| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

As July rolls forward, silver finds itself at a pivotal moment. From physical vault movements to speculative positioning, the metal is being shaped by a multitude of forces all pulling in the same direction: higher. In what may be the most compelling setup since 2020, silver is not just moving—it’s mobilizing. And as someone reading this, you’re rubbing shoulders with a market that’s waking up.

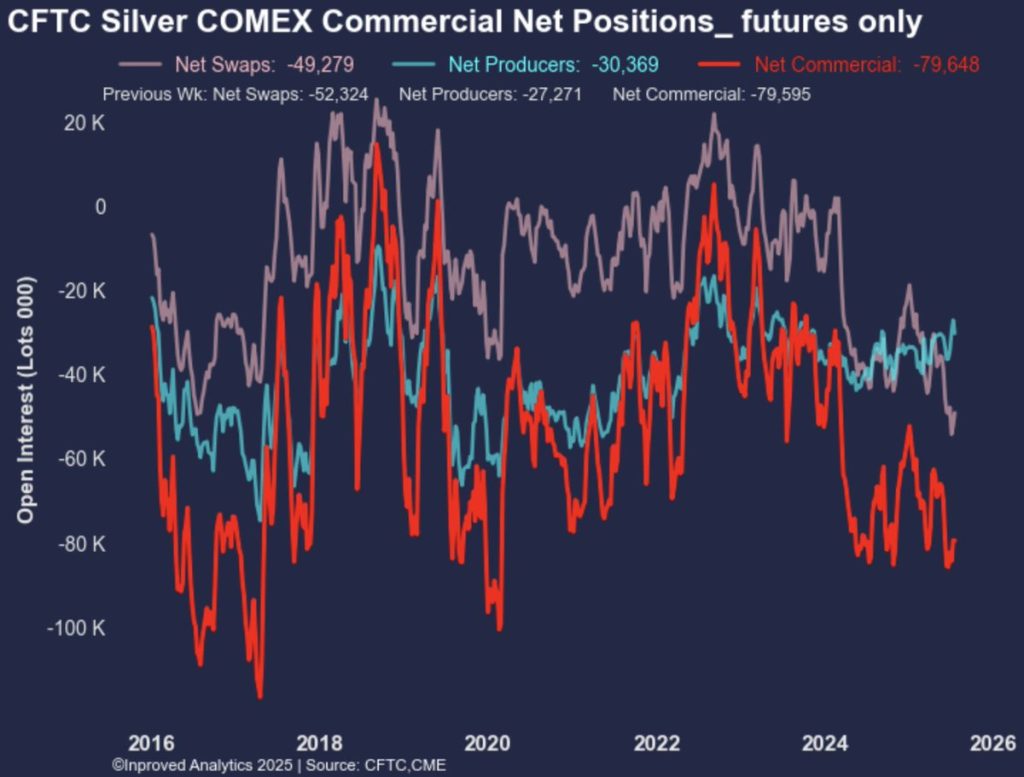

At the center of this shift lies a quiet but telling reversal in the swaps market. According to the latest Commitments of Traders data, the swaps category has now trimmed net short positions for the third straight week, down 6.2% to -49.3K contracts, equivalent to 246.5 million ounces, or roughly $9.3 billion at today’s prices. These dealers—who often stand between commercial hedgers and speculative momentum—are effectively reducing defensive hedges, a sign that they might expect less downside.

“Swaps don’t reduce shorts unless they’re bracing for upside,” Hugo Pascal remarks. “Such motion hints at conviction, not capitulation.”

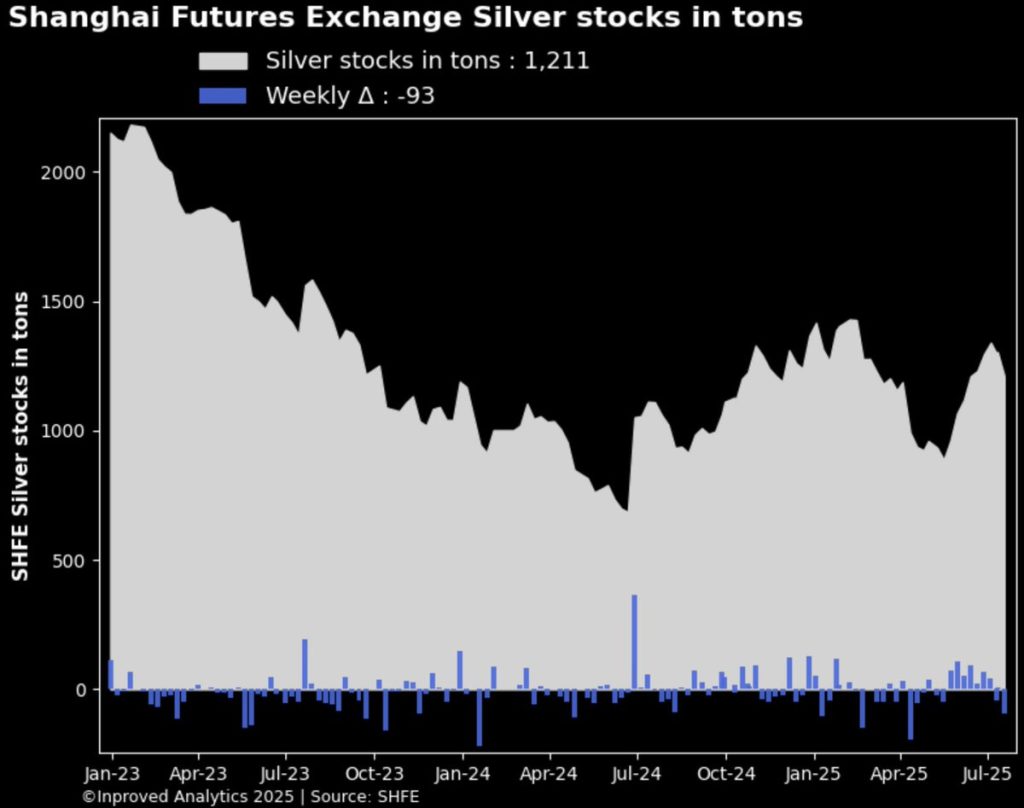

While the options and swaps markets shift, so too does the underlying physical groundwork. Shanghai vaults recorded the largest weekly outflow in three months, losing 93 tonnes (nearly 3 million ounces) and bringing total vault holdings down to 1,211 tonnes (39 million ounces). This follows a similar drop the previous week—43 tonnes—highlighting not liquidation, but crucial redistribution.

The reversal of inflows in China marks more than a logistical change. It represents a reclassification—a metal that was parked, now being prepped for trade, delivery, or even cross-border shipment. For a market so sensitive to physical pulses, this is radar-level news.

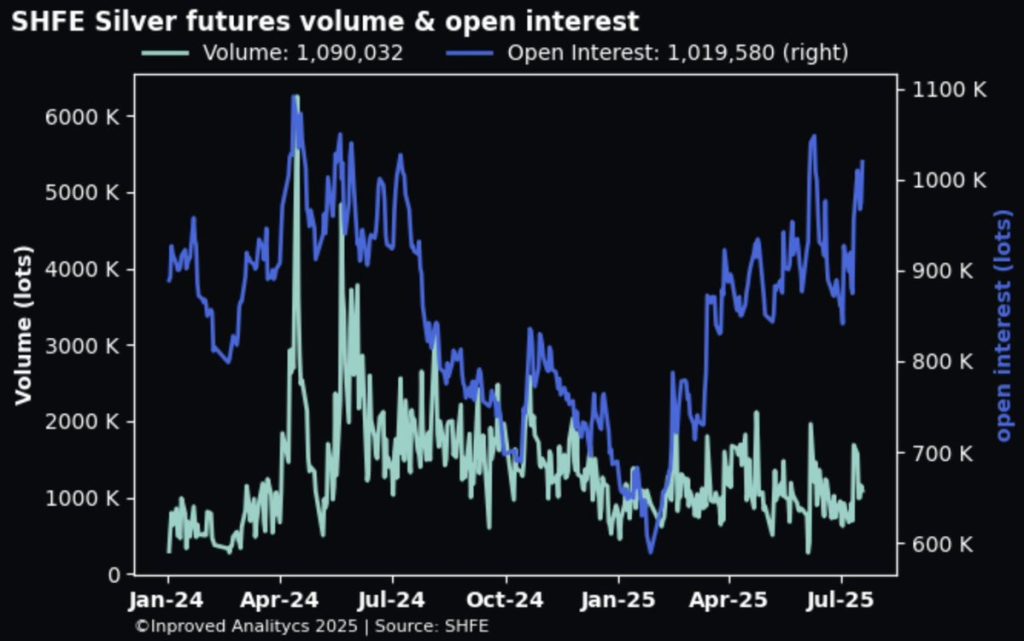

On the speculation side of Asia’s story, SHFE silver futures (Oct ’25) closed the week 1.36% higher, at ¥9,273/kg—about $40.17/oz (COMEX equivalent). Even as short-term price drivers emerged, the real headline was the 6.6% surge in open interest, adding 939 tonnes-worth of contracts to reach a five-week high of 1.02 million.

This wasn’t idle volatility. Trading volumes also climbed to four-week highs. Chinese participants are stacking contracts well above spot, hinting at structured positioning for bigger moves. OI is often where momentum meets conviction—and OI is now plugging higher.

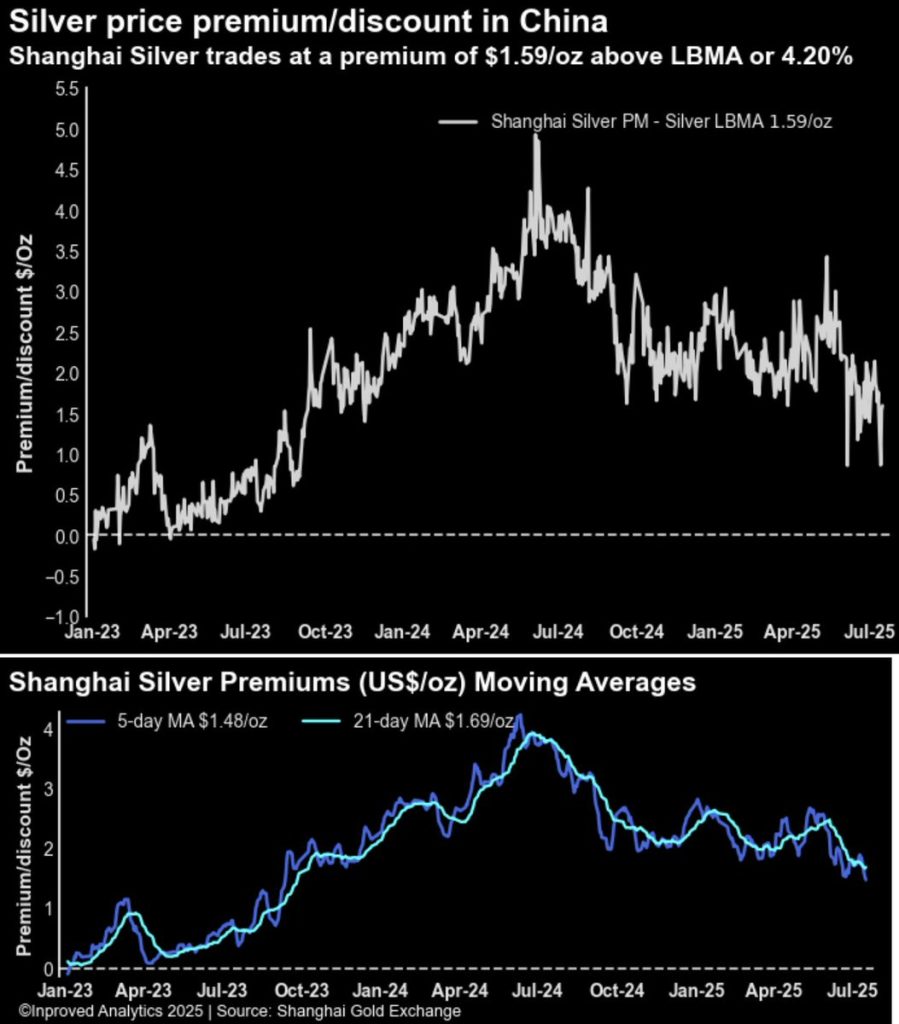

Curiously, premiums on silver have softened, even as flows and positioning intensify. Silver is trading around $39.81/oz, or +4.3% over LBMA, which is bullish. Yet the Shanghai premium hit a 22-month low of $0.86/oz (2.21%), and earlier reports marked it at $1.60 (4.2%)—two-year lows.

This divergence between vault pressure and shrinking premiums points to flow velocity—it’s not about wider spreads; it’s about who’s controlling stock. Premiums narrow when delivery accelerates. This isn’t passive interest—it’s urgency.

On the western front, COMEX silver vaults experienced a modest inflow—up 1.7 million ounces (53 tonnes) on Friday, pushing holdings to 496.6 million ounces. The “Registered” category—metal ready for delivery—also rose 0.8% (1.5 million ounces). Interestingly, this suggests a rotation of physical supply between US and Chinese hubs, or internal repositioning ahead of delivery cycles.

Merging physical flow, speculative OI, and swaps positioning, we see a complex picture: China is drawing silver out, US warehouses are replenishing—not necessarily due to loss of interest, but due to structured pipeline.

Perhaps the most evocative element of this week’s story is the options market. The 25-delta risk reversal skew on COMEX is at 4.7, identical to silver’s surge a few weeks back. At this level, call options are vastly more expensive than puts—a signal that speculators are buying draws for upside, not downside cover.

The most tracked strike—again—is the $40 call on Sept ’25. That “$40 zone” has become the flashpoint. In a short squeeze scenario, $40 might not just hold—it might accelerate.

As Hugo Pascal explains: “A high skew means speculators are playing for something big. That something is almost always beyond the current range.”

A while ago, copper went through its own squeeze cycle: physical shortages drove futures premiums, and options shattered technical ceilings. It was textbook delivery-driven breakout. Silver appears to be echoing this—but with a noticeable macro twist.

Liberation Day geopolitical fears are rekindling safe-haven demand. Silver isn’t just industrial—it’s money. When copper squeezed in its cycle, silver participated. Now, as regional tensions rise and markets itch for protection, silver is answering with positioning, premiums, and physical demand—all converging.

All these threads lead us to one central question: is silver’s story here a false breakout or a true reset?

Pessimists might point to shrinking premiums, swaps remaining net short, or geopolitical stability returning. Optimists will highlight vault dynamics, options skew, ETF conversions, and supply tightness in global mining.

Our call? We’re at a convergence crossroads, and every vector points higher. A failure below $38 could signal pause—but with dips in large topside flows, that seems less likely. More probable is a move to $41–$43, especially if Shanghai conditions remain tight, geopolitical risk ramps, or a breakout ignites speculative follow-through.

Here’s how you can action this:

1. Build modular exposure: consider small batches of calls at $40 strikes, supplemented via spreads to manage cost.

2. Acquire physical stacked in vaults where premiums are accessible—Asia or West, depending on your access.

3. Track swaps, vaults, premiums in real time, using tools like InProved to stay ahead of curve.

4. Diversify across metals, with a tilt toward others like platinum if gold begins to lag behind wider flows.

This combination of physical, options, and macro insight is no longer a niche corner strategy—it’s becoming a mainstream edge.

Navigating this week required sharp eyes on vault numbers, swaps, OI, and skew. That micro-level time-bound alignment rarely comes together so cleanly. But staying ahead of wave action is what separates sit-and-hold from smart strategy.

InProved gives you:

1. Premium dashboards across LBMA, SGE/Shanghai

2. Vault movement alerts, real-time and historical

3. Options skew modeling and strategic scenarios

4. Tailored advisory

If you’re considering how to stack silver, manage volatility, or deploy options at scale, let’s connect. Download the InProved app and look beyond the bump in price to what really matters this week.

As we close out the week, silver is staring $40 in the face: “You came close—what are you going to do now?” The question isn’t whether silver can break, but whether it should—based on the data.

Premiums might shrink again, but if vault outflows resume, swaps stay short, and Shanghai repositions, it will break. $43 then $45 would no longer seem ridiculous. But if China stops draining, geopolitical fear softens, and options volatility unwinds, it may pause near the top of this week’s range.

Either way, it’s not random—it’s structure, and understanding structure is how investors generate alpha. This isn’t speculation. It’s strategy.

If you want to build a position—or design a silver program to ride this move properly—we’d be glad to show you how InProved arms you to see and seize the structure. Let’s talk.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions