| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

There are weeks when silver prices write the headline and weeks when the plumbing does. This is the latter. The tape has been firm—spot lifting to roughly $53.06/oz, about 3% above LBMA—but the real story lives below the surface: vaults in Shanghai and New York are draining, the nearby futures contract is priced below spot as expiration approaches, and options volatility for silver and gold sits above the 90th percentile even as platinum’s risk surface cools. Add it up, and you get a market that keeps paying for immediacy while hoping the future will deliver relief. For now, it hasn’t.

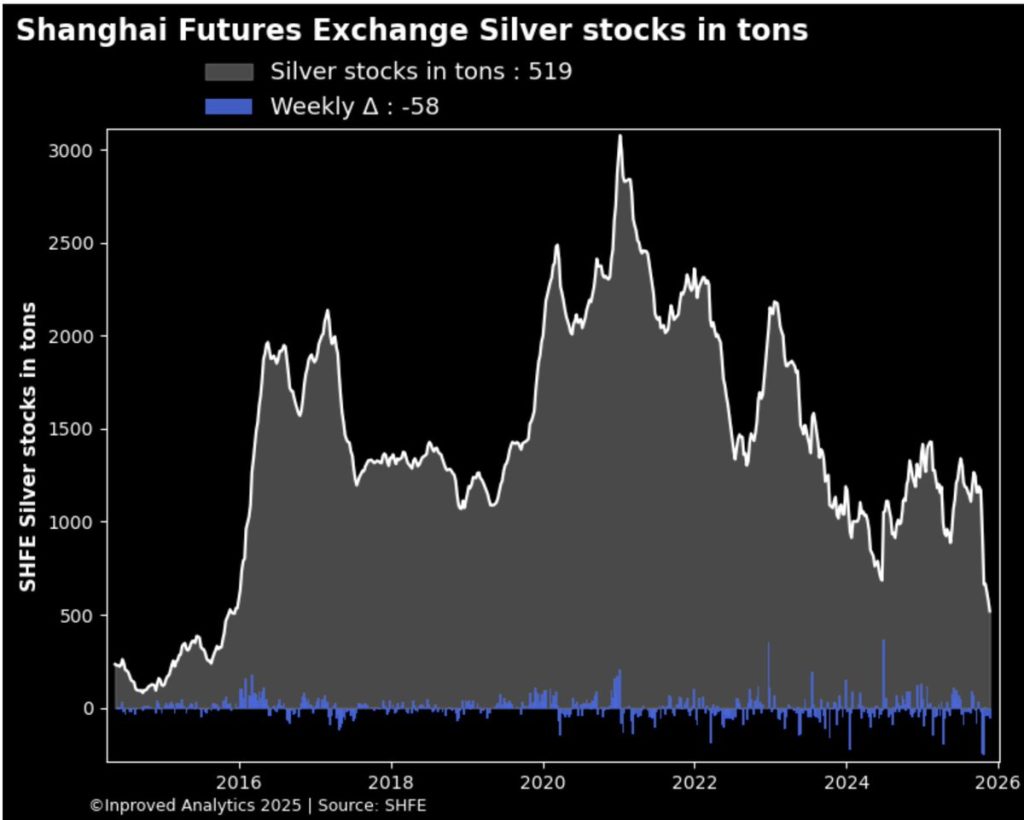

Start in Shanghai, where the balance sheet is the message. Exchange vaults have now closed the week at 519 tons, down 58 tons week to date, after earlier closes showed 535 tons, down 42 tons WTD. Desk shorthand has captured the slope with a dramatic phrase—“nine weeks to go”—not because anyone truly expects inventories to hit zero, but because straight-line math at the current pace pushes the line uncomfortably close to the horizon. Flows in and out are lumpy, shipping windows open and close, import economics change with basis moves; everyone knows the caveats. What matters is the direction and the velocity. The direction is down. The velocity is fast.

That profile isn’t coming from speculative churn. When silver leaves exchange custody at this clip, it is almost always because fabricators, refiners, and wholesale channels are pulling bars for real use or for near-term allocation rather than rolling exposure. And the market is telling you that preference explicitly in the price structure.

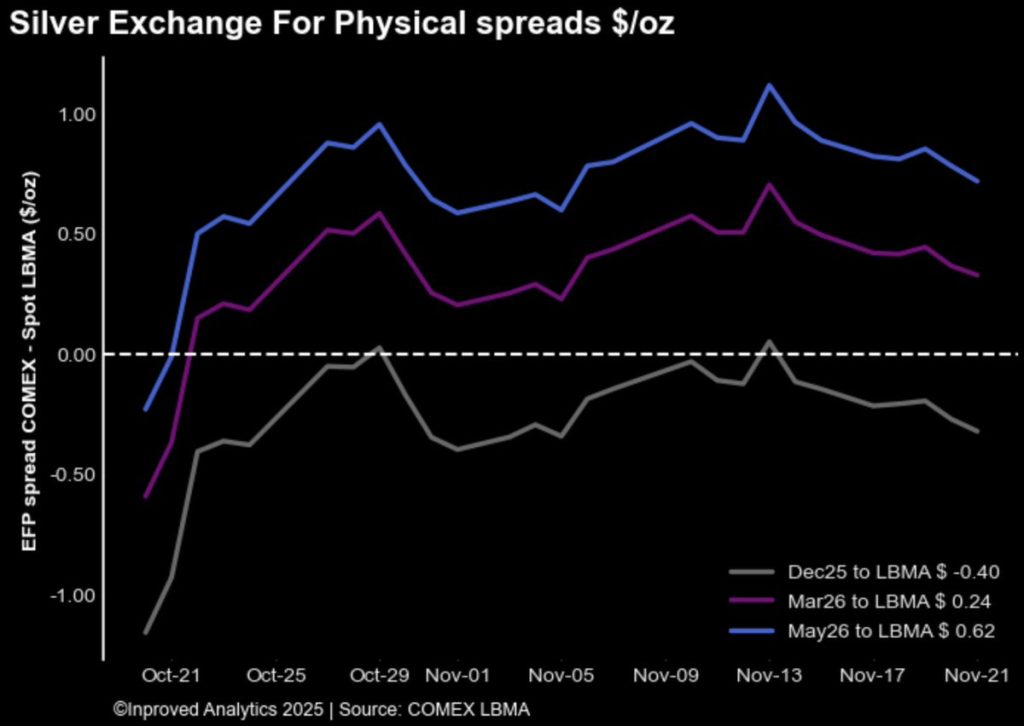

The December 2025 futures line—now only days from going off the board—trades below spot, a deepening backwardation that has moved from roughly –$0.30/oz (–0.56%) to around –$0.40/oz (–0.8%) versus $XAGUSD as the calendar tightens. That is not a curiosity; it is a signal. The contract pays less than cash because the next ounce is worth more than the later ounce. Delivery, not deferral, is the coin of the realm into expiry.

Microstructure gives you a second tell. The spot bid–ask widened to about four cents, a small change in absolute terms but a meaningful one in context. When the market edges into execution risk—rolls colliding with deliveries, shorts deciding between scramble and surrender, longs choosing between paper victory and bar ownership—the spread asks the room for patience. Spreads are not narratives; they are the cost of certainty, and certainty costs more when the market is negotiating for near-dated metal.

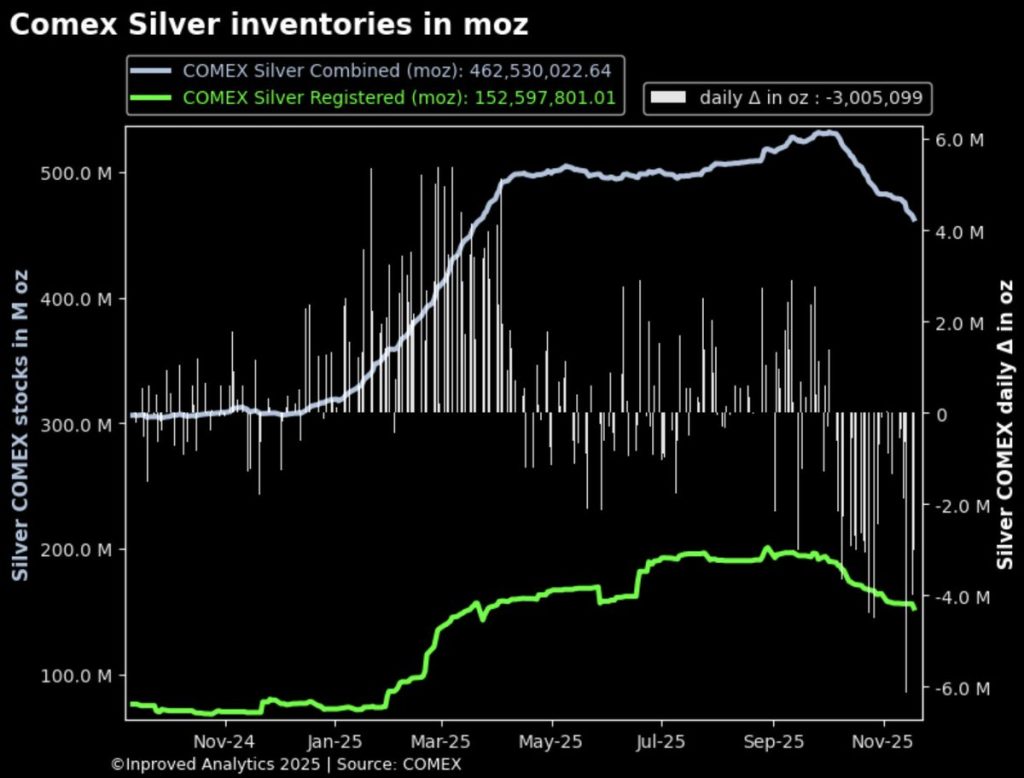

If the stress were local, it would be lesser news. It isn’t. COMEX vaults have recorded accelerating outflows—13.1 million ounces (409 tons) over the past three days—pushing total holdings down to about 462.5 million ounces, an eight-month low. One noisy day can be written off as a warehouse shuffle; three consecutive days of large tonnage following weeks of declines becomes a pattern. This isn’t metal disappearing; it’s metal migrating, and until that migration reverses—until ounces flow back toward the fabrication centers and retail channels that are light—the nearby part of the curve should be expected to speak the language of scarcity.

The simultaneous draw in Shanghai and New York is the key. The market reads both ledgers at once. Even as spot lifts, the vault arithmetic keeps reasserting itself: possession outranks promise.

Silver’s 4.7% weekly gain to $50.67/oz into last Friday and the subsequent step up to the $53 handle are not melt-up moves; they are a firm, two-way tape coexisting with a risk surface that refuses to relax. Implied volatility for silver and gold remains above the 90th percentile of the past year, while platinum’s IV percentile sits near 53%. That split matters. It says the stress is concentrated in the monetary metals, where delivery and collateral dynamics are binding—exactly the corners of the complex you would expect to be tight while vaults are light and expiration looms.

Elevated IV with a contained spot bid is the classic “coiled distribution.” Participants are paying for time not because they know the next dollar, but because they respect the cost of being wrong near delivery. Optionality becomes insurance against timing error when the market is rationing immediacy.

Backwardation in silver isn’t novel; it appears episodically whenever carry is punished and spot use is prioritized. What makes this instance significant is how neatly it aligns with the vault picture and the micro tells. As Dec’25 nears its exit, the discount has deepened, not narrowed, while physical stocks in Shanghai have tracked lower and COMEX releases continue to print daily departures. The discount does not need to blow out to tell the story; it simply needs to persist alongside falling inventories. That’s what the market is seeing.

In practice, this is the negotiation phase. Longs deliberate between accepting delivery or cashing out; shorts weigh the economics of rolling against the risk of being asked to show metal. The outcome is written into the curve. This week, it says the present still matters more than the future.

Put the last few sessions in temporal order and the logic sharpens. Near-term, the Dec’25 line in backwardation and the four-cent spot spread say delivery risk is real. Intermediate-term, the accelerating COMEX outflows and Shanghai’s decade-low cushion say the system will need time to re-balance. Longer-term, the elevated IV and the persistent spot premium over LBMA say the market still assigns value to monetary insurance even when the day-to-day price is orderly.

This is not a contradiction; it’s a stack of truths. And it argues for patience with position, not impatience with prints.

It would be convenient to pin the week’s shape on a single macro headline. That isn’t how the ledger reads. What you have is a confluence of steady industrial pull, fabrication scheduling, dealer restocking, and portfolio ballast allocation—all of it happening while the nearby futures roll approaches a hard calendar and while visible stocks are thin where the metal is most needed. None of those flows need to be torrential on their own; the intersection is enough.

Spot resilience with a backwardated front month tells you the market prefers bars today over paper tomorrow. Elevated implied volatility tells you participants are buying convexity against either a logistics relief that forces retracement or a continued draw that pushes the squeeze further down the curve. Neither outcome is foregone. Both are priced—with more weight, this week, on immediacy.

London’s role in weeks like this is to act as the balancing lung of the system. When Asia runs light and New York bleeds, London absorbs restocking from long-only portfolios and ETFs, warehouses the comfort inventory, and stages metal for redeployment. That is a buffer, not a cure. It can slow the slope of tightness; it does not reverse it unless and until flows back to Asia and North America materially change. The physical basis is telling you that piece is not yet in place.

The market understands this, which is why the spot bid persists and why the nearby discount endures. Ounces in the right zip code still matter more than ounces in theory.

There are two kinds of tightness: theatrical and procedural. In 2011, silver’s sprint toward $50 was theatrical—velocity and enthusiasm dictating the plot, with episodic inversions and a retail crescendo. In 2020, tightness was logistical—broken air routes and misallocated kilobars creating friction that the price resolved in jolts. Today’s version looks procedural. The planes are flying, the refineries are operating, the economy is slower rather than stopped. And yet the vault math insists that someone keeps underwriting immediate delivery, day after day. That is a quieter kind of squeeze, and in some ways a sturdier one. It survives headlines because it isn’t built on them.

This is why the IV surface can remain hot while spot refuses to look disorderly. The market is not panicking; it is pricing the cost of being late.

For dealers, replacement cost is the price that matters in weeks like this. With Shanghai closing at 519 tons after another heavy draw and COMEX at 462.5 million ounces after three days of outsized outflows, the ability to promise immediate, clean delivery is worth more than finesse with a quote. The near-dated squeeze, signaled by the –$0.40/oz discount into expiry and a slightly wider spot spread, is a logistical question masquerading as a market one.

The practical play is not heroic. It is provisioning—staging metal where documentation is clean and flight times short, planning rolls in hours not minutes, quoting delivery windows that are conservative enough to survive the week’s noise. The market is paying for certainty. Firms that can credibly sell certainty should not give it away.

For PMET investors and other conservative allocators, weeks like this argue for quiet accumulation rather than tactical bravado. The purpose of a physical silver position in a diversified portfolio is not to impress the ticker; it is to anchor liquidity through the cycle and to participate if scarcity forces a repricing. Elevated IV is a reminder to be price-sensitive with options; it’s not a veto on allocation. A simple ladder of small, regular purchases expressed as fully allocated holdings in a stable, LBMA-linked jurisdiction lets the vault math do the heavy lifting without asking you to guess the day of the week when backwardation finally rolls off.

If spreads relax after expiration and inventories rebuild, your average improves. If they don’t, you already own the thing the market is bidding for most aggressively: deliverable ounces.

Strip away the rhetoric and a few figures keep returning. Shanghai at 519 tons into the weekly close, after a 58-ton draw, following a prior week at 535 tons after 42 tons left. COMEX at about 462.5 million ounces after 13.1 million ounces departed in three days. A Dec’25 contract –$0.40/oz below spot within days of expiry. A spot spread at four cents during the morning rollover. A spot print holding 3% above LBMA near $53.06/oz. IV for silver and gold in the 90th percentile, platinum near 53%.

None of those numbers is sensational on its own. Together, they describe a market that values possession over promise. They describe a week in which ledgers—vault counts, delivery schedules, and roll calendars—wrote the story, and the price obliged by not getting in the way.

Resolution doesn’t require drama. It could look like a calm collapse of the near-dated discount as the contract clears, followed by a stable bid while restocking nudges vault lines upward. It could look like more of the same—spot firm, IV firm, and the curve tight—if the migration of metal fails to keep pace with off-take. The point is not to prophesy but to recognize that scarcity has already been priced into the front. When that scarcity ebbs, the curve will say so first; the vault reports will follow.

Until then, the most dangerous mistake is conflating orderly spot with easy supply. The former is on your screen. The latter is in this week’s arithmetic, and the arithmetic says the system is still rationing by price.

Some markets are driven by adjectives. Silver, this week, is driven by accounting. The East is light, the West is light, the front month is cheap to cash, and the risk surface is hot where money metals matter most. The liquidity that counts is not the kind that changes tick by tick; it is the kind that arrives on time, stamped, weighed, and eligible for delivery. That is what the market is bidding for, and that is why the bid persists.

When the tally changes, the tone will change with it. For now, the ledger still reads the same way: delivered beats deferred.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions