buying — and aggressively. Vault withdrawals and premium strength show no signs of slowing down.

2. The West is preparing, not selling. COMEX and LBMA are building inventory, not divesting it.

3. Speculative flows remain net bullish, with options, futures, and ETF demand rising in tandem.

Even as headlines about US-China diplomacy suggest relief, the smart money is not relaxing. It is preparing — for continued fragmentation, for deeper delivery risk, and for another wave of asset reallocation toward hard money.

Pascal summarizes:

“Don’t mistake inventory increases in the West for weakness. They are the other half of the story. When vaults refill here and empty there, the global silver market is gearing up — not winding down.”

In this cross-current of flows, the message is simple: watch the metal, not the mood. And right now, the metal is moving — fast.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions