| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

It was the kind of week that makes traders, analysts, and long-time precious metals watchers pause. Silver, often overshadowed by gold’s shine, roared onto center stage, smoldering with signs of a powerful shift driven by vault dynamics, options fires, futures flows, and macro pressures. To call it “a market movement” would barely capture its intensity—this was a multi-front breakout in motion. And as tensions around Liberation Day on the horizon, a copper supply squeeze status, and rising safe-haven demand converge, silver may well be entering its breakout chapter.

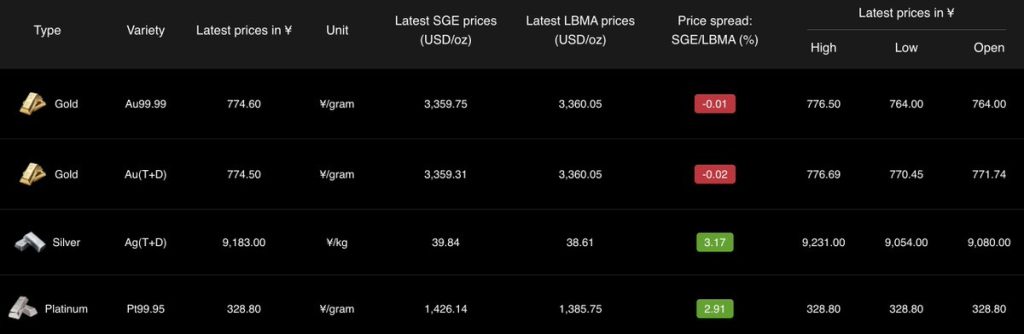

By week’s end silver stood at $39.84/oz, a 3.2% premium to LBMA benchmarks—a bold statement in bullion terms. Gone were the days when marginal premiums held little currency. Now a 3% spread reflects a real push underneath, a tightening of immediate availability. Every tick above benchmark asks the global market to take notice… and to pay up.

The magic of nearly $40 wasn’t just psychological. Around this price, physical flows lined up with derivative positioning—a convergence that often sets the stage for something far larger. Vaults drain, calls ignite, and sentiment swings in unison. As Pascal notes, “When premiums tighten and spot trades near round-number resistance, it rarely subsides—it usually fractures.”

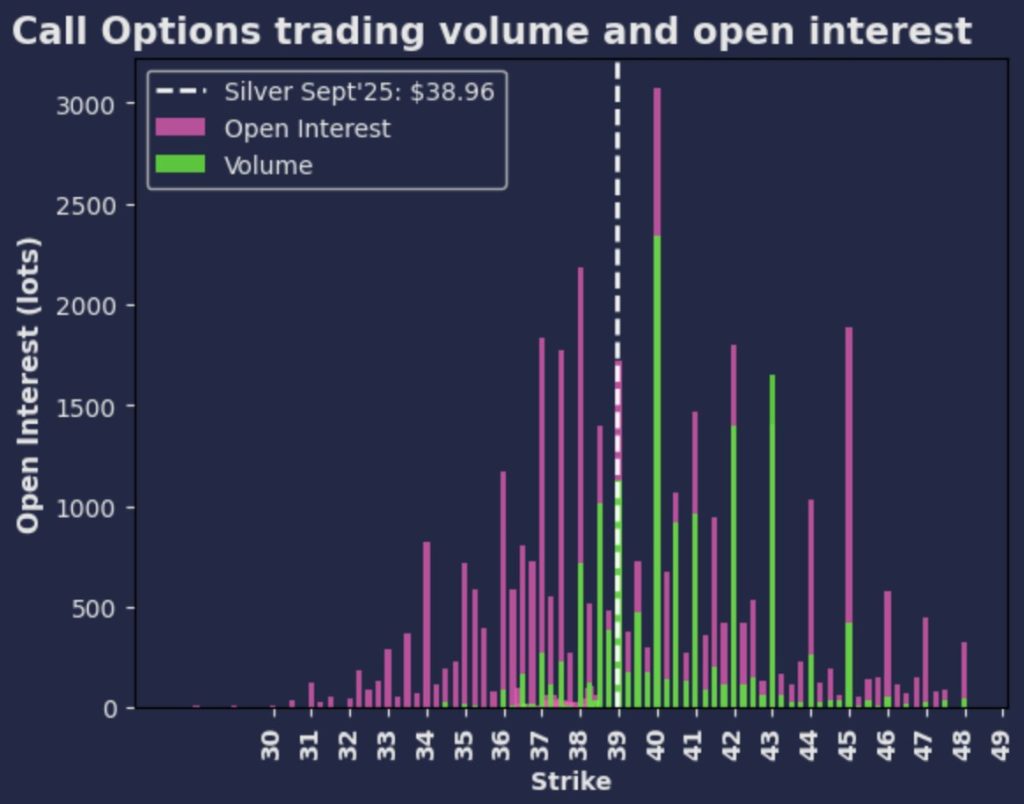

Options are the quiet stagehands of any major breakout. Last Friday, the Sept ’25 COMEX silver $40 call option was the most traded strike, confirming that traders are literally paying for tickets—to a silver breakout.

What’s more, the 25-delta risk reversal skew stood at 4.7. At this level, calls cost significantly more than puts, signaling aggressive one-sided sentiment. Call buyers are betting big on upside, with premiums reflecting not just chance, but conviction. In Pascal’s words, “A skew near 5 becomes a statement: buyers expect meaningful upside, and are willing to pay extra for it.”

Even in an inflationary environment, vault holdings matter profoundly. On Thursday, COMEX silver vaults dropped to a 5-week low of 495 million ounces, down by 616,000 ounces (19 tonnes). At first glance this looks bearish—less metal on the books. But think deeper: it’s likely being physically moved.

This drop often reflects one of two things: actual delivery out the door, or movement into the Exchange for Physical (EFP) pipeline, prepping for relocation—often toward Asia. The key is that vaults are emptying not due to disinterest, but due to action. These are not casual investors—they’re buyers or repositioners.

Meanwhile, across the Pacific, Shanghai’s silver vaults recorded their first weekly outflow in seven weeks, falling by 43 tonnes to 1,297 tonnes. But this isn’t a scramble—it’s a redirection. Asia is shifting the metal from static storage into circulation, signaling that everything from industrial restocking to speculative positioning is in gear.

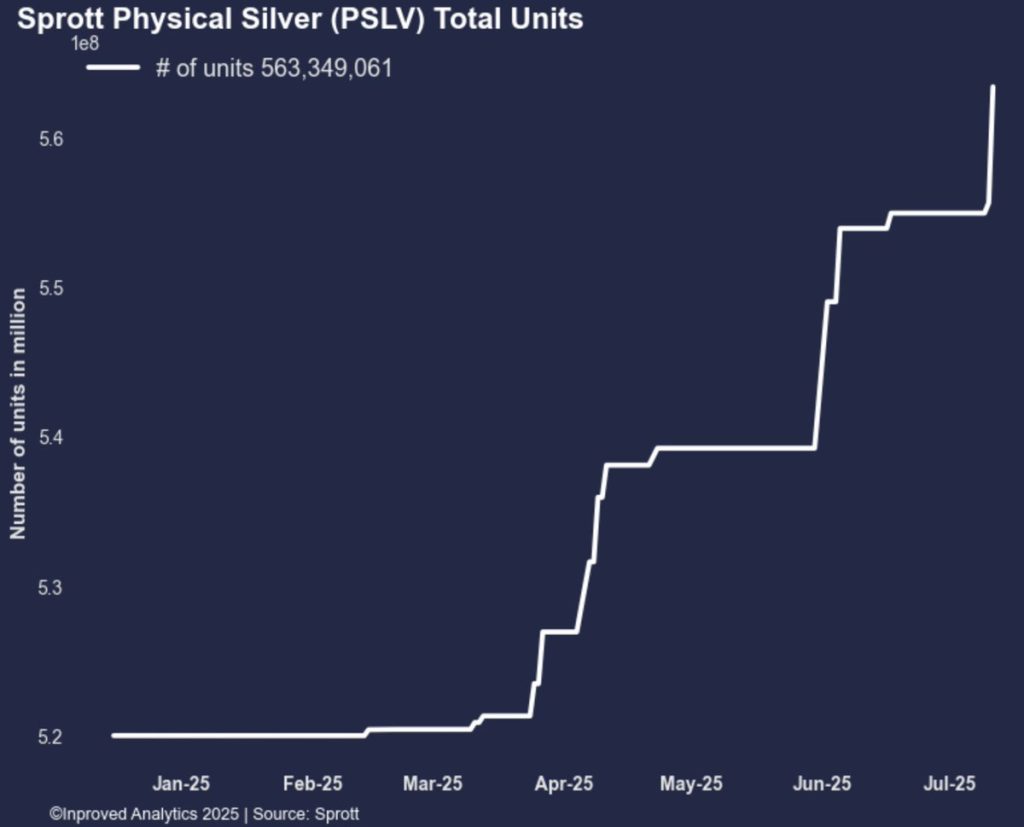

The ETF market, often the canary in financial coal mines, chimed in. The Sprott Physical Silver Trust (PSLV) added 8.45 million units—around 2.9 million ounces in a single week—to reach 563.3 million ounces under custody. Institutional buyers, advisors, and retail investors are voting with capital, reinforcing that silver is no mere speculative play—it’s a useful hedge with monetary value.

Of course, ETF inflows don’t guarantee a breakout by themselves. But paired with vault activity and options flows, they form an ecosystem: physical flows feed derivatives, inflows communicate conviction, and together they provide the momentum for what comes next.

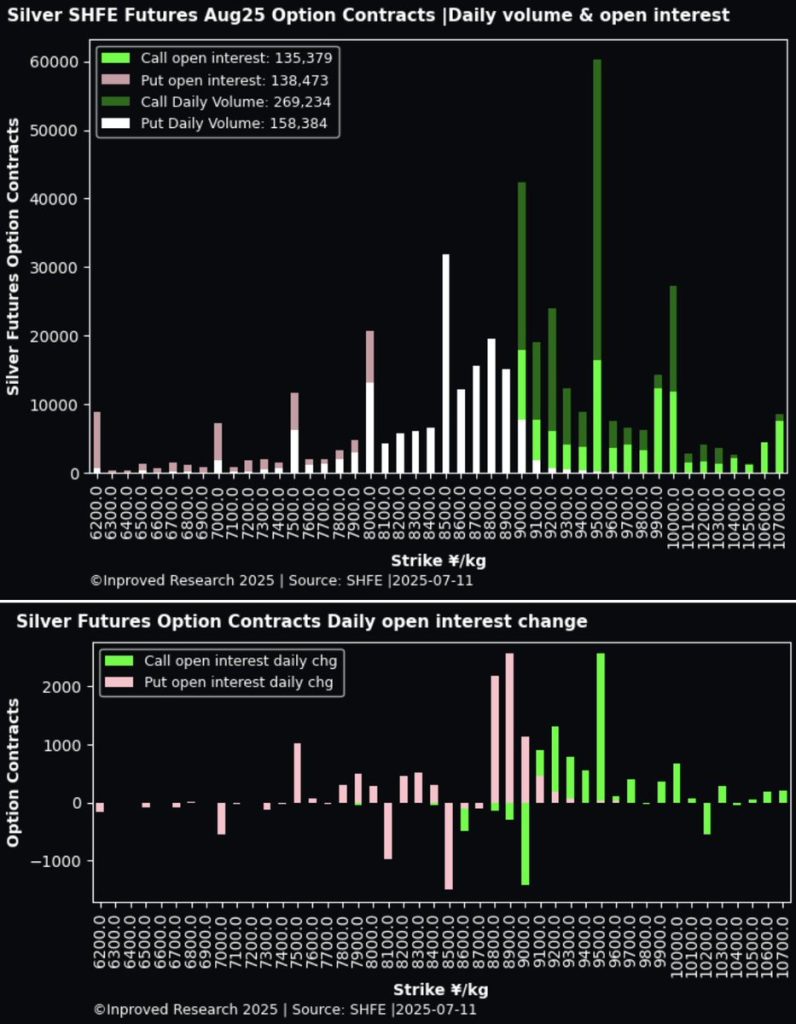

China’s Shanghai Futures Exchange (SHFE) didn’t stay on the sidelines. Silver futures rose 1.74% on July 4, closing at ¥9,040/kg, or $39.20/oz equivalent. That’s nearly where COMEX stands—but futures traders aim higher. The ¥9,500/kg call, equivalent to $41.25/oz COMEX, was the most active strike. The put/call volume ratio sits at 0.59, while the P/C open interest ratio is 1.02—both suggest deeper bullish appetite.

What’s remarkable is that futures trading volume hit its highest in four weeks, and open interest surged 4.5% week-over-week, reaching 957,000 contracts (461 million ounces). That’s money positioning for $41+ in Asia, backing the thesis that silver is on a collective upward path.

Markets don’t move in isolation. On the macro front, two major pulses synchronized with silver’s movement:

1. Liberation Day Heightened Tensions:

As July approaches, concerns around US–Iran and broader Middle East geopolitics are cropping up. Liberation Day is often accompanied by volatility not just in oil, but in defense, shipping, and metals markets. Silver, with its dual role as currency and industry metal, reflects both pricing forces.

2. Copper Supply Squeeze:

Copper recently entered its own squeeze cycle—supply bottlenecks triggered futures premiums and realized price spikes. If silver reins in parallel fashion, it would confirm the structural risk that physical scarcity, not just speculative fervor, is at play.

Pascal frames it: “Copper’s squeeze showed us the delivery mechanics in action. Silver is now following suit—but with the added volatility and hedge demand that comes during geopolitical tension. It’s a multi-vector move.”

Act I – Premium Price & Momentum

$39.84/oz spot price with strong premium shows the demand foundation has taken hold.

Act II – Physical Rebalancing & Allocation

COMEX vault lows and Shanghai outflows show metal being distributed to where demand actually is—options, delivery, industrial use.

Act III – Call Positioning & Skew Explosion

Risk reversal at 4.7 and top call strikes show a coordinated bet on >$40, not just noise hedging.

Act IV – Macro Pressure & Cross-Market Echoes

Geopolitical tension and copper constraints confirm a broader wave, one that rarely stops mid-course.

Silver’s talent lies in volatility and leverage. If all vectors are aligned—vaults, ETFs, skew, macro—the path to $41.25 or $43 becomes rational, not speculative. A failure to crack above $40 might test downside slightly—$38 area test—but the structure suggests strength persists, not to mention a real squeeze.

Pascal’s baseline: “If physical continues to tighten, Skew stays elevated, and macro stays charged, $43 becomes a realistic target—especially as this is summer and active positioning is underway.”

On the other hand, a calm geopolitical weekend, Chinese clearance of metal, or ETF slowdown could see a $38–$39 consolidation—not a collapse, but a recalibration before the next move.

This is more than a market story—it’s a wealth story. Silver isn’t just a trade; it’s a portfolio anchor. You’re not simply betting on numbers—you’re anchoring in scarce supply, global demand, and cross-border flows. If you’re looking to:

At InProved, our mission is to make these powerful structural shifts accessible and digestible. You get:

And all wrapped into an intuitive mobile app, where you can buy physical bullion at institutional LBMA rates, combine it with options tools, and vault securely—right from Singapore or anywhere else.

Expect that next week will test $40. Whether it holds or not depends on how these vector elements align. Versatility may be your greatest ally: allocate physical, use options for upside, and keep tabs on vault flows and ETF movements. Because this isn’t a single-move market—it’s a series of structural moves now aligning into a real breakout.

Download the InProved app today to capture this opportunity before it unfolds further.

And if you’re ready to build the strategy—physical, options, and structural—designed for $40+ next wave, let’s talk.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions