| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

Some weeks the silver market moves like a headline. This week it moved like a ledger—one that keeps tallying up the same idea from three different directions: investor demand is rising, near-dated metal is scarce, and the pipes that feed physical delivery are narrower than most portfolios are built to handle. The screen told the story in pieces: the Sprott Physical Silver Trust added units again, the Shanghai futures curve sank deeper into backwardation even as inventories inched higher from emaciated levels, the COMEX front stayed cheap to spot, and US exchange volatility funneled spec money into calls with the $50 strike glowing like a runway light. Stitch those pieces together and you get a market that continues to pay for immediacy—and that is exactly when small doors can produce big price re-ratings.

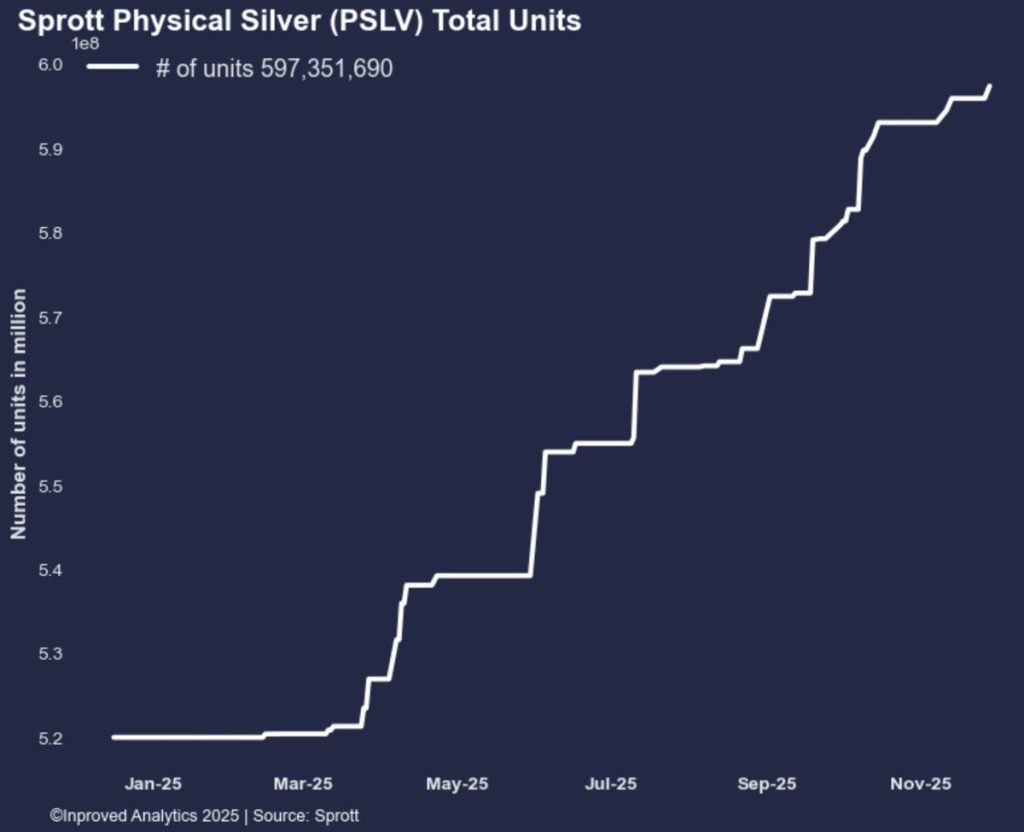

Start with the vote you can count. Sprott Physical Silver Trust’s register grew by 1,470,800 units to 597,351,690 on Friday. That is not a meme; it is metal. PSLV is a fully allocated structure, so unit growth maps to bars under custody. When investors add to a trust that cannot issue paper unbacked by inventory, they aren’t chasing optionality—they are locking supply. Moves like this don’t set intraday highs. They build the floor underneath them.

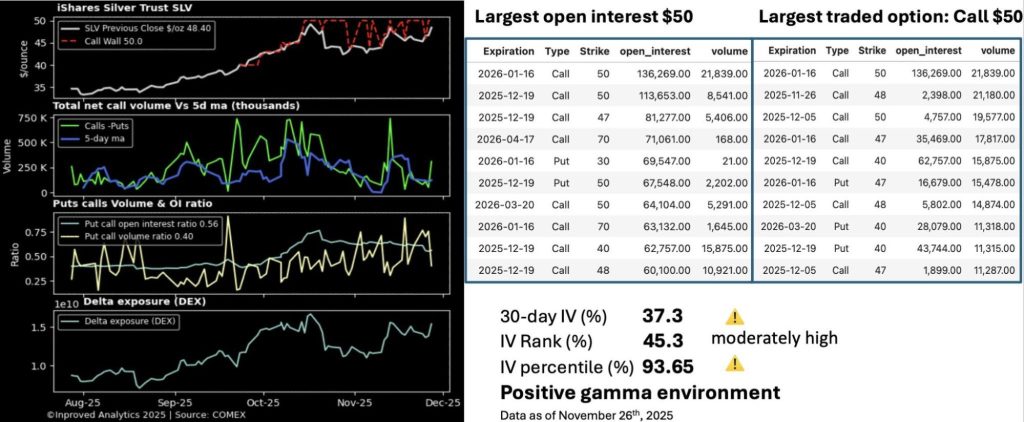

If you want the Western mirror of that behavior in options form, look at the largest US silver ETF. SLV’s call wall has crept toward the $50 strike, with traders racking up calls and the put-call open interest ratio sliding as upside appetite outpaces hedging demand. In other words, the equity-listed wrapper for silver exposure is trading like investors want convexity to the upside, not protection from downside. That doesn’t determine the destination, but it does tell you how the crowd is positioned to travel.

Now pan to Shanghai, where the market’s plumbing has been doing most of the talking. “CME is down but silver is roaring in China,” as traders like to say on days when time zones disagree. On the SHFE, silver closed up about 3.3% at roughly $56/oz on the Feb ’26 contract, while open interest jumped 10.6% week-to-date to 789,444 contracts. Participation is not a concept there; it’s a number. And it keeps rising.

The structure of that market is doing something more revealing than price alone. Backwardation has been widening on the SHFE forward curve. The Apr ’26 versus Feb ’26 spread moved from –¥33/kg to –¥49/kg; the Jun ’26 versus Feb ’26 from –¥53/kg to –¥77/kg. Translate the jargon: later delivery is worth less than near delivery—and increasingly so. That only happens, and sustains, when the market values immediacy more than time. It is the dictionary definition of a tight front.

If you put that curve alongside the basis, you get the same message in a second language. China’s spot premium over LBMA has been persistent—about 2.75% at one point, 2.55% more recently, with spot near $55.2/oz. You don’t see premiums and backwardation coexisting in a vacuum; they tend to appear when local fabrication, wholesale restocking, and investment flows all tug on a pipe that’s too narrow to satisfy them all at once.

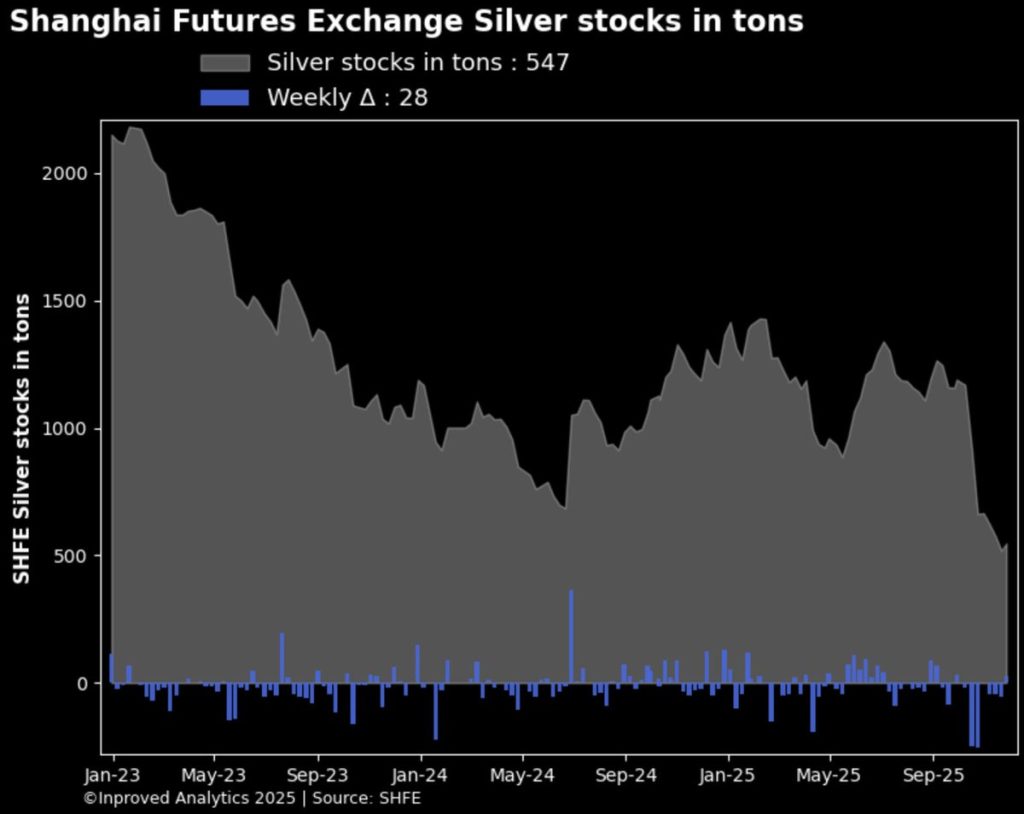

That pipe is the vault ledger. After months of relentless drain, Shanghai silver inventories finally notched a modest inflow of 28 tons week-to-date, lifting stocks to around 547 tons. The context matters more than the uptick: those warehouses had been decimated by roughly 61% (–793 tons) over four months. From that base, +28 tons doesn’t fix anything; it just proves that bars can still be coaxed into the city when prices and timing cooperate. Think of it as a catch-breath, not a trend. The market clearly did—because while those ounces were arriving, the SHFE curve backwardation widened, not narrowed, and the premium to London persisted.

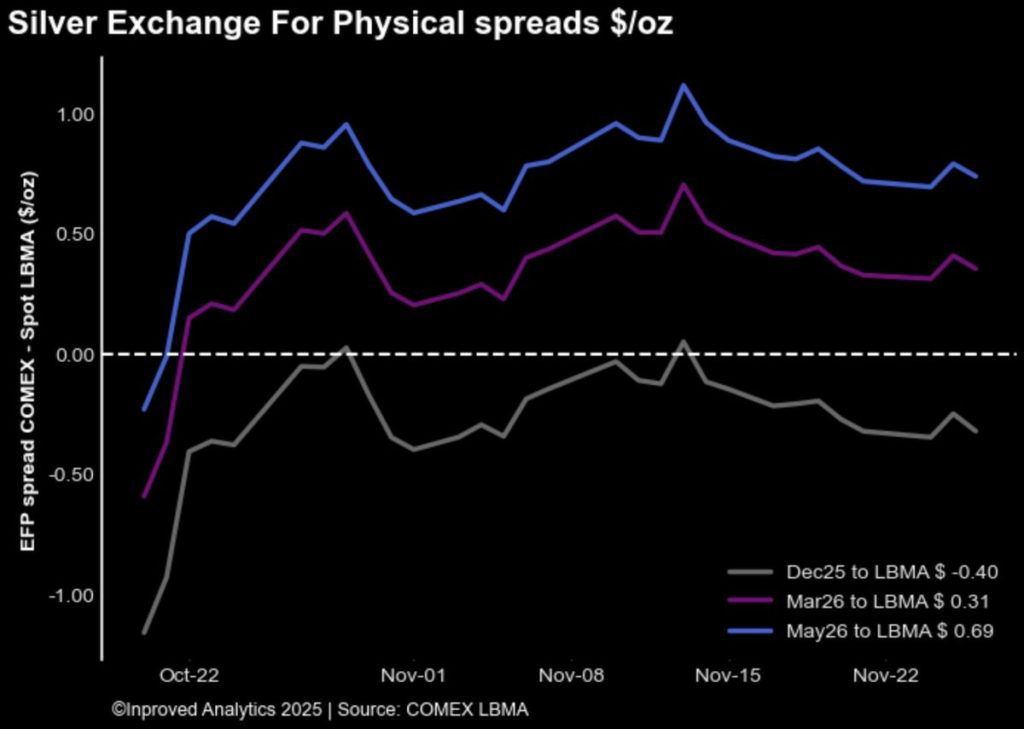

Across the Pacific, the US futures board is reading the same story. The COMEX Dec ’25 contract deepened to about –$0.40/oz vs. LBMA spot (≈ –0.76%). That is the Western echo of Shanghai’s near-dated squeeze. Paper can be rolled; fabrication cannot. When immediate bars are tough to secure in more than one venue, nearby futures start to price below cash until the system has enough physical certainty to re-open the door. Until then, the curve whispers the same word in every time zone: now.

All of this would be less consequential if silver were the same size as gold. It isn’t. A simple market-size scatterplot makes the point in one glance: gold and copper trade as oceans, with daily exchange volumes measured in tens of billions of dollars, while silver sits closer to nickel and the PGMs (platinum, palladium, rhodium) huddle in the bottom-left corner of the chart—small in annual production value and constrained in exchange liquidity. That architecture matters. When investment and jewelry flows rotate toward silver or platinum, the capital is not pouring into an ocean; it is trying to go through a small door. Small doors make for fast repricings. They also make for basis dislocations, local premiums, and forward curves that sink below spot as participants pay for immediacy.

That is exactly what you are watching now: two regions, two curves, one message. The SHFE confirms it with widening negative spreads across spring and summer ’26. The COMEX confirms it with Dec ’25 cheap to spot. And the basis confirms it with China consistently bid above London. When three microphones pick up the same frequency, it isn’t a rumor. It’s a note.

If you don’t want to trade on screenshots or anecdotes, keep a proper thermometer on your desk. During Shanghai hours, you can track live Chinese premiums vs. LBMA for gold, silver, and platinum on inproved.com/lbma-vs-sge. It won’t tell you what tomorrow brings, but it will tell you whether today’s talk of “China bid” or “China discount” is actually on the tape, and by how much. This week it has been doing exactly what the flows suggest: silver rich to London, gold often flat to cheap, platinum piggybacking on mood with a much smaller door behind it.

Back to the Western side of the ledger. SLV pressing toward a $50 call wall with put-call skew drifting bullish is a double-edged read. It proves that speculative interest is migrating toward upside convexity. It also warns that gamma can amplify both ways into events. If you are a dealer, that is a liquidity consideration: quotes can be two-way but air pockets appear when dealers hedge deltas in a thin strip. If you are an investor, it’s a sizing consideration: don’t let options premiums do your risk management for you. They will happily make you look brilliant and broke in the same week if you outsource discipline to them.

Desks that live on replacement cost already know what to do in a tape like this. Near-dated backwardation in two regions, basis positive to London, and rising public call interest is not a prompt to swing for the fences; it is a prompt to own availability. Stage inventory in jurisdictions where lift-out and settlement are predictable—Singapore and London remain the hubs that keep promises—and schedule replenishment ahead of calendar bottlenecks. When the premium for “now” is visible in three places at once, the firm that can say “deliverable today” writes the spread.

If your profile is conservative, the message is simpler still. The point of a silver allocation in a diversified portfolio is not to impress the next hour’s chart; it is to own a scarce monetary-industrial metal in a form that can’t be printed. This week’s combination—PSLV unit growth, China premium, SHFE backwardation, COMEX discount—is the setup that historically rewards quiet accumulation. Ladder purchases rather than chase, insist on fully allocated custody, and remember what the market-size chart is telling you: silver’s door is small. That’s why the upside can be violent when flows rotate, and why chasing with leverage is a different game than building a position that can live through noise.

One last apparent contradiction is worth defusing. How can Shanghai report a small weekly inflow of 28 tons and still show widening backwardation and a positive basis? Because level and flow aren’t the same variable. The level, at ~547 tons, is still down ~61% in four months; the flow, +28 tons, is a drizzle arriving on a parched field. A drizzle doesn’t end a drought; it makes the next shipment slightly less urgent. Until levels rebuild materially, the market will keep paying for immediacy. That is what backwardation is: the price tag on urgency.

So the ledger reads like this. Western investors are adding allocated exposure (PSLV) and chasing upside convexity (SLV’s call wall) even as New York screens drift. China is bid: higher close, higher open interest, wider negative forward spreads, and a persistent premium over LBMA. The COMEX front month is cheap to spot, which is the domestic rhyme to Asia’s song. Shanghai’s vaults, after being cut by more than half in four months, managed a 27–28 ton inflow, which is something, but not enough to make the curve behave like carry is comfortable again. None of those facts say “guaranteed squeeze.” All of them say “immediacy has a price.”

In markets with small doors, that price can move faster than models anticipate. Which is why the people who will be least surprised by whatever happens next are the ones keeping a ledger, not a slogan: they are counting units added to PSLV, watching premiums on the inproved.com dashboard during Shanghai hours, tracking SHFE spreads, and checking the COMEX basis against real delivery windows. In a week like this, the winner is not the loudest narrative. It’s the simplest arithmetic.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions