| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

Silver has always been a market of contradictions. It is mined alongside base metals, yet treated as a precious one. It is hoarded by central banks in small doses, yet consumed voraciously by solar manufacturers. It is a safe-haven in one geography and an industrial input in another. And this week, the contradictions have rarely been sharper.

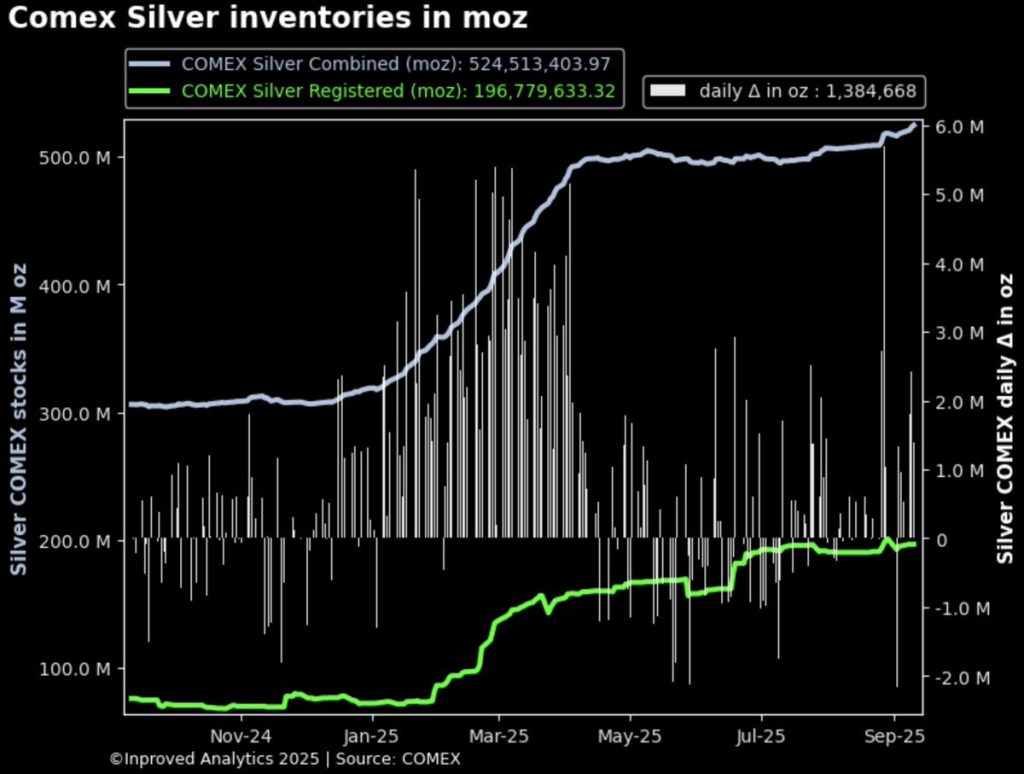

On one side of the Pacific, Shanghai vaults closed the week with another outflow of 19 tons, extending a string of withdrawals that suggest Chinese traders are pulling physical silver from the exchange, perhaps to meet industrial needs or to arbitrage premiums. On the other side, the story could not be more different: COMEX vaults in New York are overflowing, surging to an all-time high of 524.5 million ounces after another week of relentless inflows. Just this week alone, 175 tons were added, with single-day jumps of 75.3 tons on Tuesday and 43 tons on Wednesday.

This divergence raises the question: is the silver market being pulled in two opposing directions, or is this the prelude to a convergence that could fuel another price surge?

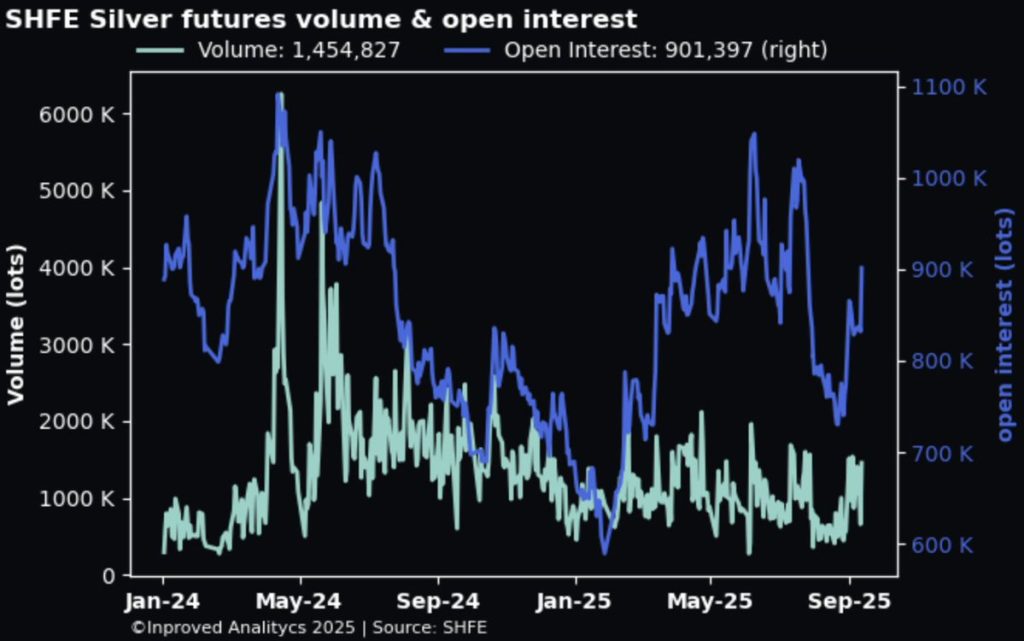

The October 2025 silver contract on the SHFE closed 2.36% higher at ¥10,035/kg, or $43.83/oz COMEX equivalent, with open interest rising 8.8% week-on-week to 901,400 contracts. Rising prices, growing positions, and shrinking vault stocks — a trifecta that usually signals tension.

Hugo Pascal of InProved observed, “The steady outflows from Shanghai vaults, coupled with rising open interest, suggest Chinese traders are not only betting on higher prices but are also pulling physical supply out of the system. That is rarely a stable combination.”

This is not unprecedented. In late 2020, as global logistics snarled, SHFE silver vaults saw similar drains even as futures positions expanded. The result was a sharp widening of spot-futures spreads, forcing arbitrage traders to scramble. This time, the spread is narrower — just ¥23/kg on the 2510 contract as of September 9 — but the risk is clear: too much futures exposure, too little physical availability.

Meanwhile, New York’s COMEX has turned into a magnet for silver. Vault inventories have surged past 520 million ounces for the first time in history, climbing day after day with near-mechanical regularity. Analysts note that these inflows, totaling 175 tons in just one week, are partly tied to September contract delivery preparations, but also to broader investor behavior: the reallocation of bullion into exchange-approved vaults to meet surging demand for deliverable supply.

It is worth recalling that in March 2020, COMEX was at the heart of a different kind of crisis — a shortage of deliverable bars, when pandemic logistics prevented refiners from moving 400-ounce London bars to New York to settle contracts. The market went into a rare state of stress, with the EFP (exchange-for-physical) spreads blowing out by more than $10/oz. Today, the situation is inverted: COMEX is not short of silver, it is drowning in it.

Yet this abundance might be deceptive. Much of the inflow is going into the “eligible” category — metal owned by private parties and stored in COMEX-approved vaults, but not necessarily available for delivery. If demand spikes, the market could once again find itself scrambling, this time from a position of perceived plenty.

Premiums: Weakening but Still Positive

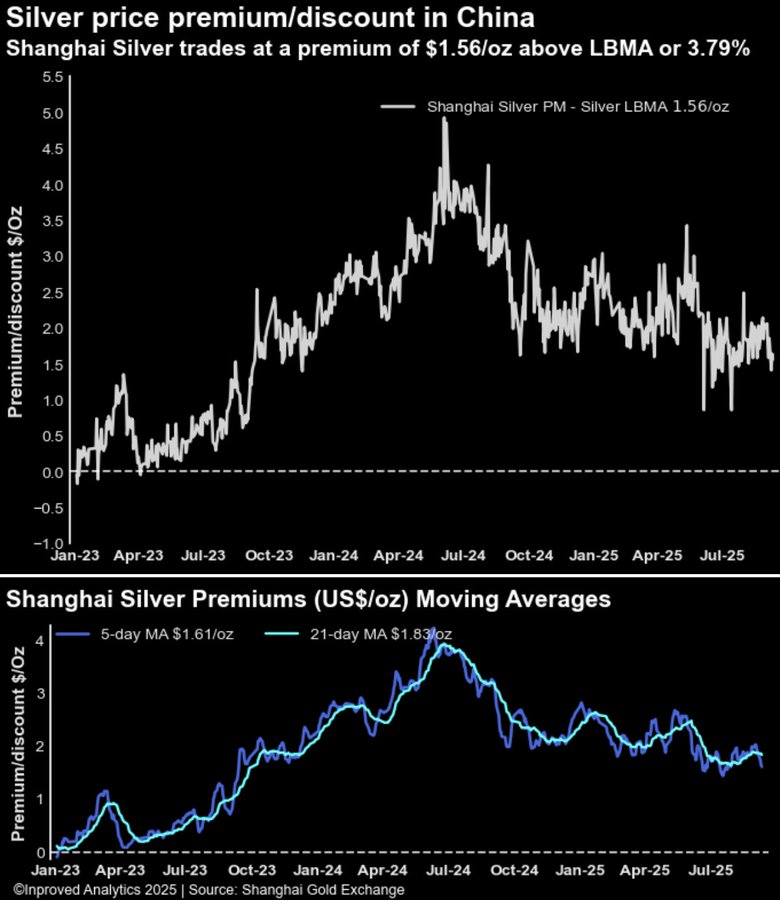

Premiums tell another part of the story. In China, silver premiums closed at $1.56/oz, or +3.8% above LBMA — still positive, but notably softer than earlier this summer when premiums touched 6–7%. A weakening premium can signal reduced urgency among buyers, though context matters. Premiums remain stubbornly positive even as vaults continue to bleed, suggesting that industrial demand is steady enough to maintain tightness.

In contrast, Western investors have turned their eyes back to ETFs. The Sprott Physical Silver Trust and iShares Silver Trust have both reported modest inflows in recent weeks, contributing to the tightening free float in London that Hugo Pascal has repeatedly flagged. This divergence — weakening Chinese premiums, rising Western allocations — suggests a rotation in demand geography rather than a fundamental softening.

The Historical Playbook

Silver’s divergence between Shanghai and COMEX vaults brings to mind past episodes of imbalance that preceded significant price moves.

Today, the setup is different but rhymes. COMEX vaults are swelling, Shanghai vaults are draining, and premiums remain sticky. Add in the speculative fervor of SHFE traders rolling into higher strikes — ¥11,200/kg ($48.8/oz) has become a frequently cited target — and the stage looks set for another test of silver’s upside limits.

What happens next depends on whether these vault dynamics converge or diverge further. If COMEX continues to absorb inflows while Shanghai keeps bleeding, the market could bifurcate into a Western abundance and Eastern scarcity — a setup that risks destabilizing arbitrage mechanisms.

Alternatively, if Shanghai inflows resume while COMEX begins to draw down in delivery season, we may witness the kind of synchronized tightening that has historically driven silver into parabolic rallies.

For now, traders are voting with their positions. SHFE open interest is surging, COMEX inventories are at records, and premiums remain in positive territory despite weakening from earlier highs. In other words:

silver is not under acute stress, but it is coiling.

As Hugo Pascal remarked this week, “Silver does not need a Reddit squeeze or a billionaire’s bet to move. It only needs a mismatch between paper promises and physical ounces. Right now, both sides of that equation are moving, and not in the same direction.”

With the October SHFE contract at $43.83/oz and traders openly targeting $48, silver is once again living up to its reputation as the most volatile precious metal. The combination of Shanghai outflows, COMEX inflows, sticky premiums, and speculative options activity makes for a combustible mix.

History suggests such divergences rarely last long. Either arbitrage restores balance — with flows reversing to even out spreads — or the imbalance breaks, forcing prices higher to ration demand.

Silver’s story has always been one of tension between abundance and scarcity. This week’s record COMEX vaults and drained Shanghai vaults capture that paradox perfectly. And if history is a guide, tension of this kind rarely dissipates quietly.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions