| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

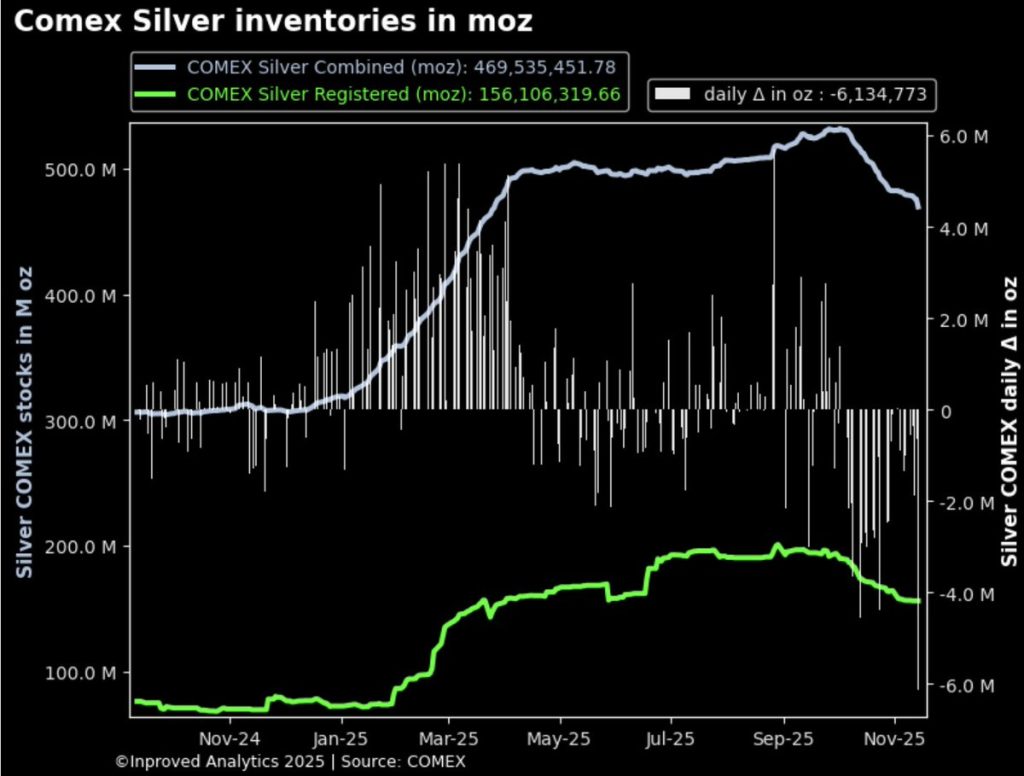

Silver just delivered one of those “split-screen” weeks that matter. On the one hand, metal bled out of key delivery hubs: on Friday, COMEX vaults lost 6.1 million ounces (190 tons), taking total holdings down to 469.5 million ounces — an eight-month low and capping weekly outflows of 299 tons.

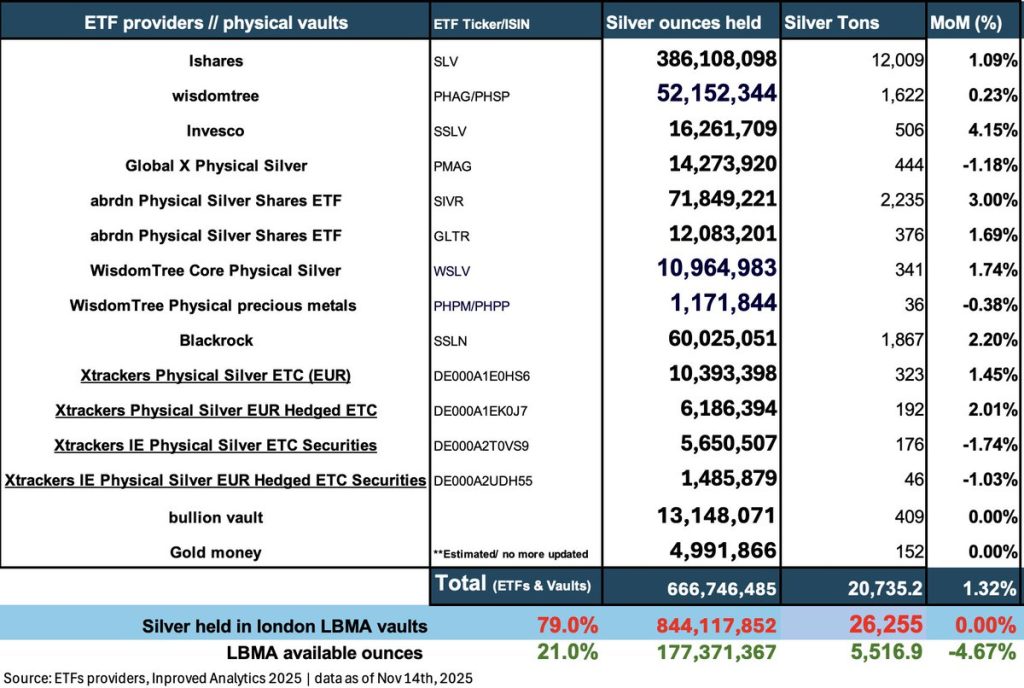

In China, Shanghai vaults fell to a 10-year low, slipping 7.5 tons week-to-date to 569 tons. On the other hand, London’s inventories rose by 271 tons (+1.3% WoW) as investors bought the prior week’s dip, and spot closed last week +4.7% at $50.67/oz before pushing to $52.37/oz — about 3% above LBMA.

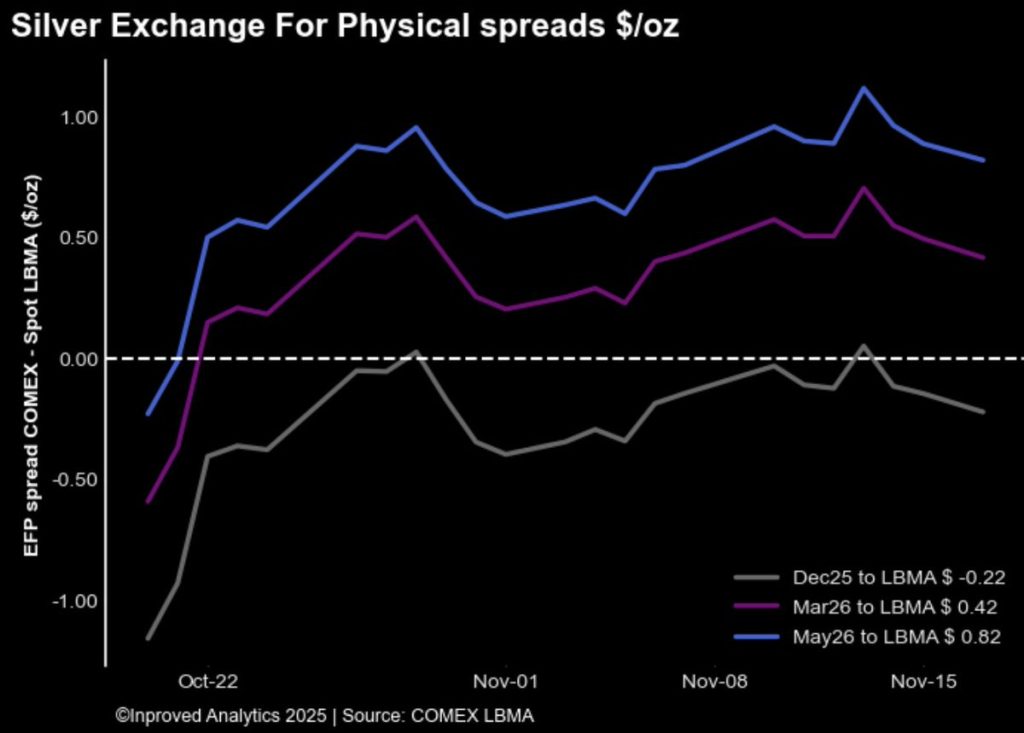

Layer on the derivatives surface: implied volatility for both silver and gold sits above the 90th percentile, while platinum’s IV percentile cools to 53%. And the near curve is still signaling tightness: the Dec ’25 silver contract deepened slightly into backwardation at –$0.22/oz (–0.43% vs. spot) this morning.

Translation: physical stress in New York and Shanghai, restocking in London, elevated option premia, and a near-dated curve that still pays for immediacy. This is not noise; it’s the market reprioritizing where deliverable ounces live.

The week’s configuration is unusual but coherent:

Historically, when Eastern stocks thin and Western custodians refill, spreads compress and near-dated backwardation lingers until metal physically migrates back toward fabrication centers. Today’s –$0.22/oz Dec ’25 differential is small in dollars but big in message: immediate ounces still command a premium over promises.

A 4.7% weekly gain to $50.67/oz and a push to $52.37/oz (≈+3% vs. LBMA) alongside >90th-percentile IV is a classic “coiled” tape: spot is trending, but participants are paying up for time. Platinum’s mid-pack IV percentile (~53%) is the control sample—stress is concentrated in the monetary metals, not the whole complex. In practice, that tends to sustain two-way liquidity while keeping replacement costs elevated for deliverable bars.

Treat the drain as a logistics signal, not a headline. With COMEX at an eight-month low and Shanghai at a ten-year low, the burden of replenishment shifts onto hubs that still have metal—this week, that was London (+271 t). For dealers, three practical moves follow:

This is a disciplined-accumulation tape, not a chase. Three reasons:

1. Physical scarcity is visible: COMEX –6.1 Moz Friday and Shanghai at a 10-year low confirm that tightness is not just a chart pattern.

2. Healthy buying on dips: London’s +271 t week shows long-only money is using weakness to add.

3. Vol remains elevated: With silver & gold IV >90th percentile, you’re paying up for optionality; allocated ounces keep it simple and cost-certain.

A practical approach: ladder small, regular purchases; keep custody in a stable, LBMA-linked jurisdiction (e.g., Singapore) to avoid policy friction; and let the flow do the heavy lifting. If spreads relax later, your cost average benefits; if they don’t, you already own deliverable metal.

Silver’s double-sided week—US and China draining, London refilling, spot firm, vol firm, and Dec ’25 still slightly backward—is the footprint of a market tight in the present and hopeful about future supply, but not yet rebalanced. Until the vault math improves where metal is needed most, expect support on dips, paid-up immediacy, and elevated carry for certainty.

For dealers, that argues for proactive inventory and credible delivery windows.

For conservative investors, it argues for steady adds and simple custody while the curve and the vaults do the talking.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions