| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

Some stories in the bullion world unfold in silence—quiet shifts in inventory, subtle moves in premiums, and the occasional tremor in options markets. But every so often, you get the loud ones. The weeks when the data is screaming, the vaults are heaving, and the spread between East and West tells you something big is underway.

This week is one of those moments, and silver is at the heart of it.

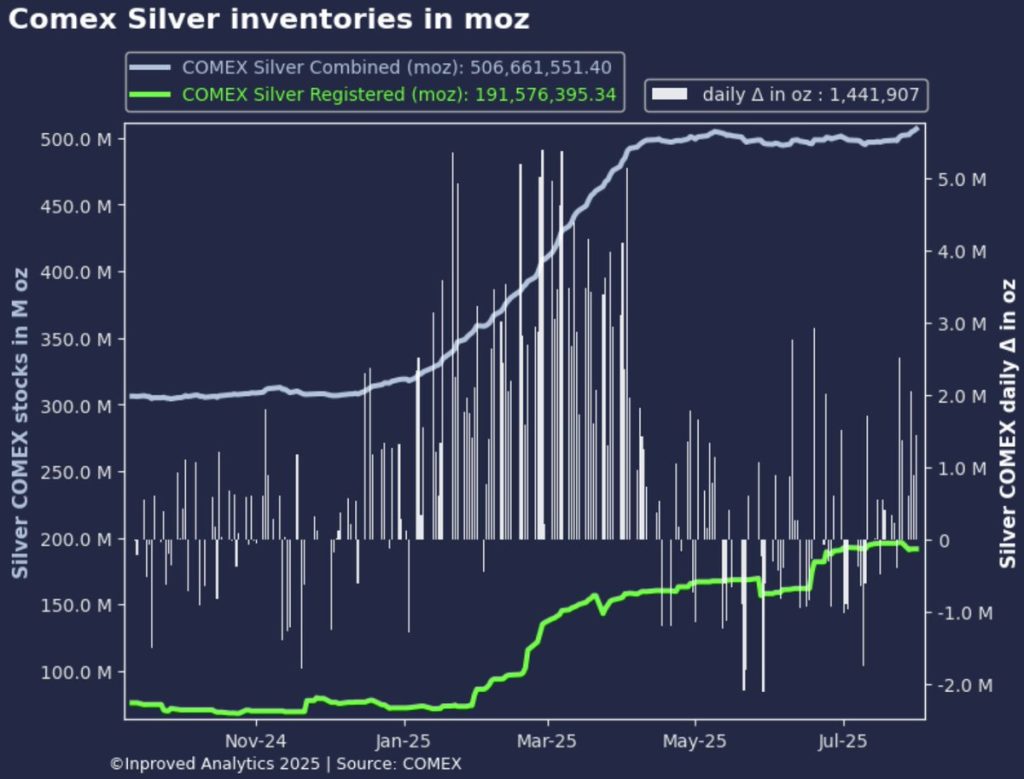

As of the end of July, silver stocks in COMEX vaults have surged to an all-time high, now sitting at a staggering 506.7 million ounces. That’s not just a statistic—it’s a signal. On Thursday alone, 45 tons of silver were added, following 62 tons (2 million ounces) earlier in the week. In two days, COMEX vaults swallowed up more physical silver than some countries import in a year.

The U.S.-based COMEX vaults, long considered the barometer for institutional interest in deliverable silver, haven’t seen this level of accumulation since the post-COVID supply chain squeeze. And now, they’ve blown past that peak.

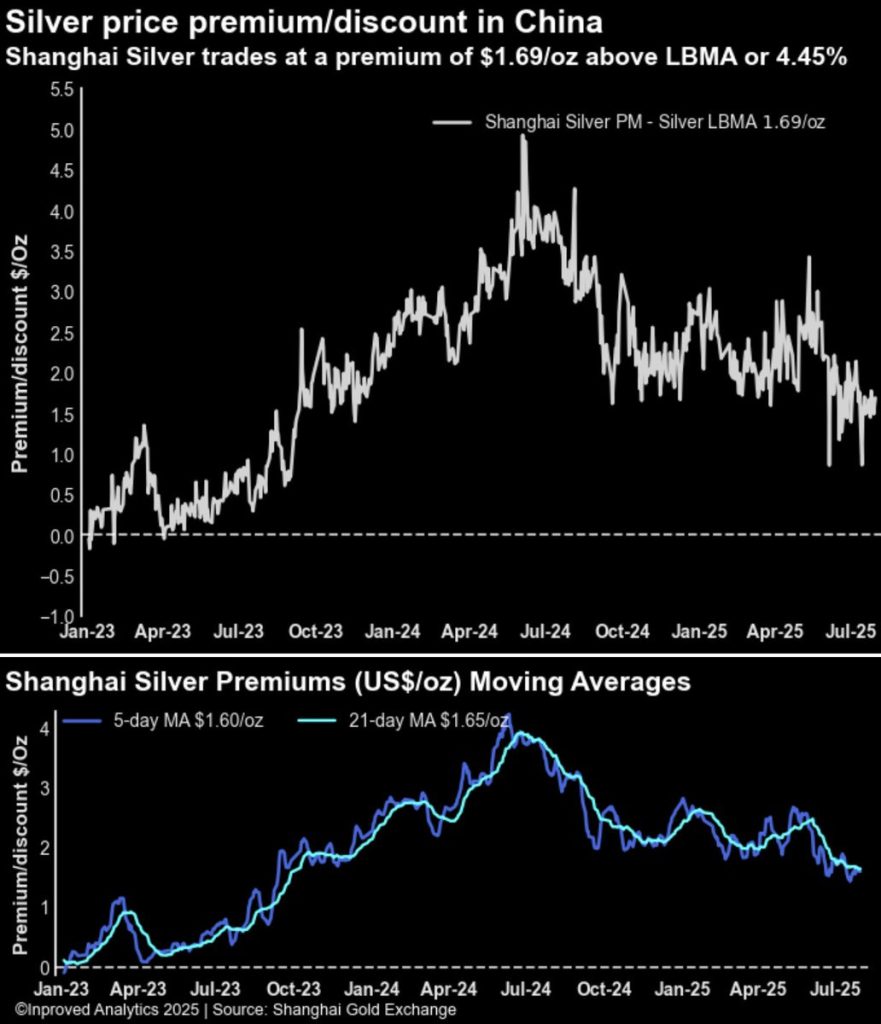

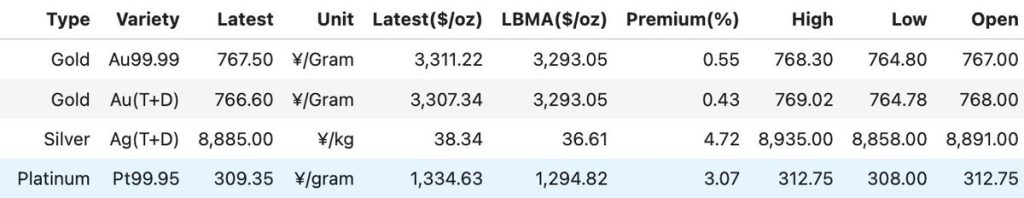

At the same time, silver premiums in China remain robust, holding at 4.45% above the LBMA benchmark—roughly $1.69 per ounce—even as more supply makes its way to New York. This tells us something very specific: the East and West are no longer competing for silver, they’re both accumulating.

“Silver is no longer just a shadow of gold,” notes Hugo Pascal, Chief Investment Officer at InProved Metals. “It’s walking its own path now. Between the industrial tailwinds, institutional rotation, and the beginning of a fresh call-option cycle, silver is being treated as a primary asset—not a substitute.”

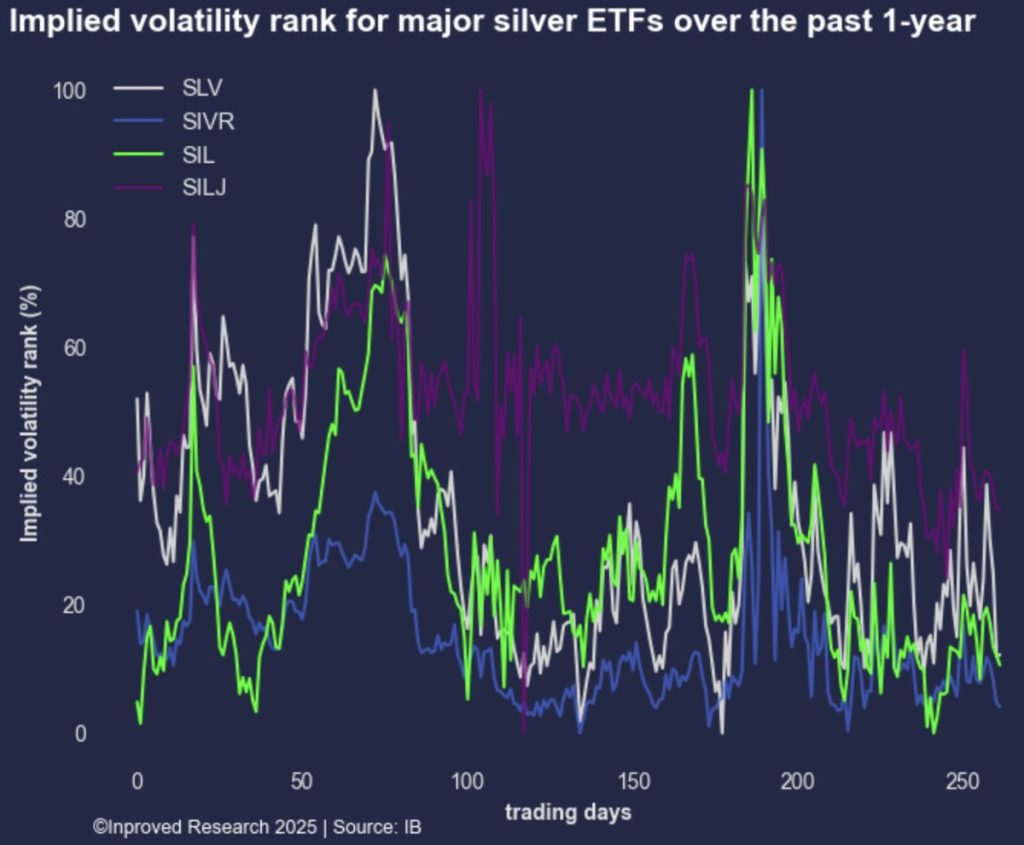

The other major piece of this puzzle? Derivatives. While the vaults tell us where physical silver is going, the options market tells us what people expect.

And the message this week is loud and clear: bullish bets are getting cheaper.

Implied volatility (IV) for the biggest silver ETFs—SLV, SIVR, and SIL—has dropped into remarkably low territory. Their IV rank sits below 15%, meaning option premiums are inexpensive relative to historical norms. In simpler terms: now is a cheap time to bet on a breakout.

For seasoned traders, that means long calls. For hedgers, long puts to lock in gains. But for institutions? This kind of setup often becomes the trigger for long call spreads or synthetic longs—betting that silver can not only hold the $38 level but push through $40 or even $42 by Q4.

On the spot market, silver is now trading at $38.88 per ounce, putting it 4.6% above LBMA’s benchmark and one rally away from reclaiming its recent highs. What’s more, the platinum-silver divergence appears to be moderating, as platinum trades at $1,380/oz or +2.7%, suggesting a broader precious metals rebound could be underway.

Meanwhile, back in Shanghai, the bullishness isn’t isolated to silver. Gold vaults at the Shanghai Gold Exchange have hit a new high, now holding 35.74 tons, a +18.15% week-on-week gain, and an eye-popping +136% increase year-to-date.

That’s a staggering 20.6 tons added since January—and all of it done with gold trading just below its all-time high.

“This is coordinated accumulation,” Hugo Pascal adds. “When you see physical gold and silver flowing into vaults in tandem while the derivatives market remains quiet, it’s like the calm before a thunderstorm.”

The global macro backdrop has done nothing to cool the bullish embers. Geopolitical tensions in the Middle East, whispers of capital controls in Asia, and signs of central bank intervention in key currency pairs have kept safe-haven demand alive, even if not loudly expressed.

But silver’s story isn’t just about macro—it’s about microstructure. The tightness of the market. The need for deliverables. The shift in vault behavior.

A quick glance at COMEX’s recent inventory shifts paints this clearly: silver isn’t just flowing into eligible categories—it’s being registered. Assigned. Ready for delivery.

That’s a big deal.

In parallel, the EFP (Exchange for Physical) market is showing signs of stress relief. EFP spreads have narrowed recently, but remain structurally positive, suggesting that physical buyers are still paying a premium to roll from futures into actual metal.

And that brings us to one inescapable question: is a silver squeeze forming—again?

Silver’s tendency to spike isn’t a bug—it’s a feature. With its small market size, dual identity as an industrial and monetary metal, and strong correlation to inflation hedging narratives, silver rarely moves quietly for long.

If you’re a retail investor or an allocator, this is a moment to pay attention.

Physical silver remains underpinned by real vault flows in the U.S. and Asia. Option markets are giving you a discounted shot at upside participation. And China, with all its regulatory and geopolitical complexity, continues to signal a steady bid in both gold and silver premiums.

Hugo Pascal sums it up best: “Silver is behaving like it wants to make another run. And this time, it may not wait for gold to lead the way.”

At InProved, we specialize in helping investors gain exposure to physical precious metals—gold, silver, platinum—with full transparency, low spreads, and ultra-competitive pricing sourced out of Singapore, one of the most tax-efficient and secure bullion jurisdictions in the world.

With real-time access to LBMA vs. SGE premiums, direct vaulting options, and a global client base, InProved is the ultimate tool for anyone looking to secure their wealth in physical bullion.

And if you’re looking at the data and wondering, “Should I wait?”, consider this: vaults don’t lie. Inventories don’t surge without reason. And silver doesn’t knock on $39 without the intent to kick the door down.

Download the InProved mobile app today, or visit www.InProved.com to start building your bullion position before the next breakout arrives. The window is still open—but silver doesn’t like to wait.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions