| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

For silver, the stage is never set quietly. In just under a month, we’ve watched the market shift with the rhythm of a metronome—beat by beat, vault by vault, trade by trade. And this week, it’s become clearer than ever that the east-west dynamic in silver is not just alive—it’s actively tilting.

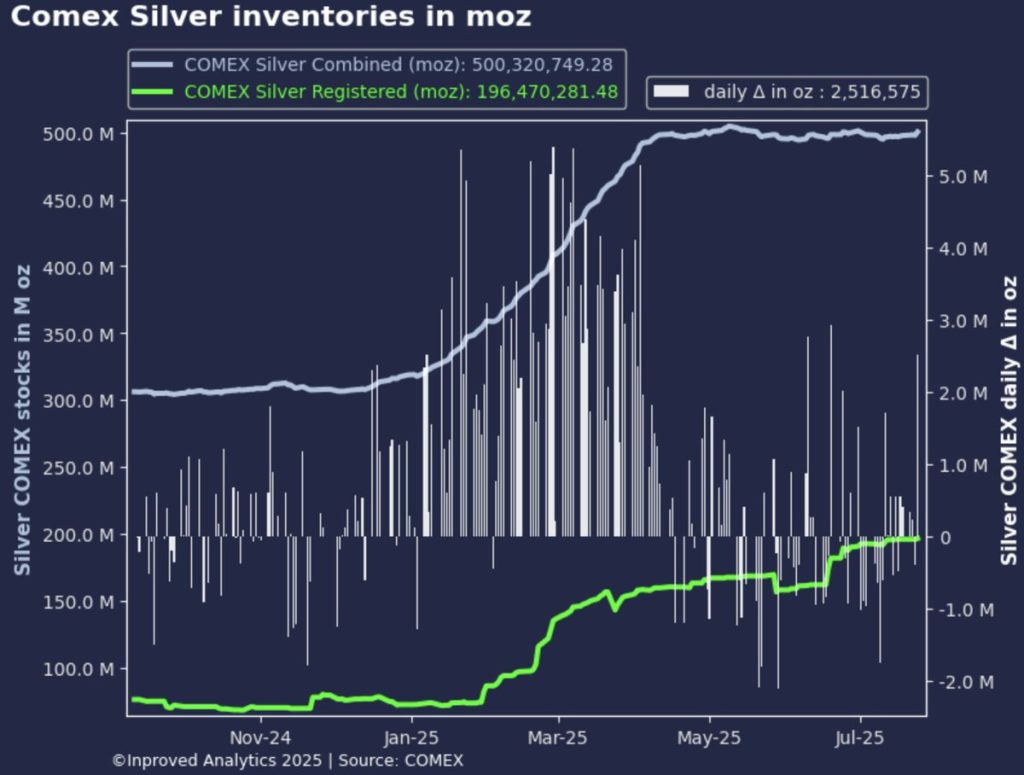

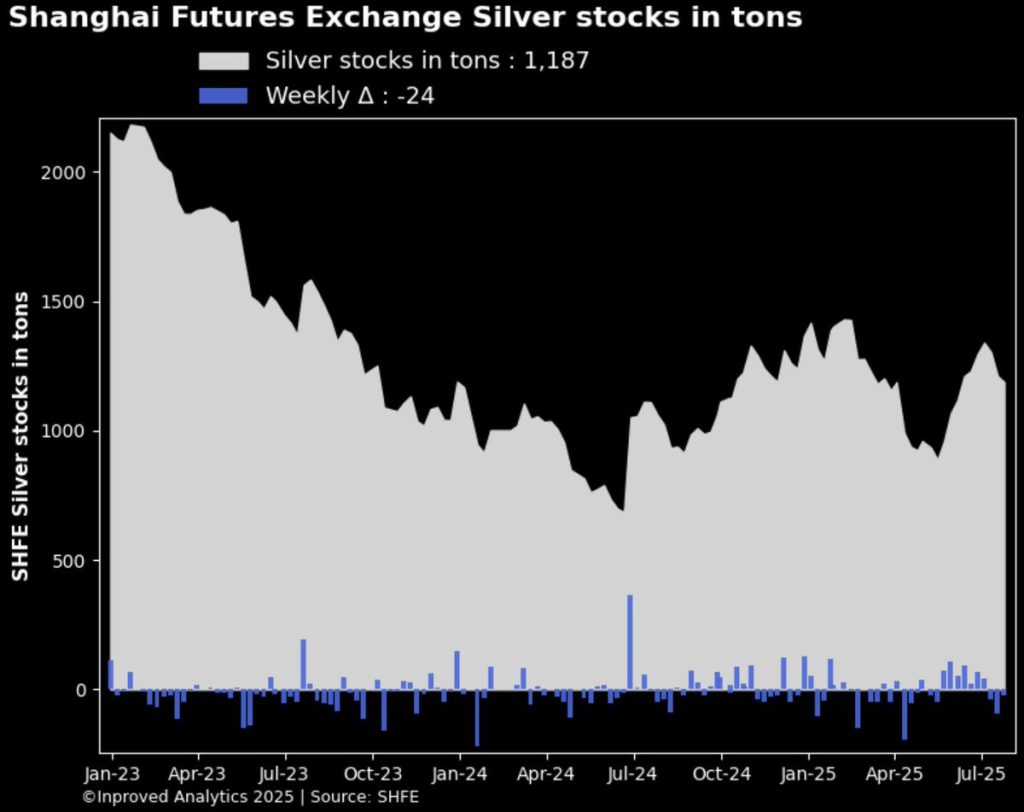

On Thursday, COMEX silver vaults reached a three-week high of 500.3 million ounces, marking a sustained upward crawl in inventories that began three weeks prior. Meanwhile, across the Pacific, Shanghai’s silver vaults registered their third straight week of outflows, shedding another 24 tons and dragging total holdings to 1,187 tons, or 38.2 million ounces.

Two opposing market forces. One glaring message: silver is moving—and it’s moving fast.

Let’s unpack the movement. Over on COMEX, we’ve seen 1.3 million ounces flow into the vaults over the past three trading days. More crucially, the registered category—which contains deliverable metal—has climbed 3% month-to-date, now at 196.5 million ounces.

That means more metal is not only coming into vaults—it’s being prepped for settlement.

This is not just passive restocking. This is structural.

Hugo Pascal, CIO at InProved Metals, puts it succinctly: “Registered silver doesn’t sit idly. When it moves like this, it reflects one thing: future delivery expectations. Someone out there is getting ready to claim physical.”

And that “someone” may well be institutional investors, ETF issuers, or industrial users preparing for what appears to be a mounting supply imbalance.

On the other side of the globe, Shanghai’s silver vaults are telling a different story entirely. After a robust seven-week accumulation streak between May and early July, the past three weeks have seen continuous outflows, this week dropping another 24 tons. Over that three-week stretch, nearly 100 tons have been drained.

It’s not uncommon for silver flows to fluctuate—but this trend coincides with rising silver prices, options market tension, and now, most significantly, a ballooning premium over the London Benchmark.

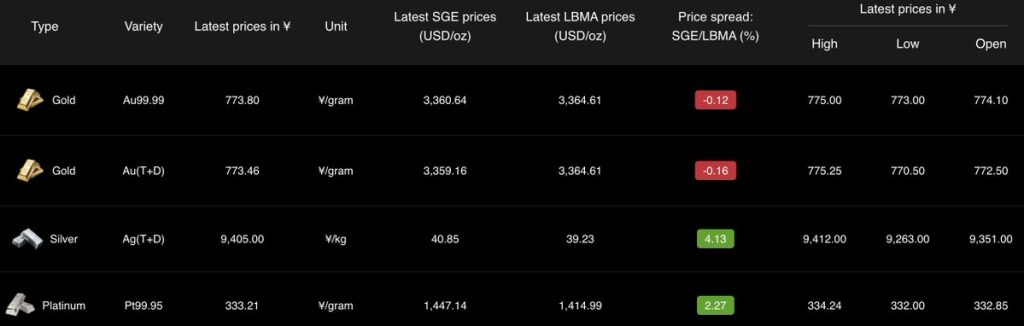

As of July 25, silver was trading at $40.85/oz, a +4.13% premium over LBMA. That’s not a fluke—it’s a signal.

“We’re watching a rotation of liquidity,” says Pascal. “Asia is selling, and the West is preparing to hold. That’s not just opportunistic trading—it’s the anatomy of a market pivot.”

This latest shift isn’t just a summer lull or a speculative cycle. It’s a broader recalibration in how silver is perceived—and used.

First, industrial appetite for silver is rising across clean energy, EV manufacturing, and semiconductors. China’s consistent restocking in Q2, followed by these July outflows, could signal that physical demand has been partially satisfied for now—but not necessarily exhausted.

Second, the volatility in premiums—from Shanghai to COMEX to London—reflects growing divergence in localized liquidity. While the COMEX registered inventory rises, the tightness in EFP (Exchange for Physical) spreads and continued strength in Sprott’s PSLV inflows suggest that physical demand isn’t fading—it’s simply shifting regionally.

Third, we’re seeing a psychological barrier at $41/oz—the next call wall in COMEX silver options. Traders are bracing for a potential test of this level, but what’s more revealing is that put-call open interest ratios have stayed bullish, and risk reversal skews remain wide, favoring upside calls.

Historically, registered vault builds tend to precede delivery spikes. They also often align with strategic positioning by ETFs and institutional allocators preparing to meet redemption cycles or hedge exposure.

Meanwhile, vault outflows in Shanghai don’t necessarily mean panic or disinterest—they often indicate conversion into other forms of metal: fabrication, industrial use, or strategic reserve buildup away from public data trails.

“The most insightful thing about the silver market isn’t price,” Hugo Pascal often reminds us, “It’s motion. And right now, motion tells us the market is resetting into a new structure—where physical delivery and vault visibility matter more than ever.”

Short term, we’ll be watching whether COMEX continues to attract inflows, and whether the registered category breaks back above 200 million ounces, a psychological comfort zone for traders.

But the bigger story may be lurking just past the headlines.

With Liberation Day tensions still echoing, and talk of further BRICS coordination around commodity pricing gaining traction, silver’s role as both an industrial metal and a monetary hedge is becoming more acute.

And with platinum recently turning heads, and gold flirting with new seasonal flows, it’s silver that seems to be commanding the deeper conviction.

The question now is not just whether silver can push past $41. The question is: once it does, how fast will the next supply squeeze hit?

If you’re an allocator, now’s the time to assess your mix of vaulted physical vs liquid instruments. If you’re an ETF investor, watch the PSLV flows carefully—an increase in units while COMEX inventories build may spell upcoming redemptions and deliveries.

And if you’re a physical buyer? This is your signal to move ahead of the institutional curve.

At InProved, we believe that precious metals strategy begins with transparency and access. That’s why we provide some of the lowest LBMA-priced bullion globally, accessible via our web portal or mobile app.

Track global premiums in real-time, compare Shanghai to London, and stack your metals in SGX-regulated Singapore vaults—backed by the very strategies Hugo Pascal and our investment team discuss daily.

Sign up at InProved.com or download the app and begin securing your bullion position today.

When vaults speak, smart investors listen. And silver? Silver is speaking loudly.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions