| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

July’s first week is unfolding like a chapter from silver’s rebound playbook—with vault inflows, options dynamics, and Chinese trader conviction joining forces to shift the narrative. And at every turn, data from Shanghai is outpacing the noise, offering context that Western markets haven’t priced in yet. As always, Hugo Pascal provides the framework to interpret these moves—at once structural, opportunistic, and rare.

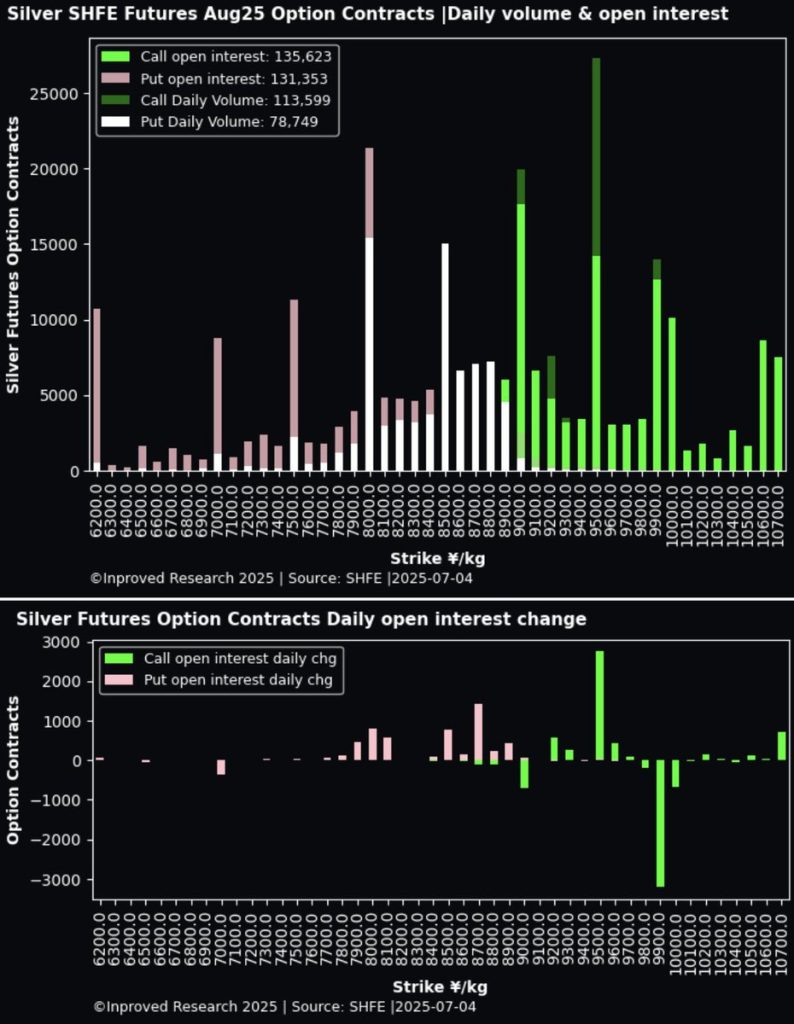

The headline shift came on July 4: Chinese traders on the Shanghai Futures Exchange (SHFE) aggressively rolled their silver bullish bets deeper and longer. With the most active call strikes at ¥9,500 per kg, targeting what amounts to $41.25/oz COMEX equivalent, participation surged. The put/call volume ratio climbed to 0.69, the Put/Call Open Interest ratio sits at 0.97, and fresh interest at the ¥9,000 strike suggests a consensus forming around a $39 breakout.

“This is not idle positioning,” says Pascal. “When OI rolls up to higher strike levels, it means players are pricing in asymmetric upside—backed by physical allocation, not just chart cues.”

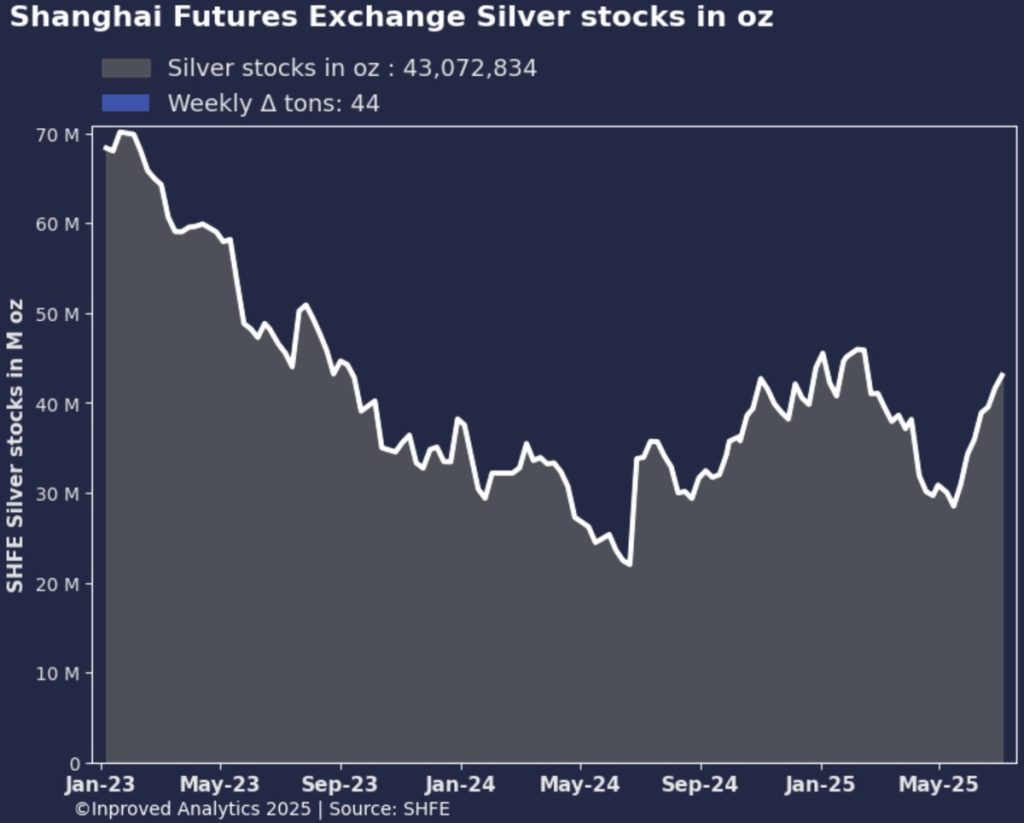

Physical silver echoes the speculative tone. On the same day, Shanghai vaults rose for the seventh consecutive week, adding another 44 tonnes—pushing total vault holdings to 43 million ounces (1,340 tonnes). That brings a staggering 453 tonnes accumulated in just seven weeks—a visible sign that physical demand is the engine driving this trade. Vaults at the SGE, meanwhile, dropped by 35 tonnes last week, a trend indicative of supply distribution between futures delivery hubs and storage nodes.

“Vaults are the best footprint we have for near-term delivery,” Pascal explains. “You can’t commit to strike prices without metal behind you—this is proof that sharks are swimming where the physical is strongest.”

Silver closed July 3 with a notable 5.35% premium over LBMA, reinforcing what physical inflows suggest: actual supply is tightening while speculative flow builds aggressive call structures. Over on COMEX, the September ’25 contract shows a tight 68.2% trading band between $36.11–$37.35, with a 25-delta risk reversal skew of 3.4, signaling a clear preference for out-of-the-money calls. The looming $38/oz call wall becomes a critical technical threshold.

“China is pricing in $40+ risk,” Pascal said, “while the rest of the world has its skewer set at $38. If $38 gives way, expect 39, 40, 41 to fall quickly.”

Here’s the layered story:

What’s happening in China should matter globally. Increased vault stocking and bullish OI suggest that a sharp curtain lift—bull call breakout or physical delivery pressure—is becoming not just possible, but probable. A $41 trade would shock Western markets, not because it’s impossible, but because it breaks the anchoring bias kept by tighter Western premiums and structures.

If you’re in Singapore—or anywhere attuned to Asia’s metals pulse—this is the time to act. InProved offers:

Download the InProved app now to follow these flows in real time and position yourself ahead of a possible surge toward (or past) $41.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions