| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

The global silver market is gaining momentum, driven by coordinated activity across vaults, futures, and premiums. At the center of it all is Shanghai, where physical accumulation continues its steady climb. According to Hugo Pascal, Chief Investment Officer at InProved, “When vaults fill week after week, it’s not just noise—it’s conviction.”

For the fifth consecutive week, Shanghai silver vaults increased, adding another 20 tonnes, bringing total holdings to approximately 39.5 million ounces—or 1,230 tonnes. That’s a mighty 343-tonne surge over the last five weeks, a structural move signifying consistent demand beneath the surface. Pascal interprets this as physical positioning—not fleeting speculation: “When Eastern vaults keep filling, physical buyers are clearly stepping up.”

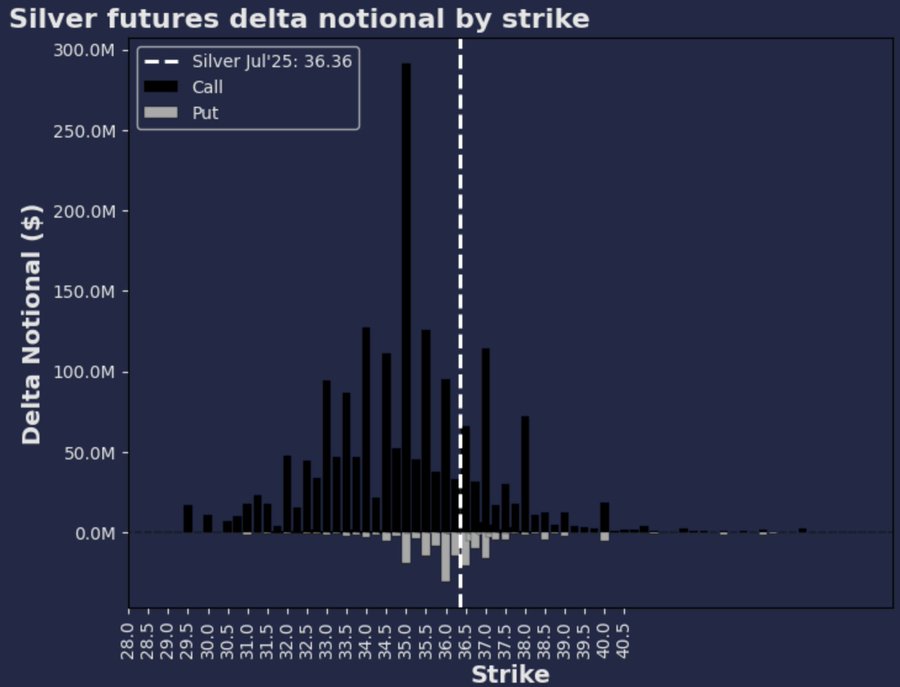

On the other side of the world, COMEX JUL 2025 silver futures are careening toward contract expiration. With just five days left, the $35.77–$36.95 band (68.2% one-standard-deviation range) is narrowing fast. Given the surge in physical demand and Asian premiums, a flush toward $35/oz doesn’t just seem probable—it’s increasingly expected.

Pascal warns, “Expiration weeks often bring volatility spikes as positions are squeezed or rolled. We’re seeing the perfect storm: Eastern vault fills and Western technical pressure ahead of expiry.”

Adding fuel to the fire, silver prices now trade around $37.95/oz, representing a 4.6% premium over LBMA benchmarks. These premiums reflect real-time shortages in Asia and a rising cost to acquire bullion. Traders can track these premiums live via the InProved portal, which compiles Shanghai vs LBMA data during market hours to provide insights into the physical flow dynamics that just don’t show up in futures.

When vault accumulation coincides with near-term contract structures and premiums climbing, the market is sending a clear message: physical tightness plus technical pressure equals volatility ahead. As contracts roll or expire, positioning begins anew—and with 343 tonnes added in just five weeks, restocking may come with a price.

If volatility reaches the expected levels, the price may gurgle near $35 before jumping higher or reversing. But for now, the confluence of factors—physical accumulation, looming expirations, inflated premiums—means one thing: watch closely and be prepared.

The escalating tensions between the United States and Iran have thrown another log on the fire, stoking safe-haven demand across the precious metals space—silver included. While gold often takes the limelight in geopolitical crises, silver, as both a monetary and industrial metal, is now revealing its dual personality. Prices have surged near $38/oz, and premiums, especially in Asia, have widened to nearly 5%–7% above LBMA benchmarks—levels not seen since peak COVID-era dislocations.

Hugo Pascal noted in a post on InProved’s platform, “With the COMEX curve steepening and EFPs widening, geopolitical hedging is flowing into silver just as fast as it is into gold—maybe even faster given the leverage embedded in the trade.” This means both institutional buyers and sophisticated retail investors are willing to pay more to secure physical delivery, a trend likely to persist or even intensify if the Middle East situation worsens.

In short, the premium is not just a price—it’s a signal. It reflects fear, urgency, and a shortage of immediate supply. And in the current climate, it may only be the beginning of a larger repricing cycle.

If you’re looking to stay ahead of this silver wave—or secure physical metal before premiums rise further—InProved offers unmatched access to some of the lowest LBMA-aligned prices globally.

Download the app now or sign up at InProved.com to secure your position in real, vaulted bullion—backed by live premiums, live data, and real security.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions