| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

As global investors continue to digest an evolving macro landscape — from interest rate uncertainty to geopolitical recalibration — the silver market is sending an unmissable signal: the squeeze is getting real.

Over the past week, multiple developments across the Shanghai, London, and COMEX silver markets have converged to paint a clear picture of a tightening global market. Inventories are draining, speculative flows are heating up, and technical structure across futures and options is pointing toward further upside risk.

According to Hugo Pascal, CIO of InProved, “This isn’t a blip in sentiment. This is a structural divergence in supply and demand that’s playing out across every corner of the silver ecosystem — physical and paper alike.”

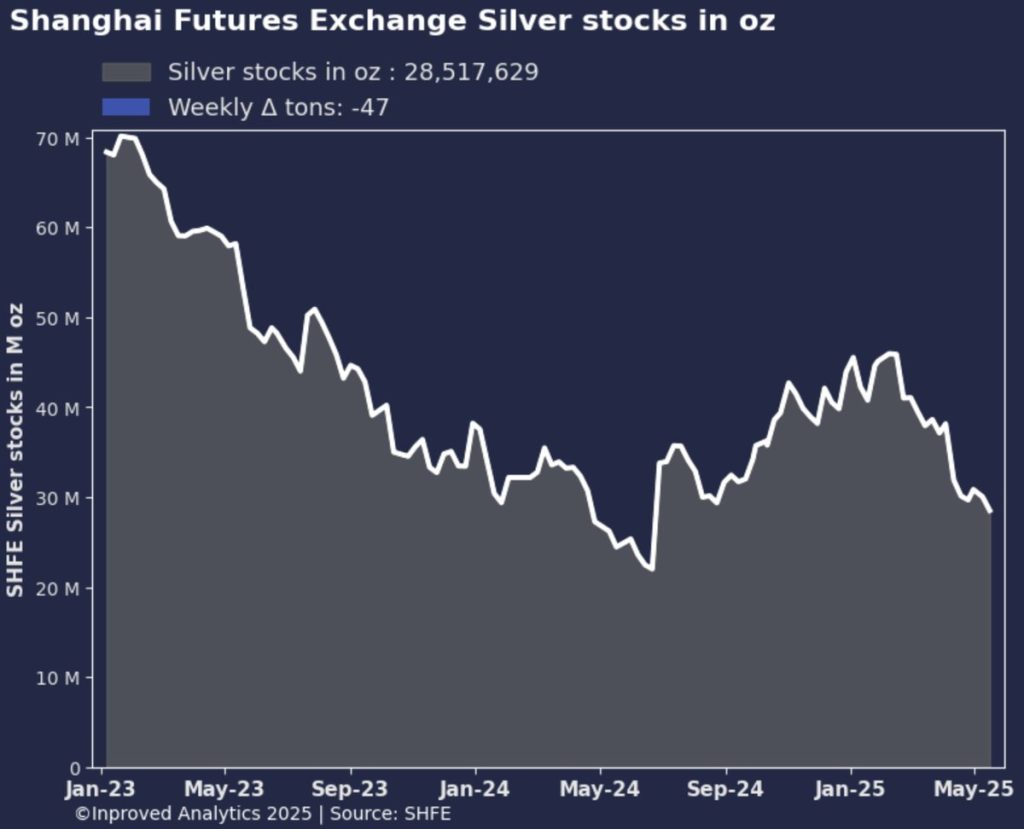

The most telling signal remains in the East. As of May 13, Shanghai’s silver vaults dropped another 47 tonnes, reaching just 887 tonnes, or 28.5 million ounces — marking the lowest level in 11 months. It’s a continuation of a relentless trend that has seen weekly outflows accelerate, with successive prints in the past fortnight showing vault holdings at:

Pascal describes this as a “slow-motion depletion” that’s finally tipping into critical territory. “When vaults reach 9-month and 11-month lows back-to-back, it’s not a seasonal dip,” he notes. “This is strategic withdrawal — long-term positioning into tight hands.”

These withdrawals come as China’s industrial and investment demand for silver continues to climb, particularly in solar, battery, and electronics production. But they also reflect growing retail preference for physical over paper — a pattern often seen during periods of macro uncertainty or yuan weakness.

While Asia draws down metal, the COMEX market is absorbing that tension through its futures curve and options activity.

As of May 13, COMEX Silver (July ’25) is trading within a key technical zone:

For readers less familiar with derivatives jargon, the 25-delta risk reversal skew measures the premium investors are willing to pay for upside call options versus downside puts. A skew of 2.3 indicates that call options are significantly more expensive than puts — a strong sign that traders are actively hedging or speculating on further gains.

“This is where you see smart positioning emerge,” Pascal explains. “When skew moves above 2, it’s usually institutions building directional bets — not just insurance.”

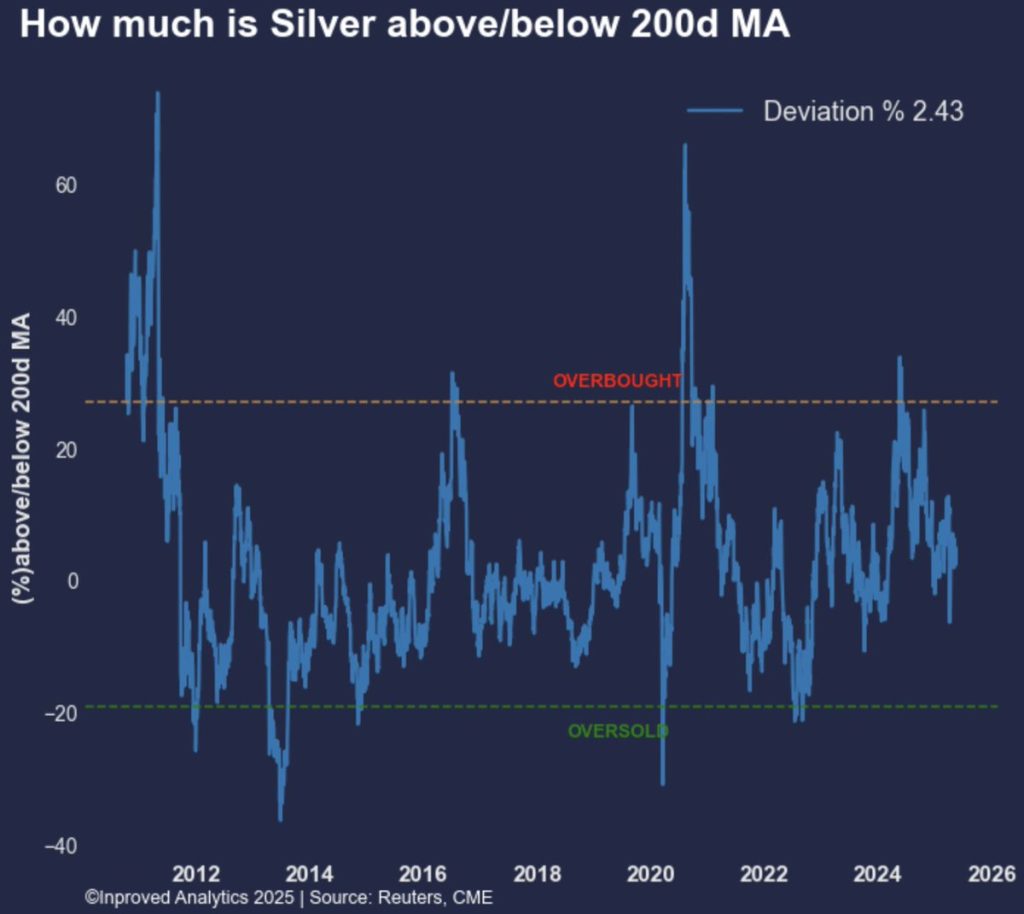

Despite recent spot price volatility, silver has consistently held above its 200-day moving average — and notably, it’s now trading 2.43% above that trendline, adding further fuel to the bullish technical outlook.

Prices are holding firm in the $34.50 to $35.13/oz range, with premiums relative to LBMA benchmarks remaining strong:

In short: even with vaults draining and futures skew building, spot buyers are still paying up for physical metal — a dynamic that rarely sustains for long without a pricing breakout.

Multiple sessions this month have confirmed a key technical floor: spot silver continues to attract buyers consistently above the $32/oz mark.

Pascal emphasizes this as a meaningful anchor. “$32 has become the line in the sand. Every time silver dips near that level, new buyers step in. And that floor is rising — just two weeks ago, it was $31.”

This kind of price memory — where dips are met with reliable demand — often precedes momentum breakouts when coupled with bullish skew and falling inventories. With the call wall at $35 remaining intact, and the technical floor rising, traders may be watching for a potential “volatility coil” to unwind.

Across all metrics — technical, physical, and speculative — silver is quietly tightening. China is leading with visible inventory drawdowns, while Western traders are reinforcing that move with upside hedges and rising spot premiums.

While the broader macro story remains dominated by central bank policy and global supply chain reconfiguration, silver’s microstructure is whispering a different message: this market is under stress, and that stress may soon translate into upside pressure.

As Hugo Pascal concludes: “When vaults drain, futures skew bullish, and physical buyers are still paying a 7% premium, the market’s not worried — it’s preparing.”

For traders, investors, and bullion professionals alike, the time to pay attention is not when silver breaks $36 — it’s now, while the pressure is quietly building underneath.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions