| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

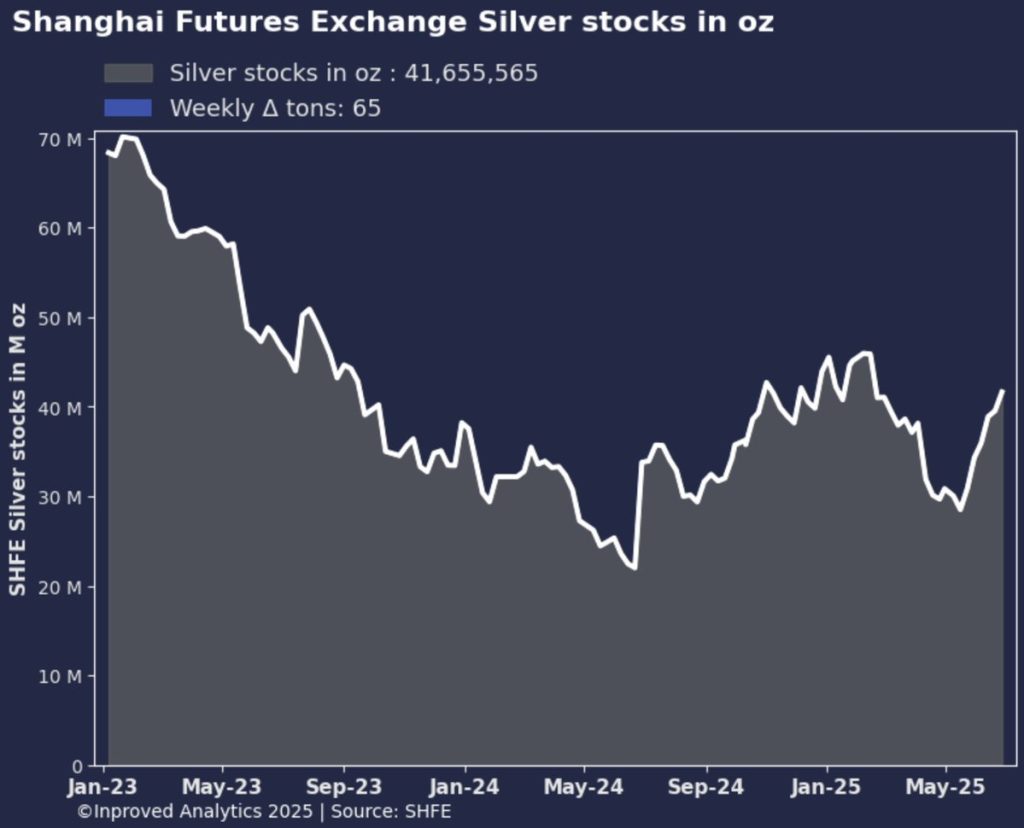

Week after week, Shanghai continues its relentless accumulation of silver. In the latest update, vaults expanded for a sixth consecutive week, climbing by 65 tonnes to reach approximately 41.7 million ounces (1,296 tonnes). That brings the last six-week total to a commanding 409 tonnes, signaling nothing less than a structural refilling of a physical market that had been running on fumes. As Hugo Pascal, CIO at InProved, puts it, “When 409 tonnes flow into Shanghai vaults in just six weeks, you’re looking at more than restocking—this is positioning for delivery, not speculation.”

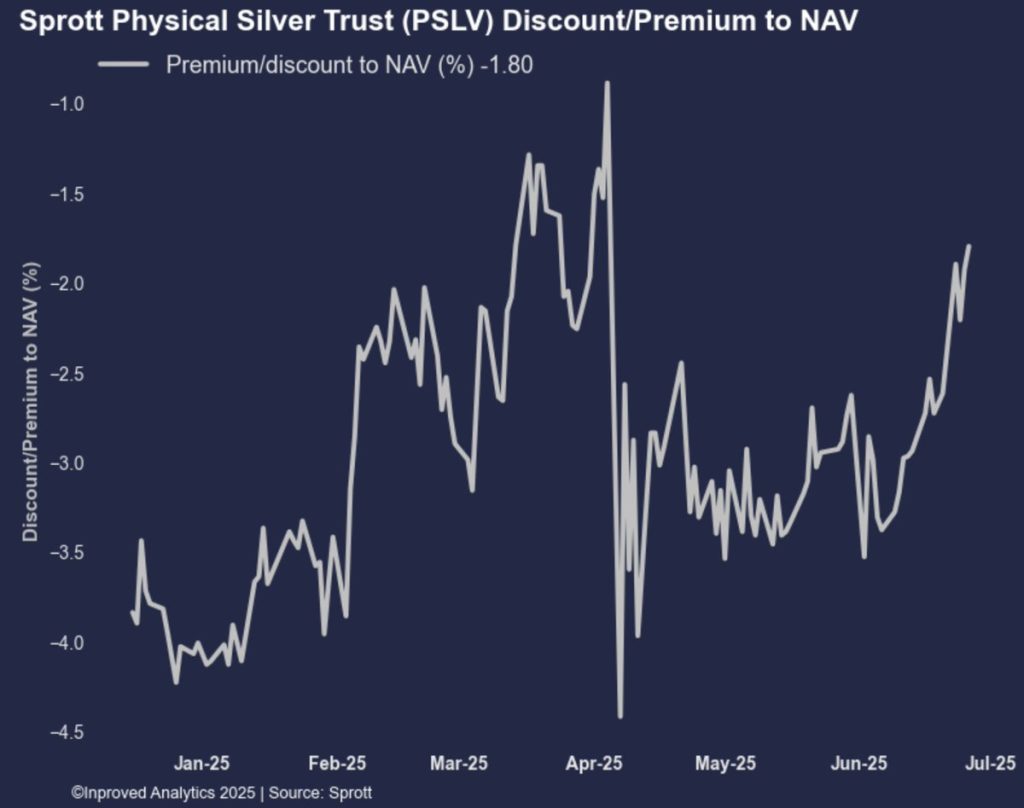

Across the Pacific, the Sprott Physical Silver Trust (PSLV) discount continues to shrink, making the fund more attractive to buyers seeking physical silver exposure backed by actual metal. This converging global interest in the tangible product reflects a market increasingly focused on delivery rather than just price movement. With the PSLV discount narrowing, demand is no longer about trading; it’s about owning.

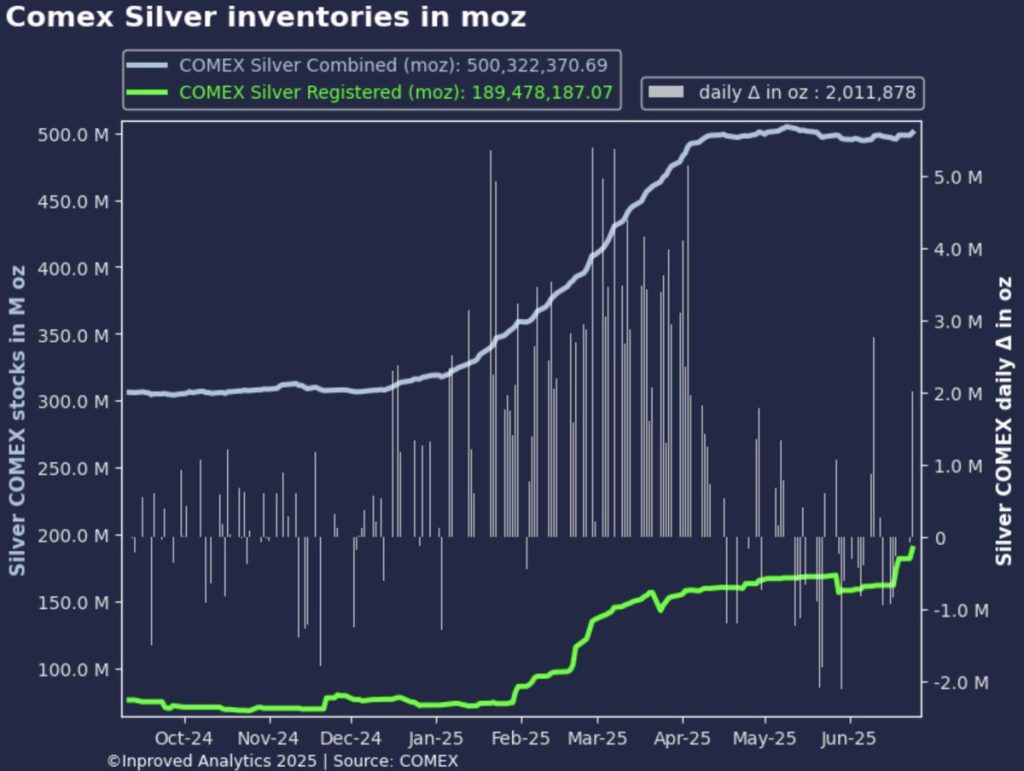

COMEX silver dynamics are confirming this trend. Around 25,222 July ’25 contracts remain open, inching toward delivery. When such a large volume is close to expiry, it often unleashes one of two phenomena: a deliberate squeeze as longs refuse to roll, or panic among shorts struggling to source physical silver.

We saw a glimpse of that yesterday, when silver leapt by $0.40 per ounce within minutes—a classic flash indicating delivery anxiety. While it might feel minor, in a market near delivery, that spike speaks volumes.

Further evidence comes from the registered silver category on COMEX, which has surged roughly 20% month-to-date, adding 31.4 million ounces to reach 189.5 million ounces. This registered status is key—it no longer means holding paper; it means the metal is prepped for delivery. According to Pascal, “Registered volume is the best gauge of actual physical commitment. This isn’t passive storage—it’s active intention.”

Vault activity continues to confirm this: COMEX vaults hit a five-week high of 500 million ounces, with another 2 million ounces (62 tonnes) added just this Tuesday. Far from rebalancing, these inflows reflect actual bullion accumulation in the U.S. hub, readying for delivery or investment.

With all eyes on delivery and technicals tightening, silver continues trading firm above $36.50. The next psychological and options barrier lies at $38/oz. As of the Sept ’25 contract, the 68.2% retracement band sits between $35.88–$37, and risk reversal skew has jumped to 3.1, up from 2.4—an unmistakable sign that out-of-the-money calls are in heavy demand. The call wall at $38 is now the focal point. Pascal notes, “When both premiums and skew tighten around the call barrier, a breakout becomes not just possible—but likely.”

When physical vault flows outpace speculative pressure, when registered metal rises and delivery anxiety drives sharp moves, it all amounts to one thing: structural tightness. Whether or not we label this a “#SilverSqueeze,” the mechanics are in place. Slippage below $36 becomes less believable; a push past $38 grows more plausible, perhaps imminent.

“This is supply-starved physical bullion intersecting with technical call demand. It won’t require a black swan—just delivery mechanics,” Pascal warns. “If you’re not ready by the $38 wall, you may be left priced out.”

If you’re in Singapore, or anywhere seeking a judicious entry into a potentially historic silver rally, there’s no better moment—and no better partner—than now. At InProved, our mobile app empowers you with:

Download the InProved app today and position yourself before the squeeze tightens and the call wall fractures.

Let us know if you’d like to discuss a silver strategy tailored to your portfolio or see how gold, silver, and platinum interplay under stress.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions