| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

This week may go down as one of the most consequential in the modern history of the silver market.

Not because of a new all-time high — but because the physical foundations beneath the market are eroding in plain sight.

Across every major vaulting center — London, Shanghai, and New York — the same signal is flashing: metal is leaving faster than it can be replaced.

At the same time, China’s domestic silver is trading at a rare discount to the LBMA, global implied volatilities are surging, and derivative spreads have contorted into deep backwardation.

To the untrained eye, it looks chaotic. To those who have watched metals markets for decades, it looks like the early stages of a structural squeeze — the kind that rewrites the rules of price discovery.

Start in London, the heart of global silver storage.

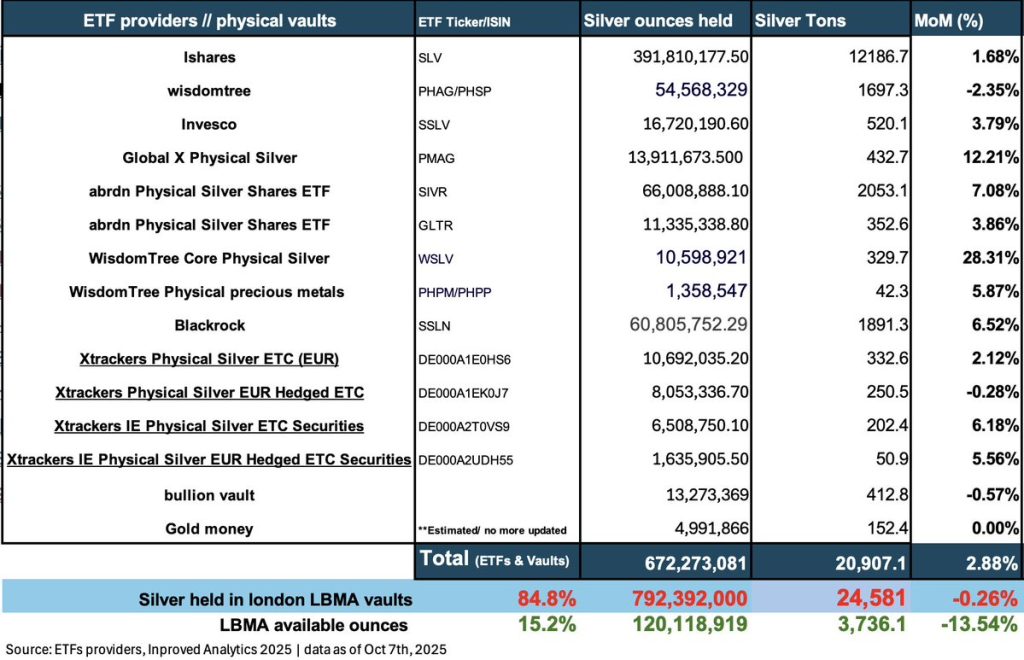

According to the latest LBMA data, the city’s “free float” has collapsed 13.5% month-on-month — a loss of roughly 585 tons — leaving just 120 million ounces (3,736 tons) available.

To understand why that matters, it’s important to define free float. In bullion markets, it refers to metal that is both stored in recognized vaults and not already pledged, leased, or allocated to ETFs, industrial users, or long-term investors. In other words — the silver that can actually move.

When the free float shrinks, liquidity evaporates.

In 2011, when the free float fell below 150 million ounces, the result was a 70% spike in price within three months. In 2020, when pandemic shutdowns disrupted London refining and vault logistics, the free float fell to similar levels — and silver jumped from $12 to $30.

At 120 million ounces, London now sits at the lowest point in at least five years, signaling that the world’s largest silver hub is once again running on fumes.

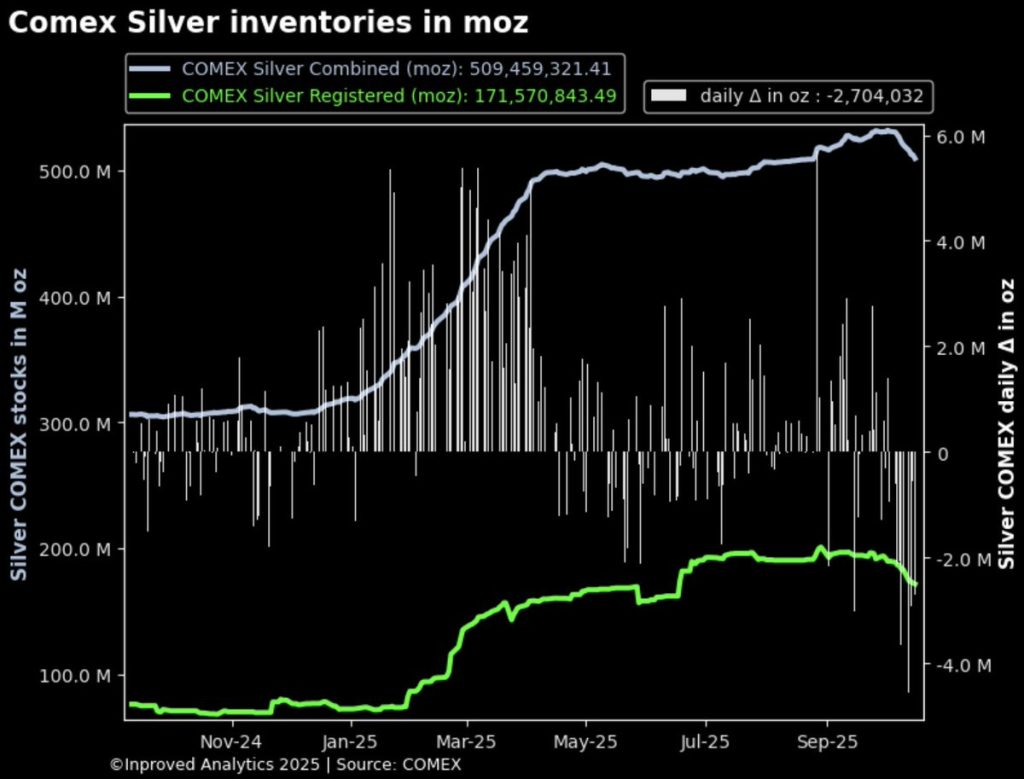

If London is running dry, New York is hemorrhaging.

COMEX vaults have now recorded ten consecutive days of outflows — a staggering 22.4 million ounces (697 tons) in less than two weeks.

The reason? Arbitrage. Traders are capitalizing on a steep backwardation — currently around $1.30 per ounce — between London spot and COMEX December futures.

Here’s how the trade works:

1. Sell silver in London (where it trades higher).

2. Buy the discounted December COMEX contract.

3. Deliver the London bars to the exchange at settlement, pocketing the spread.

In normal markets, that’s risk-free profit — but backwardation of this magnitude is extremely rare. It only happens when immediate physical demand exceeds future supply confidence — meaning the market would rather pay more today than wait three months.

Every time this happens, physical inventories fall sharply, as arbitrageurs strip metal from vaults to fulfill their trades. It’s precisely what we’re seeing now — an arbitrage that only repeats once or twice a decade, usually before structural re-pricings.

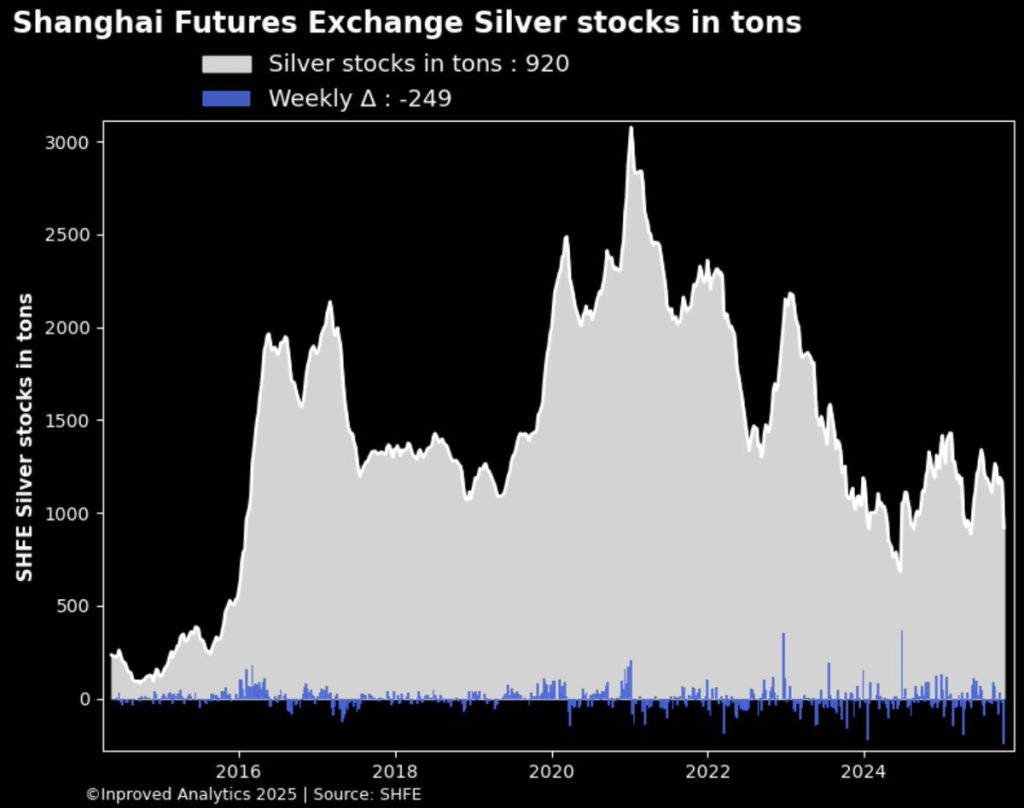

China’s role in this drama is equally remarkable.

In just three trading sessions this week, Shanghai’s silver vaults have plunged below 1,000 tons for the first time in five months, losing 187 tons week-to-date, followed by an even deeper 249-ton drawdown, bringing total holdings to just 920 tons (29.6 million ounces).

At this pace, vaults could empty in four weeks.

What’s driving it? Two forces: India’s insatiable import appetite and London’s refining bottlenecks.

India — historically the world’s largest silver importer — has resumed aggressive buying as domestic ETFs and jewellers scramble to replenish supply. The rush is so intense that Tata Mutual Fund and several peers have suspended new silver ETF subscriptions, citing “a shortage of physical silver in the domestic market and a sharp premium in local prices.”

Meanwhile, U.K.-based refiners, facing declining inventories at home, have begun rerouting unallocated silver to meet Eastern demand.

In short — London and India are both drawing from China’s pool, reversing the usual flow of metal that normally travels eastward.

This kind of three-way vacuum — where London’s free float collapses, COMEX drains, and Shanghai empties — is unprecedented in the modern era.

Incredibly, despite this physical drain, silver in China now trades at a discount to LBMA — roughly -1.47% to -1.33% depending on the methodology.

It’s the first time in over two years that Chinese silver has priced below the global benchmark. The reason? Logistics, not fundamentals.

With metal leaving vaults for arbitrage and exports, the domestic market temporarily faces lower liquidity — forcing refiners to offer mild discounts to entice inflows.

Historically, Chinese silver discounts have been short-lived, often flipping back to premiums once the metal re-enters the supply chain.

It’s the classic “rubber band” effect of global bullion: tightening stretches until it snaps back — often violently.

This week, the TDEX index — which tracks the cost of “crash protection” across global stock markets — surged 25.3% to a six-month high at 26, signaling a sharp rise in demand for deep out-of-the-money put options on equity indices.

In simple terms, investors are paying up to hedge against a tail-risk event — a market move more than three standard deviations from the norm. It’s the kind of protection funds buy when they sense systemic stress.

While the TDEX doesn’t measure commodity volatility directly, its relationship to precious metals is historically inverse. When equity tail-risk hedging demand spikes, it reflects fear building in traditional assets — and that fear often channels capital into tangible stores of value, like gold and silver.

This was evident in March 2020, when the TDEX hit similar levels before silver and gold staged one of their strongest rallies in a decade. A rising TDEX, therefore, is less a threat to metals than a signal that investors are rediscovering the need for real hedges — the kind that don’t expire with an option contract.

As Hugo Pascal put it: “When investors start buying crash protection, they’re admitting that paper diversification isn’t enough. That’s when physical metals regain their voice.”

For conservative investors, that spike in TDEX is not noise — it’s the sound of money looking for shelter.

The surge in options premiums reflects exactly that tension.

With implied volatility now in the 98th percentile for silver futures (IV ≈ 34.5%, IV rank 51%), traders are paying up to hedge uncertainty. ETFs like SLV and SILJ show IV ranks above 75–80, signaling widespread anticipation of big moves — but no consensus on timing.

High premiums tell us two things:

1. The market expects turbulence but hasn’t decided its direction.

2. Professional desks are not selling volatility — they’re holding it, implying confidence in a coming repricing event.

In precious metals, that combination is rare. It appeared in late 2010 (before silver’s run to $49) and again in March 2020 (before the post-pandemic melt-up).

All these signals — collapsing free float, record vault outflows, rising IV, deep backwardation — point to the same truth: the paper silver market has outgrown its physical base.

At the current rate, COMEX’s registered category — now representing about 200 million ounces — is being depleted faster than new delivery can replenish it. The ratio of open contracts to available metal stands near 4:1, meaning only a quarter of paper positions could be delivered if called.

That leverage has always existed, but it only matters when physical arbitrage kicks in — as it has now. Each bar moved from London or Shanghai to cover short futures tightens the system another notch.

Eventually, either futures will rise to match spot, or deliveries will be delayed. Both outcomes are bullish for those holding real metal.

For long-term investors — the cautious professionals, retirees, and civil servants seeking preservation over speculation — this environment demands perspective rather than panic.

Here’s what the current setup implies:

As Pascal summed it up: “This isn’t a market breaking down — it’s one breaking open. When paper loses credibility, physical gains permanence.”

The headlines may focus on inflation, rates, or Fed policy, but the real story of October 2025 is unfolding in vaults and spreadsheets — in the silent migration of real metal out of paper systems.

The numbers don’t lie:

Every ounce leaving the vaults is a vote of no confidence in paper settlement — and a validation of real possession.

For conservative investors, that’s the entire message distilled to its core: real wealth doesn’t need delivery dates.

It just needs custody.

Singapore remains one of the world’s safest and most cost-efficient jurisdictions for precious metal storage — tax-free, LBMA-linked, and fully allocated. Visit InProved.com to access institutional bullion pricing, reserve-grade custody, and full transparency in an era when every ounce counts more than ever.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions