| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

Markets have a way of reminding investors that confidence can turn faster than any algorithm can hedge. Over the past week, gold and silver have faced a broad selloff across paper markets — gold sliding nearly 8% since last Friday, silver off an even sharper 12% — yet, in Shanghai, the story is different. Beneath the noise of leveraged liquidation, China’s physical demand hasn’t blinked.

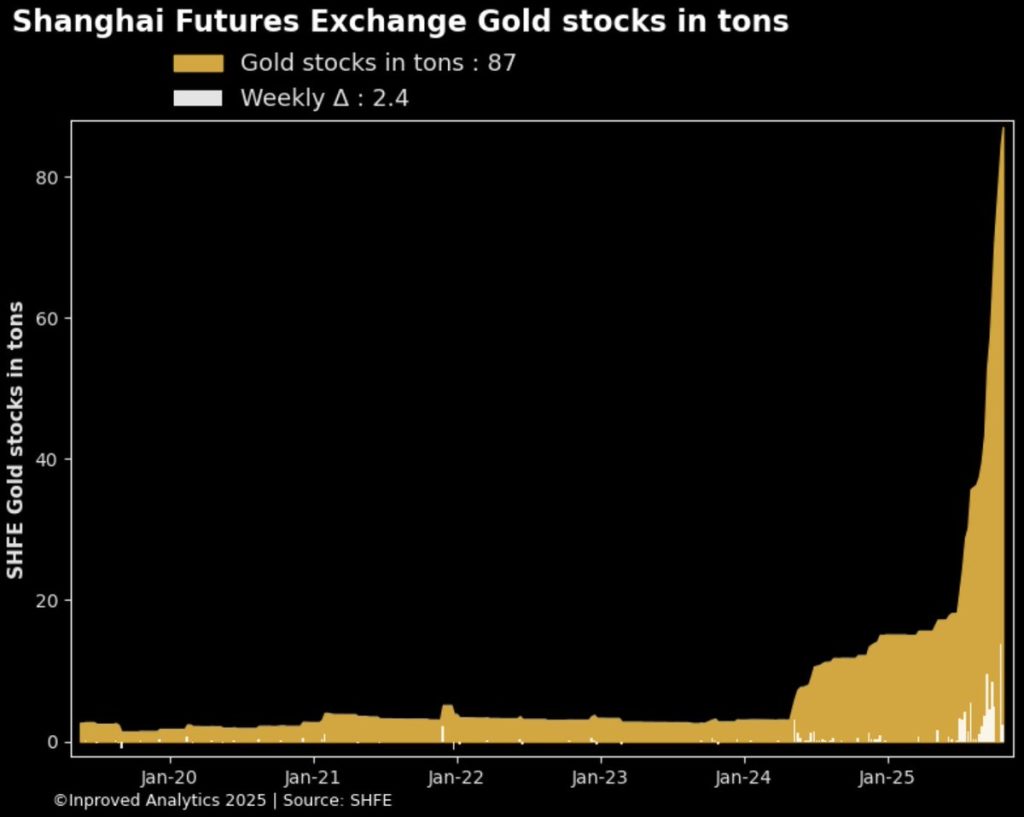

As of Friday, Shanghai’s gold vaults ended the week up another 2.4 tons, bringing total holdings to 87 tons (2.8 million ounces) — a fresh record in a month already characterized by relentless inflows. For a market supposedly “in retreat,” the vault data says otherwise: the real buyers never left.

In the West, this correction has been dominated by ETF outflows and futures-based selling. COMEX and OTC positions have thinned rapidly as funds trimmed exposure into volatility. On the screens, that looks like weakness — a $4,094 per ounce print for gold, trading marginally below LBMA spot by 0.1%.

But step back, and it’s clear that this decline lives almost entirely in the synthetic market. The physical response, especially in China, shows something else: accumulation. When traders offload contracts, and retail in the East buys deliverable metal, it’s a transfer of risk from leverage to custody — from those who rent gold to those who own it.

As Hugo Pascal commented on Friday’s close: “Every ounce of paper sold is an ounce someone wants to hold. You can’t short what’s already locked in a vault.”

The 2.4-ton weekly inflow into Shanghai’s vaults is not just a technical number — it represents steady institutional stocking even as price volatility ripples globally. At 87 tons, the vault system has now absorbed nearly 30 tons in October alone, the largest monthly inflow since official record-keeping began.

This pattern — physical inflows during paper corrections — has appeared before. In June 2021, gold futures corrected 9%, but Shanghai vaults gained 6.7 tons. In October 2022, another similar divergence occurred, and within six weeks, gold had reclaimed its losses and added another 11%. Each time, the script reads the same: Western liquidation meets Eastern accumulation, and the physical market quietly resets the base for the next rally.

To understand the dynamics, look at how the gold market bifurcates between paper and physical.

Paper gold — futures, ETFs, and forwards — dominates headline pricing but depends on leverage and liquidity. When volatility spikes, holders sell to protect margin, not because they’ve lost faith in the metal’s long-term role.

Physical gold — bars and allocated holdings — moves on trust, not ticker screens. Once it enters vaults like those in Shanghai, Singapore, or Zurich, it tends to stay there, immune to intraday swings.

This divergence between perception and possession is what fuels moments like this. The last time paper gold sold off 8% in a single week while physical inflows hit a record was April 2020, right before the largest two-month rally in a decade.

The hashtag that’s been making rounds — “#preciousmetals paper sales will only accelerate the rush to physical” — isn’t just a slogan; it captures the logic of supply stress. When gold futures fall and premiums tighten, long-term buyers step in, creating delivery pressure downstream.

It’s what Hugo Pascal refers to as “the elasticity of disbelief” — the point at which people realize that each dip in price simply transfers ownership from speculators to strategic accumulators.

In China’s case, that transfer is measurable. Vault holdings now exceed 87 tons, premiums have stabilized, and trading volume in the AU9999 contract remains well above its 5-year mean. None of this aligns with panic — it reflects patience with conviction.

In Shanghai, traders often describe these phases as “the breathing weeks” — periods where the market exhales speculative froth but inhales physical ownership. The fact that vaults are still building inventory during an 8% drawdown underscores the metal’s credibility as a store of resilience rather than momentum.

In the same way that central banks used 2013’s selloff to double their gold reserves, today’s correction may offer long-term allocators an opportunity to build at discount levels before Western investment sentiment rotates back toward inflation hedging.

For conservative investors — those who prioritize stability over speculation — this episode delivers three lessons:

1. Physical ownership remains the only non-rehypothecated exposure.

ETF and futures-based positions will always mirror paper liquidity. Allocated holdings — especially in jurisdictions like Singapore — remain fully separated from leverage and counterparty risk.

2. Discounts are opportunities, not warnings.

When gold trades slightly below LBMA, as it does now at –0.1%, it indicates short-term arbitrage or capital rotation, not structural weakness. Historically, sub-1% discounts in Asian markets have been followed by 3-month appreciation periods averaging +6–8%.

3. Macro conditions favor accumulation.

Volatility is rising, equities are overstretched, and inflation remains sticky. The combination is ideal for incremental, disciplined buying, not retreat.

For professionals, civil servants, and retirees alike, this is a phase for averaging in quietly, not chasing noise.

In every major gold cycle over the past two decades, paper-liquidation phases have coincided with accumulation in Asia:

Now, October 2025 is showing the same script. The price dip is the headline. The real story is what the vault data says: metal moving east, paper moving out.

This week’s numbers don’t describe panic. They describe preparation. Gold is down 8%, silver 12%, and volatility is spiking — but Shanghai’s vaults are fuller than ever.

The 87-ton milestone is not just a record, it’s a statement: physical accumulation continues regardless of speculative noise. As Hugo Pascal summed it up in his Friday dispatch:

“The screen says red, the vault says ready. And the vault always wins in the end.”

For conservative investors, the takeaway is simple. Ignore the panic in paper. Watch the flow in physical.

When vaults keep filling during a selloff, it means the market is telling you something it won’t say out loud — that the real money is already buying again.

Singapore remains one of the most trusted and tax-efficient jurisdictions for gold procurement and storage — LBMA-linked pricing, zero capital gains, and institutional-grade custody. Visit InProved.com to secure your portfolio with the same discipline driving the world’s strongest gold markets.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions