| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

In the space of a few short weeks, the global silver market has traveled from panic-level backwardation to a tentative return to equilibrium. But make no mistake — the stress fractures left behind are still visible.

The COMEX vaults have now logged an extraordinary 20 consecutive days of outflows, removing 49.4 million ounces (1,537 tons) of physical silver from New York depositories. That’s the largest continuous withdrawal streak since records began and represents nearly 10% of COMEX-held inventory exiting in less than a month.

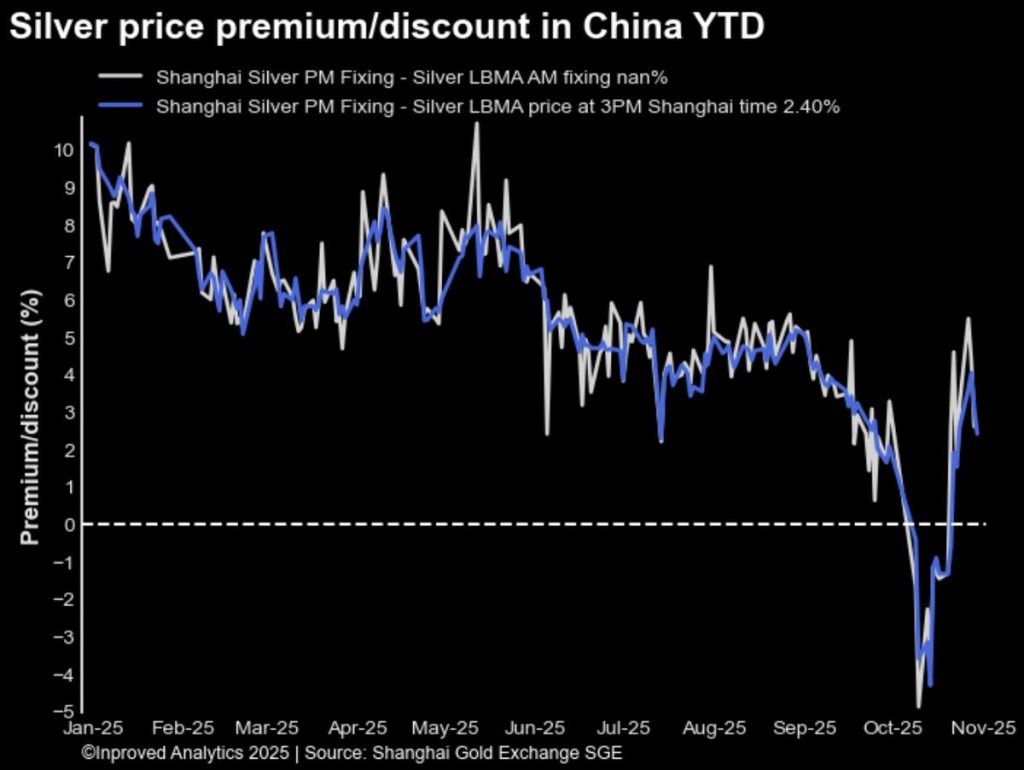

In Shanghai, the picture is no calmer. Vaults there have sunk to a 10-year low of 648 tons, down 16 tons week-to-date, while premiums in China remain firmly positive at +2.4% above LBMA, showing that local demand is still strong even as global liquidity tightens.

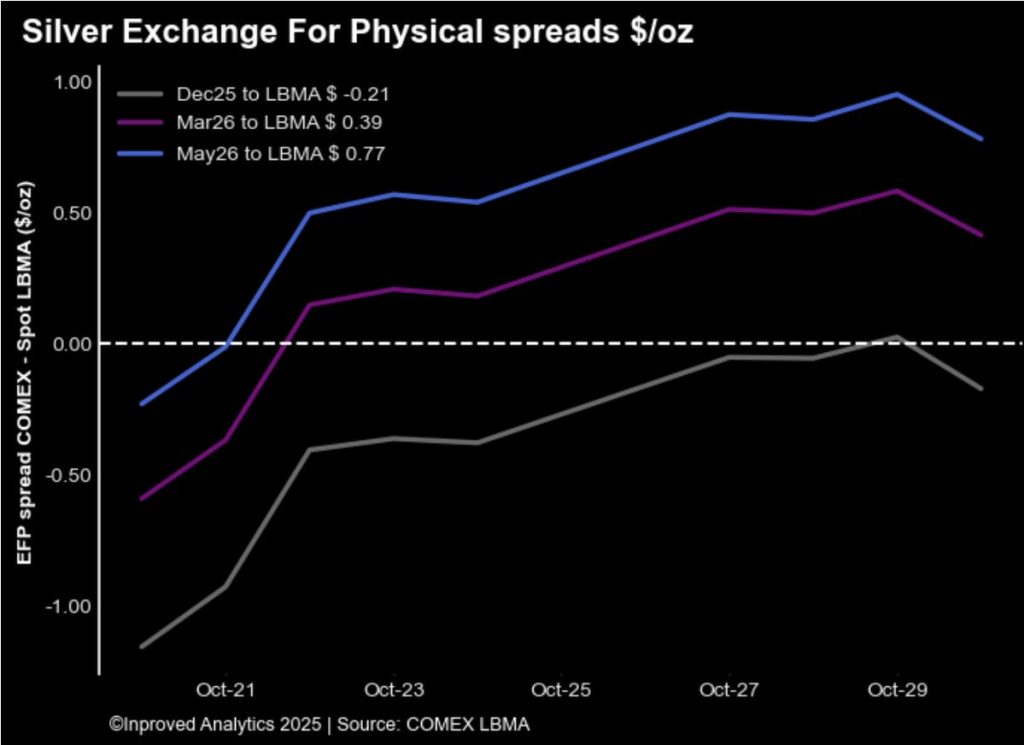

On the futures side, the pressure has begun to ease — but only just.

For most of October, silver’s Exchange-for-Physical (EFP) spreads had been flashing warning signs. On October 27, the December 2025 COMEX contract was still trading $0.21 per ounce below LBMA spot, meaning the market was paying more for immediate delivery than for future settlement — a textbook case of backwardation that reflected short-term scarcity.

But by October 29, that stress had eased:

Backwardation is now over — on paper. But the physical imbalance it exposed is still very real. When futures return to contango this quickly while inventories keep falling, it usually means traders are paying to roll positions forward rather than deliver. In other words, liquidity has normalized, but metal availability hasn’t.

Each daily vault report this month has looked like a carbon copy of the one before: more silver leaving, less arriving.

15 consecutive days of outflows became 16, then 20.

The October 28th update put COMEX holdings at a 7-month low of 492.5 million ounces, after a single-day withdrawal of 4.4 million ounces (137 tons).

By October 29, another 5 million ounces had disappeared, taking the total drawdown since early October to nearly 50 million ounces.

For comparison, the entire COMEX registered category — metal approved for delivery — stood at around 190 million ounces in early September. This month’s withdrawals alone equate to more than a quarter of that stockpile.

It’s no surprise then that some dealers are calling it the “quietest squeeze” since 2021 — a situation where prices don’t yet reflect scarcity, but logistics already do.

As we wrote in our note to clients last week: “What’s happening now isn’t a speculative rush — it’s an industrial migration. Silver is leaving vaults because someone needs it elsewhere, not because traders lost faith in it.”

In the East, the Shanghai Futures Exchange (SHFE) continues to echo the same signal. The city’s silver vaults — once a robust 1,100 tons — now hold just 648 tons, the lowest in a decade. That’s a 43% decline in under a month.

Yet premiums tell a different story. Despite lower stock, silver in China trades $1.15 per ounce above LBMA, or +2.4%, suggesting that physical buyers are willing to pay extra for immediate access.

This mix of tight supply and firm demand makes the Chinese silver market resemble the early stages of the 2020 squeeze — when Western paper markets lagged behind a tightening Asian base.

As Shanghai traders like to put it, “when the vaults run low, the spreads start to talk.”

Why does this matter so much? Because silver’s forward curve is one of the cleanest windows into global liquidity stress.

Backwardation — when near-term prices are higher than longer-dated futures — typically signals a shortage of deliverable metal. It means someone, somewhere, is paying up to get silver now, not later. That was the story for much of October.

Now, with the curve back in contango (Dec’25 +$0.10 over spot), it suggests short-term relief. But if vaults keep bleeding and Chinese premiums stay elevated, the tension will rebuild quickly.

Historically, similar transitions — backwardation collapsing into contango amid falling inventory — have been precursors to multi-month rallies.

The mechanism is simple: as supply chains stabilize, the pricing power shifts back to physical holders. The deeper the drain, the stronger the rebound that follows.

Amid all this churn, China’s silver premiums turning positive again may be the most underrated development of the week. For nearly three weeks in September, premiums were negative — a sign that local demand had cooled. But as of this week, they’re back in the +1.5% to +2.4% range.

That flip is crucial. It tells us that buyers are returning to the physical market despite volatility. Industrial users and fabricators, who had paused during the earlier price swings, are quietly restocking.

In practical terms, this means the floor is rising, even if spot prices haven’t caught up yet.

For wholesale bullion traders, this environment is a gift disguised as chaos.

With silver still trading near $47/oz on LBMA but premiums tightening across Asia, the arbitrage between regions is widening. Singapore and Dubai-based dealers, for instance, are now quoting 30–40 cents higher for deliverable bars than U.S. peers.

That’s not speculation — it’s logistics. Every ton leaving COMEX or SHFE increases replacement costs. Dealers who lock in allocations now, while the EFP curve is still modestly positive, will be the ones setting tomorrow’s retail prices.

For conservative PMET investors — those who view silver as portfolio diversification rather than speculation — the lesson is similar to what we saw with gold last month: don’t mistake volatility for weakness.

Long-term investors can interpret this as a reset phase — a moment when paper-based volatility clears speculative froth, while the fundamentals quietly tighten underneath.

Those accumulating physical silver in tax-friendly hubs like Singapore — where LBMA-linked pricing and zero capital gains tax align — can use this window to build positions while global sentiment remains cautious.

This week’s data shows a market catching its breath after a frenetic month. Silver’s backwardation is over, the EFP curve has normalized, and yet vault inventories continue to shrink on both sides of the world.

It’s the paradox that defines precious metals: when the noise gets loudest, the quiet buyers do the most.

As Hugo Pascal summarized in his latest note: “Silver’s no longer in backwardation, but the vaults haven’t noticed yet. The paper curve can change overnight — the physical drain takes months to reverse.”

And that, perhaps, is the truest signal of all.

Access institutional-grade bullion pricing, real-time market intelligence, and Singapore-based custody through InProved.com — where informed investors turn volatility into opportunity.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions