| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

Something rare — and potentially historic — is unfolding in the silver market.

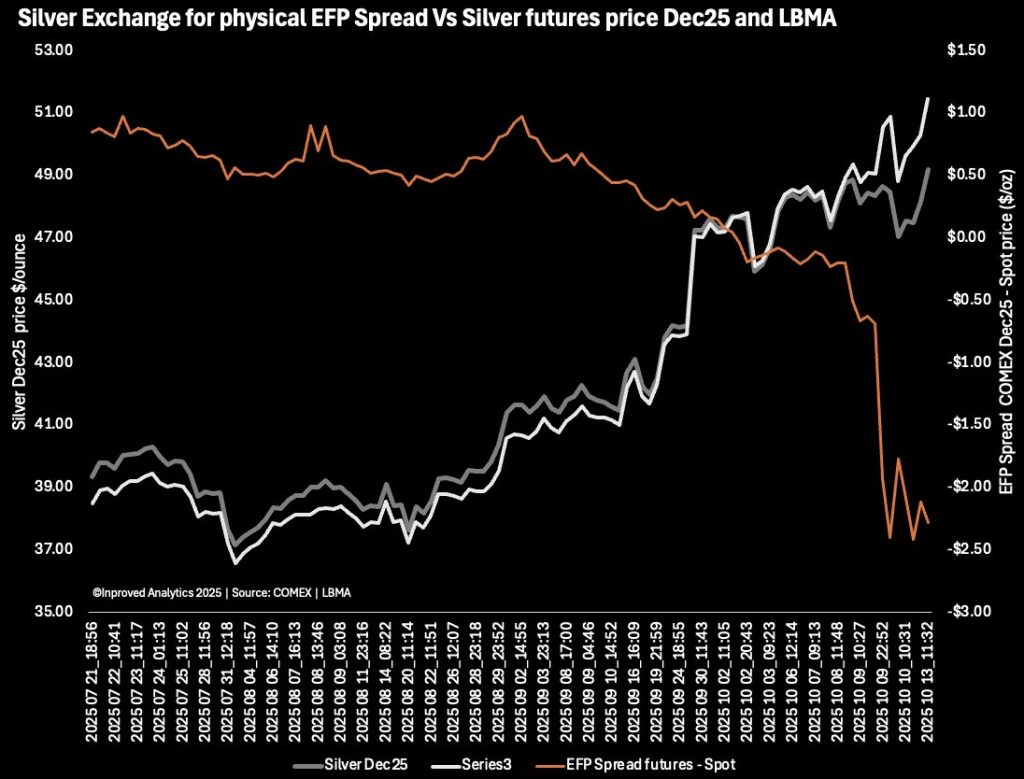

For the first time in two and a half years, silver in China is trading at a discount to LBMA spot, while in New York, the futures curve has collapsed into deep backwardation — a full -$2.80 per ounce between spot and the December 2025 contract. In plain language: the world’s paper silver is now cheaper than the metal itself, and that’s turning every ounce into a prize worth fighting for.

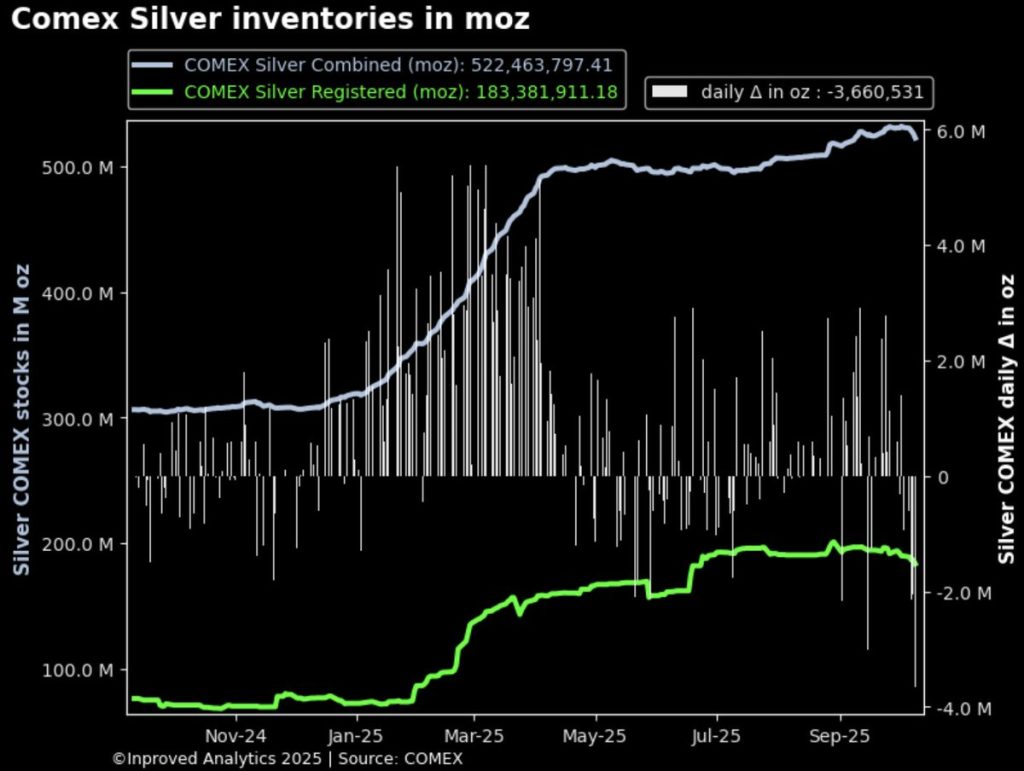

At the same time, COMEX vaults have lost more than 8.5 million ounces (264 tons) in just five days, one of the steepest inventory drops on record. The Shanghai Futures Exchange (SHFE) reported its own drawdown, with vaults down 21 tons week-to-date to 1,169 tons. For a market accustomed to steady inflows all year, this synchronized exodus from both Eastern and Western vaults marks a decisive break from equilibrium.

Backwardation isn’t new — but silver’s current structure is extreme. The Dec 2025 COMEX contract now trades at $48.56, while spot silver on the LBMA sits at $51.04, a gap of $2.48 per ounce or 4.85%. Even more telling, the inversion now extends all the way to 2027, meaning every forward contract out to two years trades below spot.

In normal times, futures trade above spot — a reflection of storage, financing, and insurance costs. When that relationship inverts, it means traders are desperate for metal now, willing to sell future delivery at a discount.

In Hugo Pascal’s words: “When futures go below spot, it’s not a trade — it’s a confession. The market’s saying, ‘we can’t wait.’”

This structure — where the curve turns inside out — has historically appeared during acute supply crises. In 1980, the Hunt Brothers’ accumulation triggered a similar inversion; in 2011, a milder backwardation preceded silver’s run to $49.80. But this time, it’s broader and deeper, encompassing nearly the entire forward strip.

The immediate cause is a physical arbitrage that’s reached its limits. Traders are selling London spot and buying COMEX December futures, trying to capture the $2–$3 gap. On paper, that’s easy money — sell high, buy low. In reality, it’s straining the system.

Each arbitrage requires actual metal to leave vaults. That’s why COMEX inventories have fallen 8.5 million ounces in five days, on top of a 5.75 million-ounce drawdown the week prior. As bars are shipped to meet delivery or collateral needs, available stock dwindles, and the curve steepens further.

It’s a feedback loop: the tighter the market, the more backwardated it becomes, and the more metal leaves the system to exploit it.

Shanghai’s outflows tell the same story. After months of inflows, SHFE vaults have lost 21 tons last week, marking the second consecutive week of drawdowns. The last time both COMEX and SHFE saw simultaneous outflows of this scale was March 2020, when refinery shutdowns paralyzed global flows and silver jumped 50% in two months.

As Pascal quipped on X this week: “RIP silver price mechanism. $51 spot, $48 futures, and the world still thinks it’s just a trade.”

What’s happening now is not a pricing anomaly; it’s the fracture of a hybrid system — half digital, half physical. Spot trades reflect real-world demand, especially in Asia where industrial users, refiners, and jewelry manufacturers compete for immediate supply. Futures, on the other hand, represent leverage and expectation, instruments used by funds and dealers to hedge exposure months or years ahead.

When those two systems diverge by nearly 5%, it exposes a truth the market prefers to ignore: the paper market is too big, and the metal too finite.

Perhaps the most telling signal of all: for the first time since 2023, Chinese silver is trading at a discount to LBMA, roughly -$0.21 per ounce (-0.43%).

At first glance, that seems bearish — why would Chinese buyers pay less? In reality, it reflects the mechanical delay of arbitrage. When global traders drain Western inventories to exploit London-COMEX spreads, less metal moves east. That temporary scarcity of liquidity — not lack of demand — narrows premiums. Historically, Chinese discounts have never lasted long. In early 2020 and mid-2022, each episode reversed within weeks as restocking surged.

Meanwhile, implied volatility for silver options has exploded, mirroring the stress. ETF and futures IVs have surged into the 90th percentile — comparable only to the 2020 pandemic dislocation.

When options premiums rise sharply, it means market makers are scrambling to price risk. For professionals, high IV translates into expensive insurance; for retail and conservative investors, it’s a reminder that volatility is the tax you pay when you’re late to the story.

Backwardation this steep — nearly -$2.8 per ounce — is a signal that trust in paper promises is eroding. Normally, arbitrage would close such a gap quickly. But to do that, traders need physical bars to deliver — and those bars are increasingly unavailable.

The system depends on confidence that futures can always be settled either in cash or physical. When settlement starts requiring physical movement on a large scale, that confidence wobbles. The deeper the backwardation, the closer the market gets to revealing who actually has metal — and who only has exposure.

It’s why, in 2020 and 2021, major banks quietly reduced their forward hedging books. As one former metals desk head put it then: “You don’t want to be short something you can’t find.”

The last episode of sustained multi-month backwardation in silver occurred in late 1998, when Warren Buffett’s Berkshire Hathaway quietly accumulated 129 million ounces. That inversion lasted six weeks and ended only after deliveries in London were partially delayed — a subtle sign that available bars had been drained.

Today’s setup is arguably larger in scale. The global futures complex holds over 900,000 active silver contracts, representing 4.5 billion ounces — nearly five times annual mine production. Against that, the COMEX registered category sits at roughly 200 million ounces, and the total available “free float” across LBMA and ETFs is shrinking as funds continue to absorb physical metal.

This means that at current leverage, only one in twenty paper ounces could be delivered if every holder asked for metal.

For risk-averse investors — the civil servants, professionals, or retirees who view metals as wealth anchors rather than trades — this kind of dislocation carries three lessons:

1. Price volatility is not risk; it’s revelation. When futures collapse below spot, it’s the system showing you where true value lies. Backwardation is less about panic and more about discovery — it reveals that immediate ownership is worth more than deferred promises.

2. Physical trumps paper, always. Whether vaults are full or empty on paper, what matters is accessibility. The current $2–3 backwardation shows what buyers are willing to pay to secure real delivery. For conservative holders, that’s the strongest argument for allocated, numbered bullion rather than derivative exposure.

3. The entry window is narrow. Every past backwardation in silver — 1980, 2011, 2020 — was followed by price normalization at higher levels. Once arbitrage flows reverse and inventories stabilize, the curve flattens — but spot prices rarely return to pre-inversion levels. History implies that today’s $47–$51 range could reset higher once balance returns.

For investors in Singapore, Hong Kong, or other stable jurisdictions, the strategy remains consistent:

As Pascal often writes: “Silver doesn’t reward speed. It rewards conviction — and the quiet hands who don’t flinch when the curve goes upside down.”

Silver’s backwardation isn’t just a quirk of contracts — it’s a referendum on trust. For years, the paper market has priced abundance. Now, with vaults draining and futures collapsing below spot, that illusion is cracking.

The numbers tell the story:

1. COMEX vaults down 8.5 million ounces in five days

2. Shanghai vaults down 21 tons week-to-date

3. Dec 2025 futures $2.8 below spot

4. China trading silver at a discount for the first time in 2½ years

These aren’t random fluctuations — they’re stress points in a system that’s over-leveraged on paper and understocked in reality.

For conservative investors, that’s not a signal to speculate. It’s a signal to fortify. The next few months may redefine how silver is priced — and who controls it.

As Pascal concludes: “When silver runs backward, the clock of complacency runs out. The market isn’t breaking — it’s resetting, back to real metal, real value, and real possession.”

Singapore remains one of the world’s most efficient, tax-free hubs for buying and storing physical bullion. Visit InProved.com to access institutional-grade pricing and allocate your silver directly — before the paper market’s promises get tested.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions