| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

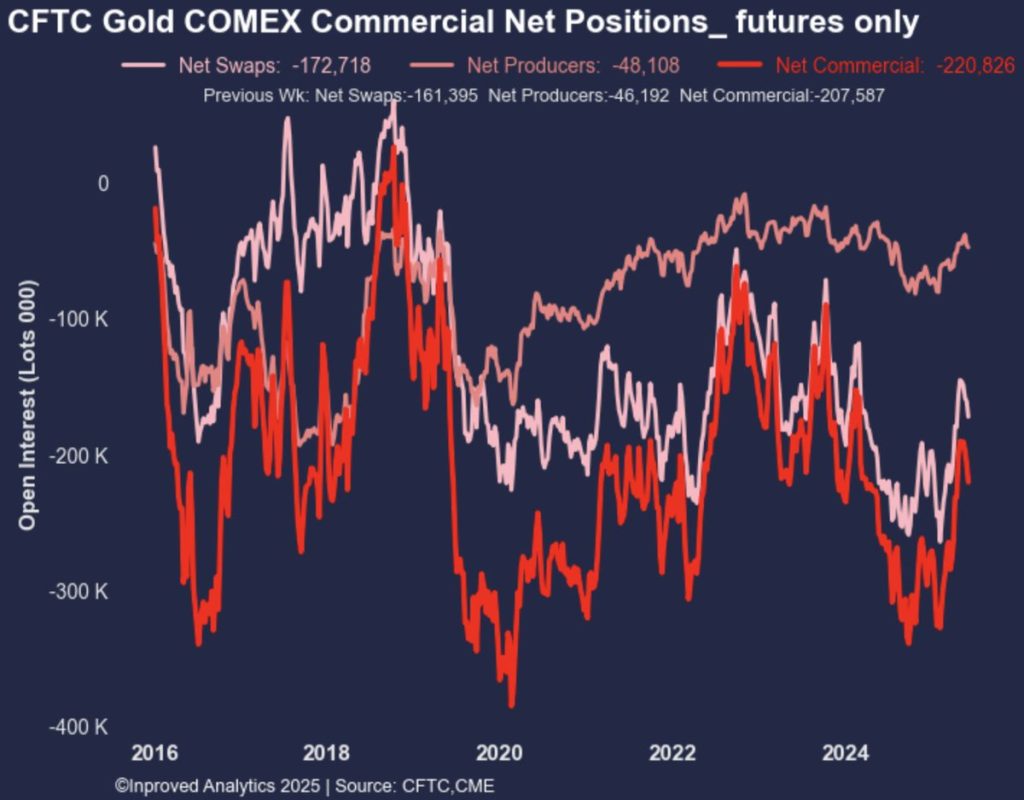

Gold’s recent price appreciation—up 1.5% since the last COT report—has lit a fresh fire under speculative traders. According to Hugo Pascal, one of the most followed voices in the bullion world, funds have bolstered their net long positions by 11.5%, adding 12,766 contracts and signaling a renewed appetite for upside exposure. At the same time, swap dealers have expanded their net short stance by an additional 11,300 contracts, a significant 7% increase, which highlights their pivotal role in feeding this speculative demand with liquidity.

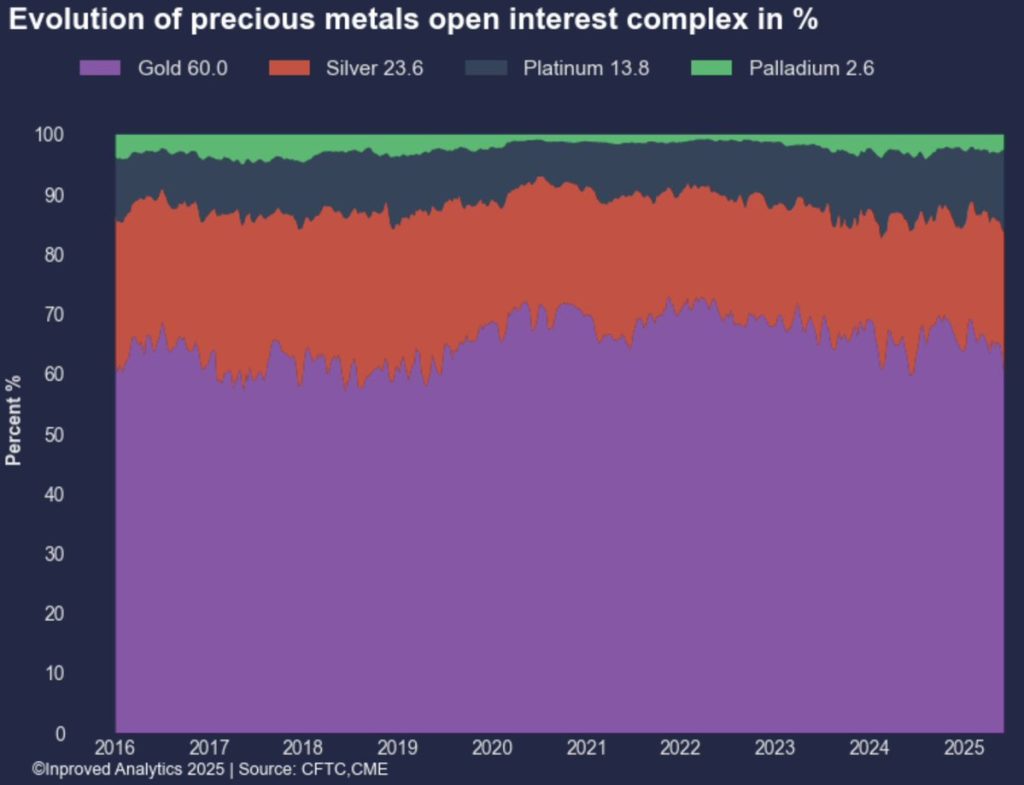

Perhaps the more intriguing development is the subtle rebalancing within the precious metals complex itself. Gold’s dominance, long unrivaled, has slipped to a 12-month low of 60% of total open interest, while silver surged to a yearly high of 24%. This reallocation reflects a growing recognition of silver’s dual role—not only as a monetary hedge but also as an industrial metal in high demand amid global electrification and green energy trends.

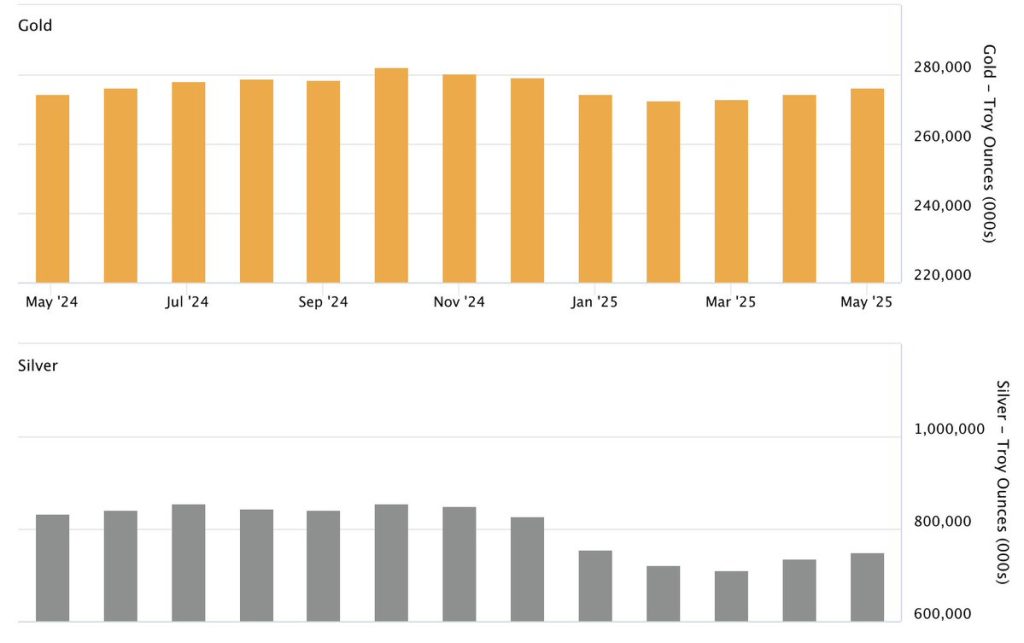

The London Bullion Market Association (LBMA) recorded inventory gains for both gold and silver at the end of May. Gold holdings rose by 0.73% to 8,598 tonnes, while silver jumped 2.2% to 23,367 tonnes. More revealing, however, is how this silver is being locked up—ETF holdings now represent 78.3% of silver in vaults, an increase from 77.8% the prior month. As Hugo Pascal points out, this trend underscores how both institutional and retail players are embracing ETFs as proxies for physical ownership.

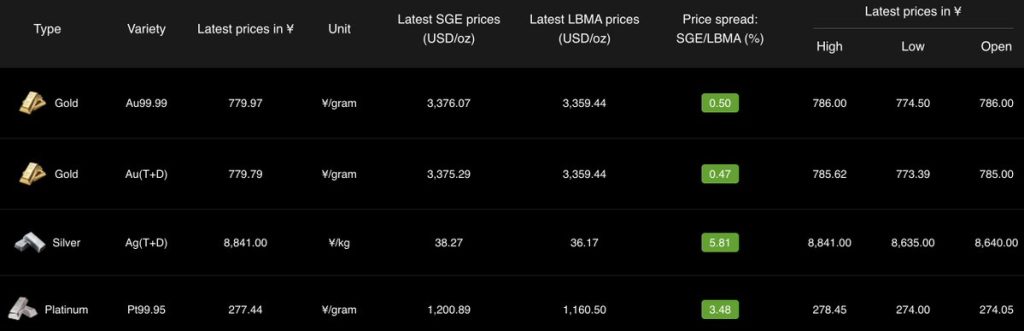

Across the globe, physical demand continues to show in premiums. On June 6, Shanghai prices for gold closed at a 0.5% premium over LBMA rates, while silver showed a sharp 5.80% premium and platinum followed with 3.55%. These premiums reflect the localized demand pressure in China, where buyers are turning increasingly to bullion amid economic uncertainties, yuan depreciation, and geopolitical considerations.

Perhaps the most significant yet underreported trend is the return of central banks to gold markets. As Hugo notes, a growing number of these purchases are going undeclared—a strategy not uncommon in times of monetary flux. These hidden flows suggest official accumulation is likely being used as a hedge against macro risk, currency volatility, and inflation persistence.

June 2025 is shaping up to be a turning point for precious metals markets. Speculative flows, strategic ETF positioning, widening regional premiums, and quiet central bank purchases are all converging into a narrative that speaks of systemic recalibration. This is not merely a rally—it’s a repositioning.

For investors, wealth managers, and bullion enthusiasts, this moment demands action and insight. At InProved.com, we offer access to some of the lowest LBMA bullion prices in the world, powered by real-time market intelligence and the kind of institutional-grade support inspired by analysts like Hugo Pascal.

Sign up now at InProved.com and start protecting and growing your wealth with metals that move the world.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions