| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

In the ever-volatile world of commodities, silver appears to be stepping into the limelight with renewed conviction. With prices climbing 4% since the previous Commitment of Traders (COT) report, and speculative funds aggressively boosting their long positions, the precious metal is moving with both tactical urgency and structural strength. Hugo Pascal, CIO of InProved and a widely regarded thought leader in the bullion space, sums it up bluntly: “The silver trade is heating up—and this time, it’s not just paper demand. Physical and speculative forces are finally in sync.”

According to the latest COT data, managed money increased net-long bets by 35%, adding 11,600 contracts to reach a total of 44,900 contracts. This move underscores the deepening conviction among hedge funds and asset managers that silver’s upside potential is far from exhausted.

At the same time, swap dealers—typically representing large banks and institutions—have taken the other side of the trade, expanding their net-short exposure by 17% to -45,700 contracts. This dynamic, where institutional hedgers lean against speculators, is often a key ingredient in explosive rallies when momentum persists.

Pascal notes, “When swap dealers feed into speculative flows, it’s usually because the positioning on the other side is becoming too aggressive to ignore. But this doesn’t mean they’re calling the top—just that volatility is about to get louder.”

Physically, the trend is equally compelling. In Shanghai, vaults have continued their three-week accumulation streak, now totaling 1,118 tons or 36 million ounces—a 231-ton rise over the last month. This marks the highest level in two months, reflecting renewed physical demand, particularly from traders and manufacturers preparing for higher prices.

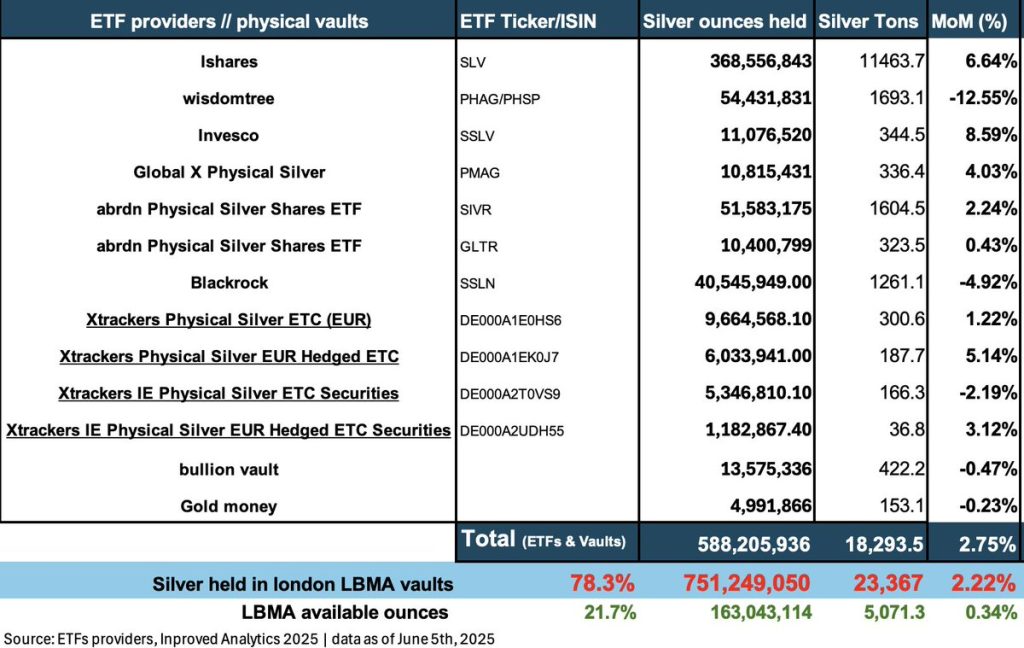

Meanwhile, in London, vault data released by the LBMA confirms a broader trend of accumulation and strategic allocation. Silver holdings rose 2.22% MoM to 23,367 tons, with available silver rising marginally by 0.34% to 5,071 tons. But the more telling figure lies in ETF behavior: the amount of silver allocated to ETFs rose to 78.3%, up from 77.8% the month before, fueled by a 2.75% rise in ETF inflows.

“This marks a turning point,” said Pascal. “ETF investors tend to lag market sentiment slightly. But when they move, it often confirms that physical allocation is more than just a trade—it’s a conviction.”

The derivatives market echoes the sentiment seen in physical and futures flows. The CVOL index for silver has surged to a 6-week high at 35.06, and at-the-money implied volatility currently stands at 32.2%. But perhaps most notable is the behavior of skew—a measure of the imbalance between call and put options.

The 25-delta risk reversal skew for the July 2025 silver contract has jumped to 4, indicating a strong preference for out-of-the-money call options, a classic signal that traders are positioning for a breakout move.

On the Shanghai Futures Exchange (SHFE), Chinese silver traders have been especially aggressive. The most active strike remains the ¥9000/kg call, roughly equivalent to $39/oz COMEX, with 107,000 contracts traded, dwarfing the open interest of 28,000. The put/call volume ratio at 0.56 further confirms the one-sided nature of bullish bets.

Pascal commented, “When the most traded options are calls with double or triple the volume of OI, it’s clear traders are expecting fireworks. And given the build-up in open interest to 1 million contracts, the fuel for a move is already there.”

For diversified investors and bullion dealers, these developments should prompt immediate reassessment of exposure and hedging strategies. Prices may be higher, but so is conviction. With both speculative capital and physical demand flowing in from opposite ends of the world, and the options market pricing in significant upside potential, the silver market could be entering a new volatility regime.

Pascal offers a parting thought: “This is no longer a quiet rally. The silver complex is active at all fronts—vaults, futures, options. Everyone’s positioning, and some are clearly betting big on $39. Whether it hits or not, this is a trader’s environment and a bullion holder’s time to review their game plan.”

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions