| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

The silver market is beginning to show signs of something rare, powerful, and potentially historic. Over the past several weeks, prices have surged toward multi-year highs, vault inventories have ballooned in some regions and drained in others, ETF inflows have accelerated despite lingering trust issues, and speculation in Asia has intensified at a pace not seen since the post-COVID rally.

As of September 25, silver closed at $46.35 per ounce on the Shanghai Futures Exchange (SHFE), with traders openly targeting $52 per ounce, or ¥12,000/kg. At the same time, COMEX vaults in New York crossed 530 million ounces, the highest on record, while premiums in China remained elevated at more than 2.6% above LBMA benchmarks.

For seasoned observers, this isn’t just a technical rally — it has the hallmarks of a structural shift. Some call it a bull market. Others whisper something more volatile: a squeeze.

No conversation about silver today can begin without addressing exchange-traded funds (ETFs). Since their creation, ETFs like iShares’ SLV and WisdomTree’s PHAG/PHSP have served as the main bridge between retail and institutional investors on one side, and the physical silver market on the other. In theory, each ETF share is backed by real ounces in vaults.

But reality has never been so simple.

Earlier this year, SLV faced fresh criticism for inconsistencies between its published bar lists and the information available on its website. While SLV has dealt with similar controversies before — most notably during the 2021 “Reddit silver squeeze,” when it was forced to issue disclaimers about sourcing metal in extreme conditions — the persistence of these issues undermines confidence.

More recently, attention has shifted to WisdomTree’s products, which are showing an even larger mismatch. According to reporting, 1.4 million ounces (44.5 tonnes) of silver appear to be misaligned between reported holdings and bar list disclosures.

This may sound minor relative to a global market measured in billions of ounces, but in silver, these discrepancies matter. Shanghai vaults, for example, reported outflows of 43–87 tonnes in recent weeks. That scale was enough to move local premiums higher and ignite speculation about physical tightness. If ETF mismatches are occurring on the same order of magnitude, they are far from trivial.

And investors are paying attention. As Hugo Pascal remarked recently, “Every inconsistency in ETF reporting is an advertisement for physical bullion. The more cracks investors see, the faster they migrate from paper promises to vaulted ounces.”

That migration has already begun. Global silver ETFs collectively saw 2.07% inflows in September, adding 421 tonnes to reach a total of 20,743 tonnes held. But if trust continues to erode, investors may bypass ETFs entirely and move toward allocated storage — a shift that could stress supply chains even further.

While ETFs struggle with credibility, COMEX vaults in New York are swimming in silver. As of September 25, inventories crossed the 530 million ounce mark, the highest on record. On the surface, this suggests ample supply, even abundance.

But seasoned traders know better. Not all COMEX silver is created equal. Inventories are divided into two categories:

As of this writing, only about 196 million ounces sit in the registered category — less than 40% of the total. That distinction matters, because it’s registered stocks that ultimately meet the obligations of futures expiry.

This nuance recalls the situation in 2011. Then, too, COMEX inventories appeared flush, yet when demand spiked and delivery notices surged, spreads widened, exchange-for-physical (EFP) markets destabilized, and futures prices diverged sharply from physical premiums.

We may be witnessing a repeat. Already, the Dec25 EFP spread has been fluctuating between $0.26 and $0.81 per ounce above LBMA spot prices — small in absolute terms, but large relative to normal conditions. It’s a flashing signal that arbitrage between futures and physical is straining.

As Pascal put it, “Big vault numbers create comfort. But when you strip away what’s truly deliverable, you realize how fragile that comfort really is.”

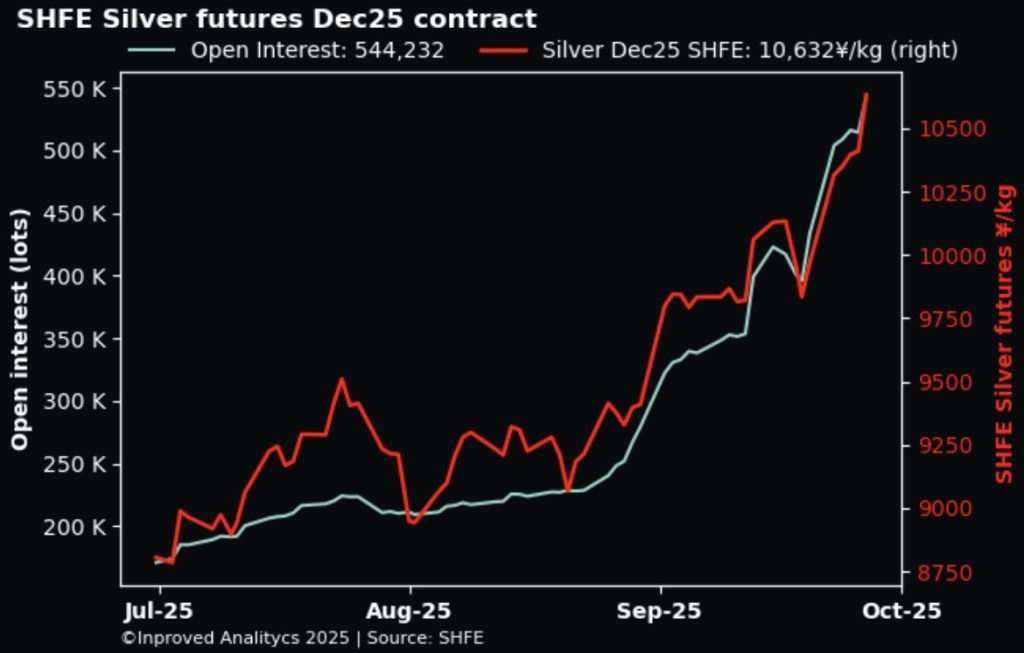

While the West wrestles with definitions, Asia is charging forward. On the SHFE, silver closed at ¥10,632/kg ($46.35/oz) on September 25, with bullish bets piling into out-of-the-money (OTM) calls targeting ¥12,000/kg ($52.3/oz).

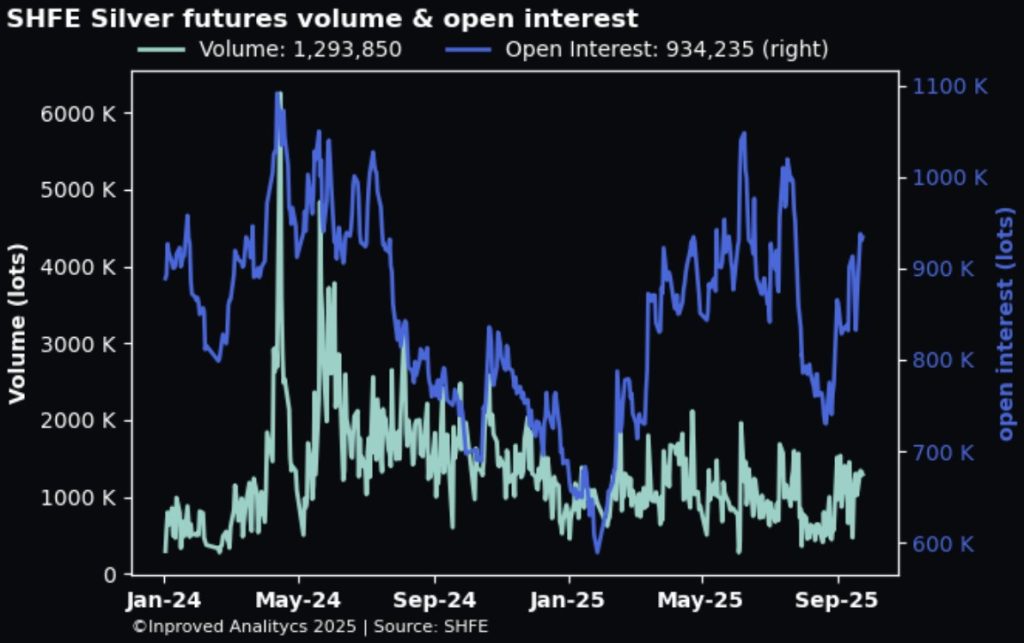

The speculative fervor is palpable. On September 24, options volumes tripled relative to open interest, with a put-to-call ratio of just 0.31, signaling heavy skew toward bullish calls. Open interest itself has surged, climbing toward 1 million contracts, equivalent to nearly half a billion ounces.

This isn’t the first time SHFE traders have led a global rally. In 2020, during the COVID recovery, Chinese gold traders aggressively bid futures long before Western markets caught on. That pattern seems to be repeating in silver, where China is once again not just participating but setting the tone.

Premiums confirm it. On September 25, silver traded 2.6% above LBMA in China, a persistent sign that local demand is willing to pay up for physical supply even at elevated prices.

While China drives speculation, India has been quietly transforming the physical market. Over the past three years, India’s silver imports have soared to record highs, rivaling its gold appetite.

This matters for two reasons:

1. India remains the world’s largest consumer of physical silver, particularly for jewelry, investment, and industrial use.

2. Unlike ETFs or futures, Indian demand translates directly into physical bars and coins leaving vaults.

If India’s appetite persists while China’s premiums remain elevated and Western ETFs see inflows, the result is a trifecta of demand that could overwhelm supply.

Historically, India’s silver demand has spiked in times of inflationary stress and currency weakness. Today, both conditions are present, with the rupee under pressure and inflation stubborn in food and energy.

The implication is clear: India is not done buying.

To understand where we might be heading, it’s worth revisiting three critical episodes in silver history.

Today’s environment borrows from all three: ETF trust issues (2021), Asian demand (2011), and speculative fervor (1980). Add in industrial demand from solar panels and electronics — now a structural floor — and the setup looks even more combustible.

The conditions for a squeeze are falling into place:

Add to this the broader macro backdrop — slowing growth, potential U.S. rate cuts, and geopolitical uncertainty — and silver finds itself at the intersection of safe-haven demand, industrial necessity, and speculative firepower.

As Hugo Pascal summarized, “Silver doesn’t need everyone to believe in the squeeze. It just needs enough stress on inventories, enough distrust of paper, and enough demand from Asia. Then the market will do the rest.”

Looking forward, the key signals are clear:

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions